How you manage and track your valuable assets can either make or break your company, no doubt about it.

In this article, we’ll, therefore, delve deeper into the best practices regarding fixed asset accounting—an integral part of asset management—providing insights, tips, and real-world examples to guide you in optimizing your accounting processes.

By implementing these practices, you can then enhance your financial reporting accuracy, improve decision-making, and lay some solid groundwork for sustained financial success.

Let’s dive in.

In this article...

Setting a Capitalization Policy

In the construction industry, assets like heavy machinery, safety equipment, power tools, vehicles, and construction materials form the backbone of any successful business.

And while some of these have long-term utility, others are used and expended immediately.

So, the question arises: how do you determine which of them should be classified as fixed assets on the balance sheet and which should be recognized as expenses on the income statement?

This is where your capitalization policy comes into play.

In accounting, this policy acts as a cost threshold that distinguishes between fixed assets and expense items.

Here’s how it works.

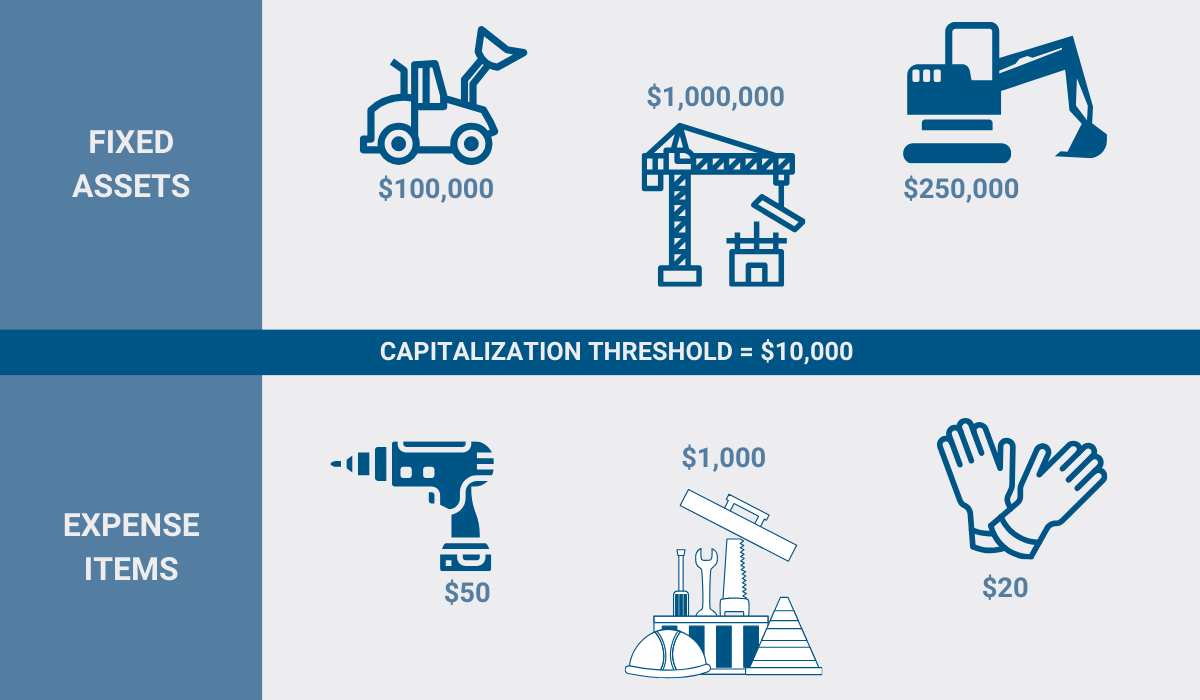

Let’s say you’ve established a capitalization threshold of $10,000.

Any item exceeding this value will be considered a fixed asset, while anything below will be treated as an instantly incurred expenditure.

Essentially, this protocol serves to ensure uniform consistency across your accounting books, therefore minimizing the risk of accounting errors and preventing misstatements in the company’s financial reports.

But how do you establish your own capitalization threshold?

