Depreciation is the gradual reduction in the value of an asset over time, reflecting wear and tear, obsolescence, or aging.

As such, it plays a pivotal role in financial reporting, compliance with tax regulations, and strategic decision-making.

In this article, we take a look at the factors affecting this loss of value, both internal and external, and explore what can be done to potentially slow down the depreciation of your own equipment, empowering you to maximize its lifespan and value.

In this article...

Brand of Equipment

Investing in assets made by well-known brands won’t just dazzle the clients and make your job sites look more professional and sleek; it’ll also impact the machinery’s perceived worth and, consequently, its depreciation rate.

For starters, renowned manufacturers that built their reputation through the production of durable, top-notch machines tend to hold their value better in comparison to some of their less-known counterparts.

In the simplest of terms, higher quality equals a slower decrease in value.

Consider, for example, John Ballmann, the owner and operator of Ballmann Earthworks, who can attest to the positive outcomes of aligning with a reputable brand such as Fabick Cat.

The key factors contributing to the company’s success, according to him, include the exceptional quality and longevity of their machinery, along with a notable resale value.

That’s why Ballmann is loyal to this brand and this brand only.

Furthermore, when your name is associated with durability and long service life, the market demand for your product will be much higher and buyers will be willing to pay more for it, resulting, yet again, in a prolonged depreciation for these products.

However, it is crucial to acknowledge that while brand reputation is a significant factor, it is not the sole determinant of equipment depreciation.

There’s a multitude of other elements affecting the overall value of your machines that you, as an owner, can control.

How you use and care for the assets is one of them.

Usage Hours

The rule of thumb is that the more hours of operation a piece of equipment has accumulated, the more damage it’ll likely experience over time.

Heavy use contributes to heightened wear and tear of components, potentially shortening the overall lifespan of an asset or damaging it beyond repair.

In short, the more a machine is used, the faster it’ll depreciate.

So, what are you supposed to do if you want your machinery to retain its value? Not use it?

No, you just have to maintain it properly.

