Key Takeaways

- Considering total cost of ownership is crucial when deciding whether to own or rent construction equipment.

- Having equipment at their disposal is especially important for companies that take on large-scale projects or work on multiple jobs at the same time.

- Equipment becoming obsolete due to technological advancements pushes companies to rent instead of own it.

Successful construction project execution rests on having access to the right equipment.

However, you need to make a decision first: will you be buying or renting?

The choice between owning construction equipment or renting it has become increasingly more complex, affected by various factors, from rising costs to technological advancements.

This article takes into account different sides to the argument, listing both the pros and cons of equipment ownership.

Want to make the best possible decisions for your business?

Then join us for a deep dive!

In this article...

The Pros of Owning Construction Equipment

First, we’ll explore the advantages of owning construction equipment.

We’ll zoom in on three benefits, starting with long-term savings.

Long-Term Cost Savings

Owning your equipment can be more cost-effective than renting, resulting in significant cost savings in the long run.

Although its value drops with time, construction equipment is designed to be durable and withstand harsh conditions and inhospitable terrains for years on end.

For example, a typical excavator has an average lifespan of 10,000 hours.

Some newer models, on the other hand, are specifically designed to have a long service life and can even reach 60,000 hours.

So, even if you’re buying more modest machinery, 7 to 10 years is still plenty of time to make the most of your asset’s useful life and get a sizable return on investment.

In other words, businesses that invest in their equipment strategically are playing the long game.

On the other hand, using rentals gives you more flexibility—you’re paying for the equipment you need for a specific project based on predetermined fees and terms.

So why would you bother purchasing costly equipment at all?

Well, the thing is, rental fees are easy to manage on a short-term basis, but tend to add up over time.

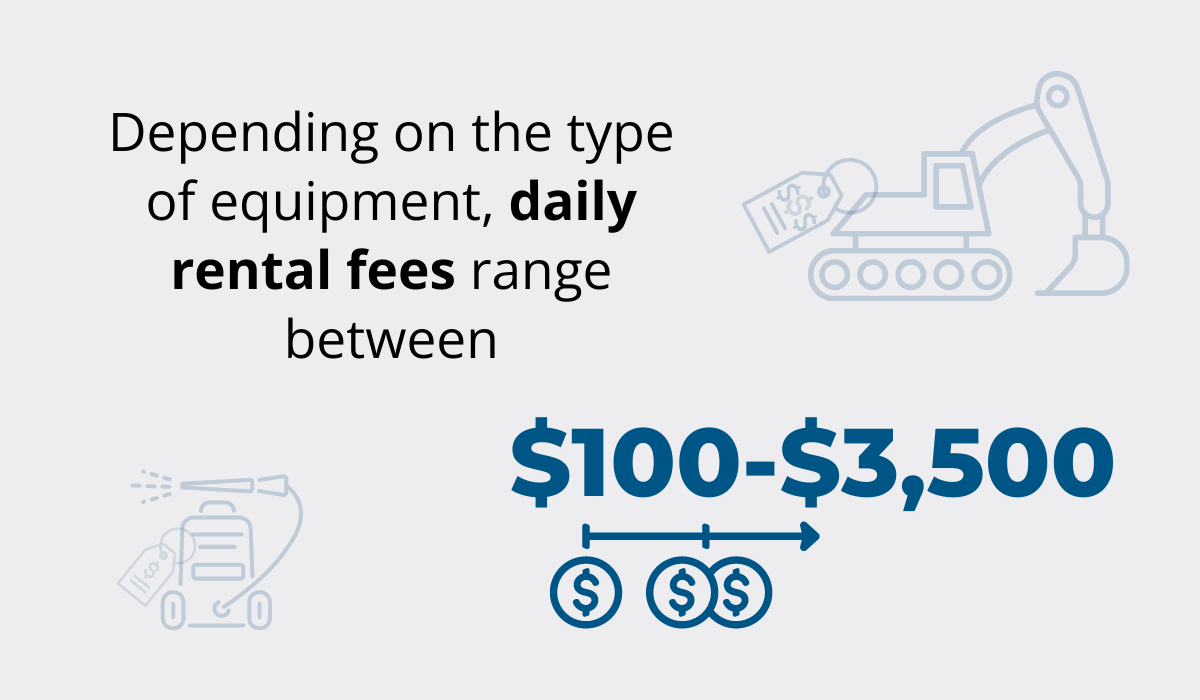

CAT Rental Store estimates that renting a piece of equipment can cost up to $3,500 a day.

