From assisting you in maximizing the utility of your equipment and navigating tax implications to optimizing financial strategies, fixed asset depreciation assumes various crucial roles within the realm of financial operations.

So, it’s definitely worthwhile to familiarize yourself with this important accounting concept.

This article, therefore, aims to address six commonly asked questions about the depreciation process, providing as much detail, practical tips, insights, and advice as possible.

Let’s start with the first question.

In this article...

What Is Fixed Asset Depreciation?

Before diving into the inner workings of fixed asset depreciation, let’s explain what fixed assets are in the first place.

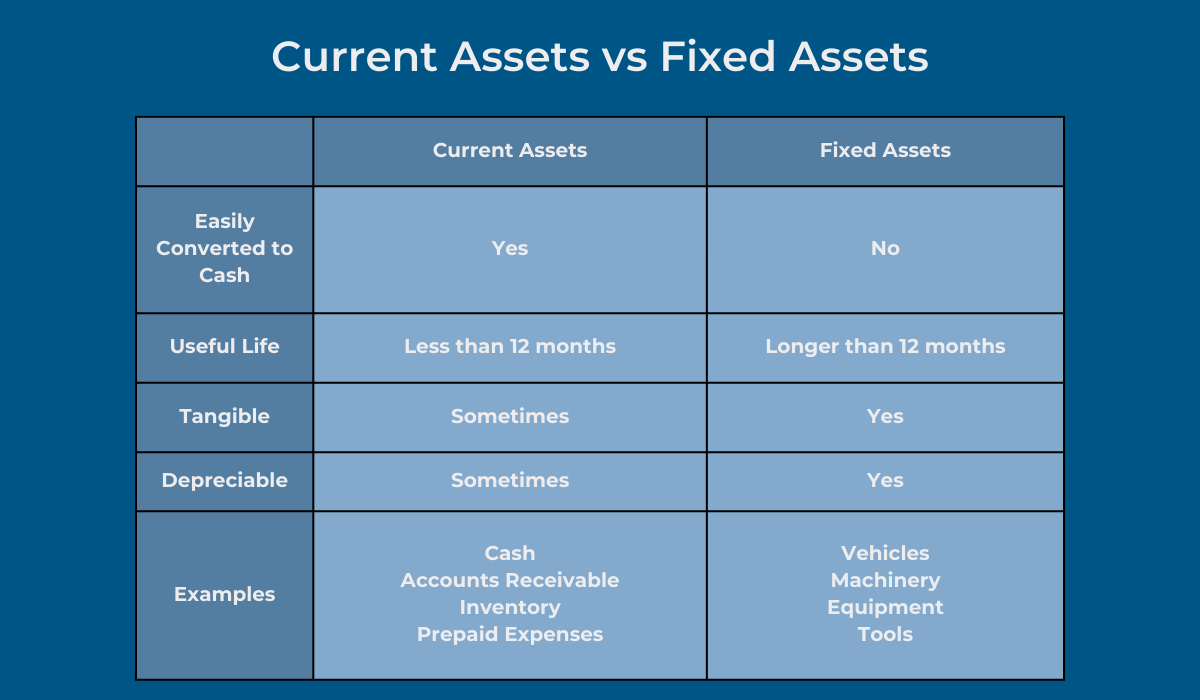

When we’re talking about fixed assets, we’re referring to the heavy machinery, tools, vehicles, equipment, and all other tangible property you use to generate profit over multiple fiscal years.

In other words, a fixed asset is usually a high-value property used to make money for longer periods of time.

Cash or other items that are easily convertible to cash, like inventory, are not considered fixed, but rather current assets.

Now, you already know that, no matter how frequently you inspect or perform maintenance on your machines, or even how careful you are when using them, their value is bound to decline over time, either due to wear and tear, age, or technological advancements.

Depreciation accounts for that drop in the asset’s value.

It’s an accounting concept that periodically reassesses your assets’ worth until they reach the end of their lifecycle and spreads the decrease in value across different accounting periods, aligning with a machine’s or tool’s gradual decline.

An important thing to note is that there are several criteria equipment must meet in order to be depreciable.

It must:

- be a property you own

- be used to generate income for your business

- have a useful life that can be determined

- have a useful life must be more than one year

If all these requirements are met, you can proceed to depreciate your asset using one of the many depreciation methods, which we’ll delve into later.

Overall, depreciation is a vital accounting process, safeguarding a company’s financial well-being in more ways than one.

