The one inescapable truth about your construction equipment is that it’s going to lose its value over time.

And while depreciation can’t be avoided, it can certainly be slowed down through regular maintenance, as well as used for tax purposes.

But what equipment depreciation methods are even there, and how do you choose the right one for your business?

That’s exactly the topic of this article, so let’s dive right into it.

In this article...

Straight Line Depreciation Method

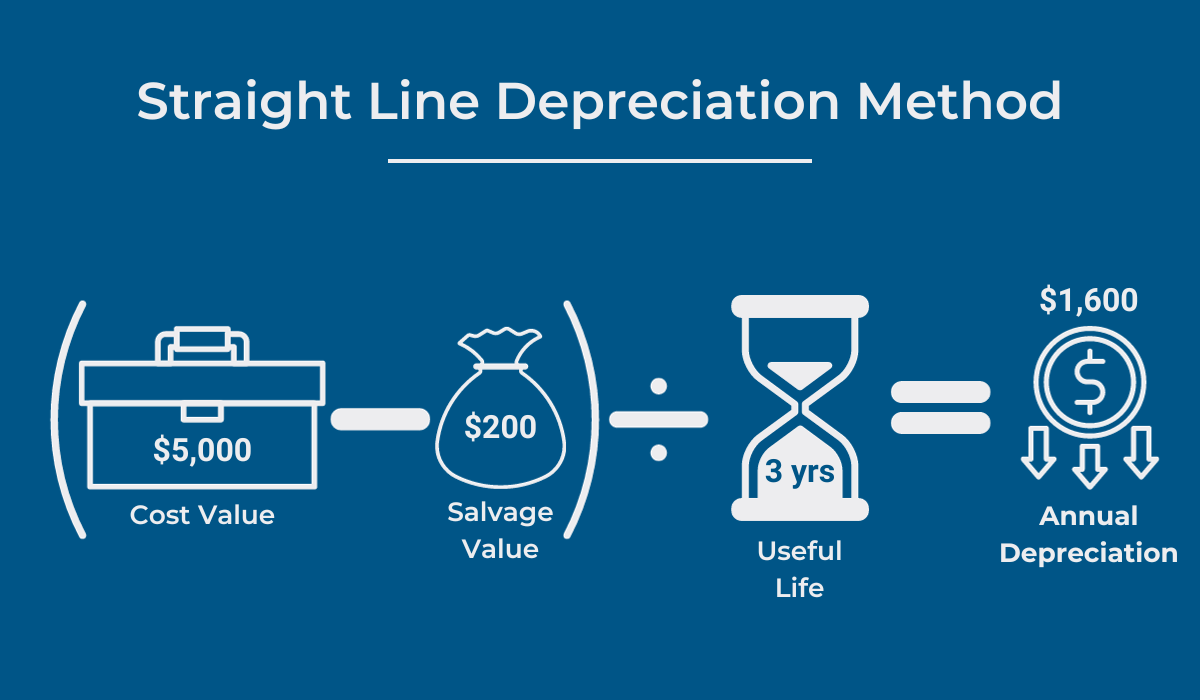

Straightforward and easy to calculate, the straight-line depreciation method is the first choice for many business owners.

Straight-line depreciation is a method under which the same amount is going to be deducted from your equipment’s value every year.

In other words, your equipment’s value is going to decrease by the same amount each year, until it reaches its salvage value.

So, how is straight-line depreciation calculated?

Let’s take a look at the formula.

As you can see, the formula consists of several components: cost value, salvage value, and useful life.

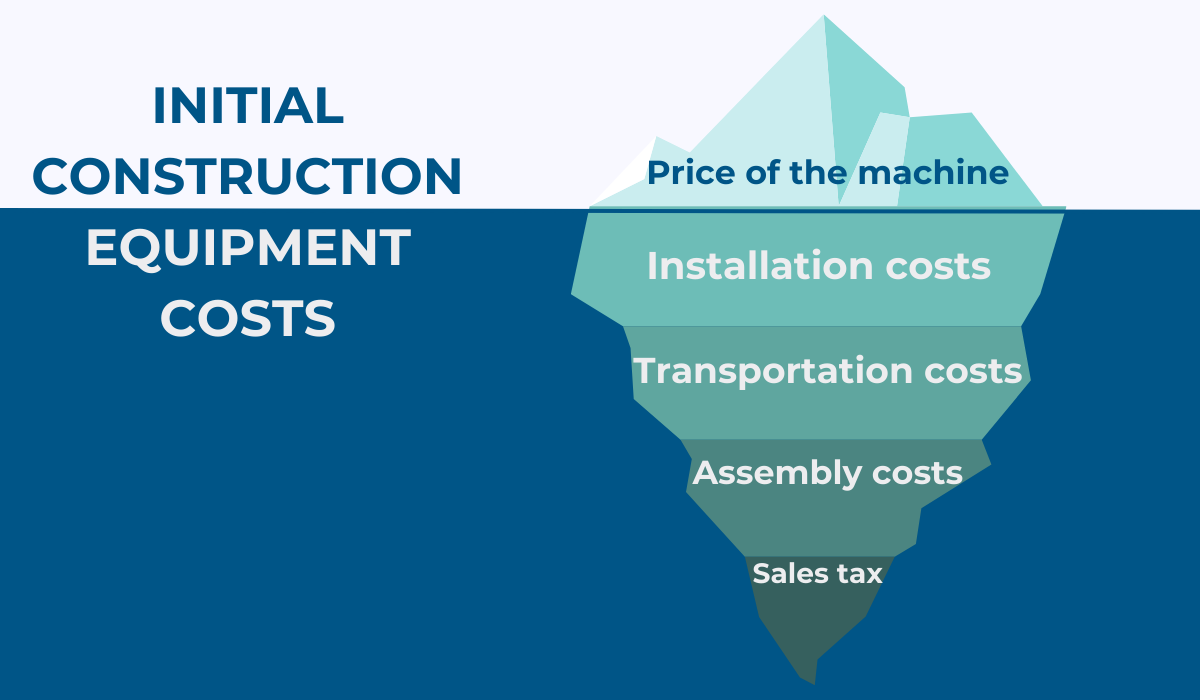

The cost value represents the initial cost of the piece of equipment in question.