Of course, contract length plays a huge part in the pricing, but if you’re going to be working on a longer project and need to rent multiple assets, you should consider doing some calculations first.

More often than not, however, the math would show that buying is more advantageous long-term.

Acquiring the right pieces can help you accumulate substantial savings over time, even when you no longer have use for the equipment yourself.

Let’s imagine a scenario where a business-savvy contractor buys a used bulldozer at an auction for $80,000.

Over the next 3 years, the contractor uses the machine on various projects and invests some $10,000 to keep it in good condition and ultimately sell it.

With its well-maintained condition, the bulldozer fetches a handsome price of $75,000—just $5,000 less than the original price of purchase.

In essence, the contractor ended up paying $15,000 and used a functional bulldozer for 3 years.

No rental terms can come close to this in terms of affordability and savings.

The bottom line is that you should always do the math and take into account your priorities.

And if long-term savings are among them, it’s time to pursue equipment ownership.

Consistent Availability of the Equipment

When you own certain equipment, you can always count on its availability, no matter the project or deadline.

Such unrestricted use means you have more flexibility to make all the critical decisions on-site and beyond.

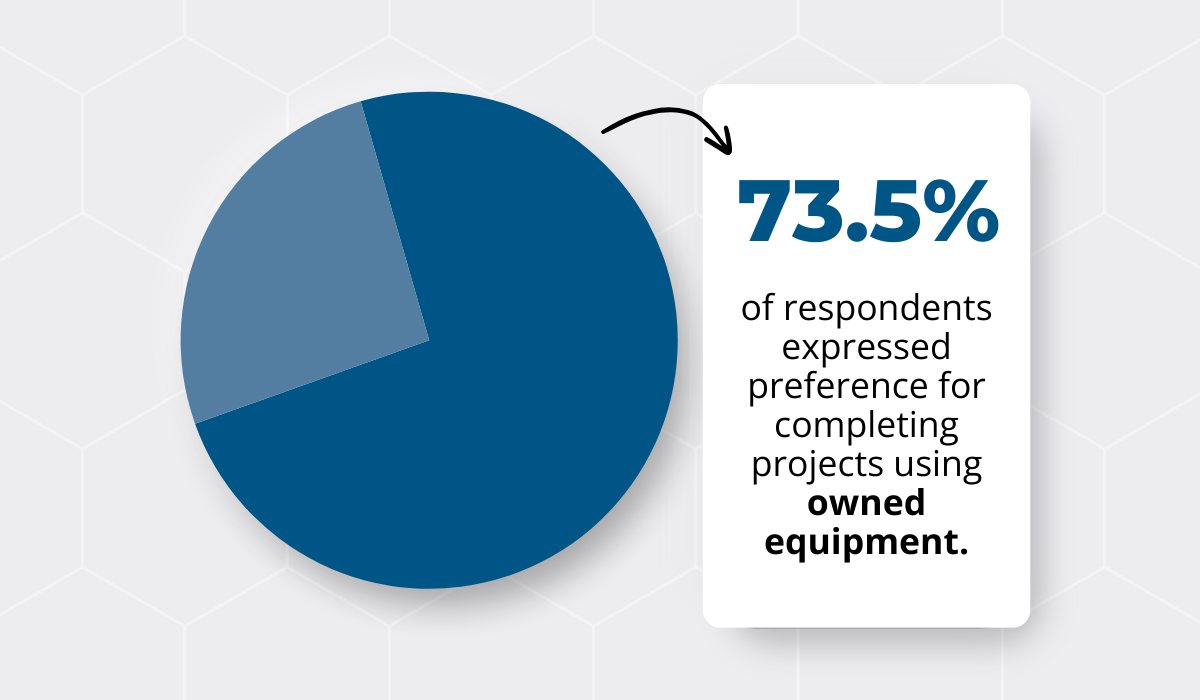

Keeping that in mind, the recent findings from the Equipment Watch survey come as no surprise.

Namely, nearly 3/4 of respondents prefer to complete projects using owned equipment.

Companies that take on large-scale projects or deal with multiple jobs at the same time need all the flexibility they can get.

Why?

Because being able to deploy vital machinery when and where it’s needed ensures efficiency and helps counter disruptions to work schedules.

Every jobsite is a dynamic, complex environment, that much is obvious.

But if you’re working on a massive, demanding project, where a few inefficiencies could mean the difference between huge profit and crippling debt, you don’t want to risk not having access to key machinery.

So, if you have to account for return deadlines and other terms of the rental agreement, things can get tricky.