Let’s see why.

What Are the Benefits of Tracking Fixed Asset Depreciation?

Besides ensuring compliance with tax laws, tracking fixed asset depreciation presents a range of advantages for your business.

For starters, the US tax code extends a provision allowing businesses to decrease their taxable income through depreciation.

So, by spreading the expense over time and allocating it to counterbalance revenue in multiple periods, you can maximize this deduction, making your cash flow much more stable.

To illustrate, consider the scenario of buying a $100,000 machine with an estimated useful life of ten years.

In such cases, it’s far more advantageous to record a $10,000 cost over these ten years than dishing out the entire $100,000 in the acquisition year, followed by $0 in subsequent years when the asset still contributes to profit generation.

But beyond tax benefits, monitoring and managing the decline in value of fixed assets also facilitates making better-informed financial choices, especially when it comes to equipment replacement and maintenance planning.

Understanding the depreciation timeline of an asset provides a foundation for evaluating the cost of ownership versus the value it delivers.

Such insights are crucial, for example, when deciding whether to retire a piece of equipment or continue investing in its maintenance.

The ability to make such discerning decisions is invaluable since it leads to savvy resource allocation, smarter investments and ultimately, fosters better long-term returns for the company.

After all, a little bit of financial foresight can go a long way.

What Tools Should You Use for Streamlining Fixed Asset Depreciation?

Although depreciation management is typically considered an accountant’s responsibility, there are tools the whole team can use to significantly streamline the entire process.

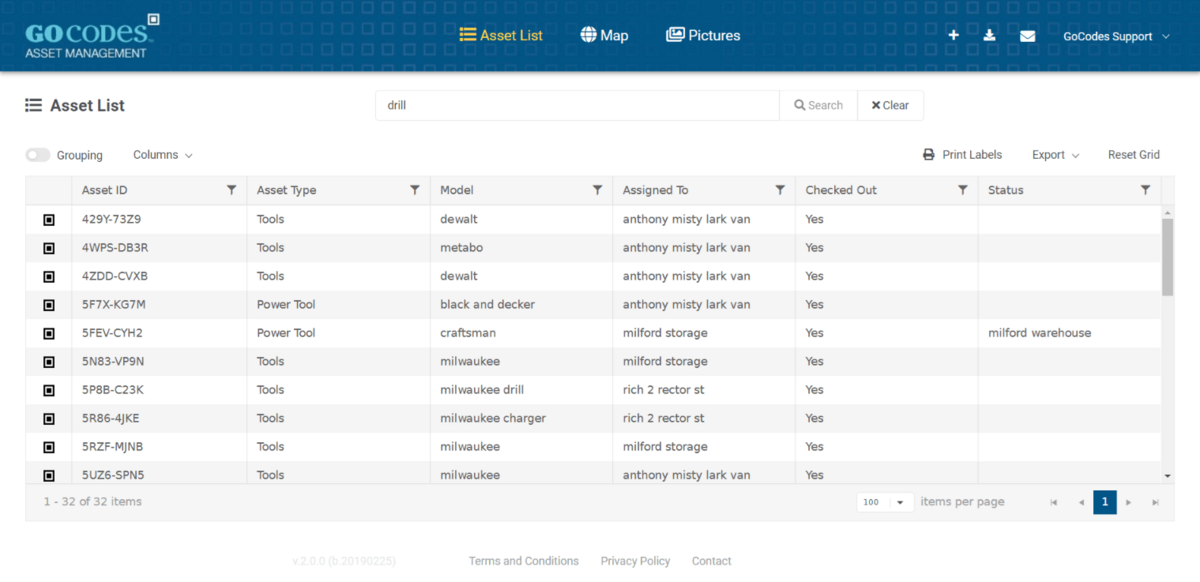

Asset tracking and management solutions, for example, particularly those that are cloud-based, offer real-time visibility into all your equipment, which is vital for accurate depreciation calculations.