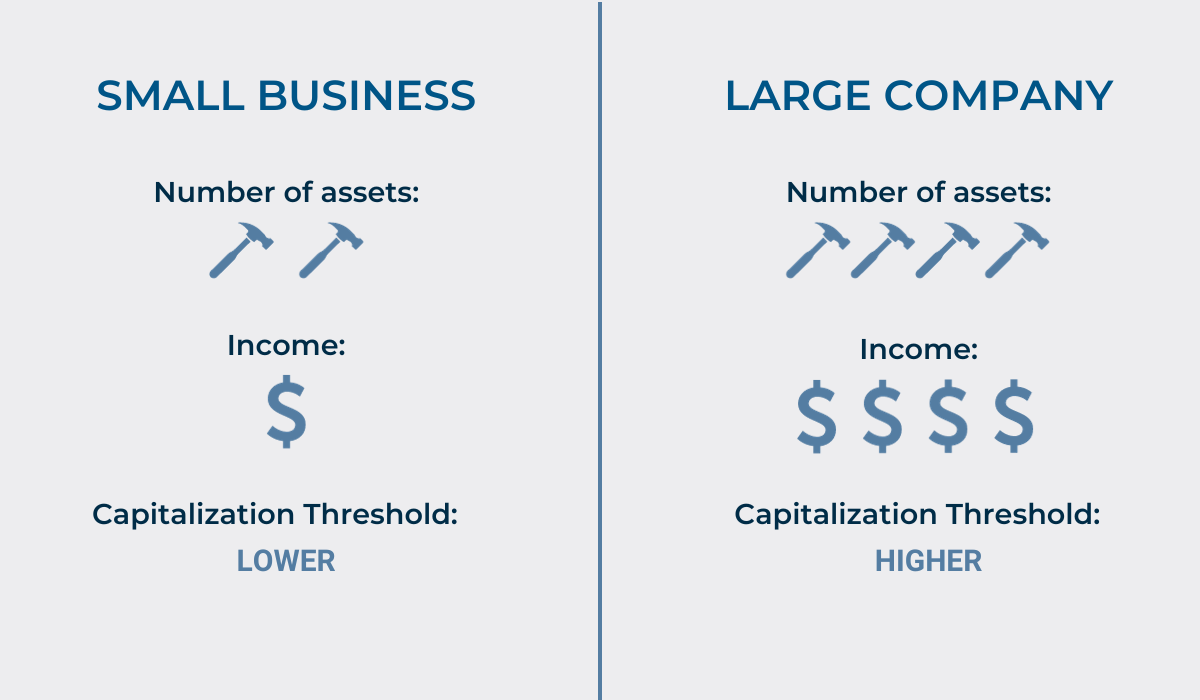

This decision will be greatly affected by the size of your business, as well as the revenue it produces.

Generally speaking, higher profit-generating enterprises set a higher threshold.

This is because, for larger businesses, it may be impractical to categorize every single hammer, pair of gloves, or a similar item as fixed assets, since the effort involved considerably outweighs the benefits.

On the other hand, smaller companies and non-profits might opt for a lower threshold to monitor their property more closely.

In any case, it’s always advisable to consult industry benchmarks, as certain aspects of the policy may be influenced by common procedures within your sector.

Such an approach ensures that your capitalization policy aligns with industry standards, promoting uniformity and accuracy in financial reporting.

Tagging Your Fixed Assets

This is a big one, especially in an asset-intensive industry such as construction, where machines, tools, and equipment are dispersed across a single—or even multiple—job sites, some being transported daily.

Keeping track of it all is no easy feat.

But what happens when you neglect to monitor your valuable property?

Well, it can get lost, stolen, or damaged, triggering a cascade of issues.

Asset records showing inaccurate numbers and amounts, for instance, can result in wasted spending and increased tax liability, while misplaced equipment itself causes unplanned downtime, project delays, decreased operational efficiency, and potential reputational damage.

So, how do you make sure you avoid these problems?