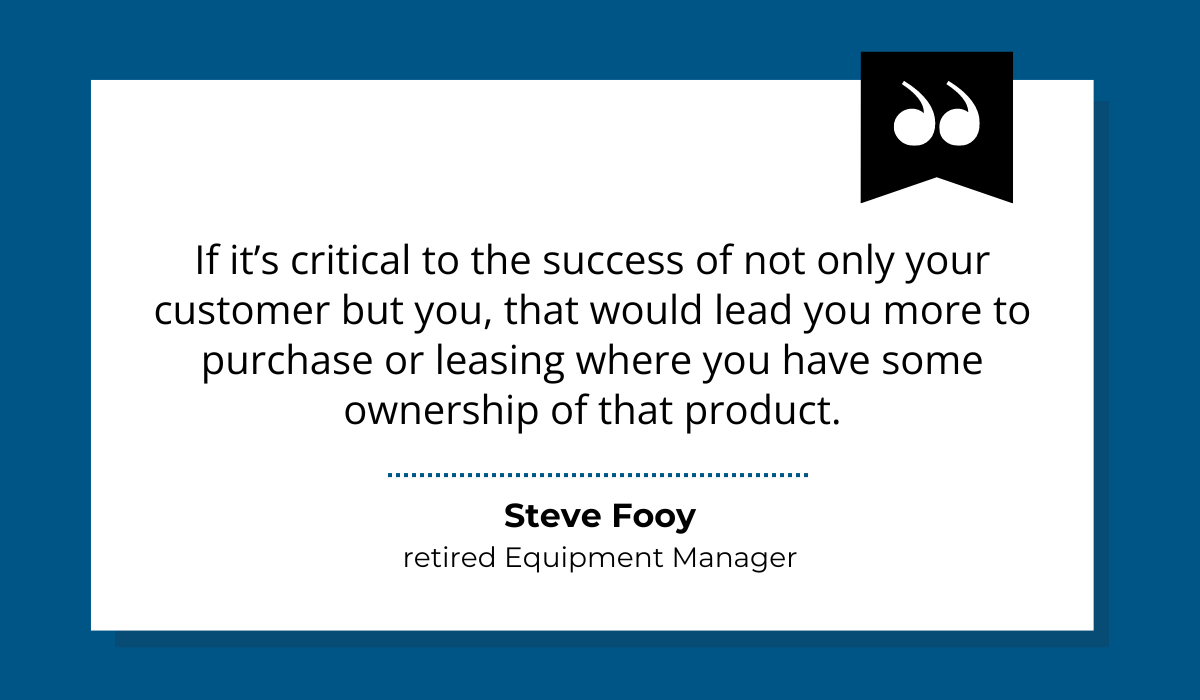

This criticality of equipment is precisely the point made by equipment industry consultant and retired equipment manager, Steve Fooy.

Equipment ownership creates a difference through greater flexibility in scheduling and better overall control over project timelines.

To sum up, owning equipment—or at least leasing it for several years as Fooy points out—is a smart choice if your business success rests on having full control over the deployment of key pieces.