However, this initial cost doesn’t only refer to the amount you paid for the machine itself.

It also entails all of the expenses associated with making that machine operational, which you can see in the image below.

It’s the first thing to calculate, to be able to use this depreciation method.

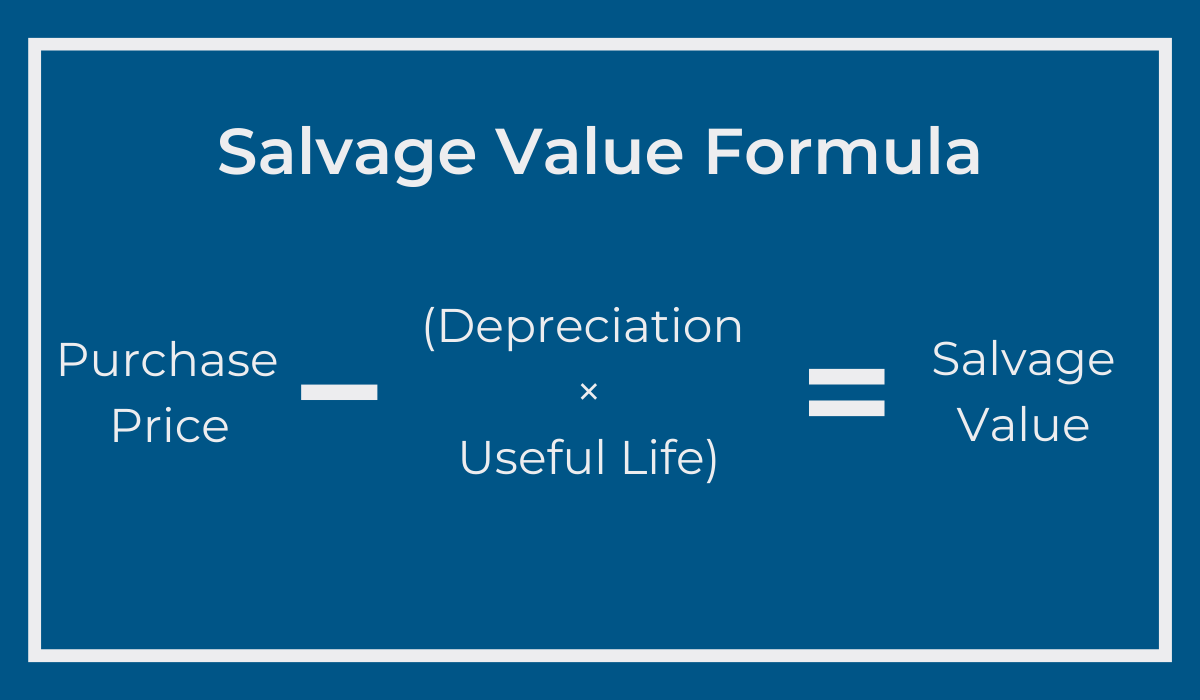

Once you know the cost value of the piece of equipment, it’s time to determine its salvage value.

Salvage value, also known as residual value, represents the amount of money you could get for the piece of equipment at the end of its useful life—i.e., once it can no longer be used for its intended purpose.

To calculate salvage value, you can use the following formula:

