If you’re a construction company owner or manager, you’re probably aware that different types of insurance can protect your business from various risks inherent to construction projects.

Heavy machinery, equipment, and tools are crucial in construction operations, and their reliability is the cornerstone of successful project completion.

Considering their importance, those assets often need to be separately insured, which is why there are different types of construction equipment insurance.

So, read on to learn more about this kind of insurance and how to get it.

In this article...

What Is Construction Equipment Insurance

Construction equipment insurance is a term used to describe insurance policies that help contractors protect their business from serious financial losses (and even bankruptcy) caused by physical damage or loss of their equipment.

This type of insurance, also known as tools and equipment insurance—or contractor’s equipment insurance in the construction industry, evolved to provide coverage in specific cases usually not covered by general liability insurance.

Put simply, construction equipment insurance provides coverage when the contractor’s equipment and tools are stolen, damaged, or destroyed.

It is used to insure equipment, tools, and other items that travel from site to site—in other words, items that are mobile or portable.

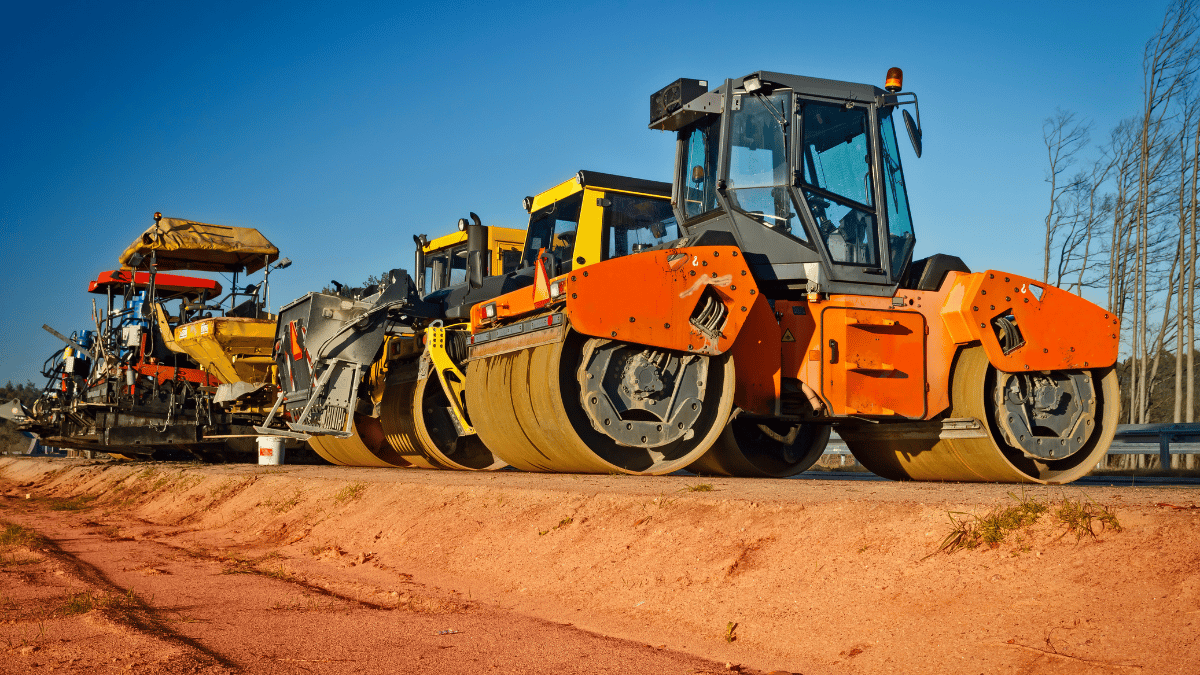

Naturally, construction companies usually use it for expensive heavy equipment like bulldozers, excavators, loaders, etc., and their attachments.

However, they can also include smaller equipment like generators, tools like drills, saws, and hammers, and personal protective equipment (PPE).

Thus, construction equipment insurance allows contractors to protect different types of equipment that go with them from one jobsite to the next.

This equipment would otherwise remain unprotected and exposed to various risks that could jeopardize the contractors’ projects.

Why Should You Consider Insuring Construction Equipment

You should consider insuring construction equipment if you wish to protect your business from substantial financial losses caused by theft, damage, or outright destruction.

Regardless of the size of your company, you can benefit from construction equipment insurance because it can protect you from various risks that could reduce your profit, jeopardize your competitiveness, or even, in the most severe cases, lead to bankruptcy.

Needless to say, construction is a complex and often dangerous profession.

The risks associated with construction projects are so varied that the Construction Industry Institute estimated that an average project faces over 100 risks in total.

And many of those risks, ranging from malfunctions and accidents to natural disasters, can damage or destroy construction equipment, like in the case of these cranes damaged by the recent hurricane Ian.

When something like that happens, any equipment that’s not insured will need to be repaired or replaced by the affected contractor from their own pocket.

So, to avoid this and protect their investment in equipment as well as their profit and cash flow, contractors should consider getting insurance against common risks to their construction equipment.

What Does Equipment Insurance Usually Cover

Most equipment insurance providers will allow you to choose what you want your equipment to be protected against.

This will usually include equipment theft, as well as damage or destruction caused by accident, vandalism, and natural disaster.

However, you can also protect your business from costs arising from the damage caused to your equipment by uninsured subcontractors operating it.

Furthermore, you can opt for coverage that will protect you if your equipment accidentally damages adjacent properties or public infrastructures like electricity, water, gas, and sewage lines.

This type of damage is referred to as utility damage.

For instance, although excavators can be equipped with a locator that detects underground pipes and cables and notifies the operator, damage to pipes and cables can still occur, as explained here, courtesy of Underground Construction:

In similar cases, business interruption insurance can prove helpful.