Depreciation Benefits

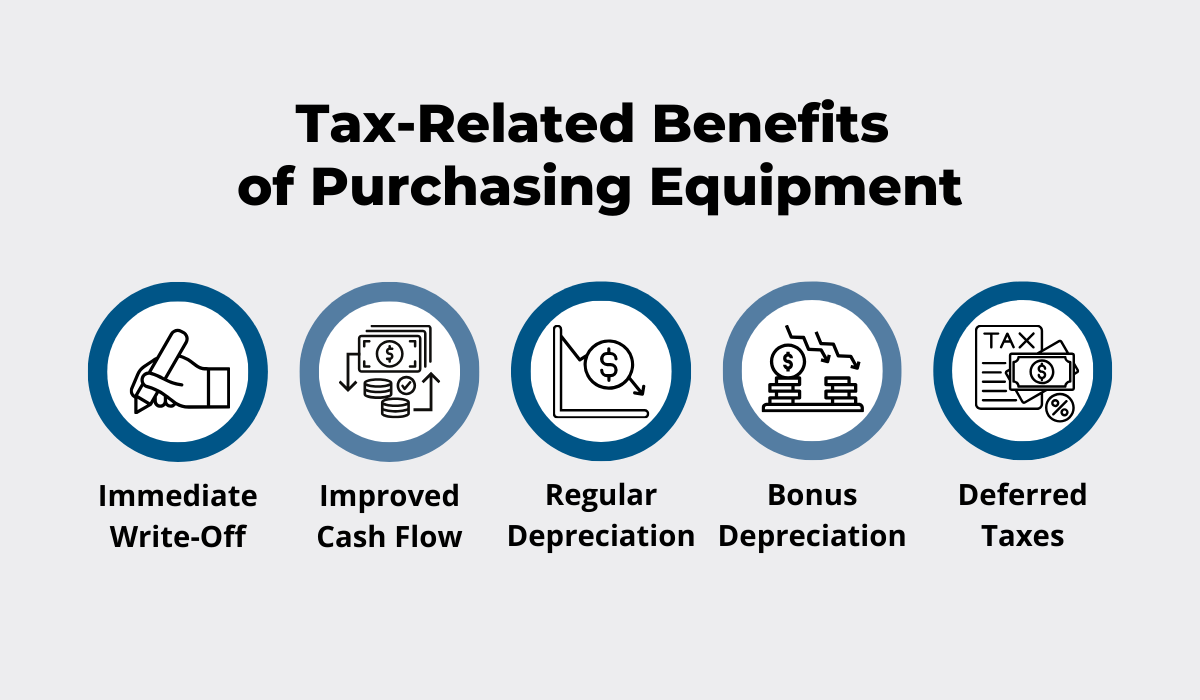

Owned construction equipment can be depreciated over its useful life, giving you several tax-related advantages.

To put it simply, proper fixed asset depreciation can help you maximize tax savings in a strategic way.

For many businesses, and especially those that expect to move into a higher tax bracket in the future, the best course of action is to deduct a portion of the equipment’s cost over the years.

On the other hand, those looking to improve their cash flow can pursue immediate write-off under Section 179 of the U.S. tax code to deduct the full purchase price of their qualifying equipment, and even combine it with bonus depreciation.

In theory, if you purchased an excavator for $200,000 in 2024, and you want to deduct the whole amount the same year based on Section 179 and its stipulations, you’re getting more cash in hand.

This can then be reinvested back into your business.

However, a word of caution.

This isn’t always the best depreciation scenario, and there are lots of complex rules on when this section applies, depending on the type of equipment and total spending in the tax year.

Since it’s easy to make mistakes, many businesses avoid calculating and reporting complexity and opt for depreciation over several years using one of these common depreciation methods:

- Straight Line (SL)

- Declining Balance (DB) 200%

- Declining Balance (DB) 150%

- IRS PATH Act Bonus Depreciation

There are also tools that can do these calculations using pre-built depreciation reports.

You just need to input the asset data and you’ll get current and last year’s depreciation, as well as total depreciation over the years and the remaining balance.

Remember: the key to maximizing (or minimizing) profits as needed is to understand different depreciation factors, and how your balance sheet is impacted by:

- depreciation methods, and

- timing of equipment purchases.

Of course, these benefits will only be available to you once you’re ready to commit to purchasing and owning construction equipment.

The Cons of Owning Construction Equipment

As we just saw, owning construction equipment does indeed come with a variety of advantages.

However, there are disadvantages to it, too.

So, next up, we’ll take a closer look at several disadvantages that you need to keep in mind when making the decision between buying or renting equipment.

High Initial Costs

High initial costs are the number one con of owning construction equipment.

The hefty price tag attached to both new and used machinery gives pause to many construction firms considering purchasing equipment.

This is especially true for smaller and mid-sized companies that aren’t in the ideal position to make sizable investments and tie up their resources in one area.