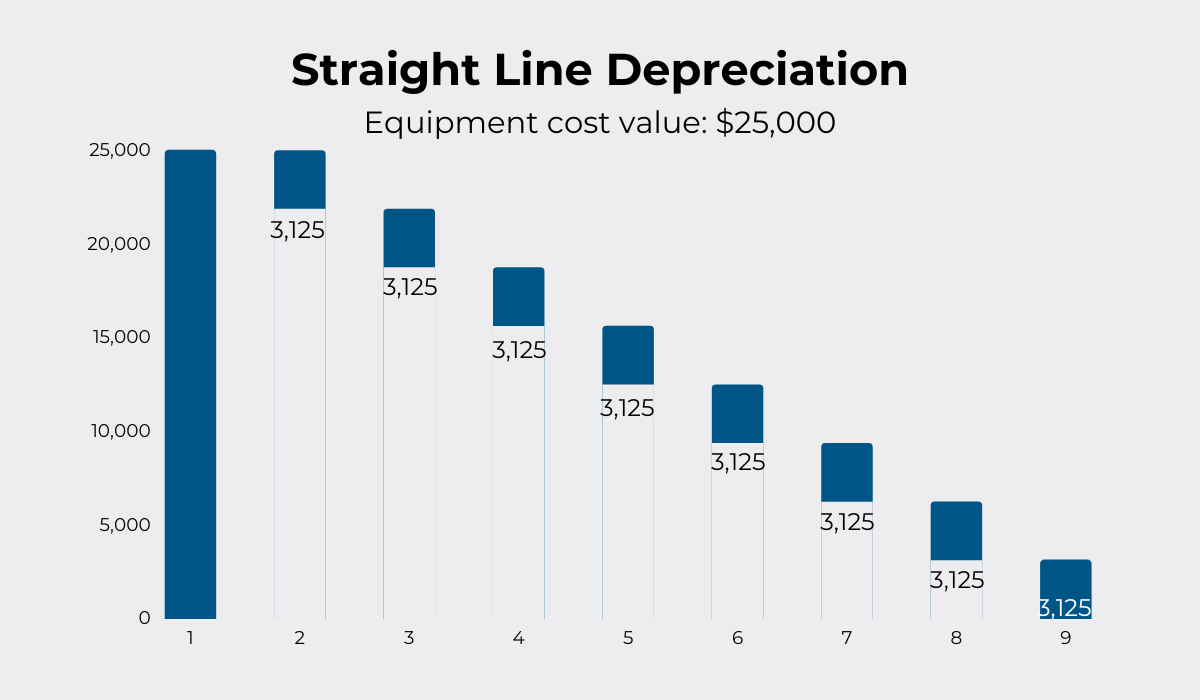

Now, let’s take a look at what calculating straight-line depreciation can look like in practice.

In this example, a piece of equipment costs $25,000, has an estimated useful life of 8 years, and a salvage value of $0.

To get the annual depreciation number, we simply had to subtract the salvage value from the cost value, and then divide it by the number of years that are the estimated useful life.

And we got to the number of $3,125. That is the yearly depreciation for this piece of equipment.

Apart from the fact that it’s easy to calculate, using the straight-line depreciation method allows you to purchase (often costly) construction equipment without negatively affecting your profits.

Namely, you can use the straight-line method to evenly spread out the cost of the equipment piece as an expense on the income statement across multiple years.

But what if you know that your equipment will become less and less efficient and need more and more repairs as it ages?

Well, in that case, the straight-line depreciation method might not be the right choice.

That’s why we’ll explore other depreciation options, starting with the declining balance method.

Declining Balance Method

The declining balance depreciation method is one of the accelerated depreciation methods.

According to SVA Certified Public Accountants, this method might be the right choice for you if you have equipment that can be expected to depreciate faster in its early years.

Simply put, using this method will allow you to front-load the deductions, i.e., you’ll be able to deduct a larger portion of the equipment’s cost in the earlier years of using it.

That way, your taxable income in those earlier years will be reduced, thus lowering your tax liability and leaving you with more money to use for repairs and maintenance later on.

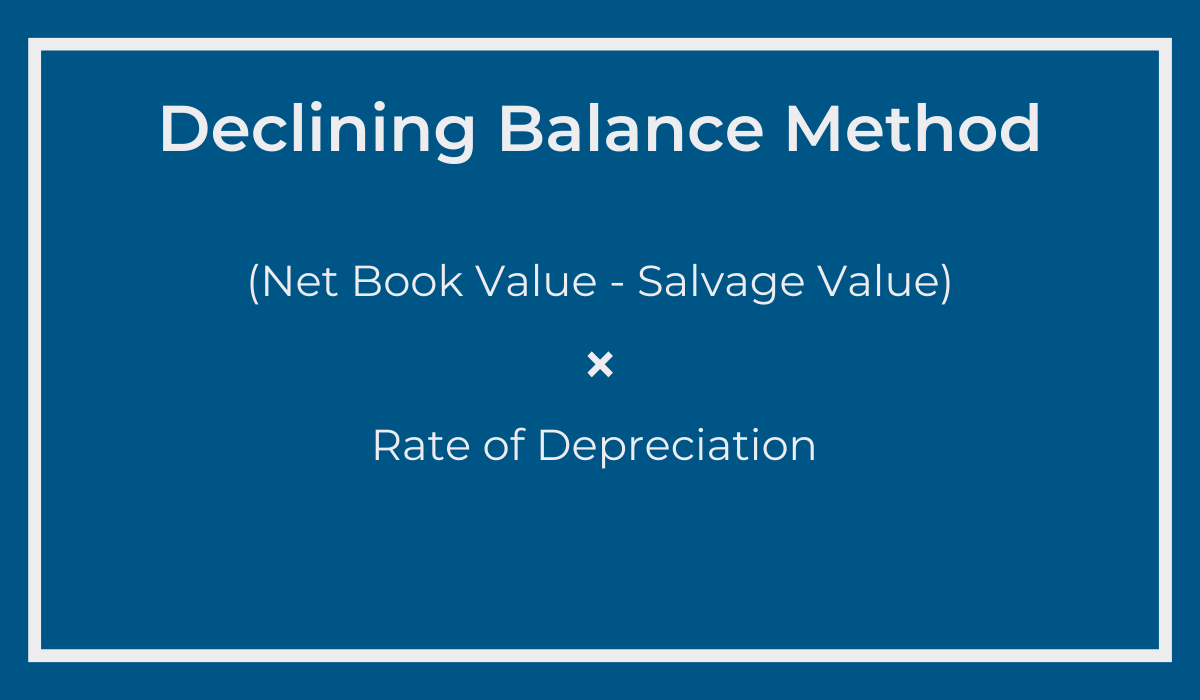

Now, let’s see what formula is used for calculating depreciation using the declining balance method.

To calculate depreciation using the declining balance method, we first need to calculate the straight-line rate. To do that, we’ll divide 1 by the useful life in years.