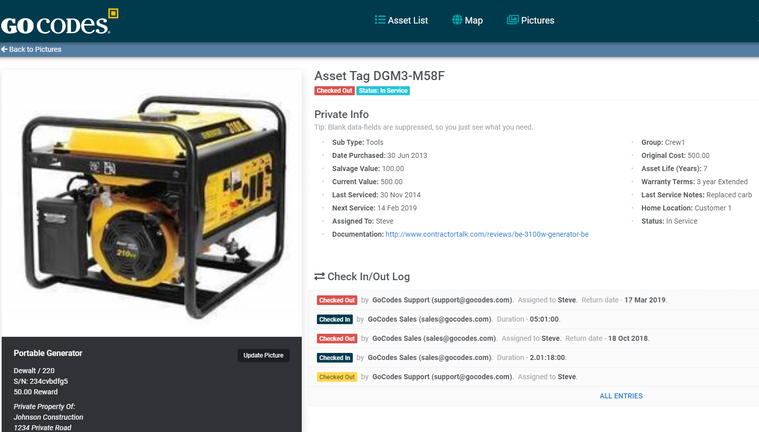

Such technology enables you to monitor maintenance logs, warranty terms, salvage values, GPS locations, and other critical data through an easily searchable database, consistently providing you with detailed and up-to-date information, which your accountants can then use to do their job with more precision and speed.

Moreover, these solutions provide insights into the total number of assets and their locations, even if they are spread across multiple job sites.

This ensures you’ve got every asset covered during the depreciation procedure.

Let’s illustrate how this process works using the GoCodes Asset Tracking asset management solution.

Our system is composed of two elements: QR code asset labels made out of tamper-proof materials and a central database that securely stores all the equipment data in the cloud.

Labels are affixed to your tools and machines, and the GoCodes Asset Tracking scanner app is used to scan them for a quick check-out, check-in, or information update.

The database keeps records of the locations of these updates as well as information such as maintenance schedules, asset costs, purchase price, or date of purchase, all of which can then be accessed via any internet-connected device.

Going a step beyond just monitoring equipment data, GoCodes Asset Tracking also automatically calculates depreciation, using a variety of the most frequent IRS MACRS schemes.

After you input key data into the system, it’ll calculate:

- the prior year’s depreciation

- the current year’s depreciation

- the total depreciation across all years

- the remaining balance to be depreciated

For more details on how GoCodes Asset Tracking does these calculations, feel free to read the article we dedicated to this topic.

All in all, implementing advanced asset tracking and management solutions enhances the efficiency of depreciation processes by providing real-time visibility and accurate data, empowering the accounting department through a streamlined and error-free workflow.

What Factors Should You Consider During Fixed Asset Depreciation?

No matter what kind of software you use, the key elements of fixed asset depreciation will always be the same.

Let’s see what they are.

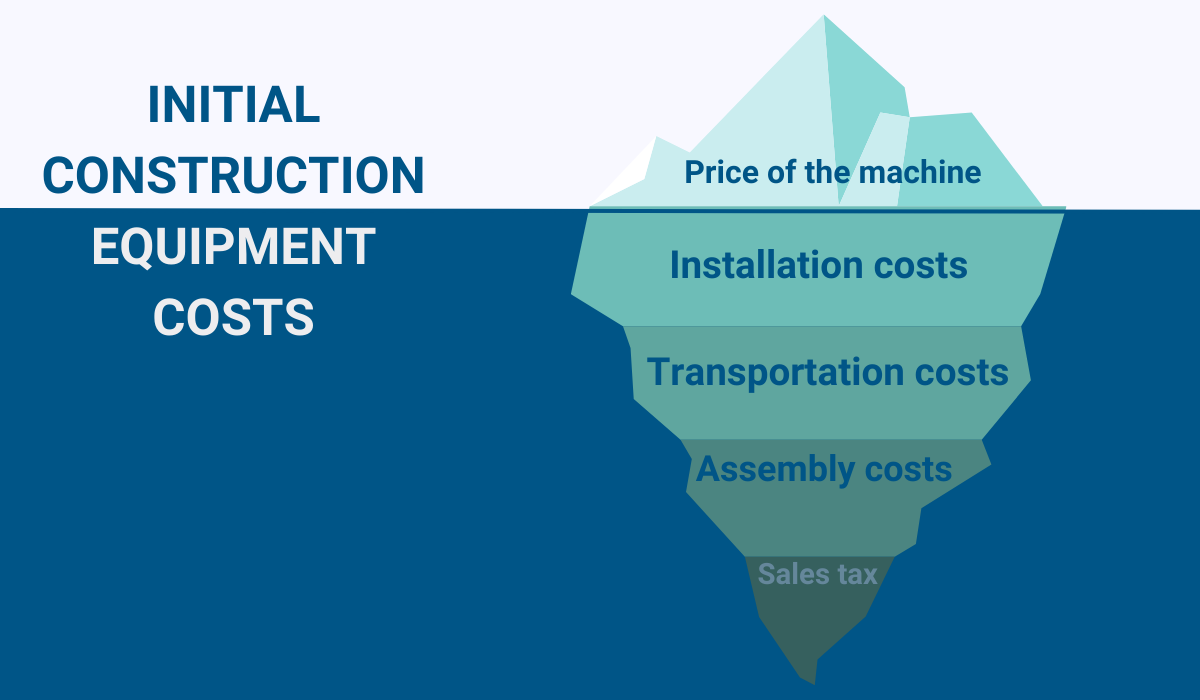

The first element you’re going to need to consider is the original cost of a machine or tool.