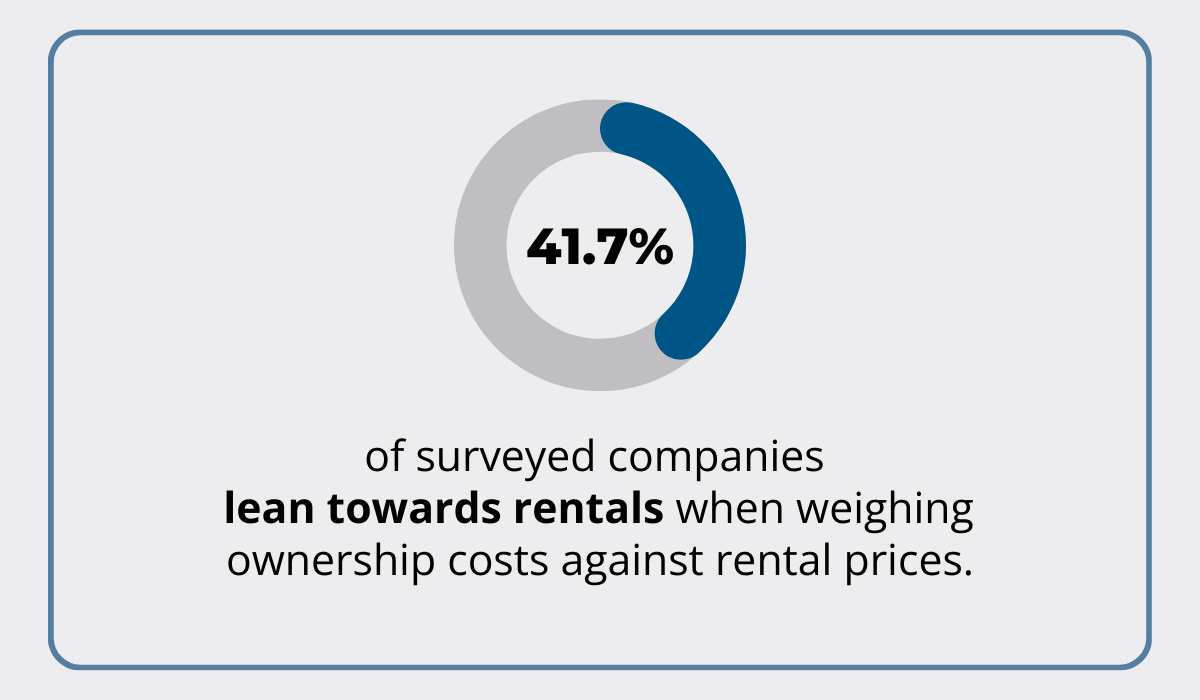

To go back to the Equipment Watch survey we mentioned earlier, despite the respondents’ notable preference for owning equipment, over 40% of them lean toward rentals when considering the total costs.

Awareness of ownership costs has certainly helped fuel the growth of the global rental market, expected to reach $140 billion by 2027.

After all, once you purchase a piece of equipment, it becomes an overhead expense.

In other words, it’s costing you money even when collecting dust in the storage.

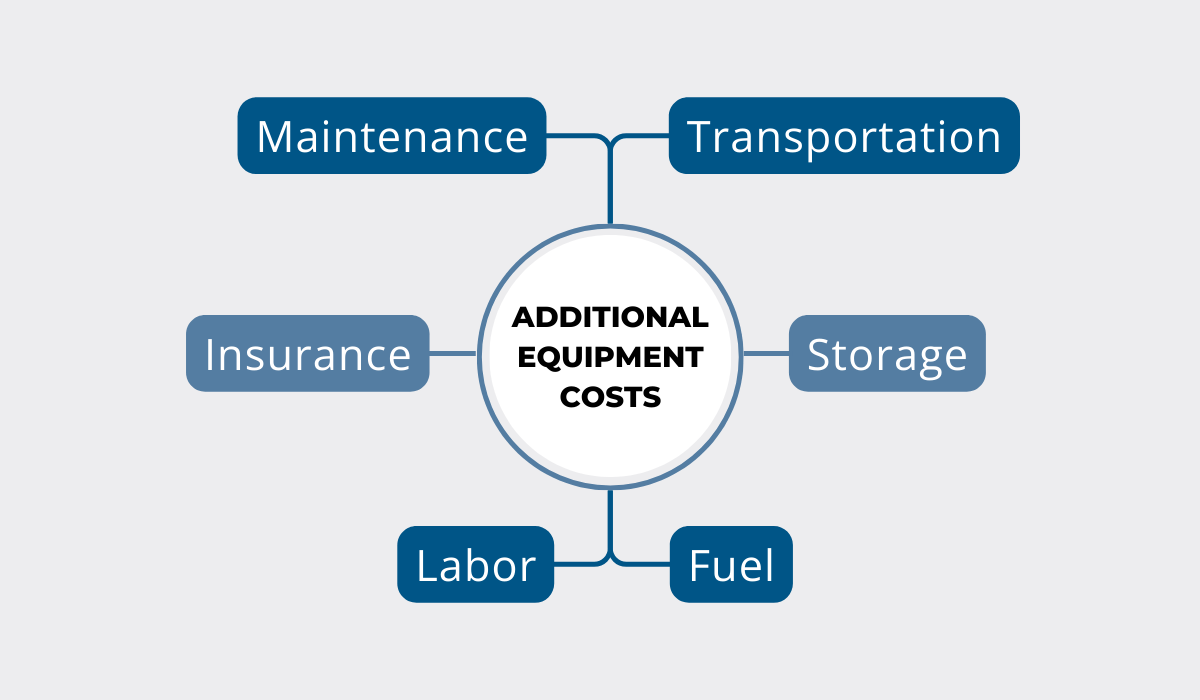

Speaking of storage, the storage and insurance fees are among the first to pop up after you’ve acquired your asset.