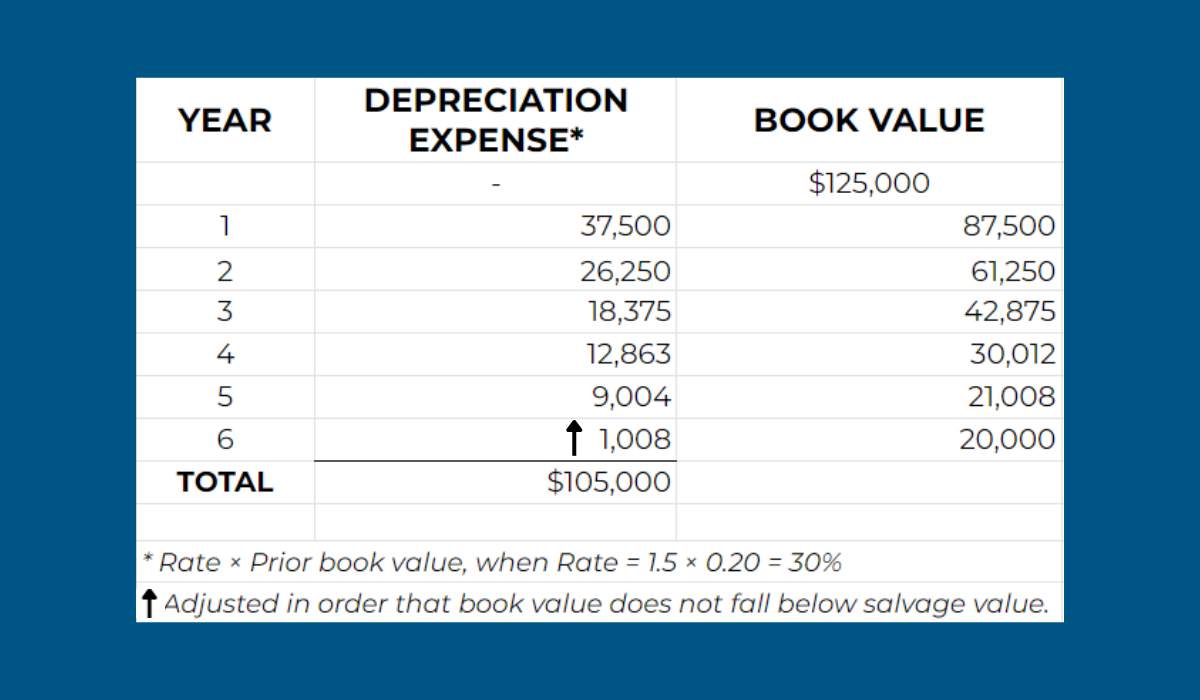

In this example, the useful life is 5 years, so our straight line rate will be 0.2.

Next, we’ll take that straight-line rate and multiply it by 1.5, since business owners often choose a rate of 1.5 for this method. This gives us a 0.3 rate of depreciation.

Lastly, we need to multiply the net book value minus the salvage value by that rate in order to get the depreciation expense for that year.

Net book value is the value at which a piece of equipment is documented on the company’s balance sheet.

In the first year, the net book value is going to be the cost of the piece of equipment, and the salvage value is not going to be considered.

Following the declining balance method formula, we’ll come to the conclusion that the depreciation expense in the first year is going to be $37,500.

With that being said, make sure to keep the following instructions from the IRS in mind when calculating your depreciation using the declining balance method:

When using a declining balance method, you apply the same depreciation rate each year to the adjusted basis of your property. You must use the applicable convention for the first tax year and switch to the straight line method beginning in the first year for which it will give an equal or greater deduction.

All in all, the declining balance method is worth considering if you don’t expect your equipment to depreciate at a steady rate.

Double Declining Balance Method

The double declining balance method is another accelerated depreciation method that depreciates your equipment at twice the speed of the declining balance method.

In other words, it’s a variant of the declining balance method, but with a higher rate of depreciation applied.

To calculate it, we are going to use the same formula as for the declining balance method, but with one difference:

We’ll take the straight-line rate and multiply it by 2 (instead of 1.5 like we did above).

