Many people hear the words “fixed asset depreciation” and immediately tune out.

It sounds important, but is it really?

We’re here, not only to tell you that it is, in fact, paramount when it comes to financial management but also to explain how tracking depreciation can fortify your company’s financial health and propel it toward sustainable growth.

Let’s dive in.

In this article...

Provides an Accurate Estimate of Value

From the moment you buy a piece of equipment and put it into operation, its monetary worth begins to decline.

Consequently, the purchase price alone cannot accurately represent the asset’s true value.

Instead, the depreciation of a machine needs to be taken into account, too.

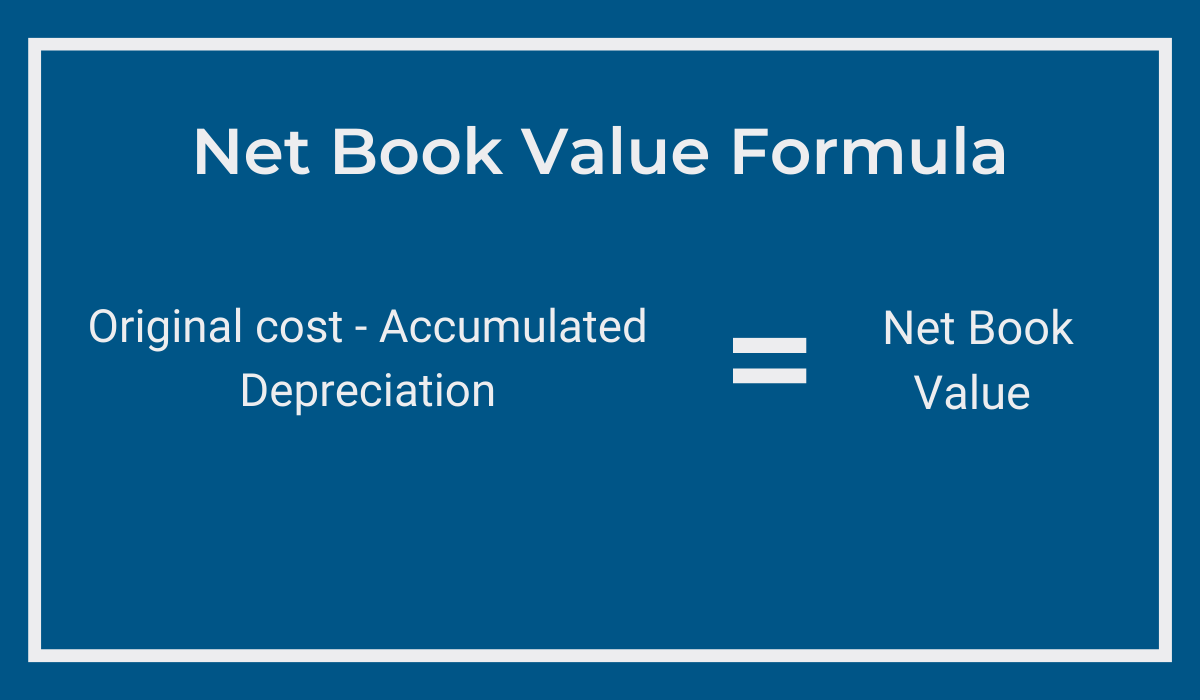

The formula for calculating the book value itself is pretty straightforward; simply subtract the accumulated depreciation from the original cost.

Still, there are a couple of important things to remember.