And if you think that’s all you need to consider, it’s not.

Once you’ve secured insurance coverage and safekeeping for your investment, that’s still not the total cost of ownership, which includes other planned costs.

You can see those outlined below.

Keeping these costs in mind, there are two questions you need to ask yourself:

- Can we handle all the costs of equipment ownership?

- Do we have enough projects rolling in to justify this investment?

Ultimately, the choice between renting and owning boils down to both finances and utilization.

A good rule of thumb is to figure out whether this new addition will be used more or less than 2 working days a week.

So, if you don’t think you’ll be using a machine at least 40% of the time on-site, then it makes more sense to rent it instead of owning it.

High initial costs may discourage equipment ownership, but a full understanding of the total costs, as well as your potential to make these assets profitable, is essential to ensure continued business success.

Ongoing Maintenance Costs

Owning your equipment means dealing with plenty of challenges, including ongoing maintenance costs that can be difficult to keep track of.

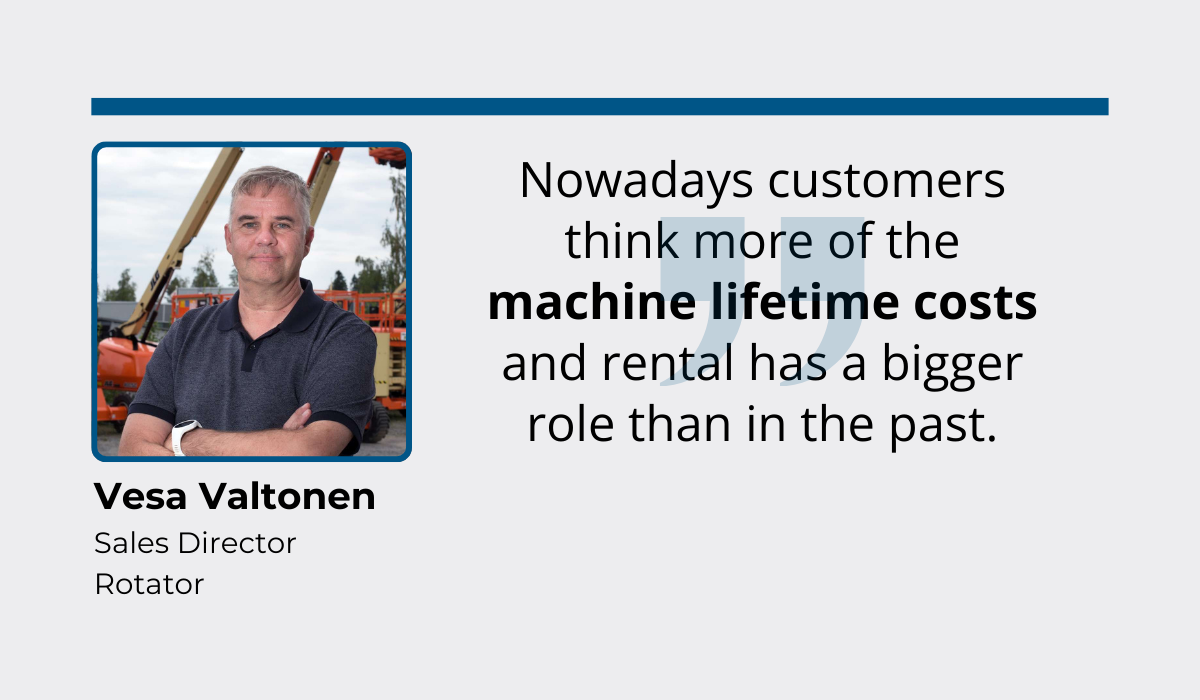

Regular maintenance is crucial for ensuring your equipment’s health and longevity, and construction businesses today are more aware than ever that they need to factor in maintenance and other long-term expenses.

Vesa Valtonen, Sales Director of Finland’s equipment dealer giant, Rotator, explains that this shift in perception actually helped open up the floor for the rental business.

Since maintenance costs are ongoing, they can prove to be crucial when choosing between owning and renting equipment.

After all, to keep the equipment fully operational and in peak condition, you need to have a dedicated budget for upkeep and repairs.

You may be tempted to keep the maintenance costs down by skipping routine preventive maintenance, but here’s why that can have the opposite effect.