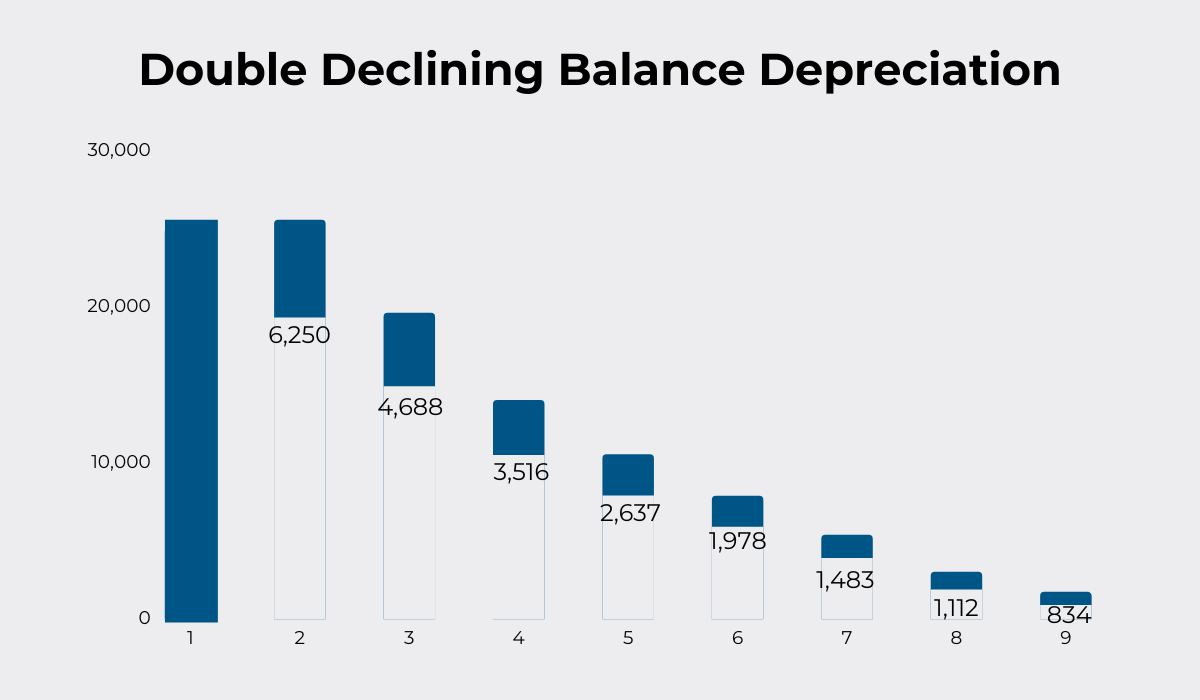

This is what calculating depreciation using the double declining balance method looks like when presented visually:

In the example above, the net book value is $25,000 for the first year, and the estimated useful life of the piece of equipment is 8 years.

Dividing 1 with a useful life of 8 years gives us a straight-line rate of 0.125.

Next, we’ll multiply 0.125 by 2, which gives us a depreciation rate of 0.25.

According to the formula, all there’s left to do is to multiply $25,000 by 0.25, and we’ll get the depreciation expense of $6,250 for the first year.

This also means that the book value of $18,750 at the end of year 1 will be our starting book value for year 2.

While this method might be better suited to the nature of your equipment, it’s worth noting that it is also more susceptible to error, given that you have to subtract a different amount every year.

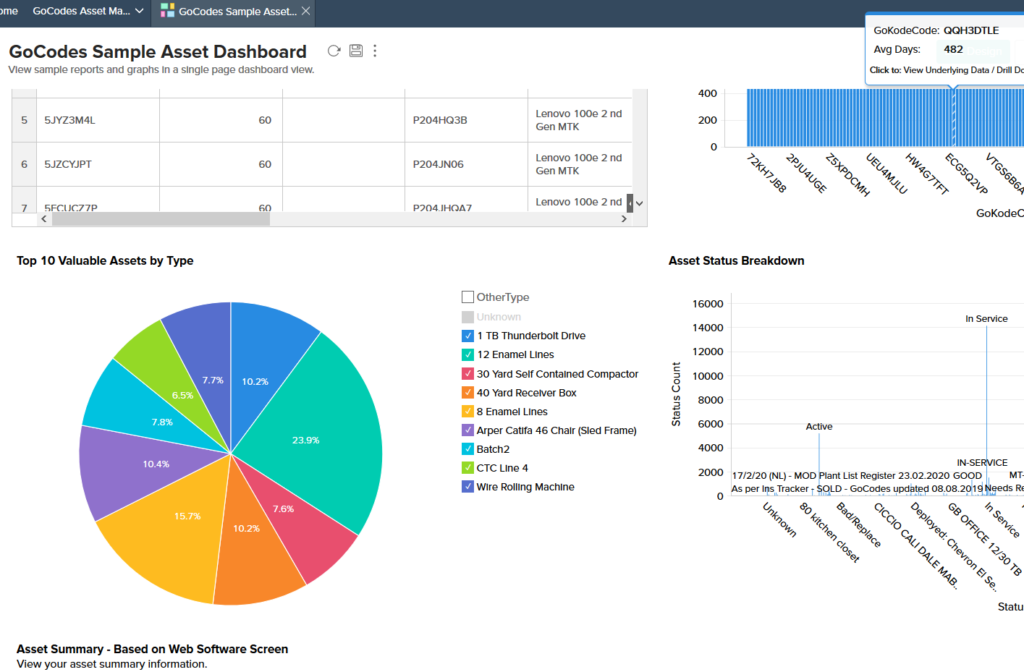

To take that stress out of calculating the depreciation of your equipment, you may want to consider using software like GoCodes that will do it for you.