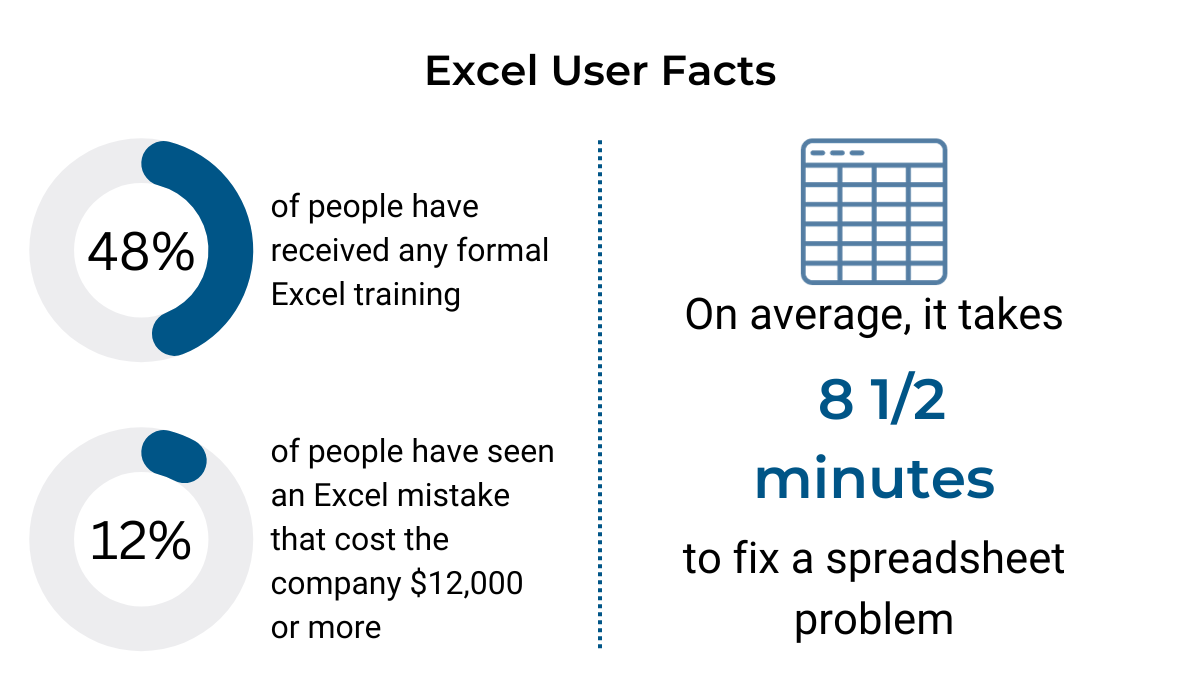

The first step would be, if you’re still relying on manual asset management methods like spreadsheets, to reconsider your approach.

After all, spreadsheets are known to be highly prone to human error anyway, costing companies a lot of time and money in the long run.

The second step is to find the most effective, accurate, and reliable way to track your fixed assets.

In this case, your safest bet is to use an asset management system, like our own GoCodes Asset Tracking.

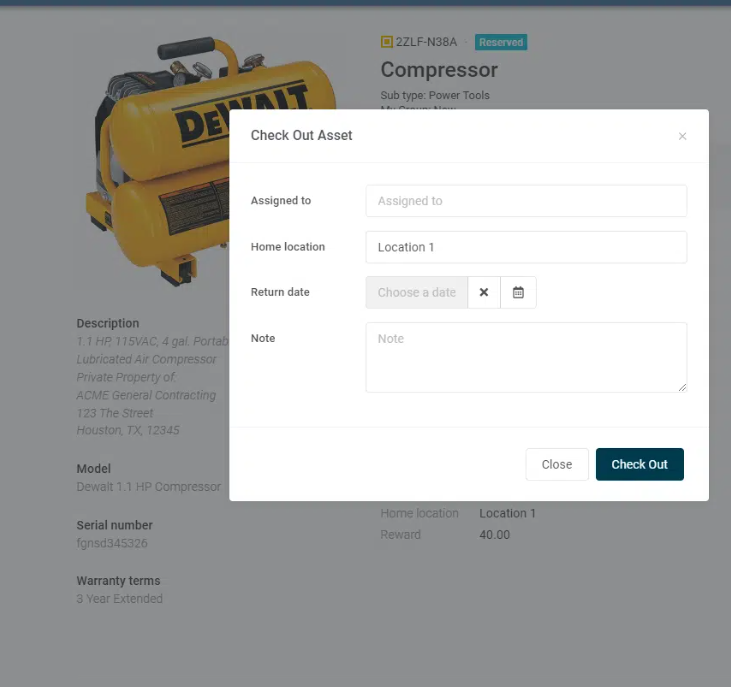

GoCodes Asset Tracking provides QR code tags and labels for your machinery and tools as well as accompanying software, serving as a one-stop, user-friendly, solution for all your asset-tracking challenges.

