This article discusses the most common ways that small and medium sized organizations use deprecation with fixed-assets such as computers, tools, equipment, furniture etc. Depreciation can become very complex and we refer readers to their government’s policy and guidelines. For the US IRS, this is covered in publication 946 here.

In this article...

What is deprecation

Depreciation is an accounting convention that attempts to reflect the way the value of an asset declines over time through normal use. The goal is to better align an organizations financial statements with the true value of the fixed-assets purchased over time. So, for example, say your company purchases a piece of equipment (computer, compressor, vehicle etc.) with a 7-year life. Depreciation allows you to spread the expense for the purchase over the life of the asset. Note that the residual value of the asset is updated on the balance sheet as depreciation deductions are taken each year.

How depreciation affects cash flow, income statement and balance sheet

When your organization purchases a new asset, you will pay for it and your cash-flow will experience an immediate deduction for the purchase price of the asset. At that point, your balance sheet will reflect the addition of the new asset at its full purchase price (it’s new after all). So, in effect a transfer occurred from your cash account to your balance sheet in the full amount for the asset purchased.

The new asset is immediately put into service and therefore starts experiencing normal wear and tear which starts to reduce its true value – resulting in the need for depreciation. The process of calculating and reporting deprecation results in recording regular expenses and the adjustment to the value of assets on the balance sheet. So, in effect, a series of annual expenses are charged to spread the cost of the usage of the asset over its lifespan. As these expenses are recorded, the value of the asset is decreased on the balance sheet in corresponding amounts until it’s fully depreciated.

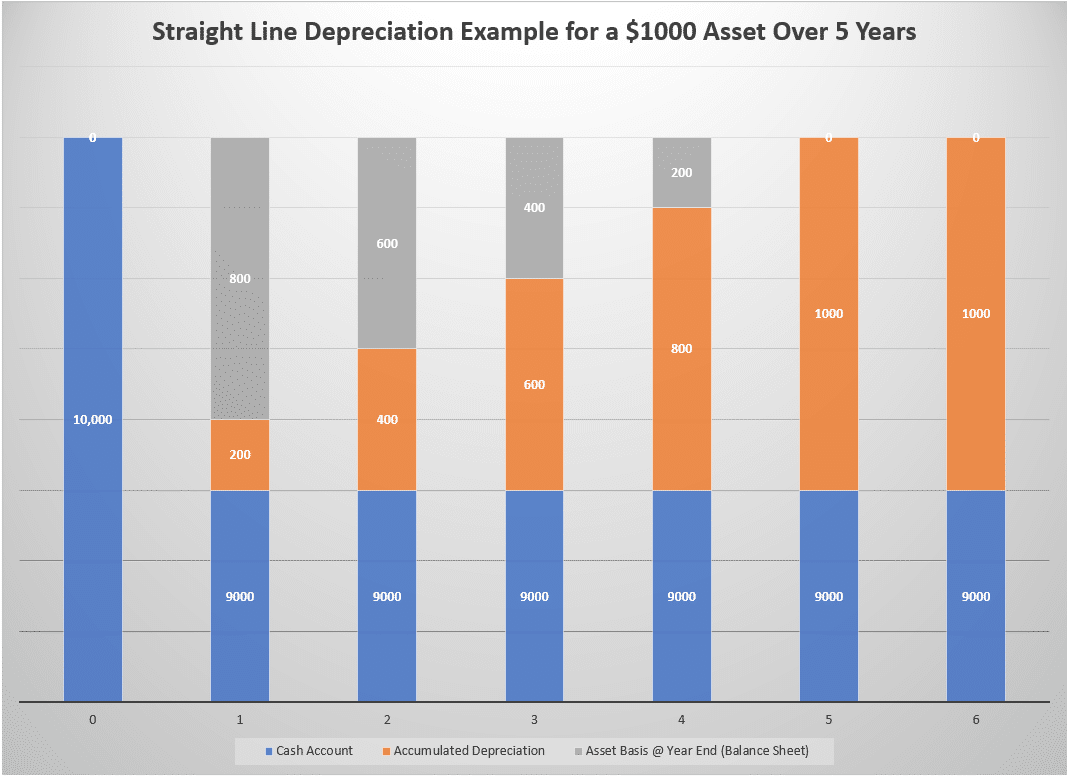

Here’s a simplified example:

Your company purchases a $1,100 computer that is expected to have a 5-year lifespan and a salvage value at end of life of $100. The amount to be depreciated is $1,000 over 5 years.