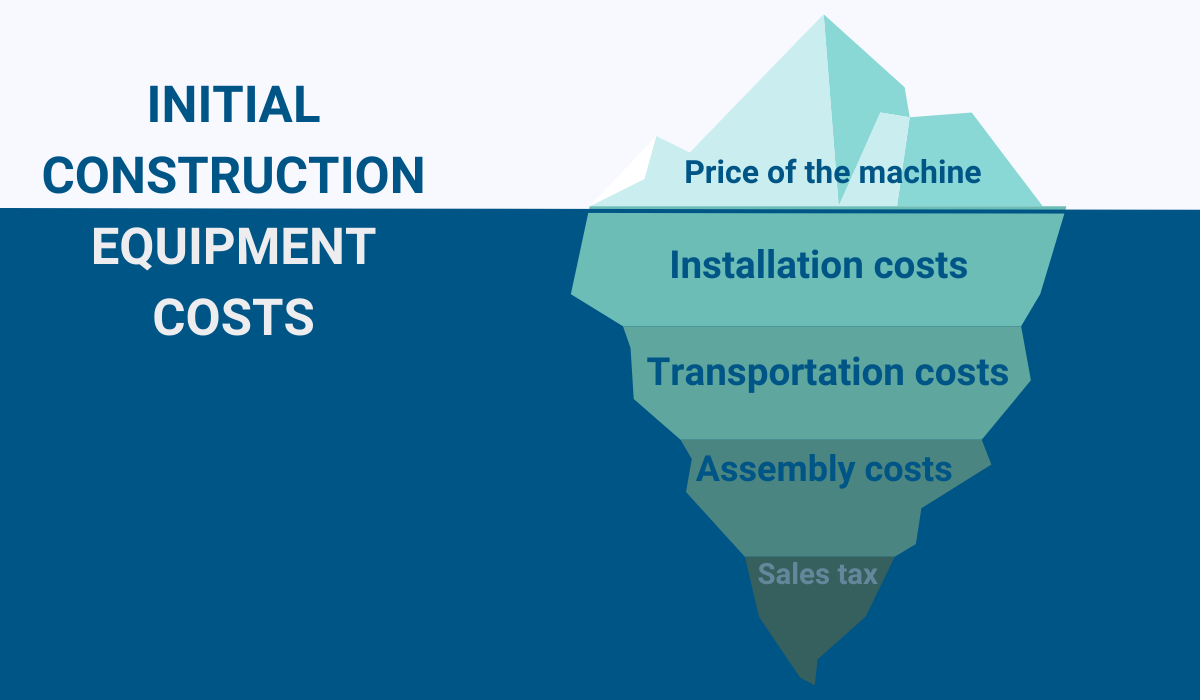

For starters, the initial cost doesn’t entail just the price you paid to buy a machine.

It encompasses all the expenses necessary for making a piece of equipment operational, such as transportation, assembly, installation costs as well as sales tax.

Relying solely on the purchase price for calculations would result in inaccurate book values.