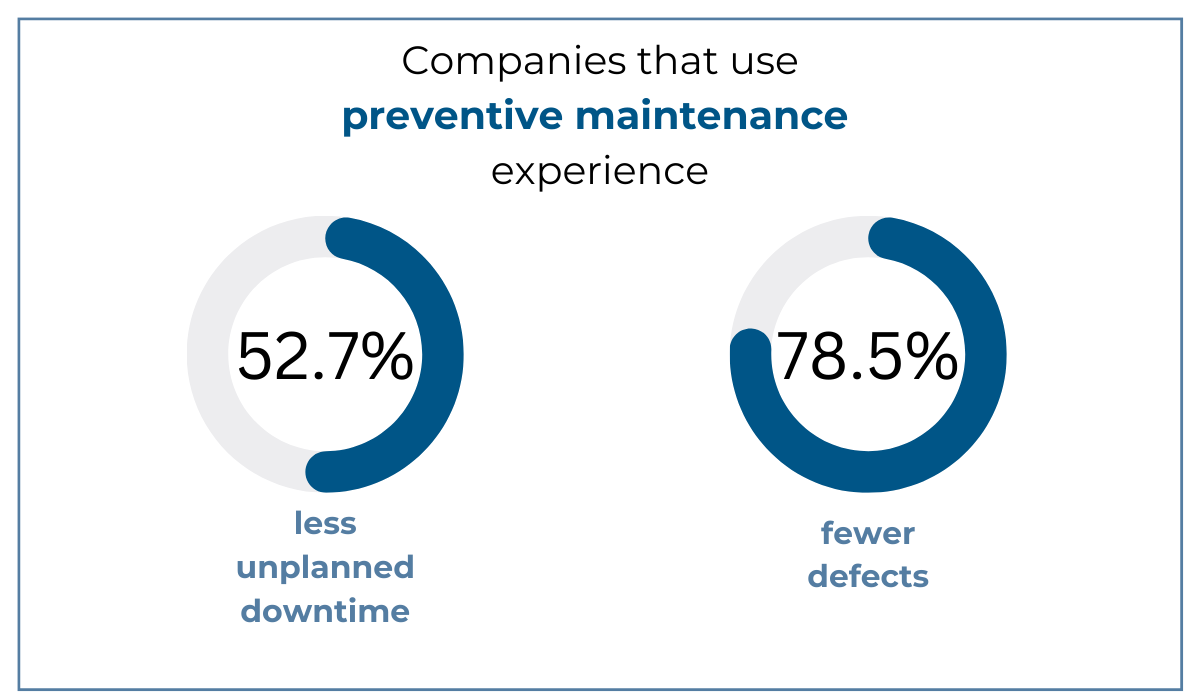

In fact, research has shown that a preventive maintenance regimen significantly reduces the incidence of defects in equipment.

In other words, through regular machine inspections, frequent calibrations, and prompt repairs, you can prevent major machinery problems from happening, mitigating depreciation to at least some extent.

Seems like a lot of work?

It doesn’t have to be.

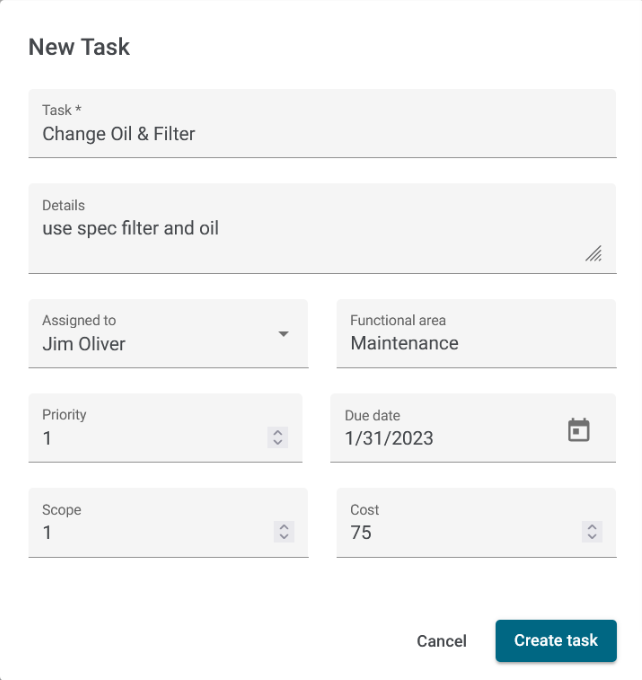

GoCodes Asset Tracking’ asset management software is a reliable partner for construction companies aiming to master the art of heavy equipment care.

Our Tasks feature allows users to schedule, assign, and monitor maintenance assignments effortlessly.

But besides its ability to set up tasks and plan out equipment service, the system can also send timely email notifications the day before scheduled maintenance or inspection, making sure that crucial responsibilities are never overlooked.

Long gone are the days of missed oil and filter changes.

At the end of the day, it’s the consistent execution of these minor yet essential tasks that’s the cornerstone of maximizing the longevity of your assets and putting the brakes on their depreciation.

