Fixed asset accounting represents a crucial part of the company’s financial statements since this type of asset is generally used for a longer time and should be depreciated.

This article will explain fixed asset accounting and which records are essential while also giving tips for more efficient accounting.

If you make decisions, do, or oversee accounting, this article will offer you interesting insights and some advice.

In this article...

What Are Fixed Assets?

By definition, assets are basic economically valuable units owned by a company or an individual who expects financial gain from them. They can be tangible (physical) or intangible.

Fixed or capital assets are tangible assets supposed to last for an extended period, which a company uses to produce goods or services or contribute to making an income.

They are also called property, plant, and equipment, as those are the most common categories such assets fall into and how you list them on the balance sheets.

The amount of such an asset in your business books is its net book value after deducting impairment and depreciation costs.

Such assets are not supposed to be converted into cash at the end of the year as the company intends on using them for a longer time, meaning that you don’t purchase them just to resell.

Companies write the purchasing expense down as a cash inflow, but they won’t have a cash outflow for that asset that same year.

Companies invest in such assets to ensure a long-term financial gain, which means you can depreciate them—they lose value over time due to frequent use and wear and tear.

Some categories of capital assets are land, equipment and machinery, buildings, and vehicles. Despite the name, fixed assets don’t have to be stationary. On the contrary, they can be mobile.

How Do Fixed Assets and Inventory Differ?

Inventory entails all your finished products and the materials you need to make them.

As mentioned above, companies aren’t supposed to convert capital assets into cash in under a year.

On the other hand, inventory consists of assets whose purpose is to be sold to make a profit, making such assets current.

The main difference between the two is that you use your fixed assets to generate income over time, and you’re not interested in getting rid of them since you bought them to profit off their usage.

In contrast, you have inventory to guarantee you have enough of the finished products or raw materials, but your ultimate goal is to sell the finished products as soon as possible and make a profit that way.

Otherwise, you might end up with a lot more stock of inventory than you need.

If you don’t sell it by the end of the business year, it will show in your books, and you will be stockpiling items you don’t need.

What Is Fixed Asset Accounting?

Fixed asset accounting entails keeping precise records of financial information about your capital assets, mainly because such assets usually represent a significant investment for your company.

It’s often hard to keep up with the changes in an asset’s value as they’re prone to devaluation—the constant diminishment of value over time.

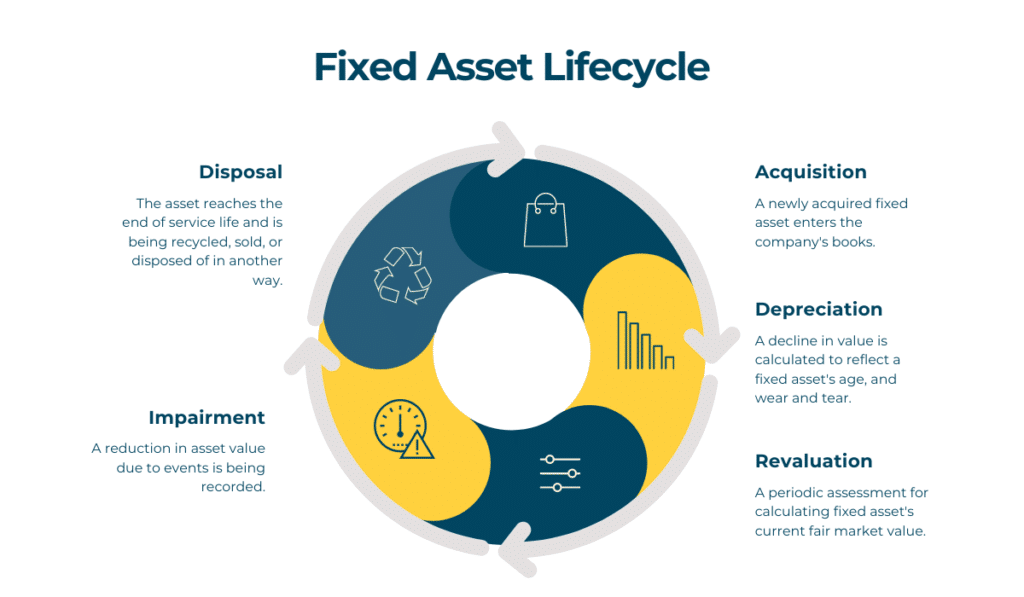

As a company, you have to keep your records clean and account for each asset throughout its life cycle, starting from its purchase to disposal.