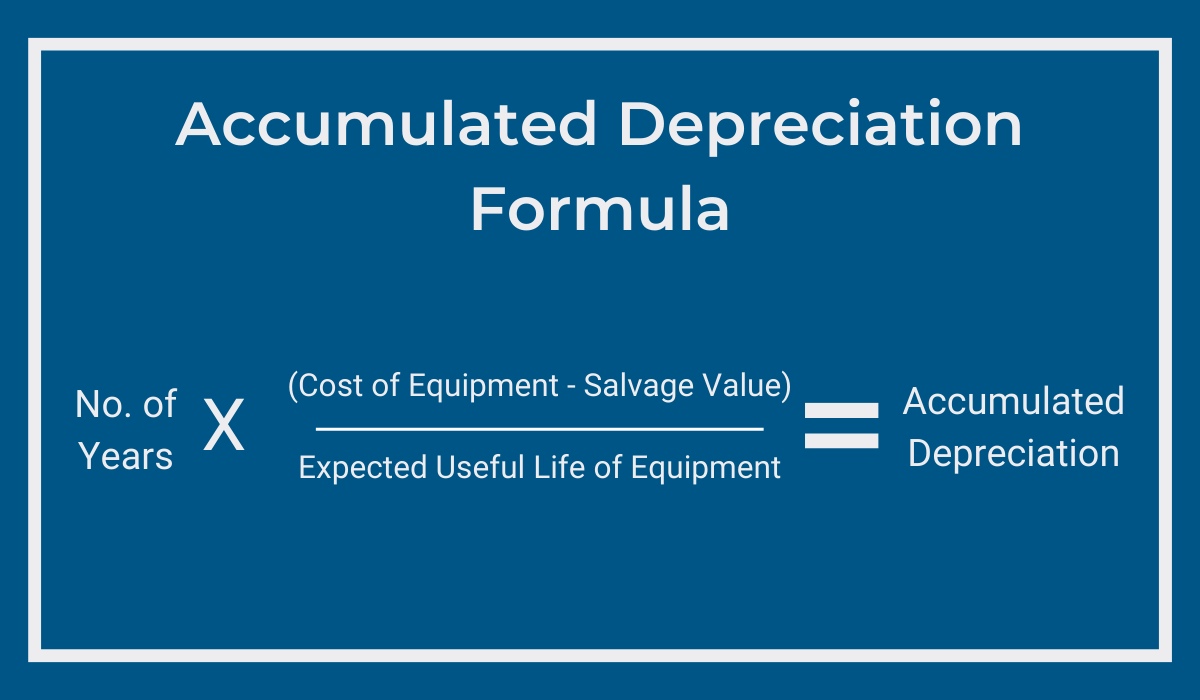

Furthermore, accumulated depreciation represents the total depreciation expense recognized for the asset since it was acquired.

In other words, it’s the portion of the original cost that has been “used up” or “consumed” during a tool’s useful life.

Different methods, such as straight-line or declining balance depreciation, exist for calculating this expense, and the decision about which one to adopt is best made in collaboration with your accounting department.

Overall, net book value is a key metric for financial analysis and decision-making, as it provides insights into the carrying amount of an asset on the balance sheet.

For example, if the book value of a machine is close to the price you’d get for it if you were to sell it, this may suggest that the asset has retained its value well over time.

However, in many cases, the book value may differ significantly from the market value, especially for machinery that experiences rapid technological obsolescence or significant changes in market conditions.

We also have an article where you can learn all about the factors affecting your assets’ depreciation.

Allows for Asset Replacement Planning

As a construction industry professional, you already know how a piece of machinery breaking down can throw a well-laid plan into disarray.

Picture this: your dedicated team is diligently working on a critical project when suddenly, the excavator grinds to a halt.

Upon investigation, the harsh reality sets in—the machine is beyond repair and now, you have to find (and pay for) a replacement, wait for its delivery, and explain to the client why the project has to stop.

Unfortunately, this is not a hypothetical scenario; it reflects a common challenge faced by many businesses.

