From a business perspective, most types of assets a construction company owns, including its vehicles, heavy machinery, tools, and equipment, will stop making and start losing money at some point, thus ending an asset’s useful life.

That can occur for any number of reasons, like wear and tear, underperformance, or equipment becoming obsolete due to technological progress or new government regulations, to name a few.

Naturally, construction companies want to determine the moment their equipment will outlive its useful life with as much precision as possible.

Pinpointing that moment allows them to improve their operational and financial planning and calculate depreciation for accounting and tax purposes.

That’s why we’ll first explain what useful life is, its importance, and related factors, followed by tips on calculating it for your assets and equipment and using it for their depreciation.

In this article...

What Is Equipment Useful Life

In essence, the useful life of an asset is an estimate of how long an asset can be used until it stops generating profit for the company.

But let’s dissect this sentence to understand the concept better.

The term “assets” usually encompasses all physical assets owned by a construction company, such as land, facilities (office buildings, plants/workshops, warehouses), and movable assets like vehicles, machinery, tools, and equipment.

However, in this article, we use it to refer only to the latter, i.e., movable assets, because land and buildings don’t lose their value over time in the same way.

Likewise, “estimate” means calculating, as precisely as possible, how long an asset will remain functional and how long it will continue to generate revenue or provide other benefits.

That estimate is essential for calculating asset depreciation (the loss of value over time), which has significant accounting and tax implications.

So, since most of these assets (apart, as mentioned earlier, from real estate) are subject to depreciation, determining their useful life is prescribed by different generally accepted accounting principles (GAAP) and standards like IAS16.

Given all the above, we can now better understand the definition of useful life provided by Investopedia:

“The useful life of an asset is an accounting estimate of the number of years it is likely to remain in service for the purpose of cost-effective revenue generation.”

To sum up, the useful life is not an estimate of how long a piece of equipment (or another asset) could actually exist, but of the number of years it is expected to be useful, i.e., financially profitable for the company.

Why Determining Useful Life Is Important

In a nutshell, determining the useful life of their assets allows construction companies to comply with accounting and tax regulations, improve their maintenance and purchasing decisions, and determine the asset salvage value at the end of its useful life.

Thus, calculating the useful life of their assets and equipment has long-term implications for both the financial and operational side of their business.

As said above, from an accounting perspective, you have to determine an asset’s useful life in order to be able to calculate depreciation, i.e., allocate the cost of an asset over the years it will be used by the company.

When assets are depreciated, that can result in tax savings, as this definition explains:

Furthermore, calculating an asset’s useful life allows companies to estimate the asset salvage value, i.e., what an asset might be worth at the end of its useful life.

In many cases, that salvage value will be zero; however, some companies routinely resell their outdated equipment, either whole or for parts, through auctions and other resale sources.

In such situations, determining the useful life enables companies to estimate the salvage or residual value for depreciation purposes.

Now let’s move from accounting to financial planning.

In essence, knowing when a piece of equipment will need to be maintained or replaced allows companies to make more accurate long-term financial plans.

In other words, calculating the useful life and depreciation rate tells companies how long they have before new equipment needs to be acquired, which informs their long-term purchasing decisions.

From an operational perspective, it helps companies determine how close that equipment is to becoming obsolete, which impacts its maintenance schedule and safety of operation.

For instance, it might be more cost-effective to replace near-obsolete equipment when it breaks down instead of investing in its repair.

Similarly, such equipment can be subjected to more frequent safety inspections due to its condition, in order to prevent breakdowns, accidents, and delays.

In conclusion, determining an asset’s useful life is vital for calculating depreciation and the salvage value (if any).

Having this information enables the company to comply with accounting standards and achieve tax savings while improving long-term financial planning and enhancing its maintenance and safety practices.

Factors That Impact the Useful Life of Your Equipment

Factors that impact the useful life of equipment (and other assets) can be operational, financial, technological, or even regulatory by nature.

For instance, overworked or poorly maintained equipment can experience major breakdowns that shorten its initially estimated useful life, which is an operational factor that’s hard to assess when that equipment is purchased.

Of course, one factor that does impact the initial useful life estimate is what condition a piece of equipment was in at the time of purchase.

Construction companies should consider these factors when making the initial estimate of the useful life of their equipment and when assessing whether that estimate should be adjusted due to their impact.

