Any construction company owner or manager knows that the bulk of their workers’ everyday tasks rely on heavy machinery, vehicles, equipment, tools, and other high-value fixed assets.

Since such assets typically involve a considerable investment, contractors rightfully want to keep them in good condition, prevent their theft or loss, and optimize their utilization.

To do that, construction companies should understand the six stages any fixed asset goes through during its lifecycle, from procurement to disposal.

In this article, we’ll explore each stage to help construction leaders streamline their asset management practices and, ultimately, enhance their bottom line.

In this article...

Procurement

The initial stage of asset management is, naturally, acquiring a fixed asset.

Before exploring the key considerations that go into evaluating, planning, prioritizing, and executing the acquisition of fixed assets and streamlining the procurement process, let’s get our bearings first by defining what fixed assets are.

Maybe the most succinct definition comes from the Corporate Finance Institute (CFI):

To clarify this even more, we should add that, to qualify as fixed assets, these long-lived items should be owned or leased by a company (i.e., rentals excluded), used to generate revenue, and can be depreciated (as we’ll discuss later).

As such, these assets can include buildings and infrastructure, but this article will primarily focus on managing the lifecycle of high-value fixed assets crucial for any construction operation: heavy machinery, vehicles, equipment, and tools.

So, what should a company consider before deciding to procure a new asset, say an excavator?

Assuming the need to buy an (additional) excavator is clearly established, decision-makers should initiate the procurement process by assessing the company’s immediate project requirements.

Key factors to consider include:

- the specific type of excavation work required,

- the size and capacity of the equipment needed,

- any specialized features/attachments essential for efficient task completion.

In this assessment, it’s crucial to collaborate with excavator operators and equipment managers to gain valuable insights.

This should be followed by gathering price estimates for potentially suitable excavators, whether by conducting online research or contacting original equipment manufacturers or trusted dealers.

Next, it’s time to consult with accountants and tax advisors to evaluate the budget and explore potential financing options, such as leasing or loans.

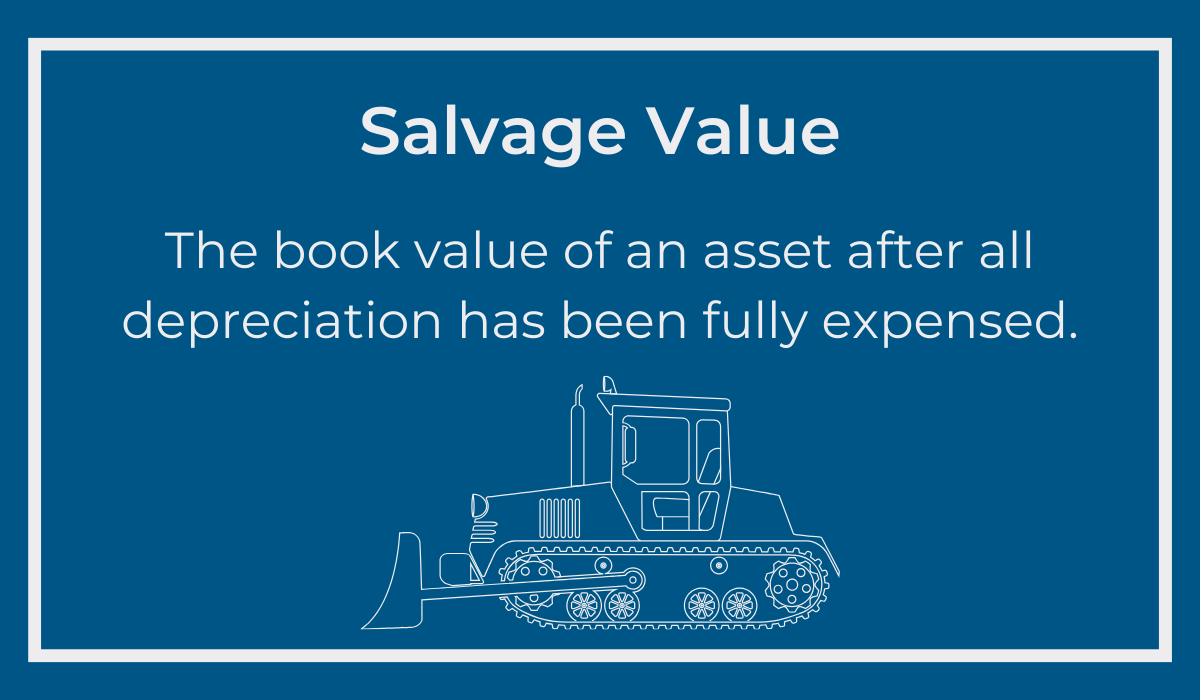

Other than the initial acquisition cost, this evaluation should include the long-term impact on the company’s cash flow (operational and maintenance costs throughout the excavator’s lifecycle and its anticipated end-of-life salvage value).