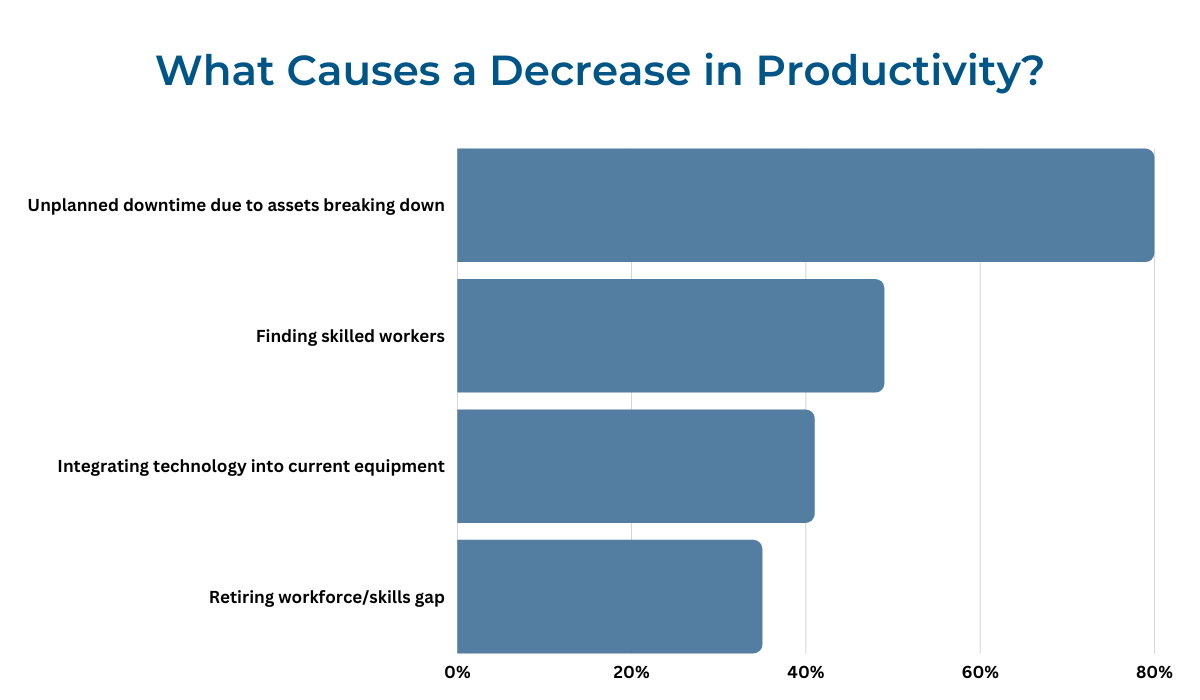

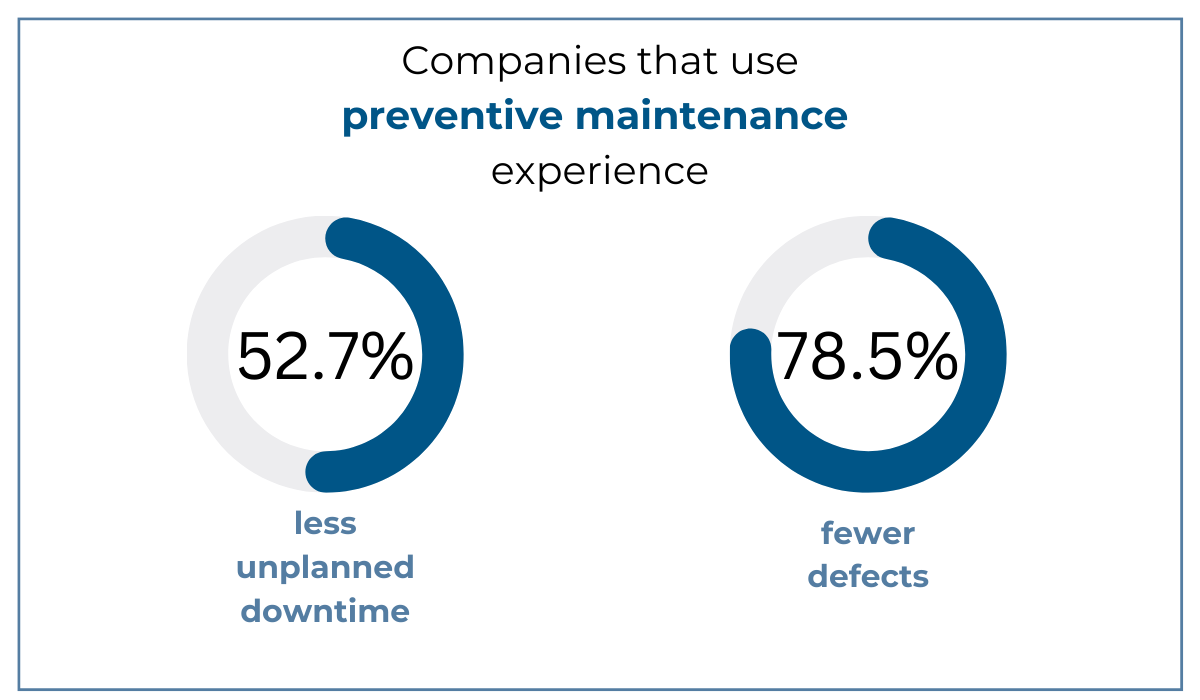

As revealed by surveys, equipment failure and aging are significant contributors to a decrease in productivity and unplanned downtime.

Understanding the depreciation becomes paramount in such situations, as it unveils insights into equipment’s expected useful life.

This knowledge can then empower you to formulate effective strategies and budgeting plans for the timely replacement of aging assets before they succumb to failure, causing severe disruptions to workflows.

In other words, the careful calculation of depreciation allows you to anticipate these scenarios, enabling proactive planning to avoid financial strain and maintain the smooth flow of operations.

Moreover, the dilemma of whether to repair or replace an asset is a common question that often haunts decision-makers within the industry.

Depreciation offers a solution to this puzzle.

By assessing whether a machine’s maintenance and fuel costs outweigh its revenue-generating capacity, you can make informed decisions on whether it’s time to retire the aging asset.

To sum everything up, calculating and leveraging depreciation isn’t just an exercise in math for your accounting team—it’s a strategic tool that safeguards against unexpected hiccups, ensuring that projects stay on course and efficiency remains unaffected.