Simply attach the tags to your equipment and use our smartphone scanner app to scan the tag and alter information about a particular asset on the go.

Each time this is done, the records are immediately updated.

So, when someone, for example, checks a piece of equipment out, you can instantly see this update, including the machine involved, its location, and the responsible person, on any device with access to the Internet.

As a result, your documents remain consistently and frequently updated, minimizing room for mistakes and ensuring everything is accounted for and in its rightful place.

Talk about efficient.

Keeping Track of Asset-Related Costs

Effective fixed asset accounting involves tracking assets throughout their entire lifecycles, from acquisition to disposal and replacement.

Naturally, each stage in this cycle incurs specific costs.

It’s vital to meticulously monitor these expenses, not only for more precise project cost estimations, financial management, and budgeting but also to ensure a more accurate valuation of your business.

In essence, cost monitoring is an essential part of successful fixed asset accounting.

So, let’s delve into some of the key asset-related expenses that require your attention:

- Acquisition

- Maintenance

- Depreciation

- Replacement

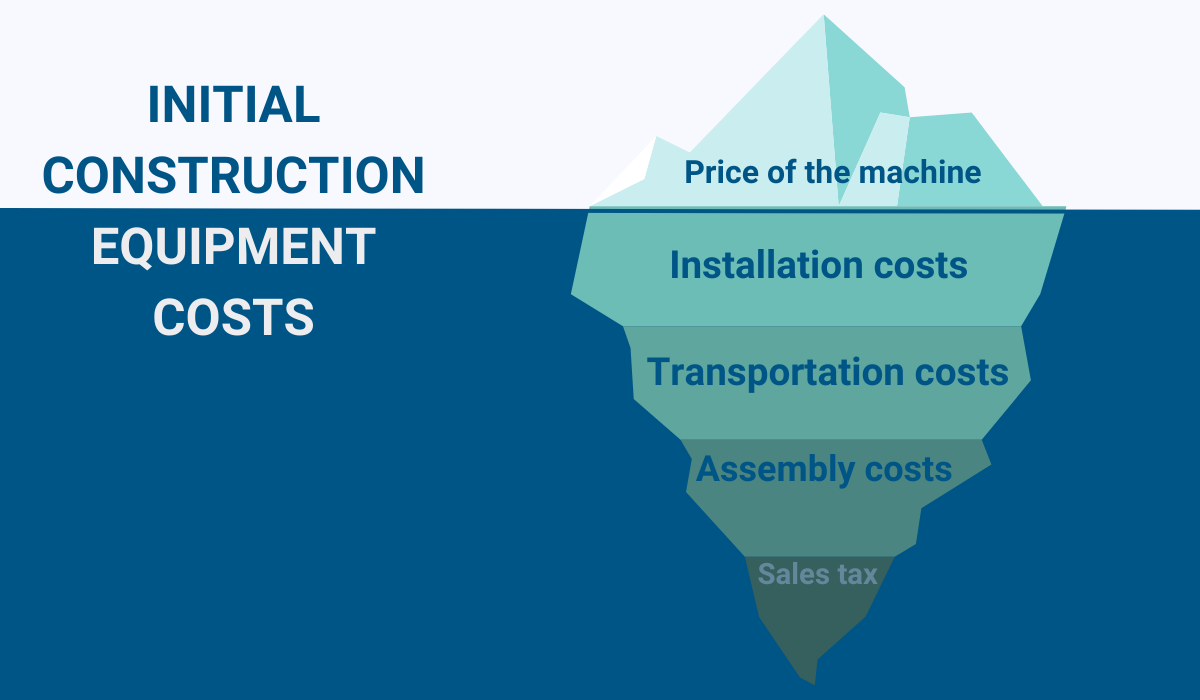

A piece of equipment’s service life starts, of course, with you buying it, but contrary to what many people assume, the acquisition cost itself extends beyond just the machine’s purchase price.

Instead, it entails all the expenses associated with bringing the asset into the company’s hold and making it operational.

After you’ve acquired your machine or tool, the financial tug-of-war between how much money that asset spends vs how much it makes doesn’t end here.

In fact, it just begins.

When it comes to making the most out of your assets, proper care is paramount, and neglecting maintenance can bring about the final stage of equipment’s useful life much quicker, catching you off guard.

Therefore, provided you’re looking to increase a machine’s life as much as possible, you’ll have to allocate a certain portion of your resources to repair and maintenance costs.