Although it sounds pretty straightforward, it doesn’t include just the purchase price but all the expenses associated with bringing that asset into the company’s possession and making it operational.

This includes sales tax, transportation, assembly, and installation costs.

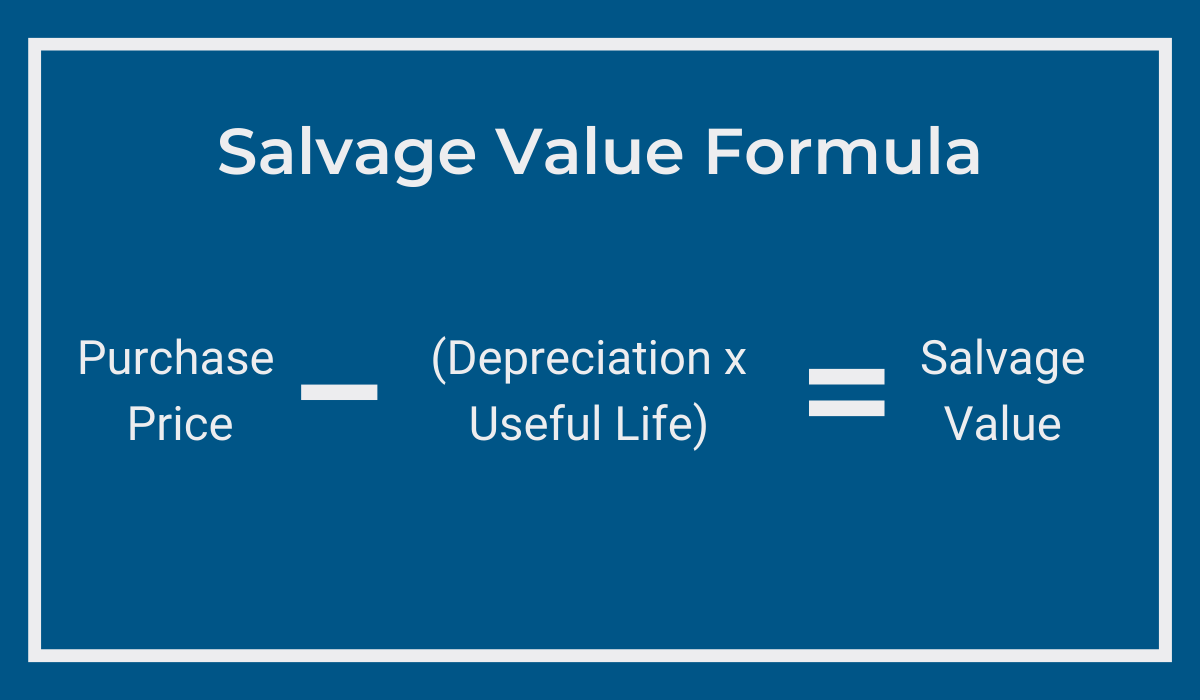

Another factor to take into consideration is the salvage value, also referred to as residual value.

It represents the anticipated amount of money that’d be received after selling that property at the end of its useful life.

This brings us to the final component—the expected life span of an asset, or the estimate of how long you’ll be able to use that piece of equipment for its intended purpose before it completely depreciates.

This value can be expressed in years, months, working hours, or even units produced.

While your experience may contribute to the assessment, consulting user manuals, which typically provide their own estimate, is advisable.

Moreover, obsolescence significantly affects equipment’s longevity, too.

For instance, if a machine is capable of functioning for 10 years, but becomes obsolete in five, either due to technological advancements or changes in your own needs, then the service life is limited to that shorter duration.

Once you have gathered accurate data on all these aspects, the next step is to select a depreciation method.

However, the question arises: how do you make this choice?

How to Choose the Right Fixed Asset Depreciation Method?