Helps Keep Finances Stable

Effective equipment replacement and maintenance planning won’t just positively impact your productivity, but your finances as well.

That’s because determining the rate at which an asset will depreciate helps allocate the budget for its repairs, aligning it with its condition.

This approach ensures that resources are not disproportionately allocated to assets nearing the end of their operational life, enabling redirection of funds to machinery that could benefit more from such investments and can yield greater returns.

Simply put, sometimes, retiring a machine makes the most sense financially, and other times, it’s best to keep repairing it.

Understanding depreciation means understanding when and what decisions should be made in order to make the most out of your equipment.

Moreover, by determining whether or not an asset’s depreciation correlates with its actual performance, you can determine if the maintenance that is implemented to keep its value is fulfilling its purpose.

For example, if depreciation is faster than you expect, it means there are things you could do better and some adjustments should be made to your maintenance strategy to improve your assets’ longevity.

Remember, an efficient maintenance regime will curb the costs of future repairs, replacements, unplanned downtime, and project delays, all of which affect your financial stability.

At the same time, it’ll generate cash flow that can now be allocated to more critical areas, fostering a cycle of continual improvement and resource optimization.

Provides Tax Benefits

By diligently tracking the decline in the value of your assets, you can leverage tax deductions to reduce your company’s tax burden.

Essentially, the depreciation expense reduces the amount of earnings on which taxes are based, and consequently, it decreases the amount of taxes owed by a business as well.

In simpler terms, the larger the depreciation amount, the lower the taxable income and your tax bill.

At this point, your accounting department might say this is sometimes easier said than done.

The truth is that fixed asset depreciation tracking will always be a complex process, equipped with its own set of challenges, but there are tools that can simplify it, at least to some extent.

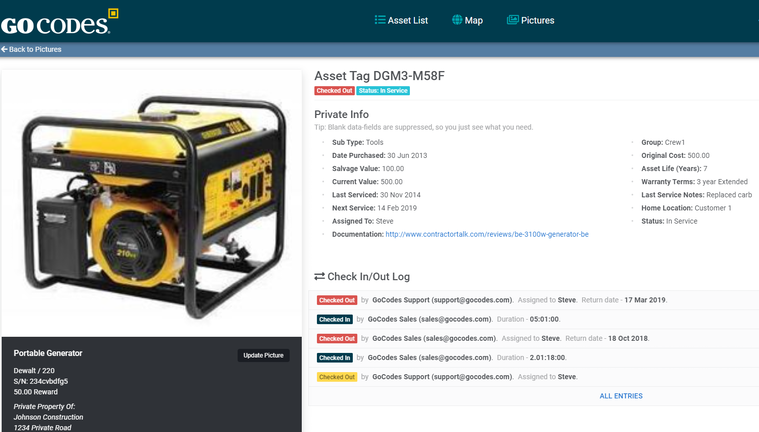

For instance, with asset management software like GoCodes, struggles associated with tax returns and financial statements become a thing of the past.

Here’s how our system works: as you tag your equipment with GoCodes asset labels and scan them to record or update information—including the purchase price or date—you create comprehensive, accurate, and up-to-date asset records.

The records can then be used by your accounting team for managing and monitoring depreciation.

Remember, without accurate asset data you can’t get accurate depreciation estimates.

This is where automated software like GoCodes plays a pivotal role.

Once information is recorded, it’s safely stored in the cloud and cannot be deleted or altered.

What’s more, our solution goes a step further than just recording the data and automatically calculates depreciation, using a range of the most common IRS MACRS schemes.

After inputting the key information such as the machine’s cost, salvage value, and expected useful life, the software will calculate:

- The prior year’s depreciation

- The current year’s depreciation

- The total depreciation for all years

- The balance remaining to be depreciated

Such a tool is a valuable addition to your accounting team, contributing to the reliability and precision of your financial reporting.

Conclusion

Taking everything into consideration, it’s safe to say that depreciation tracking isn’t just about crunching numbers for no apparent reason.

Instead, it’s a useful strategic tool that can greatly help the overall profitability of your business.

From providing you with the basis for well-informed decision-making regarding asset allocation, maintenance, and replacement to bringing stability to your finances, depreciation is an invaluable ally in strengthening a company’s financial well-being.