So, we just said that some pieces of equipment will have a longer useful life than others, whether due to their design or the fact that they were bought brand new (as opposed to already used).

We also gave an example of how improper operation and maintenance can cause incidents that shorten the equipment’s useful life.

The same is true of forces of nature, like in the case of this tower crane overturned by strong winds.

Thus, how frequently and how properly equipment is used and maintained and in what working environment (e.g., extreme temperatures) can also affect its useful life.

Next, a financial reason for shortening the initial lifespan of a piece of equipment can be the fact that it’s more cost-efficient to replace the equipment nearing the end of its useful life, rather than to invest in repairs.

Finally, technological advances and new government regulations that might render equipment obsolete are also factors to consider.

For instance, digital technology is present in all types of equipment nowadays, and it provides great benefits for users, but also increases the risk of such assets (or the technology inside them) becoming obsolete relatively fast.

Stricter environmental regulations that could render some equipment non-compliant and thus obsolete before its useful life represent another such example.

Overall, companies should consider different operational, financial, technological, or even regulatory factors when making the initial useful life estimate and monitoring whether that estimate might need to be adjusted.

How to Determine Equipment Useful Life

So, how can construction companies determine the useful life of their equipment and other assets?

They can use the baseline information provided for tax purposes, check the original manufacturer’s specifications, and use their past experience (and past data, if any) with similar equipment.

First, a good starting point for determining useful life is to visit the Internal Revenue Service (IRS) website, which provides useful life estimates for different types of assets in Publication 946, Appendix B.

To find the relevant number of years in which you can claim tax benefits, after which a piece of equipment will be depreciated for tax purposes, you’ll need to consult two tables, B-1 and B-2.

If your asset (property) is listed in Table B-1, that’s the generally used depreciation (recovery) period for that class of assets.

However, you still need to check Table B-2 to see whether that asset class is listed under the specific type of activity for which it’s used, such as “Class 15.0-Construction”.

In simpler cases, this estimate of an average useful life (recovery period) can be used as the company’s initial useful life estimate for its equipment.

In many cases, the IRS-prescribed termination of tax benefits will correspond with the end of the equipment’s useful life in terms of how cost-effective it is for the company to repair or replace it.

However, sometimes that might not be the case, and that’s why the IRS estimates can be adjusted based on different factors impacting the useful life we covered above, such as the frequency of usage or technological progress.

Thus, these estimates can also be used as a baseline that will be adjusted to such specific factors.

For instance, checking the original manufacturer’s specifications (manuals, warranty info, number of cycles or hours of operation, etc.) for equipment and its components can help companies calculate their useful life based on the expected usage.

Simply put, most (but not all) equipment will have a longer useful life if it’s not used too frequently and is properly stored.

Likewise, when determining the useful life of their equipment, companies should use their past experience with similar equipment operating in similar conditions.

Moreover, to make their experience more data-based, companies should take advantage of past data on similar assets obtained from different software solutions they use to manage their operations.

For instance, if a company has been using an asset tracking app like GoCodes for some time, it already has the past maintenance and usage data for all tracked equipment and other assets, which could be used to better predict the useful life of the same or similar equipment.

Utilizing this and other construction management solutions, including accounting software, can provide a lot of past data that can be used to make more precise useful life estimates.

To sum up, determining equipment’s useful life can start and end with the estimates provided by the IRS for tax purposes.

However, to get a more precise estimate, companies can analyze the original manufacturer’s specifications and use their past experience and any available past usage data on comparable assets.

How Asset Depreciation Ties In

Now that we have determined how useful life estimates can be made, let’s explore how asset depreciation ties in.

We already provided one definition of depreciation, but it bears repeating in another way:

“The term depreciation refers to an accounting method used to allocate the cost of a tangible or physical asset over its useful life.”

When companies fail to account for depreciation, that can seriously affect their balance sheets, income statements, and tax liabilities.

However, when depreciation is taken into account, it allows companies to spread the initial purchase cost across the number of years they expect an asset to generate revenue, rather than the entire cost affecting their books all at once.