Make sure you keep track of those as well, not just for accounting purposes, but for future maintenance planning, too.

However, no matter how well you maintain your equipment, it will inevitably lose some of its value over time, i.e., it will depreciate.

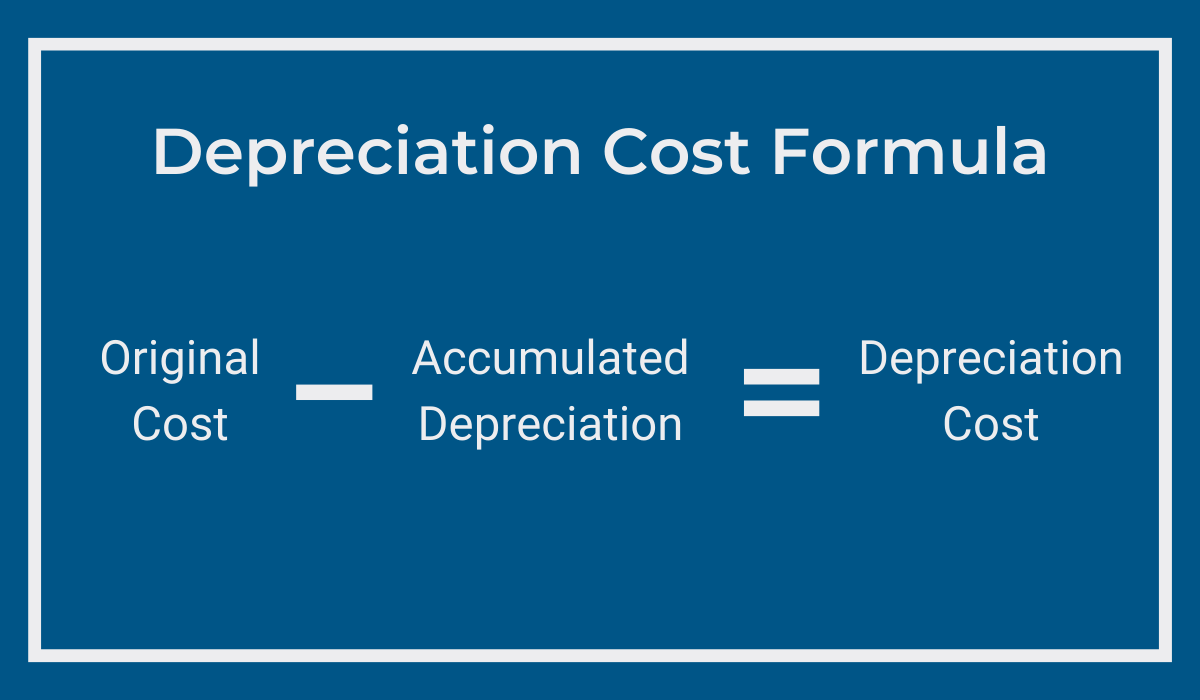

Subtracting the accumulated depreciation amount from the original price is what yields the depreciation cost.

If you’re looking for more information on depreciation, we have created a detailed guide on this accounting practice.

Finally, your assets will (hopefully later rather than sooner) reach the end of their service life, and you’ll need to decide whether to sell, scrap, or otherwise dispose of them.

You’ll also have to find a substitute for the old asset, and so the cycle will begin anew.

But, is there a way to predict how long your asset will remain useful, allowing you to better prepare and plan for its replacement?

Estimating the Useful Life of Fixed Assets

Before we answer that question, let’s first define what the useful life of an asset actually means.

This term doesn’t just denote the period during which a particular piece of equipment will exist but rather the duration it’ll remain functional for its intended purpose.

So, yes, estimating a machine’s service life can certainly help with effective maintenance and replacement planning, as it helps determine whether investing in repairs is worthwhile or if selling the asset is a better course of action.

As a machine’s value approaches its maintenance costs, it marks the onset of a critical juncture that Matt Lang, Senior Vice President at Amegy Bank, calls the break-even.

At this point, a machine may transition from being a useful asset to becoming a financial burden, prompting considerations for replacement.

To obtain a precise estimation of a service life, several different avenues can be explored.