It’s essential to ensure that the data is correct and that you’ve listed all fixed assets under cash statements.

Capital assets are seen as cash inflows when they are purchased. When you sell them or discard them at the end of their useful life, they’re considered an outflow.

Be precise when writing down the amount it costs you to purchase the asset and choosing the correct depreciation method for your equipment to ensure that you get the most out of them.

Each year, the asset’s value will change until it reaches the end of its useful life, i.e., until it holds no value to you.

What Records Does My Fixed Asset Accounting Require?

The accounting of capital assets needs to be accurate to ensure that your books are in order.

Therefore, you need to consider procurement, depreciation, revaluation, impairment, disposal, and audits to assure that the data is correct and easy to track throughout the years.

Your asset will have at least three of these phases, and some will have more. Let’s find out more about them!

Procurement

When you purchase an asset, you need to make a note of its value in the books under a new account.

Each fixed asset should have its account, allowing a more accessible following of devaluation.

However, don’t simply write down the purchase price.

Instead, consider all purchasing-related costs such as transportation, installment, taxes, or anything else necessary for the proper functioning of the newly acquired asset.

The capital asset’s total value isn’t how much you’ve paid for it—it’s how much you’ve paid to buy, install, and get it to function, which can often be a significantly higher amount.

Once you’ve calculated all the purchase-related expenses, you have the total amount you’ve spent on the asset, which is its starting net value in your books.

Any changes that happen—be it an increase or a decline in value—will reflect on this amount, which will change over the years of useful life.

That’s why it’s crucial to write down the correct amount in the beginning.

When writing the price down, you debit the asset account in the amount of purchase price while crediting the cash account for the same price.

| Debit | Credit | |

| Asset account | $5,000 | / |

| Cash account | / | $5,000 |

| Total | $5,000 | $5,000 |

In simpler terms, if you buy an asset that costs you $5,000, you’re losing $5,000 in cash or credit, but you are gaining $5,000 worth of assets.

Impairment

If your assets undergo a change that might affect their value or performance in the future or even make the tool obsolete, you need to make a note of it in your books.

This process, called impairment, is crucial in cases where the asset’s carrying value becomes higher than the future cash flow, i.e., when it costs more to own the equipment than you get from it, despite your earlier calculations claiming otherwise.

The goal of impairment is to deduct the non-recoverable difference between the asset’s value and the recorded cost.

Impairment explains the decrease in the asset value due to different factors like:

- negative changes in the asset’s condition

- operating losses

- an increase of unexpected asset-related costs

- a big drop in the market’s price

- a notable difference in the way or frequency of use

If some less critical assets drop down in value or get damaged, you probably won’t have to use impairment.

Impairment applies only to significant assets which prove not to be as financially viable as expected.

You should regularly test for impairments to stay on top of all the deductions and current asset costs.