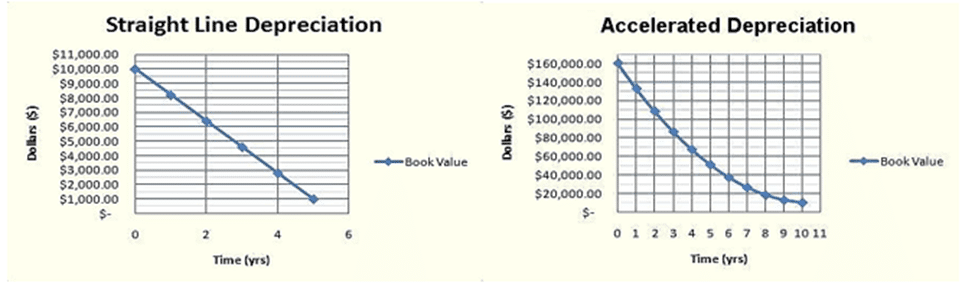

Not surprisingly, there are many types of depreciation, but we’ll focus on the two most commonly used ones—straight-line and accelerated depreciation—as they’re illustrated here:

We’ll also provide examples of calculating each, so bear with us.

Straight-Line Depreciation

It’s the most common way to calculate depreciation, whereby the value of an asset gradually declines over its useful life in equal amounts.

Provided that the estimated salvage value of the equipment is zero and its estimated useful life is 10 years, the total acquisition cost of that asset (e.g., transportation and installation costs) would be equally distributed over that period.

In this case, a piece of equipment bought for $100,000 would be depreciated by $10,000 per year.

If it’s estimated that equipment will have some residual (salvage) value left after its useful life, that amount is deducted from the total purchase cost, and the equal division of the remaining amount is repeated.

For example, if it’s estimated that the said $100,000 equipment will be worth $10,000 in resale value after ten years, it would be depreciated by $9,000 per year ($100,000-$10,000=$90,000/10 years=$9,000).

Accelerated Depreciation

Accelerated depreciation assumes most of the asset’s value will be lost within the first few years of its useful life and uses different methods, including sum-of-the-year and double-declining balance, to calculate depreciation amounts that reflect that assumption.

Both of these methods aim to depreciate (write off) an asset’s acquisition cost at an accelerated rate to achieve higher tax savings in the first few years after its purchase.

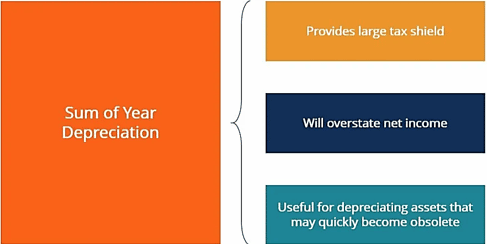

The sum-of-years depreciation (SYD) method is beneficial for depreciating assets that can quickly (i.e., before the end of their estimated useful life) become obsolete due to technological advancements, such as IT equipment.

Here are the advantages applying SYD can bring in the first few years of the asset’s life:

So, the SYD method depreciates the asset’s value by applying a unique depreciation factor for each year of the asset’s useful life.

That factor is obtained by dividing the number of years of the asset’s useful life by the sum of all years.

Let’s say that $100,000 is the acquisition cost, the useful life is 5 years, and the salvage value is zero.

This would mean that in the first year of depreciation, the company would write off one-third of the asset’s acquisition cost, or $33,334 (1+2+3+4+5=15 years, 5/15=0.333 or 33%).

In the second year, the write-off would be equal to 4/15=0.266, or about 27%, and so on until zero (or the estimated salvage value) is reached.

As for double-declining balance, this type of accelerated depreciation also involves all the above elements other than the sum of years.

Its formula is “2 X cost of the asset X depreciation rate”.

First, the asset’s depreciation rate is calculated using the straight-line method, then the asset’s cost is doubled and divided by the said rate.

In the above $100,000 example, the company would write off $40,000 in the first year, $24,000 in the second year, and so on.

In summary, depreciation aims to spread the asset’s cost throughout its useful life.

To do so, different depreciation methods can be used, such as straight-line depreciation, which depreciates the assets in equal amounts, or the accelerated depreciation methods described above, which allow companies to write off higher amounts in the first few years of an asset’s useful life.

Conclusion

So, we first learned that an asset’s useful life is an estimate of its revenue-generating period, its importance for accounting, financial and operational planning, and realizing tax benefits, and what factors impact it.

Then we explored how to determine the useful life and how it can then be used to calculate depreciation in different ways.

We hope this article helps you in calculating the useful life of your assets and equipment, thus improving your business financially and operationally.