Using the most common straight-line convention, the depreciation expenses are recorded in equal increments over the 5-year life of the asset so:

|

Year |

Cash Account |

Annual Depreciation Expense |

Depreciated Value at Year End (Balance Sheet) |

|

2016 |

10,000 |

0 |

0 |

|

2017 |

(-1,000) – 9,000 |

200 |

800 |

|

2018 |

9,000 |

200 |

600 |

|

2019 |

9,000 |

200 |

400 |

|

2020 |

9,000 |

200 |

200 |

|

2021 |

9,000 |

200 |

0 |

|

2022 |

9,000 |

0 |

0 |

Here’s the same data shown in a graph. Note there’s no half-year convention shown for simplicity.

As you can see, depreciation affects cash-flow, expenses and the balance sheet and so has consequences for your organizations profits and taxes in any given year.

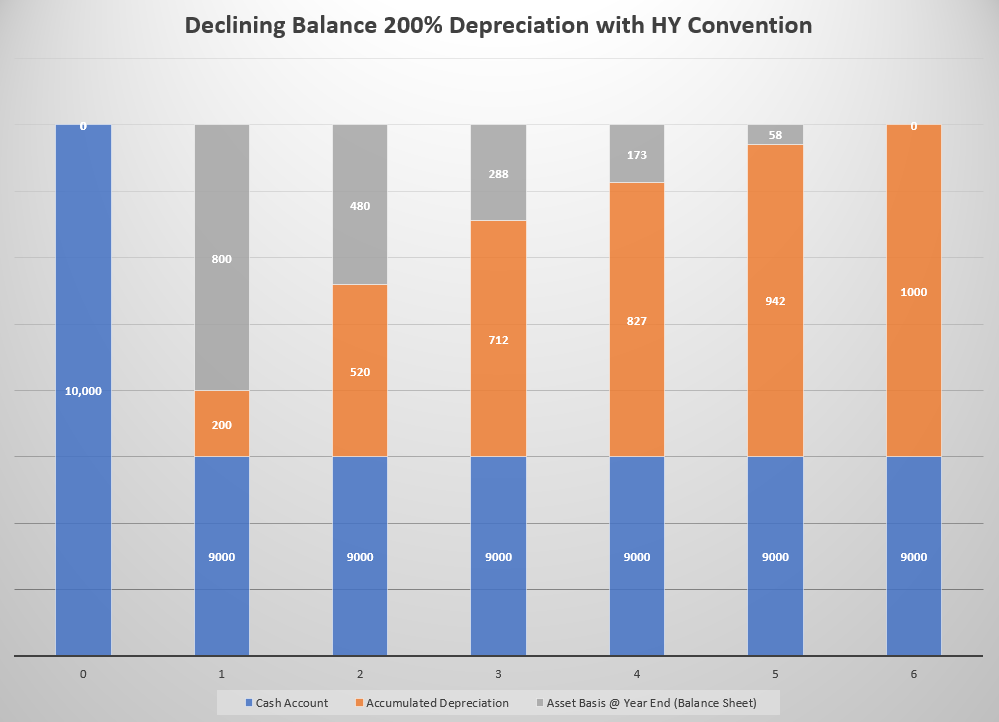

Here’s an example showing IRS MACRS Declining Balance 200% with Half-Year (HY) convention.

In practice, your organizations may purchase many different assets of different types and so there may be several different depreciation conventions that apply based on the type of asset and it’s expected useful life. The government defines the rules which apply to how depreciation is calculated and recorded in any given situation.

Choosing the right deprecation strategy for your fixed-assets

In many cases you will have some choices to make in terms of which depreciation convention you choose to adopt for your assets. You should choose carefully as in many cases it’s difficult if not impossible to change the convention later. Your accountant/controller will be able to help advise you on this too.