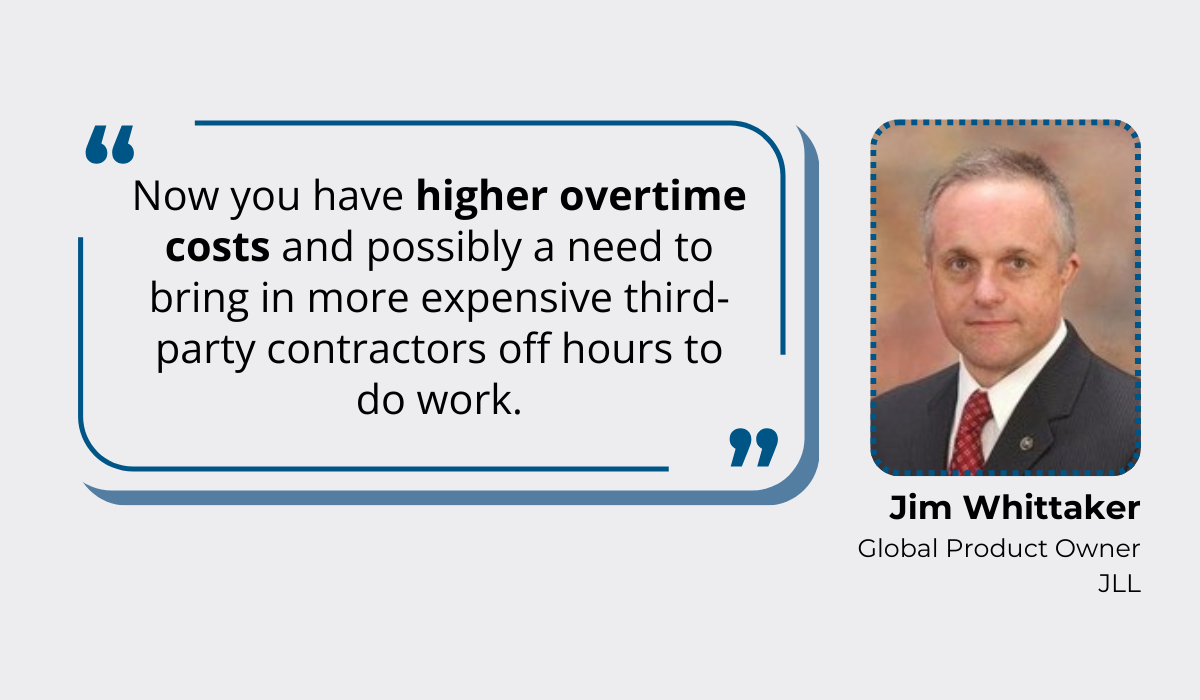

Global Product Owner at JLL, Jim Whittaker, emphasizes that the costs of unplanned or reactive maintenance go beyond just equipment and into labor.

Unexpected breakdowns and operational delays that come with them create huge problems on several levels—including finances—and should be avoided at all costs.

This is why planning and scheduling maintenance is an important part of equipment ownership.