This type of insurance will cover your financial losses from unexpected downtime and delays caused by equipment theft or breakdown.

On top of that, you can opt for rental reimbursement insurance, which will cover the cost of renting equipment while the damaged asset is being repaired or replaced.

Additionally, you can cover the costs of debris removal after an accident involving insured equipment or the costs of firefighting services in case of fire.

Finally, you can choose to extend the policy to include leased and rented equipment you are (or might be) using to complete construction projects.

So, even though equipment insurance usually covers theft and damage to your equipment that occurred under specific circumstances, there are many more coverage options to consider.

How Much Does Insurance Usually Cost

With so many different risks, options, and conditions to consider, the price of your equipment insurance policy will ultimately depend on the insurer’s rates and your choices regarding coverage and deductibles.

Usually, the cost of insurance is determined by where the construction company is located, the type of equipment it wants to insure, how the equipment is used, its total value, and how the company plans to protect it.

In other words, insurers will calculate the above factors based on the information provided by the company and their own criteria and then offer a rate.

For information purposes, insurers often provide an insurance disclosure sheet listing the key insurance terms and conditions, like this one.

Naturally, equipment with a higher value will result in higher insurance costs.

Thus, we cannot provide an average percentage or dollar amount, as that amount will differ according to the insurer’s rates arising from the specific factors mentioned above, as well as deductibles and any additional provisions the company wants to have in its policy.

We’ve already listed different types of basic and additional coverage, but we still need to define what a deductible is.

This is how Investopedia describes it:

An insurance deductible is a specific amount you must spend before your insurance policy pays for some or all of your claims. Insurance companies use deductibles to ensure policyholders have skin in the game and will share the cost of any claims.

In other words, a deductible is the agreed amount you will pay to share the cost of repair or replacement with the insurer when the insured equipment is damaged or stolen.

Generally, policies with lower deductibles will be more expensive, i.e., have higher insurance premiums. Conversely, higher deductibles will usually mean lower premiums.

Given all of the above considerations, we can finish by saying that a very rough estimate of the insurance cost could be between $600 and $1,200 for a piece of equipment worth $100,000.

Keep in mind, however, that this is by no means a definitive amount, and it can only serve as an approximation to get you started.

Tips for Buying Equipment Insurance

So, what should you look out for when buying construction equipment insurance?

In essence, you should first assess the risks to your construction equipment, so you can choose insurance policies that cover those risks.

However, when comparing different equipment insurance policies, you should be aware of various forms of coverage (blanket vs. scheduled) and reimbursement (actual cash value vs. replacement cost value) offered by insurers that can affect your decision.

Blanket coverage refers to all equipment, tools, and other items that were defined in the policy as “covered property.”

For instance, Great American Insurance Group calls it “Automatic Acquisition Coverage,” as highlighted below.

Conversely, scheduled coverage means that any insured equipment has to be specified in a schedule attached to the insurance policy and that only such equipment will be covered.

Companies often use a combination of the two to protect their equipment in a cost-efficient way.

Thus, when shopping for insurance, you can provide potential insurers (or your broker) with a list of equipment and tools you want to insure, preferably together with their date of manufacture, model/serial number, and estimated current value.

When you hear back from them, their rates and other conditions will help you decide what type (or combination) of coverage would be best given the specific risks you want insured.

The second thing to look for when purchasing insurance is whether the policy is written on an actual cash value (ACV) or replacement cost value (RCV) basis.

The main difference between them is that ACV will cover the repair or replacement of the damaged equipment but won’t cover the value that equipment lost (i.e., depreciation) from the time it was insured until the moment it was damaged or lost.

RCV, on the other hand, will cover the initial value of the insured equipment.

However, although it looks like a better option, insurers will often grant RCV coverage only for new equipment (no older than five years).

Here’s how each of them is calculated, courtesy of Miller Public Adjusters:

Thus, contractors would do well to ask about RCV options and, if available, monitor their insurance policies to see when some equipment should be reinsured on an ACV basis.

Of course, depending on the assessed risks, it could be advisable to consider buying additional equipment insurance that covers leased and rented equipment, business interruption insurance, and rental reimbursement coverage.

Finally, companies should regularly review their other insurance policies and combine them through the same insurer if that would result in lower insurance costs.

How to Track Which Equipment Is Covered

Finally, you should utilize equipment management software to track which equipment is covered and other pertinent insurance information about your construction equipment.

Considering the number of equipment, tools, and other assets contractors use to complete construction projects, as well as the number of different risks, tasks, and people involved in their operation, many contractors already rely on some type of equipment management software.

Such software allows them to create and manage a database that contains detailed information on all the equipment, tools, and other assets.

As equipment management software solutions are usually easily customized, contractors can use them to include relevant information on equipment insurance in their database.

For example, one such solution is our tools and equipment tracking app, GoCodes.

This mobile app combines the power of cloud-based software, rugged QR code tags, and smartphone scanner apps to provide automatic GPS tracking of the location of tagged equipment and tools.

In addition, GoCodes will provide other information like the equipment’s condition, maintenance and repair history, and usage.

On top of that, GoCodes can be easily customized to include important equipment insurance information, such as the start and end of insurance, type of coverage, deductible, and premium amounts.

Hence, this solution allows you to track all equipment, insured or not, in near real-time and from any device and enables you to monitor which equipment is covered by insurance.

Taking advantage of such equipment management software to monitor your insured equipment can help you avoid instances where you find out that insurance coverage has run out only after a piece of equipment was stolen, damaged, or destroyed.

Conclusion

Having taken this tour with us, we hope this article will help you get the best construction equipment insurance for your business.

Remember, no amount of information can eliminate the need to carefully examine insurance terms and conditions before getting insurance for your construction equipment.