Depreciation

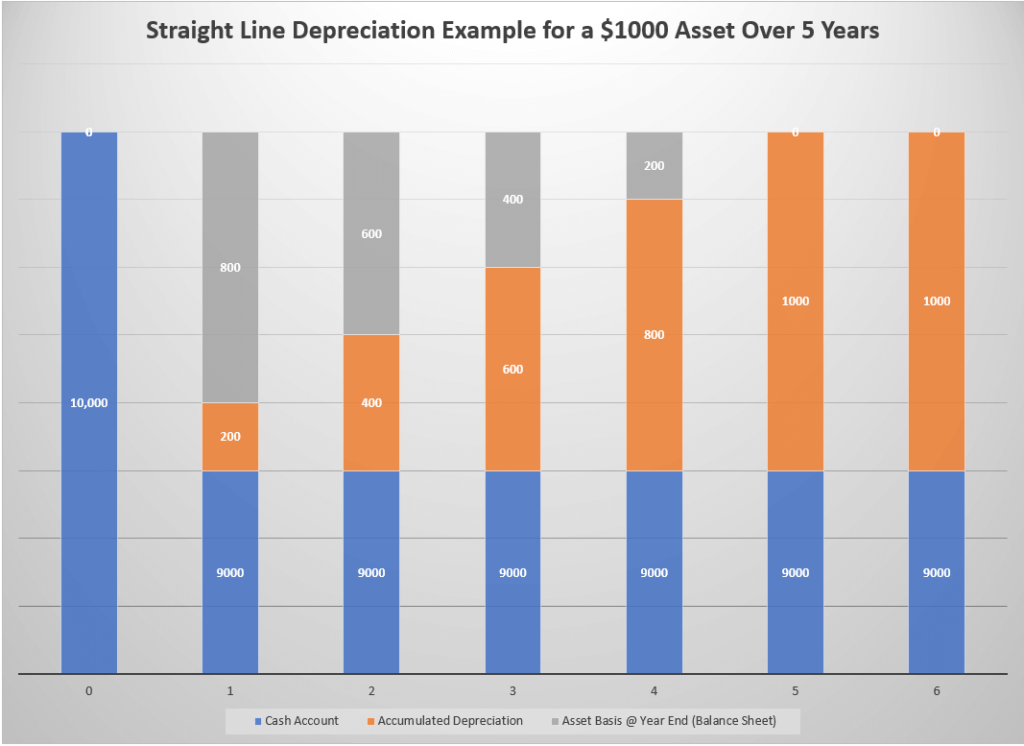

The next record that you need to consider regarding capital asset accounting is depreciation, which accounts for the loss of value over time due to use and wear and tear.

By depreciating, you’re spreading the expenses over the asset’s useful life.

You can use depreciation to deduct certain costs yearly instead of all at once, providing some tax benefits and helping you keep your books in order.

To calculate depreciation rates, you need to be aware of the asset’s expected useful life.

That is, you need to be aware of the period during which you will be able to use the equipment for its original purpose. In general, a fixed asset’s useful life should be higher than one.

If you’re unsure of the asset’s useful life, check out the generally accepted accounting principles (GAAP) and their recommendations.

Another thing you need to know is the salvage or residual value of the item, which is the amount you can sell it for after its useful life. For some assets, the salvage value is zero, while for others, it can be a higher amount, depending on the type, quality, and frequency of use of the product, as well as standard industry practices.

It’s standard practice to deduct the salvage value from the purchase price to get the amount you will be depreciating as long as you can use the asset.

If you have an asset worth $5,000 that you can sell for $500 after five years of useful life, you will realize that you have to depreciate $4,500 over five years.

For a more detailed explanation of depreciation and the calculation of various helpful methods, consult our equipment depreciation article.

Revaluation

Revaluation is another factor you should consider when accounting for capital assets.

It entails all changes to the usefulness of an asset while reflecting the current market value of the equipment and its actual value at the time.

It’s important to note that revaluation works both ways—the value can go up or down, which makes it different from impairment, which only records the downward changes.

You can buy a low market value product today, but it can grow in a matter of years, making your first calculations incorrect, which is why you should strive to evaluate the amount of your asset when you feel it’s necessary.

Some do this once a year, but most do it every three or five years to make sure their calculations are correct. You can hire an independent specialist for this task.

There are two methods to value the cost of the asset: the cost and revaluation model.

You should subtract depreciation and impairment expenses from the original price to receive the new price in the cost model.

The revaluation model subtracts the same expenses from the current fair market value instead, according to The International Accounting Standard (IAS) 16.