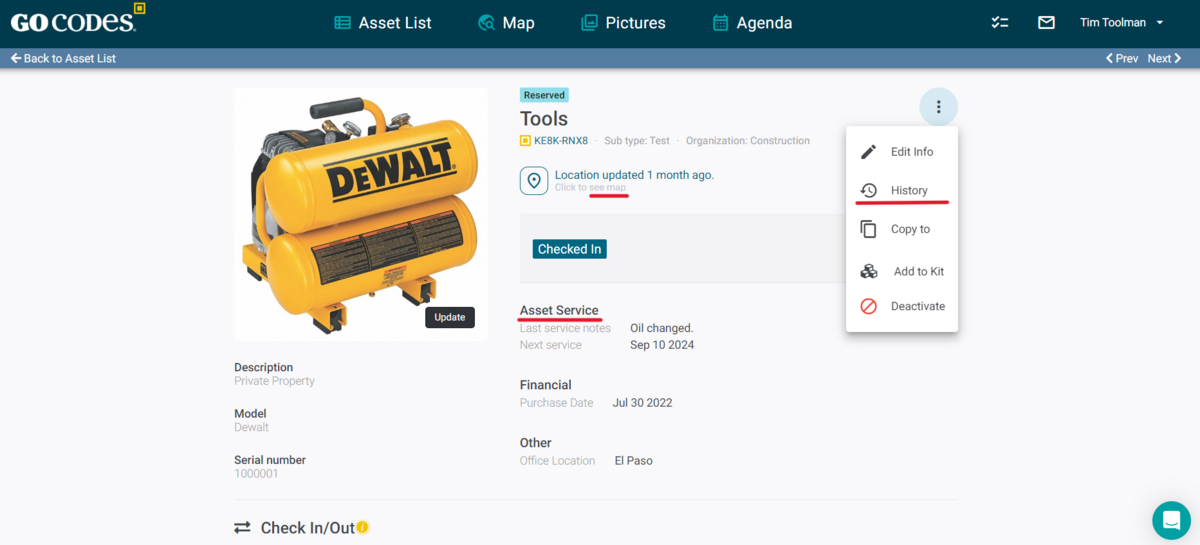

Asset management tools are perfect allies when it comes to staying on top of maintenance tasks simply because of the level of insight and functionalities they provide.

Here’s how one glance at our GoCodes dashboard can help you track your equipment’s status and maintenance history and tell you everything you need to know.

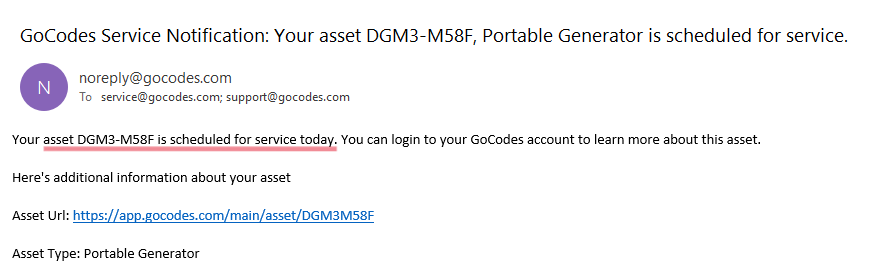

Aside from offering a wealth of data, construction companies using GoCodes can easily schedule maintenance and receive scheduled service notifications via email.

The email will notify them when an asset is due for maintenance but also include all relevant details about the previous service.

These timely reminders help you counter unnecessary costs that come with irregular servicing, and make the most of preventive maintenance.

Maintenance expenses will inevitably occur whether you own or rent equipment, but you need to be prepared to bear the extra responsibility that comes with equipment ownership.

Technological Obsolescence

Construction equipment becomes outdated with time, so every purchasing decision has to be made with technological obsolescence in mind.

There are different kinds of construction equipment obsolescence, but one of them is propelled by innovation.

Namely, continuous advancements in technology deliver increasingly more powerful, efficient, and sustainable machinery, making it easier for construction companies to meet client demands.

However, these improvements are also rendering older machines less useful and desirable.

This, in turn, makes them less viable compared to newer alternatives for several reasons, outlined in the table below.

| Aging of Equipment, Components & Materials | Aging equipment is less efficient and may require costly repairs or replacement parts that can no longer be acquired. |

| New Technology | Innovative technologies such as telematics and electric machinery improve productivity, safety, and sustainability, making older models obsolete. |

| Compliance Changes | Companies may have to upgrade equipment to be able to meet evolving regulatory standards related to emissions, safety, and performance. |

All these factors reduce the resale value of owned equipment, leading to significant financial implications.

In some cases, the decision to upgrade your fleet is entirely in your hands.

However, compliance changes tend to accelerate that process, points out Karl Werner, Chief Business Development Officer at RB Global Inc.

So, if you don’t want to risk non-compliance and its consequences, your business has to ditch some of the older models, even if they’re still in good condition and difficult to sell.

This mix of factors, and the desire to stay competitive without needing to replace equipment too frequently, actually drives construction businesses to get access to top-notch equipment through renting.

With all that in mind, you need to carefully evaluate not only the budget and frequency of the equipment’s usage in the future, but also how long the technology will stay relevant.

In the words of Ernie Stephens, the VP of Equipment Management at MasTec Renewables:

“Know the end game for that piece of equipment before you buy it.”

Careful planning and thorough equipment obsolescence management will ensure you’re not saddled with costly underutilized equipment that can only fetch a meagre resale price.

So, factor in technological obsolescence before you make any future decisions on your equipment—that’s the only way you can avoid the associated risks.

Conclusion

Choosing between owning or renting construction equipment is one of the biggest choices for construction companies today.

And as we’ve established today, there’s a wealth of factors to consider.

The advantages and drawbacks we listed are by no means exhaustive, but will guide you in finding the right balance and deciding what’s best based on your specific needs and circumstances.

Keep in mind the financial picture and operational needs, and you’ll be on track to seize success no matter if you own or rent your equipment!