Now, a company can move to researching and selecting reputable vendors or dealers while ensuring that the selected excavator model meets all environmental and safety regulations, including emission standards.

Overall, the process of procuring high-value construction assets should consist of a series of well-considered steps, from initial needs assessment and budget evaluation to vendor selection.

When properly executed, this process sets the foundation for efficient management of an asset that, after it’s purchased, needs to be deployed.

Deployment

The deployment stage in fixed asset management is where the rubber meets the road, often quite literally.

In other words, this stage involves everything that needs to be done for your new asset (e.g., that excavator we mentioned) to be put into operation.

So, once acquired, the asset should be transported, assembled (if necessary), prepared for work, and inspected for any defects or issues.

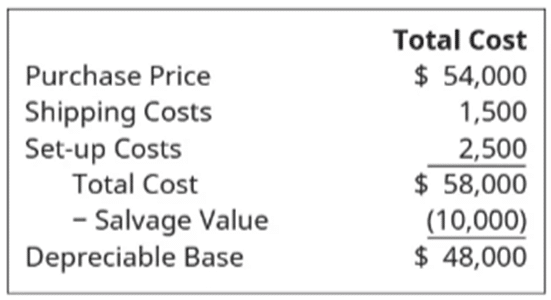

It should be noted that the costs associated with these setup activities, as well as operator training and initial maintenance, are considered part of the total acquisition cost (initial asset value) for accounting and depreciation purposes.

Here’s an example of the total cost that, once the estimated salvage value is deducted, produces the asset’s initial value (depreciable base).

Along with shipping and setup costs, operator training expenses can also be included.

What is more, operator training is a fundamental aspect of the deployment stage.

For instance, operators should be familiar with your new excavator’s controls, safety features, and maintenance protocols.

Naturally, neglecting training can lead to safety hazards, increased wear and tear, and reduced efficiency, not to mention the likelihood of breakdowns caused by improper use.

The same could be said about maintenance planning, i.e., developing a maintenance schedule to keep the excavator in optimal condition throughout its lifecycle (as discussed later).

Overall, effective deployment (proper setup and inspection, training, maintenance planning) sets the stage for the asset’s efficient operation, longevity, and profitability.

However, to monitor the condition and performance of fixed assets over time, they first need to be tagged for identification and tracking purposes.

Tagging

Since construction companies typically have many fixed assets, they need a way to track and manage these assets efficiently throughout their lifecycle to ensure optimal performance, safety, and cost-effectiveness.

This is where the next stage of fixed asset management—tagging—plays a pivotal role in maintaining control and visibility over your valuable equipment, vehicles, and tools.

In other words, tagging involves attaching unique identifiers, such as barcodes, QR codes, or RFID tags, to your fixed assets so they can be easily identified, differentiated (in case of identical assets), and their condition, usage, and location tracked.

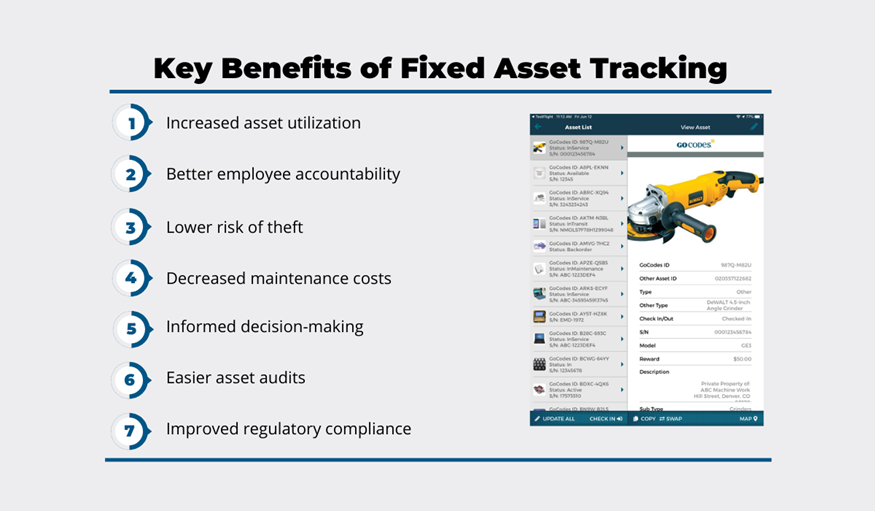

With such an asset-tracking system in place, contractors can leverage the collected data to generate the following key benefits:

Each of the above benefits helps construction companies increase efficiency and reduce costs of managing their fixed assets.