This standard also suggests revaluating regularly and determining a fair value of the asset at the time of the revaluation. However, if you choose to revaluate an item, you need to do the same to that entire class of assets, meaning that you can’t do this to only one vehicle if you have four that serve the same purpose.

Moreover, if there’s an increase in value after revaluation, you need to mark the cost as a revaluation surplus.

Keep in mind that you cannot revaluate an asset that you’ve already wholly depreciated as its value should be zero.

Disposal

Your books should follow the asset financially through all the stages of its lifecycle—from procurement to disposal.

The final stage of an asset’s life, or disposal, marks when you need to get rid of the item as it no longer serves its intended purpose or does so while being significantly slower or more prone to breakdowns.

Of course, it doesn’t mean that you cannot resell the item if it’s still usable. On the contrary, reselling is better than throwing the equipment away since you will profit from it. If you can no longer use the asset, consider recycling it according to the state’s laws and regulations.

In your accounting books, the disposal stage is when you remove the item from your books and mark a gain or a loss. The asset in this stage should be depreciated entirely, and its value should be zero.

You account for disposal in the following ways, based on whether there was a gain on the sale or not.

If there are no gains and the asset is fully depreciated, you should debit the depreciation and credit the asset.

In the other two scenarios, where there was either a gain or a loss, you must credit the fixed asset and debit cash for the received amount and all accumulated depreciation.

The only difference between the two is that you should credit the gain if you’ve gained on a sale, but you should debit it if you’ve lost on the sale.

Audits

Audits, or detailed checks of a company’s accounting records and assets, should be performed after you’ve closed the books for the fiscal year.

They help you notice any potential inconsistencies or differences between what you’ve written down and the actual state of your assets, promote transparency, and help you determine whether you’re losing money on certain purchases.

Audits can be internal or external, depending on the person performing them.

Internal auditors are the employees who work for your company and who perform audits to help you run operations smoothly and improve effectiveness by reexamining your accounting and the assets themselves.

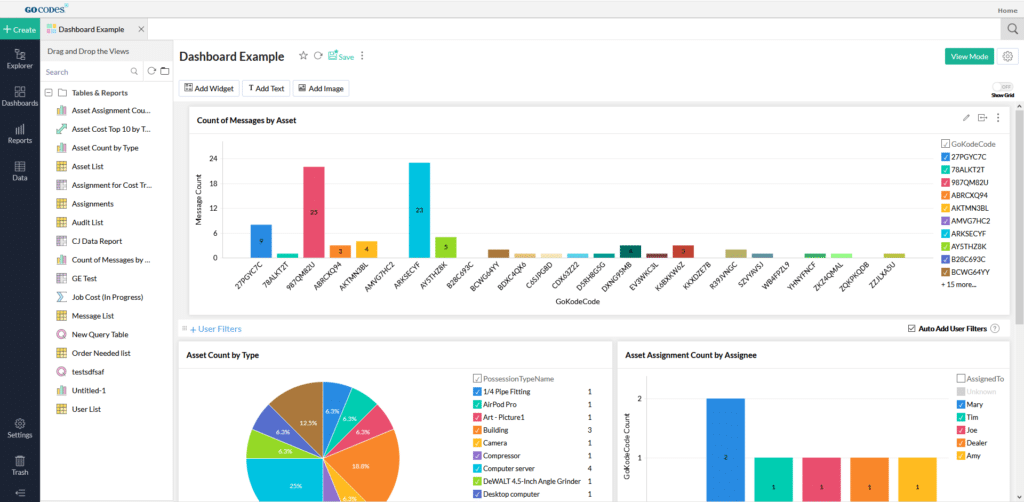

GoCodes tool has an audit feature that can help you audit your possessions:

External auditors are unbiased, third-party experts who provide the government or different organizations with information on how accurate your accounting is. Such experts often come from Certified Public Accounting (CPA) firms. Having an independent person audit your accounting statements promotes transparency and affects your credibility.

Another type of external audit is the Internal Revenue Service (IRS) audit, performed to check if your company is behind on its taxes and if you’re paying the taxes you owe them.