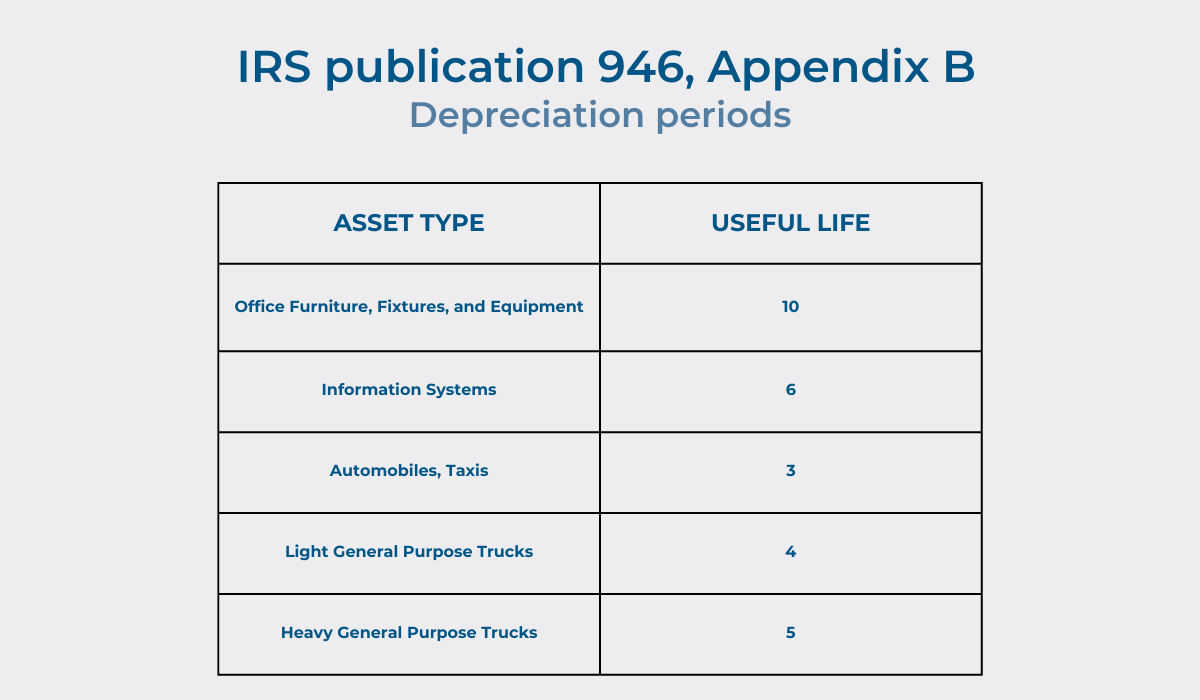

For starters, since useful life has a role in depreciation calculation, definitely consult the IRS publication 946, Appendix B, which provides assessments for depreciable assets that are both industry and application-specific.

Below you can see just some of the examples.

Although this is a solid starting point, relying solely on the IRS standards is not sufficient.

Another thing you can do is take a look at the historical performance of similar assets.

If a previous machine lasted for a certain period of time, like, say, five years, there’s a likelihood that the current one may exhibit a similar lifespan.

However, this assumption is contingent upon the condition of the equipment at the time of purchase.

Here, the general principle is pretty straightforward: new assets tend to have longer lifespans than used ones.

In addition to referencing IRS guidelines, it’s essential to examine the manufacturer’s specifications, too.

Manufacturers typically offer estimates based on factors such as hours of operation or total production, drawing on their extensive industry experience.

For instance, if a particular asset is projected by the vendor to last for three million units and your annual production requirement is 300,000 units, its estimated lifespan, in this case, would be ten years.

Still, it’s important to emphasize that assessing an asset’s useful life is not a one-time task.

Instead, periodic reevaluation is crucial, as various elements can influence the lifespan of a machine.

These regular evaluations will ensure that accurate numbers are available at any given time, facilitating informed decision-making in maintenance and replacement strategies, and enabling error-free bookkeeping.

Using Fixed Asset Accounting Software

There are a couple of different ways to approach fixed asset accounting.

One such accounting method is manual, using spreadsheets, but as mentioned earlier, these don’t constitute the most reliable approach out there.

The thing is, your competitors are starting to realize this as well.