Cost of Equipment

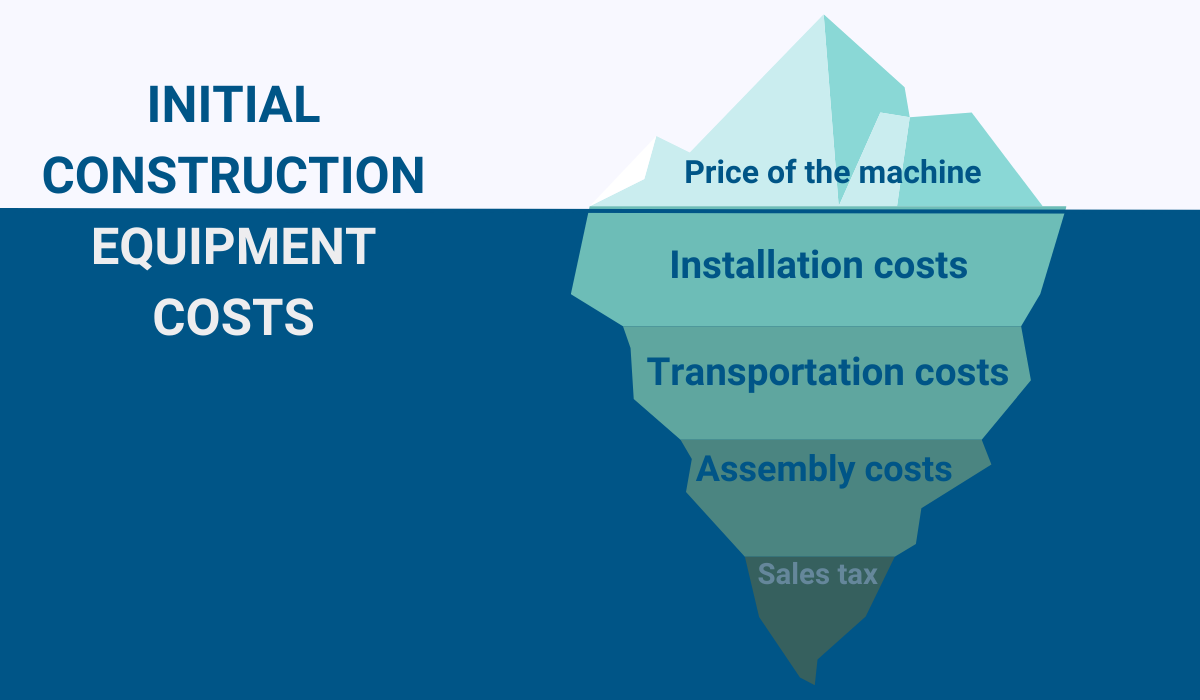

Equipment cost is used as a basis for calculating your annual depreciation amount, but it doesn’t entail just the money you paid to buy that asset.

Instead, it encompasses all the expenses associated with acquiring and getting it ready for its intended use.

While the machine’s cost obviously involves the purchase price, too, it extends beyond that to include installation, transportation, and assembly expenditures.

The sales tax, often applied during purchase, should also be taken into account.

These extra costs are all directly linked to bringing the asset into operational condition and, therefore, must be factored into the depreciation estimation.

For instance, if you bought a machine for $15,000, paid $3,000 for installation, $1,500 to transport it to a job site, and then an additional $500 in sales taxes, its total cost for depreciation purposes would be $20,000.

Still, it’s important to note that financial charges such as interest, in case the money for the investment was borrowed, should not be part of this calculation.

All in all, understanding the comprehensive nature of equipment cost will help you get a more precise assessment of your assets’ depreciation, so taking the time to acquire accurate data on the above-mentioned elements is well worth the effort.

Estimated Useful Life

Estimated equipment lifetime is an assessment of how long you’ll be able to use your asset before it depreciates fully.

In other words, this estimation doesn’t refer to the number of hours/weeks/months/years the machine will exist, but to the period in which you can use it to make a profit.

When the useful life, also sometimes referred to as the economic life of an asset, starts to approach its end, the depreciation rate tends to escalate.

Keep in mind, though, that this figure, as the name implies, is only an estimation.

It’ll be dependent on various components, such as:

- the model and make of the machine itself

- your own specific maintenance practices

- the intensity of use

- environmental factors, like temperature, humidity, dust, and corrosive materials

For a better, more precise estimation, check the manufacturer’s specifications and guidelines for the asset’s expected service life, since they often provide recommendations based on typical usage and maintenance practices.

Overall, some machines may be able to tolerate being pushed past their anticipated lifetimes better than others, but there’s always a tipping point where repair and replacement costs outweigh the equipment’s value, making retirement or selling the most logical decision.

Estimated Salvage Value

Salvage value refers to the residual, or scrap, value of a machine towards the end of its useful life.

Essentially, it represents the amount of money you’d get for it after it’s been fully depreciated and is no longer of service.

When it comes to the relationship between salvage value and depreciation, the underlying principle is pretty straightforward: as the residual value increases, depreciation over the asset’s useful life may decrease, and vice versa.