For example, when assets are tagged with QR code labels and workers are instructed to scan them when taking and returning a piece of equipment, the instances of misuse, negligent operation, or theft are minimized because workers know they’ll be held accountable.

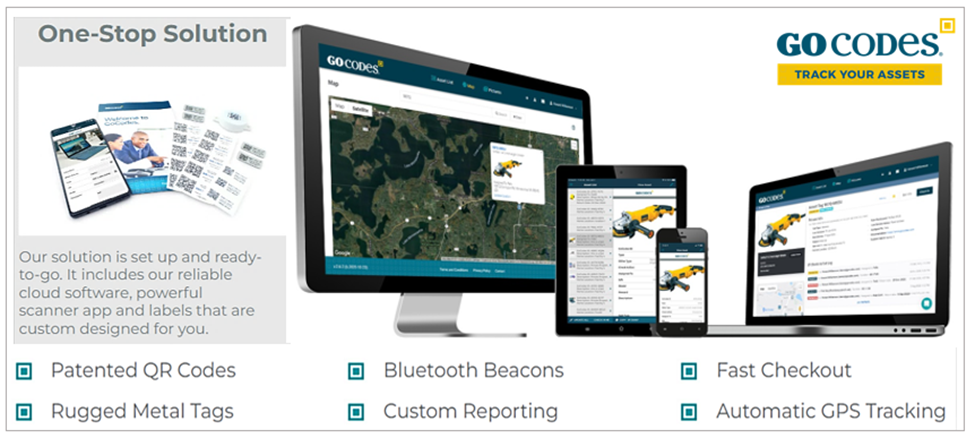

The described asset check-in/check-out functionality, and other features like GPS tracking, maintenance scheduling, and asset auditing, can be achieved by utilizing cloud software, in-app scanners, and customizable QR code tags.

One such QR code-based asset-tracking solution is GoCodes.

When it comes to asset tagging, GoCodes enables contractors to order (or print themselves) rugged QR code tags that will withstand the often harsh construction environment.

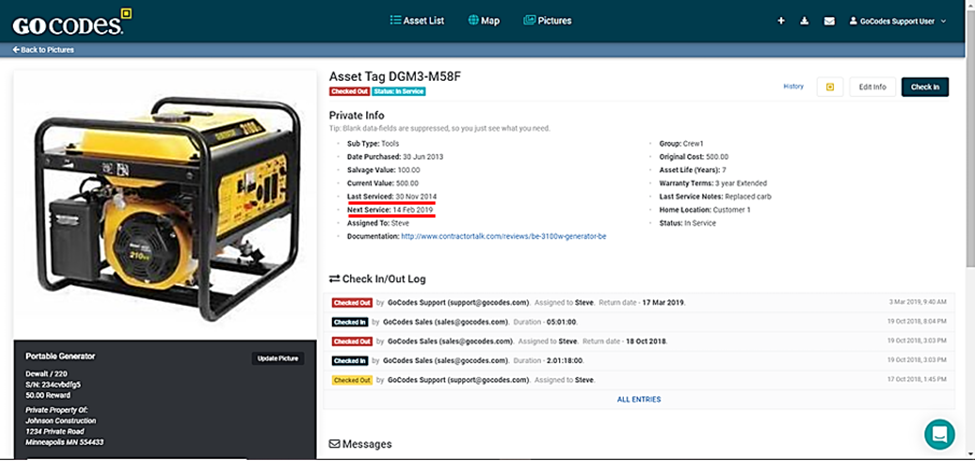

Each QR code acts as an asset’s unique identifier, meaning that it’s linked to that asset’s info page and the software’s central database of all tracked assets.

In more practical terms, after the QR code is attached to your excavator in a place where it can be easily scanned and the database is populated with initial data (purchase date and price, warranty details, estimated useful life, depreciation rate, etc.), you can start tracking it.

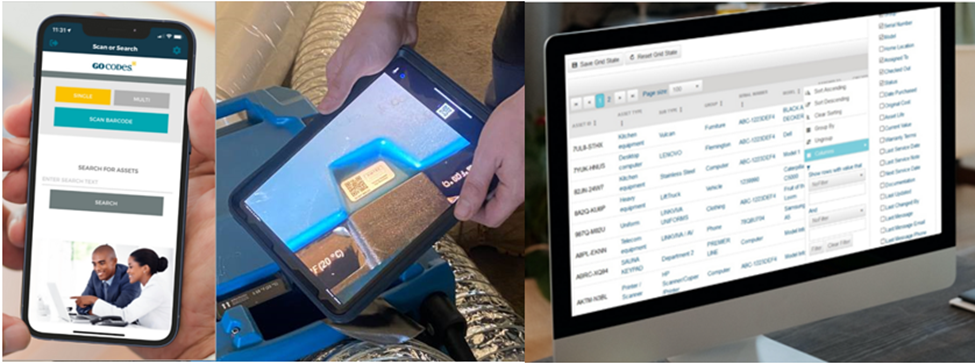

This means that users can view and update asset data at any time, from any place, and on any internet-connected device.