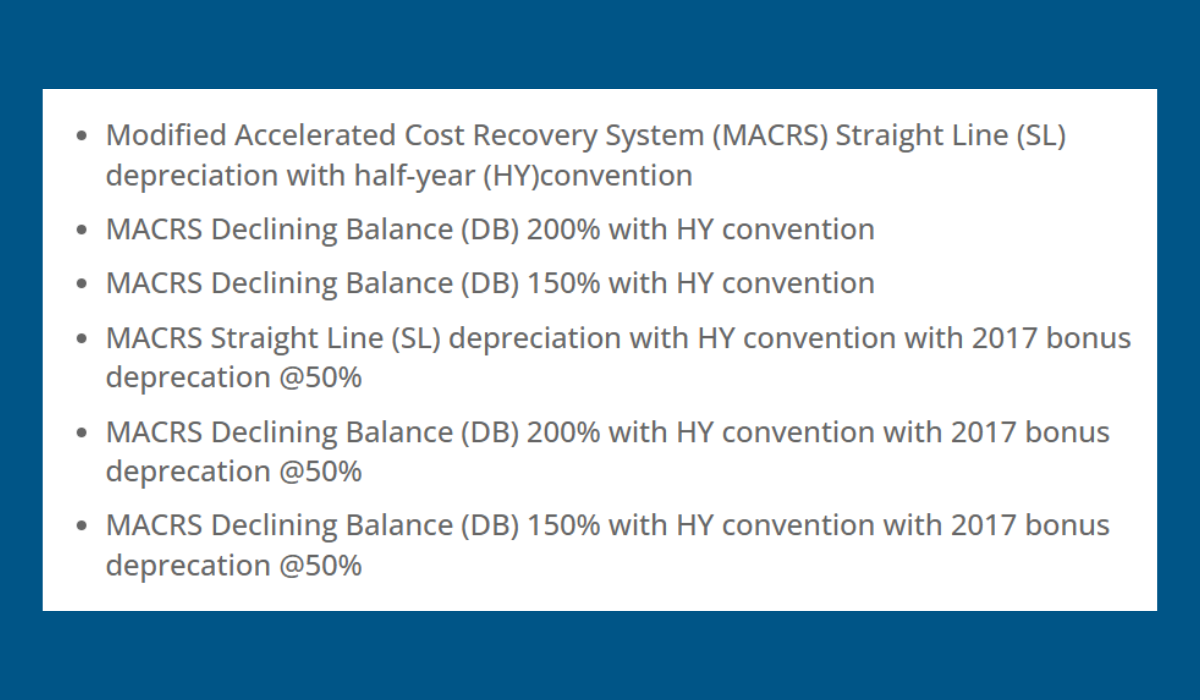

GoCodes offers the following depreciation calculations:

All you need to do is input a valid equipment purchase date, its cost, and estimated useful life, and then choose one of the depreciation calculations listed above.

Then, GoCodes will run the desired calculation and generate a downloadable report.

Source: GoCodes

Automating the process of calculating equipment depreciation will not only save you time, but also ensure the highest possible level of accuracy, which is extremely important due to the strict depreciation rules enforced by the IRS.

Sum of the Years’ Digits Method

Another accelerated method you can use to calculate the depreciation of your construction equipment is the sum of the years’ digits method.

Just like with the declining balance and double declining balance methods, your equipment’s depreciation is front-loaded under this method to avoid the financial impact brought on by purchasing a costly piece of equipment.

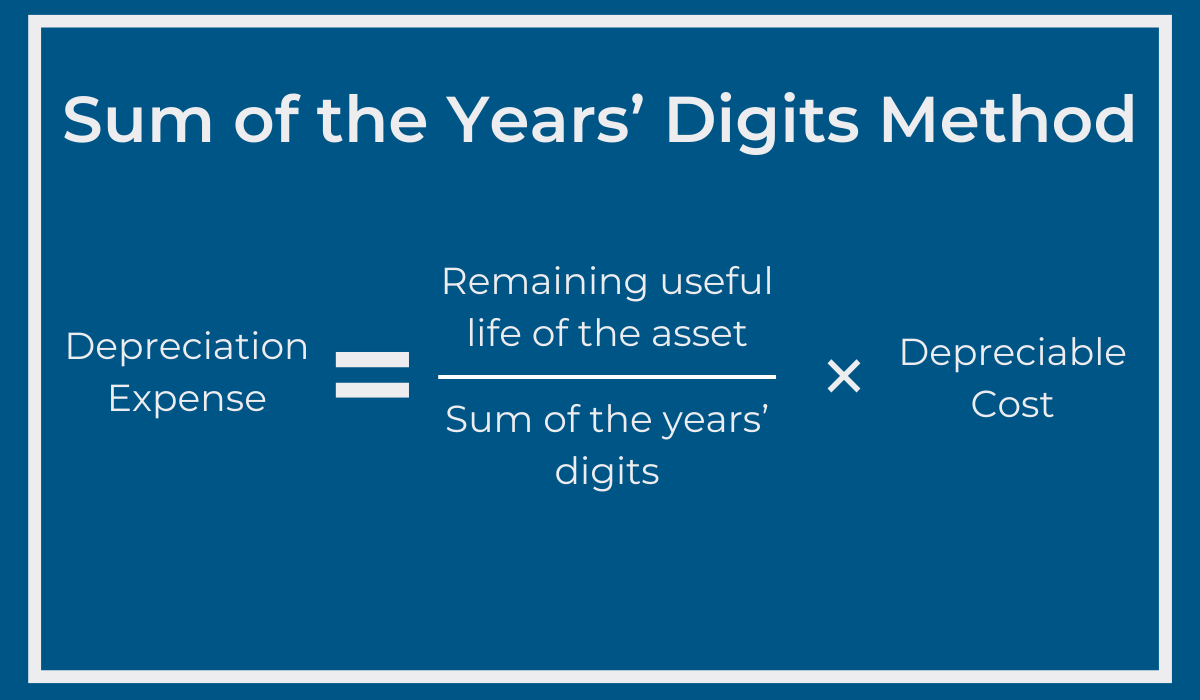

Let’s take a look at how depreciation is calculated under this method.

In order to get the annual depreciation expense, we first have to divide the remaining useful life of the asset expressed in years by the sum of the years’ digits.

To get that number, we need to add up individual years of the expected useful life.

For example, if the expected useful life of a piece of equipment is 5 years, the sum of the years’ digits would be 1 + 2 + 3 + 4 + 5 = 15.