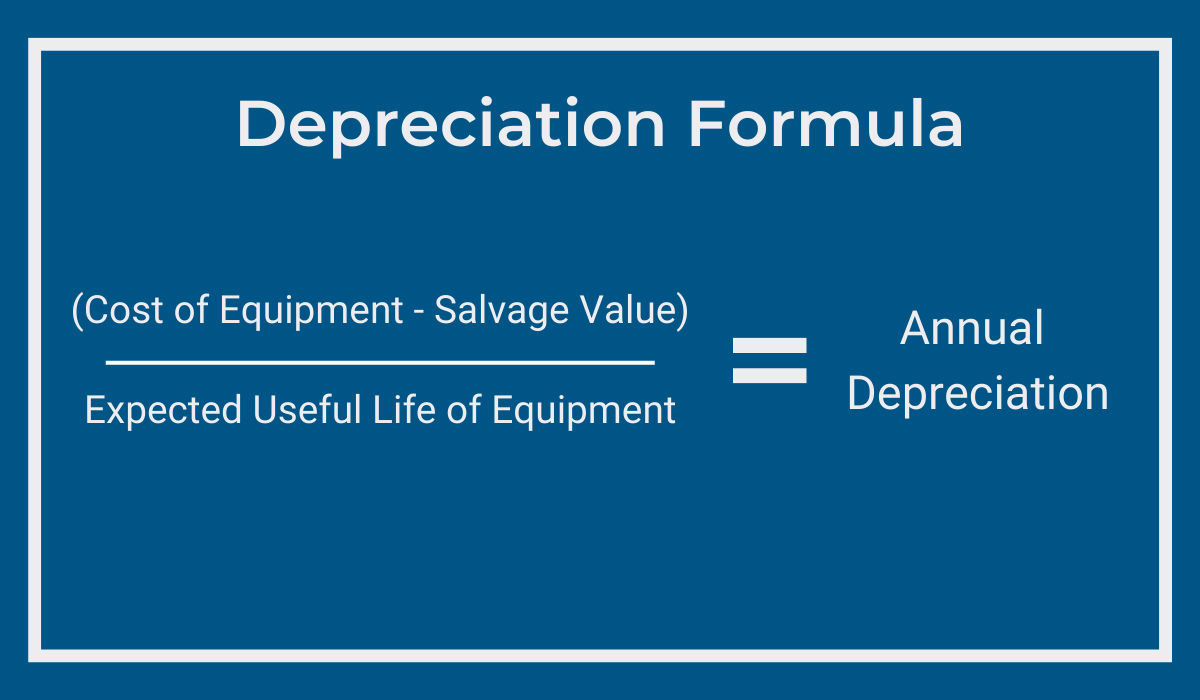

Now, delving into the mechanics of depreciation estimations, the scrap value, just like the cost and estimated service life of a machine, plays a key role in the equation.

In the straight-line depreciation calculation method, a widely employed strategy, the salvage value is subtracted from the equipment’s original cost, and the resulting figure is divided by its anticipated lifetime.

This method allocates an equal amount of depreciation expense for each year of the asset’s lifespan.

While this simpler approach is a common one, businesses may consider other methods in consultation with their accounting team.

The good news is that today, automated equipment management systems can seamlessly handle these calculations with accuracy, no matter the method, sparing you the tedious task of manual computations.

All you need to do is input the data and the software calculates:

- The prior year’s depreciation

- The current year’s depreciation

- The total depreciation for all years

- The balance remaining to be depreciated

This not only enhances efficiency but also ensures precision in financial reporting, minimizing the scope for potential human errors.

Obsolescence

Depreciation, however, isn’t solely subject to the decisions made by equipment owners and can be affected by some external factors as well.

Industry trends propelled, for instance, by environmental concerns and technological advancements, particularly in the fields of robotics, IoT, and artificial intelligence, have a role to play in how fast machinery depreciates.