The IRS checks your assets and accounting books to determine whether you’re underpaying the taxes you owe to the government. The IRS can audit you if they decide if there’s suspicious activity, but such audits can also be random.

The main goal of auditing is to determine whether your asset records are correct. If they’re not, your financial statements and taxes won’t be either, which can cause problems for the company.

How to Nail Fixed Asset Accounting?

Now that you understand what records you need to keep to be great at accounting, we will offer you some tips that can help you get even better.

Establish a Threshold for Capitalization

Capitalization means that you have chosen to depreciate an asset over time instead of writing it down as an expense.

However, there is no point in doing either one of these options for all items.

If you write each asset you get as an expense, you will record huge losses whenever you purchase any new equipment. On the other hand, there’s no point in depreciating every item you have either.

The key is determining a fixed amount for capitalization, i.e., the minimum amount that an asset can have in your books.

If an investment costs more, you will capitalize it on the balance sheet and go forward with depreciation, and if it costs less, you will write it off as an expense.

When you write down this amount, the people in charge of accounting will use it for all assets, and you will eliminate accounting errors while promoting consistency across your books.

Your books will be uniform, which will help you notice any errors on time.

Ensure Your Assets Have Tags

It’s essential to track your assets throughout their useful life as many factors can affect their value.

To check the asset for damages or assess its current state, you need to know where the equipment is and how to identify it.

If you have more than one of the same kind of asset, you need to have a system that distinguishes them and a way for you to be sure that you’re writing down the data about the item at hand, where tagging can come in handy.

Tags not only help you quickly identify the item, but they can help prevent theft, which can cause substantial accounting losses, especially when it comes to more expensive fixed assets.

Furthermore, tags serve as proof that the equipment belongs to your company, which you can use if someone claims your belongings as their own.

On top of that, tagging items lets you locate them with ease, thus eliminating the risk of misplacement.

Asset loss can be costly if you are assuming that you’re getting your money’s worth from an item that’s lying around.

The right tags can be scanned with specific devices or smartphones, making it easy for anyone performing accounting checks to identify the item and check its financial statistics in your system.

Re-Evaluate Equipment’s Useful Life

You depend on the useful life estimate to calculate your depreciation, as every method includes it in the formula.

If you’re an expert in the industry, you can usually correctly estimate how long you can use your asset for its original purpose, but sometimes, this is prone to change.

Even the GAAP recommendations can be wrong.

Since your books and depreciation rely on your useful life estimate, it’s important to re-evaluate it when necessary, as it might change over time.

If the estimate is higher or lower, so is depreciation, which affects the book value of your asset.

When you don’t note these changes, you might spend too much or too little on an asset and have wrong calculations in your books, which isn’t advisable.

However, don’t regard these changes as error correction.

At the time of entering data into the books, you relied on one estimate. When you enter a new value for useful life, you’re not correcting a mistake but simply writing down the latest estimate.

Automate Your Insights

If you’re interested in automating a lot of the manual activities and keeping track of your items while having their data available whenever you need it, use fixed asset tracking software.

Such software not only lets you input any asset-related data into the system but makes it available to anyone who scans the item’s QR code.

Those with a password will be able to see the details you allow them to, which is a good way for your team to update you on any changes to your assets that might affect impairment or useful life.

They can even upload pictures and make comments regarding the tool, pointing out the need for repair.

Such transparency lets you in on the loop and assures that you always know what state your assets are in and who is using them.

Some software can even remind you when the assets are due for maintenance, thus ensuring that your team doesn’t use the tool but lets it get checked out by a specialist.

Maintenance can prolong an item’s useful life, allowing you to make use of a piece of equipment longer.

Choose the Right Depreciation Method

As already mentioned, depreciation is an integral part of accounting as it lets you account for declines in the asset’s value over time.

There are four different methods of depreciation accepted by GAAP:

- straight line

- declining balance (DB)

- sum-of-the-years’ digits (SYD)

- units of production

They differ in how much you write off every month.