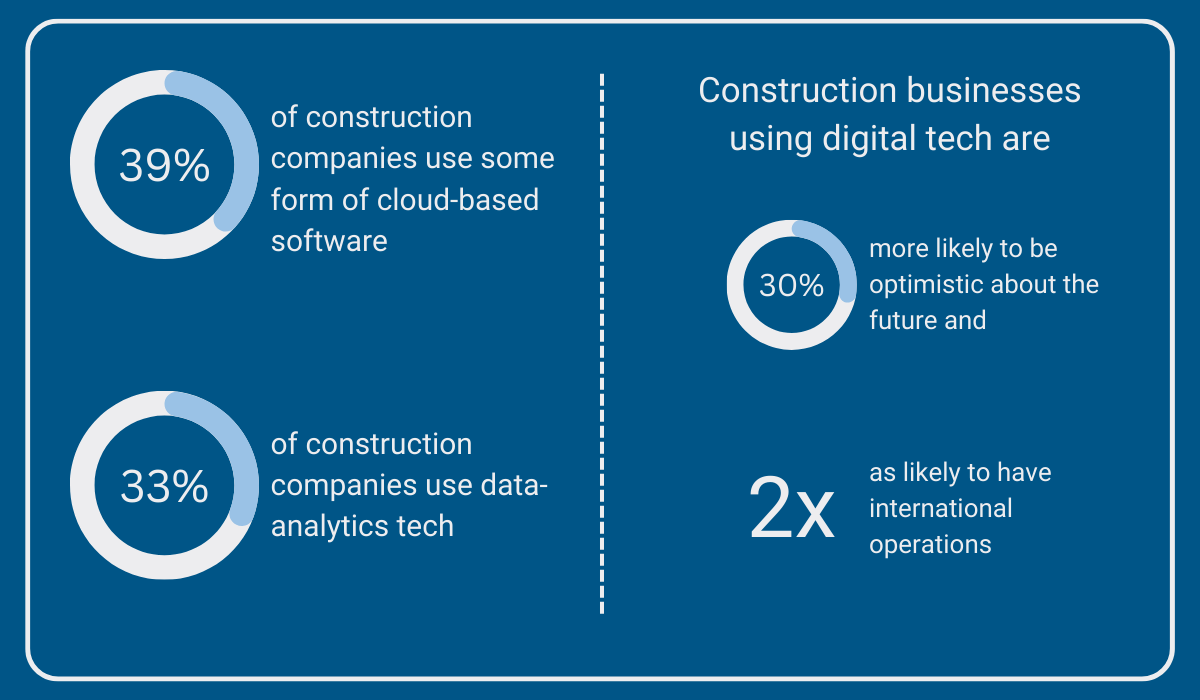

A recent Deloitte report on the state of digital adoption in construction reveals that an increasing number of companies in the industry are adopting various technologies and software for multiple aspects of their operations.

And guess what?

They are seeing the results, as you can see in the image below.

In fact, did you know that, according to the survey respondents, businesses leveraging digital technologies are 30% more likely to be optimistic about the future and twice as likely to have international operations?

Besides, enterprises using technology experience a 0.58-point percentage increase in expected annual revenue, on average.

So, why not join them, elevate your fixed asset accounting game, and utilize an automated software solution?

These solutions offer a wide range of relevant features, providing real-time access to your accounting records, as well as making sure they are thorough, up-to-date, and, most importantly, error-free.

Additionally, these records will now be password-protected, limiting access to those who genuinely need it.

In other words, by implementing a fixed asset accounting solution, you not only enhance your data accuracy but also bolster security measures.

All in all, nowadays, there’s really no excuse for relying on outdated accounting systems when automated solutions are so readily available.

Therefore, give the embracing of technological progress some thought and witness your business reach new heights.

Conclusion

Overall, when it comes to efficient fixed asset accounting, it’s all about enhancing financial transparency, minimizing the risk of errors, and making informed decisions about your organization’s asset portfolio.

To achieve this successfully, consider implementing the tips provided in this article.

While technology can assist in improving some processes, it’s crucial for you to exercise due diligence, particularly in areas like asset monitoring and tracking asset-relevant costs.

However, remember that the landscape of accounting standards and regulations may evolve, so it’s essential to stay on your toes and adapt your practices accordingly to maintain a robust fixed asset accounting system.

By doing so, you ensure regulatory compliance with accounting standards and ultimately contribute to the overall financial success of your company.

After all, a financially healthy company is a happy company.