Here’s a simple summary of some of the more common options with pros and cons:

|

Type of Depreciation |

Pros |

Cons |

|

Straight Line (SL) |

|

|

|

Declining Balance (DB) 200% |

|

|

|

Declining Balance (DB) 150% |

|

|

|

IRS PATH Act Bonus Depreciation |

|

|

|

IRS Section 179 Depreciation |

|

|

Timing of expenses is the key to maximizing (or minimizing) profits

As you can see, all these depreciation options influence the timing of the recording of expenses associated with the purchase of the fixed-asset. The total amount available to depreciate always stays the same. Given that there are some legitimate choices, you may be able to reduce your organizations reported net income and therefore taxes by adopting deprecation strategies that minimize the taxes due over the lifespan of the assets. In practice, this means looking at the available options for your newly purchased assets and then considering your likely current and future profits. In most cases, organizations strive to maximize the expenses for the current year and therefore reduce profits and tax due in the current year. Cash flow and other financing may also be a consideration. We recommend you work closely with your accounting team and tax advisor to select the most appropriate strategy.

Balance sheet implications

Just as the timing of asset purchases can impact the balance sheet, so can the choice over which method of depreciation to adopt. Reduce the size of the balance sheet by choosing options which accelerate depreciation, increase the size by slowing the rate at which depreciation is taken.

As you can see, your strategy for the timing of fixed-asset procurement and the corresponding depreciation can have important financial consequences and should be considered carefully.

How GoCodes calculates deprecation

GoCodes includes sophisticated yet easy-to-use depreciation calculations that cover all the most common scenarios for most fixed-assets. We take the asset data you input like the cost of the asset, date purchased and asset life and use this information to calculate annual depreciation using a range of the most common IRS MACRS schemes. We do this by providing a series of pre-built depreciation reports which can be run with a single click. The reports generate a Microsoft Excel compatible .csv file which contains a list of your assets along with their corresponding depreciation data like annual depreciation, current year depreciation, prior year depreciation, total depreciation to-date and balance remaining to be depreciated. This information is calculated in accordance with US IRS publication 946 conventions and can be used in the filing of financial statements and tax returns*

Which depreciation options does GoCodes support

GoCodes is designed to make it easy to complete the most common asset deprecation scenarios with confidence. All GoCodes depreciation reports adopt the half-year (HY) convention required by the IRS.

Here’s a summary of the deprecation calculations GoCodes offers:

- Modified Accelerated Cost Recovery System (MACRS) Straight Line (SL) depreciation with half-year (HY)convention

- MACRS Declining Balance (DB) 200% with HY convention

- MACRS Declining Balance (DB) 150% with HY convention

- MACRS Straight Line (SL) depreciation with HY convention with 2017 bonus deprecation @50%

- MACRS Declining Balance (DB) 200% with HY convention with 2017 bonus deprecation @50%

- MACRS Declining Balance (DB) 150% with HY convention with 2017 bonus deprecation @50%

How to calculate depreciation using GoCodes

When you’re ready to calculate depreciation, you should complete the following steps:

- Ensure your asset date is input correctly, note that a valid purchase date, cost and asset life are required for the calculations to work correctly. Specifically, the purchase date must not be a future date, the cost should be a positive number and the asset life should be a rounded positive number. The most common are examples are 3,5,7,9,10 & 15 years

- If you are using more than one type of deprecation then it’s a good idea to use a data field or a custom data field to track the type of depreciation that you will be using for each asset. This information will be used to filter the assets into group when you run the deprecation report. We recommend using the ‘Group’ data field by adding a drop-down menu option for the different depreciation calculations you plan to use.

- Navigate to the ‘Reports’ menu and scroll down to the ‘Fixed Asset Depreciation Reports’

- Decide which report calculation you want to run and click the appropriate report.

- Your report will run and create an Excel .csv file which you can save locally.

- When you open your report, you will see a new set of calculated depreciation columns for each asset. These are calculated based on the current date and will show the following calculations:

- Straight Line Annual Deprecation (for reference purposes)

- Prior Year Depreciation (for last year’s tax year filing etc.)

- Current Year Depreciation

- Total Depreciation for all years

- Balance remaining to be depreciated

- We recommend you add a data filter to your report to just show the assets you are interested in. You can do this using the Group data field that you just setup.