The straight line method allows you to pay the same amount over the asset’s useful life.

The DB method is an accelerated method as it makes you pay off more in the beginning and less towards the end, and you can use it if you have equipment that can become obsolete with age.

The SYD method lets you write off more in the earlier years and less in the later years by calculating the number of years, but not as aggressively as the DB method.

The units of production method assigns the same value to each unit your asset produces, which lets you write off more the more you use the equipment.

You need to discuss the depreciation method with your accountant as you can use different methods for financial statements, tax returns, and asset groups.

Get Insured and Record It

Since fixed assets should have a useful life longer than a year, it would be wise to insure them.

Before insuring an asset, you need to be aware of the basis of the sum insured and under insurance.

The former can include either marker or reinstatement value.

The market value always subtracts the residual value from the total cost of the item, while the reinstatement value is the amount you’d pay to get the same item without the depreciation costs.

The sum insured is essential to understand as it forms the basis of the compensation you’re entitled to in case of a claim.

The latter usually means that you’ve insured the asset for less than it is worth, which becomes relevant in cases of partial loss where the insurer bears some of the cost of the loss.

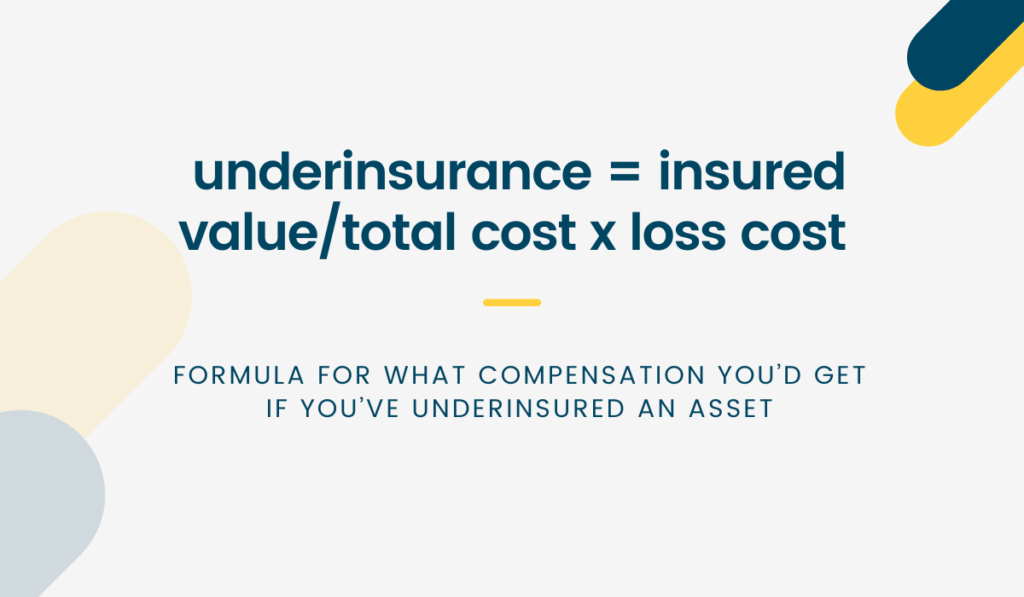

You can calculate what compensation you’d get if you’re underinsured using this formula:

For example, if you insure a $20,000 asset for $15,000, you’re underinsuring it.

In case of a partial loss of $10,000, you’d get only $7,500 instead of the total amount of the loss, which is why it’s crucial to ensure that you’re paying the correct amount.

Conclusion

Since fixed assets should be a part of your company for a longer time, you need to pay attention to the accounting practices.

Always consider the correct procurement costs, depreciation rate, and any potential damages to the asset that might make it lose its value.

To ensure that your accounting is accurate, do frequent evaluations and audits, and don’t forget to remove the asset from your books once it’s fully depreciated.

To automate some manual activities and have all the asset data in one place, consider using asset tracking software that helps you track your items by tagging them.