Before we answer this question, let’s first take a look at some of the common depreciation methods.

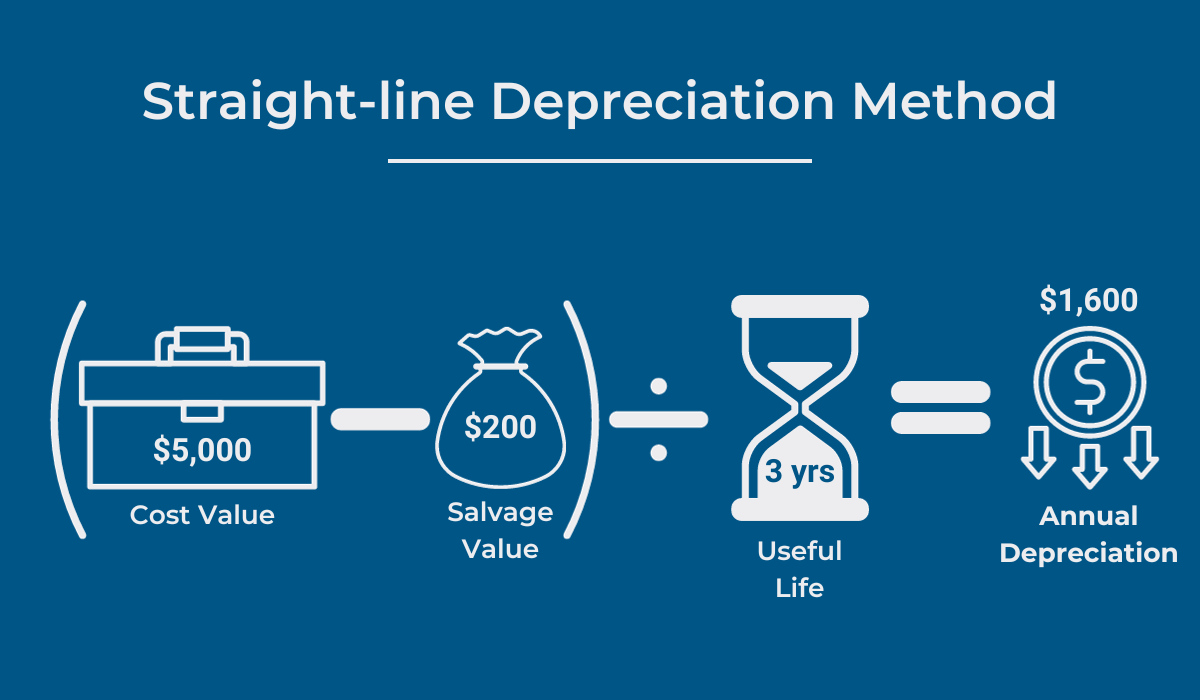

The most widely employed approach is called the straight-line method.

This is also the simplest strategy, evenly distributing a machine’s cost throughout its useful life.