Lastly, we need to multiply the result we get by the depreciable cost, and we’ll be left with the depreciation expense for the year in question.

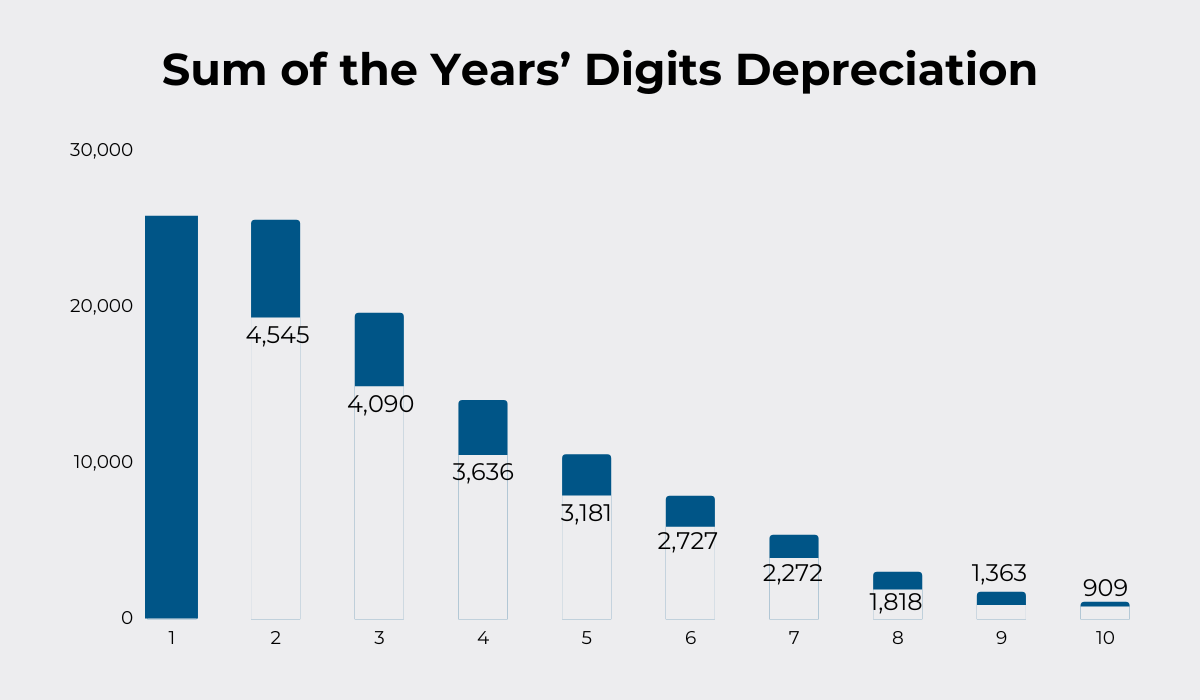

The image below shows what the sum of the years’ digits depreciation method looks like in practice.

In the example above, the total acquisition cost of the equipment is $25,000, and the salvage value is $0, meaning that the depreciable cost is going to be $25,000.

The expected useful life for this piece of equipment is 10 years, so the sum of the years’ digits is going to be 55.

At the beginning of year 1, the remaining useful life of the equipment is 10 years. We’ll divide that by 55 and get 0.1818.

Multiplied by 25,000, the depreciation expense for year one is $4,545.

Following the same logic, the depreciation expense for year 2 is $4,090, and so on.

But why would you choose to calculate the depreciation of your equipment using this method?

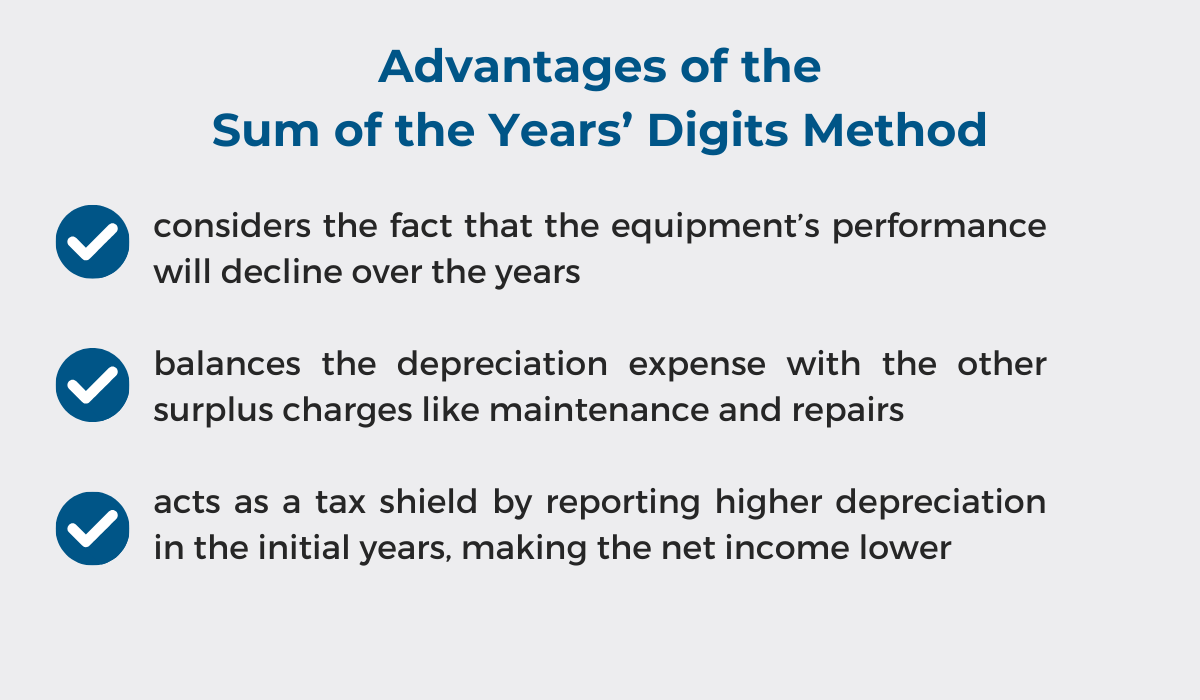

As it turns out, the sum of the years’ digits method comes with several advantages:

So, if you’re looking to realize higher tax savings during the first few years of equipment ownership, or you believe that the equipment may become obsolete more quickly, the sum of the years’ digits depreciation method might be worth considering.

Units of Production Method

The last depreciation method we’re going to discuss is the units of production method.

This depreciation method measures the depreciation of your equipment based on its usage over time, i.e., the units it produces while in use.

This means that the depreciation amount is going to fluctuate from year to year, depending on how much the piece of equipment was used.

You may be thinking, “My equipment doesn’t manufacture units of anything, so how would I use this method?”

While this method may not be as popular as the others we presented, it can still be used in the construction industry.

However, you would have to come up with an equivalent for the unit of production that represents the usage of your equipment.

This could be, for example, miles traveled for your construction vehicles, or hours of operation for equipment like bulldozers or skid steer loaders.

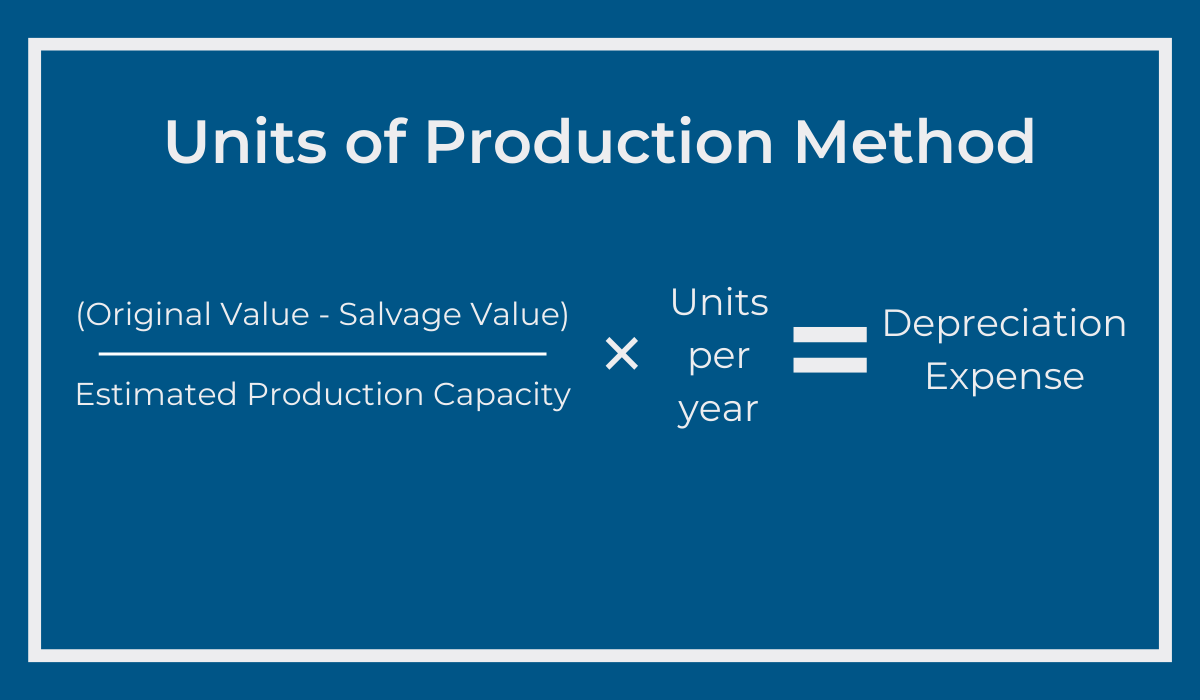

Here’s how depreciation is calculated using the units of production method.

Let’s say a construction vehicle costs you $100,000 with a salvage value of $10,000, and the estimated production capacity for it is 250,000 miles.

Using the formula, we’ll divide 90,000 by 250,000 and get 0.36.

If that vehicle crosses 15,000 miles in a year, the depreciation expense for that year is going to be 0.36 × 15,000 = $5,400.

Although calculating depreciation using this method is fairly simple, it comes with several drawbacks.

Namely, not only will you have to change the calculation each year based on the usage of the equipment, but also predict and keep track of the usage to ensure that your calculations are accurate, which can be difficult and time-consuming.

Additionally, given that the units of production method cannot be used for calculating tax deductions, you’re going to have to choose another depreciation method specifically for that purpose.

With that in mind, you may come to the conclusion that one of the other depreciation methods might be a better fit for your construction business.

Conclusion

Calculating the depreciation of your equipment is a key part of business operations and has an impact on the financial health of your construction company.

That is why it’s crucial to look into the different depreciation methods and select the one that will help you optimize your financial strategies.

We hope that this article has equipped you with the knowledge needed to make an informed decision and ensure the success of your business.