From self-driving vehicles to smart wearables, these modern solutions, almost reminiscent of sci-fi movies, give an entirely new meaning to efficiency and job site safety.

Older equipment seems antiquated by comparison.

Consequently, the contrast between these cutting-edge tools and traditional machinery translates into a quicker depreciation for the latter.

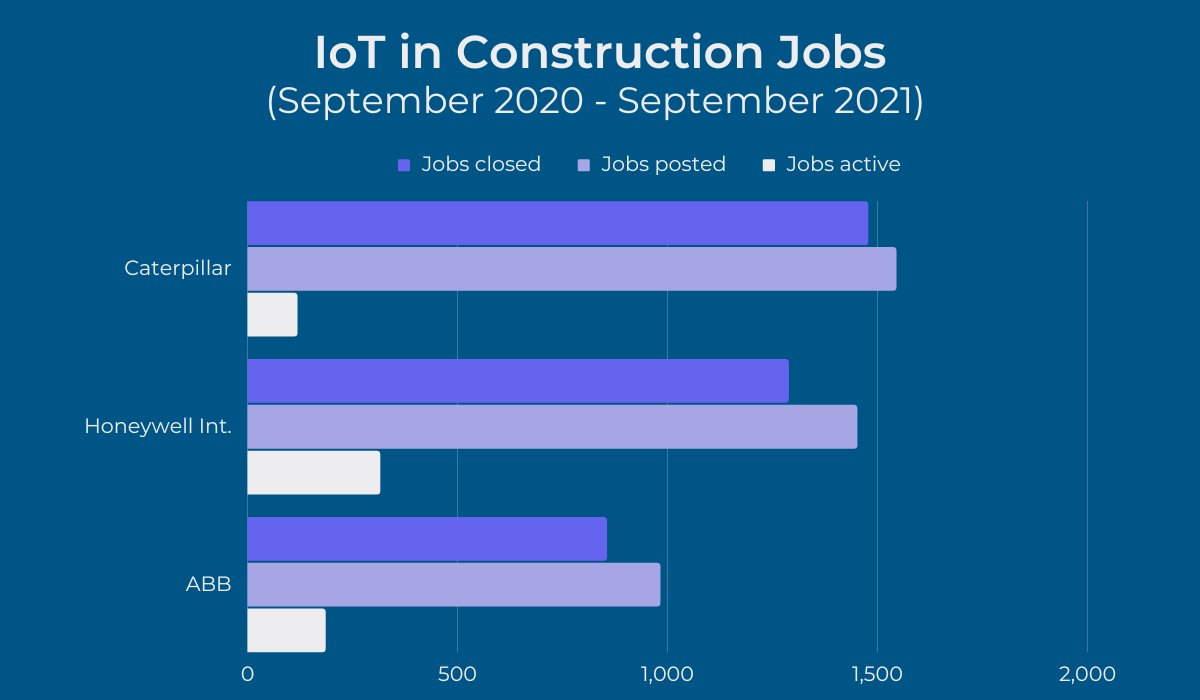

Just take, for example, IoT, a technology now heavily invested in by big players such as Caterpillar.

Through the integration of sensors into construction machines, IoT facilitates the collection, transmission, and reception of diverse data, from GPS locations and telematics to environmental metrics.

This influx of data empowers companies to monitor, analyze, and optimize their asset utilization, and, as IoT technology proliferates, equipment lacking these features will face accelerated depreciation due to their perceived inefficiency.

While we are still in the midst of technological evolution, with fully self-operating cranes and excavators remaining on the horizon, the rapid pace of development in some areas undeniably influences the depreciation rates of machinery, rendering outdated machines more susceptible to obsolescence.

Conclusion

To sum up, there’s a multitude of factors affecting the depreciation of your equipment.

While some are out of your control, such as obsolescence due to technological advancements, there are ways to, at least somewhat, slow down the rate at which your valuable assets will depreciate.

Proper maintenance, frequent inspections, and careful planning across all phases of a machine’s lifecycle can, indeed, prolong its useful life or increase its resale value, contributing to the sustained success and profitability of your business for years to come.