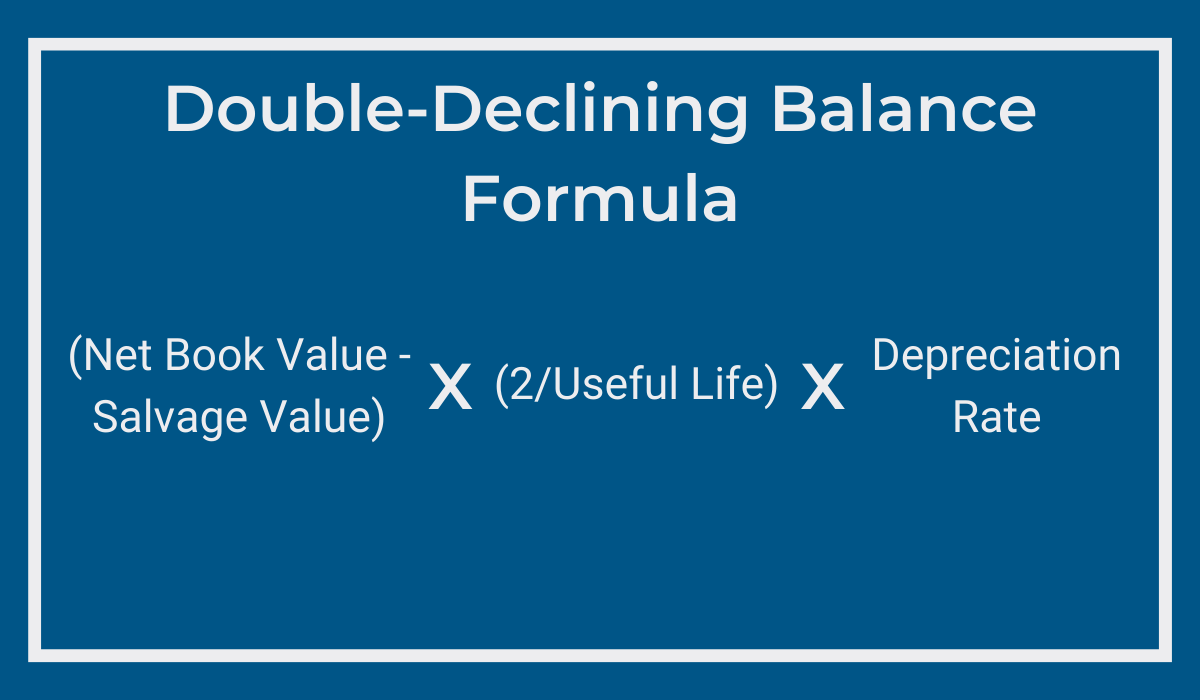

Declining balance methods, on the other hand, particularly the double declining approach, represent an accelerated alternative.

They recognize higher depreciation in the initial, higher-value years of an asset’s life when the machine or tool is more productive.

In practical terms, the double declining balance depreciation is twice as fast as the straight-line one.

The units of production method, however, takes an entirely different approach by calculating the depreciation of a fixed asset based on its actual usage instead of the time it spent in the company’s ownership.

Rather than allocating the expense uniformly over time, it’s distributed based on the produced units or operating hours, which provides a clearer picture of the equipment’s wear and tear.

So, which strategy is the right one for you?

Naturally, there is no one-size-fits-all answer; that’s why all these methods exist in the first place.

Instead, the decision should consider multiple factors, such as:

- the nature of the asset

- regulatory and tax considerations

- business goals

- asset’s longevity

To illustrate, the units of production method is ideal where usage is a better measurement than time, as seen with manufacturing equipment and vehicles, while straight-line depreciation is more suitable when an asset is expected to provide benefits consistently and evenly over its entire service life.

Smaller businesses, aiming to fortify their cash reserves as quickly as possible, may favor accelerated schemes, for example.

However, keep in mind that tax laws may dictate specific depreciation strategies and recovery periods.

Therefore, consulting a financial professional or accountant is essential for making informed decisions that comply with accounting standards or tax regulations as well as align with your company’s needs and circumstances.

How Can Inaccurate Fixed Asset Depreciation Affect Your Business?

So what are the implications of an ineffective fixed asset depreciation process?

What are you risking by miscalculating depreciation?

One immediate consequence is the potential overpayment of taxes and insurance premiums, as these costs often hinge on a percentage of the total asset value.

The failure to properly monitor the decrease in equipment’s value opens the door to mistakes, resulting in either underpayment or overpayment, both of which compromise the financial health of your business, leading to shaky cash flow at best, and serious legal consequences and worst.

And, according to Garry Bartecki, managing member of GB Financial Services LLP, you really don’t want to find yourself in a situation where you owe sales or income taxes.

Illustration: GoCodes Asset Tracking / Data: For Construction Pros

Moreover, inaccurate depreciation can distort a company’s true financial position, potentially misrepresenting financial statements.

This misinformation can put investors, creditors, or other stakeholders on the wrong track, eroding confidence in your company and jeopardizing its credibility, eventually impacting future business opportunities in a negative way.

Incorrect depreciation can affect companies in more subtle ways, too.

For example, if your finance team struggles to determine a particular machine’s depreciation—whether due to erroneous asset data in the database or an asset being misplaced—it significantly slows them down, racking up additional costs in the form of wasted time and delays.

Such expenses are not apparent immediately, but they accumulate over time, causing harm to your profitability.

All in all, each of these consequences only further emphasizes the need for a strong fixed asset depreciation process as a vital element of sound financial management and ultimately, company success.

Conclusion

Hopefully, this article managed to answer some of your questions about fixed asset depreciation and provided you with the confidence to navigate this financial tool effectively.

The concept may seem complex at first, but with the right tech, accurate data, and proper method, it can be mastered.

After all, recognizing the pivotal role depreciation plays, and understanding its nuances enables you to make informed decisions that can positively impact the long-term financial health and stability of your company.