They can do so by scanning the QR code tag or logging into the GoCodes app and accessing the assets list, as illustrated below.

This user-friendly and affordable tagging system allows managers to track a range of crucial asset workflows, from their allocation to maintenance while also tracking the asset’s users and locations.

Overall, the asset tagging stage enables you to efficiently manage fixed assets from their procurement to disposal, ensuring they’re safe, secure, and well-maintained while giving you complete asset visibility and control.

Maintenance

Regular maintenance of fixed assets ensures they’re running smoothly, extends their useful life, and prevents unexpected breakdowns, thus helping contractors avoid project delays and budget overruns.

As such, this stage of asset management is planned during procurement and deployment and continues until their disposal.

When a company uses an asset management system like the one we described above, this allows managers to create a preventive maintenance schedule, assign maintenance tasks to individual service technicians, and track all maintenance and repair activities in real time.

Moreover, most asset management solutions enable managers to set up automated service alerts, ensuring that technicians will be notified of upcoming maintenance on time.

The assigned technician can use the same system to check the availability of spare parts and other supplies needed to efficiently perform their tasks.

Such digital solutions can also be used to request maintenance and report when it’s completed, ensuring that assets under maintenance are back in operation as fast as possible.

Lastly, all users (technicians, workers, managers) can use the mobile app to easily record all maintenance-relevant data, such as minor issues, performed inspections, and routine servicing.

That way, all service logs are kept up to date with sufficient detail to streamline maintenance processes and promote proactive asset management.

To recap, proper maintenance is an essential part of fixed asset management, ensuring assets remain reliable, efficient, and cost-effective throughout their lifecycle.

Depreciation

Depreciation is a key concept in the world of fixed asset management that plays a dual role—one in financial reporting and the other in operational efficiency.

In terms of accounting, financial statements, and tax reporting, depreciation is the systematic allocation of the cost of a fixed asset over its useful life.

Moreover, depreciation is mandated by the Internal Revenue Service (IRS), which determines the average useful life of fixed assets, i.e., the number of years that the asset’s total acquisition cost should be spread over.

Depreciation provides a more accurate representation of the current value of the company’s fixed assets, allowing it to not only comply with financial reporting regulations but also realize tax benefits over several accounting periods.

Naturally, all these processes and calculations can be simplified and tracked with asset management software.

From an operational standpoint, depreciation affects the allocation of resources and decision-making.

For instance, a construction company can plan maintenance and replacement of assets as they age, and their value diminishes due to wear and tear (operational factor) and depreciation (accounting factor).

In other words, by understanding the assets’ depreciation schedules, a company can make informed, strategic repair-or-replace decisions.

Therefore, depreciation is not merely an accounting concept; it has real-world implications for tax planning, financial reporting accuracy, and operational efficiency.

Disposal

The disposal stage of fixed asset management addresses the crucial question of what to do with assets that have reached the end of their useful life or are no longer needed.

Naturally, the first option for many contractors is to sell such an asset, say an excavator, either as a whole or for parts.

Alternatively, some companies may opt to trade it in with the manufacturer or dealer for a new excavator.

In both cases, this can help recoup some of the initial investment and reduce the financial burden of acquiring a replacement.

Of course, there are many ways to do this, as illustrated below:

Other asset disposal options include donating still functional but no longer profitable construction equipment or other assets to a non-profit organization, thereby supporting a good cause and also realizing tax benefits.

Lastly, when an asset no longer holds any significant value, it may be scrapped for its materials, such as metal, which can be recycled.

This approach is environmentally responsible and can sometimes generate a small return.

As you can see, each disposal method has its own set of considerations, including financial implications and environmental protection regulations.

Therefore, construction company owners and managers should carefully evaluate their options to make informed decisions about this final stage of fixed asset management, i.e., the disposal of end-of-life assets.

Conclusion

So, we’ve taken you through the six stages of fixed asset management, from procurement to disposal.

Having done so, it’s clear that having a better understanding of factors to consider in each stage and using asset management software to track them can help contractors keep their fixed assets in good condition, optimize their utilization, and prevent theft or loss.

Ultimately, this allows them to streamline asset management practices and improve their productivity and profitability.