Asset turnover is more than just a figure on a balance sheet; it’s a key that helps unlock the secrets of the profitability and productivity of a business.

In this article, our goal is to demystify this financial metric by addressing six common questions that often perplex individuals as they navigate the intricacies of financial landscapes.

Let’s start with the basics and first establish a clear definition of what precisely constitutes an asset.

In this article...

What Is Asset Turnover?

Assets, both physical and intangible, play an essential role in the financial structure of a business.

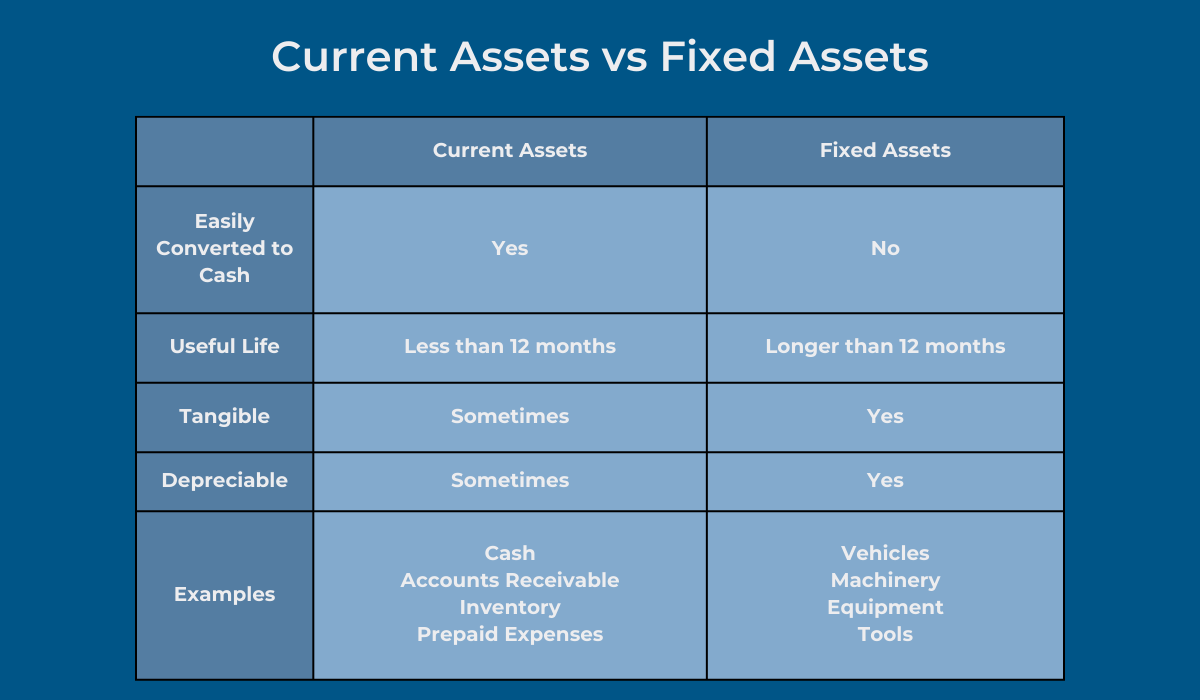

Defined as property owned by a company with the purpose of generating revenue, assets are divided into two broad categories:

- Current

- Fixed

Current assets are vital for smooth day-to-day operations and can be converted into cash quickly, which makes them highly liquid.

Examples include resources like cash, accounts receivable, or inventory.

Fixed assets, on the other hand, are tangible property used to produce income over longer periods of time and are not as easily or swiftly convertible to cash.

Anything from tools and safety equipment to vehicles and heavy machinery falls into this category.

Now, let’s get to the main question—what is asset turnover?

Not to be confused with the turnover rate, which is associated with the frequency at which employees quit working at a company, asset turnover is an important metric in financial analysis, used for assessing whether or not you’re making the most out of what you have.

In other words, it measures how efficiently you’re utilizing all your resources to turn a profit.

For instance, if your turnover ratio is good (we’ll define what’s considered “good” later in the article), this suggests you’re investing in the appropriate tools, equipment, and inventory to turn a profit.

Essentially, it means you’re doing something right.

On the flip side, if your business is not where you want it to be and you’re unsure why, it could be a good idea to get in touch with your accounting department and investigate your own asset turnover.

It just might provide you with an explanation as well as offer a pathway to strategic improvements.

How Is Asset Turnover Calculated?

So, how do you calculate your asset turnover ratio?

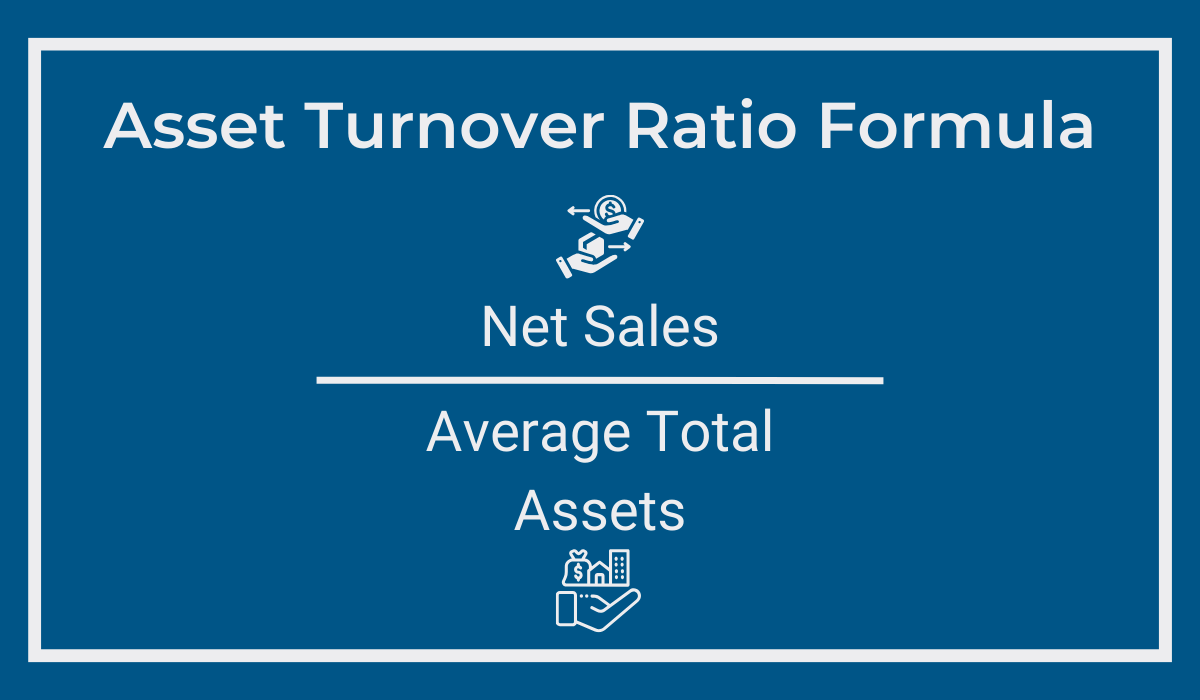

The formula itself is pretty straightforward: net sales divided by average total assets.

However, to get a better understanding of this calculation, let’s dissect its elements, starting with the net sales.

This value represents the total amount of money you’ve made from your company’s primary operation, like, for instance, the sale of services or goods.

As such, it’s usually a good indicator of a business’s overall financial performance and health.

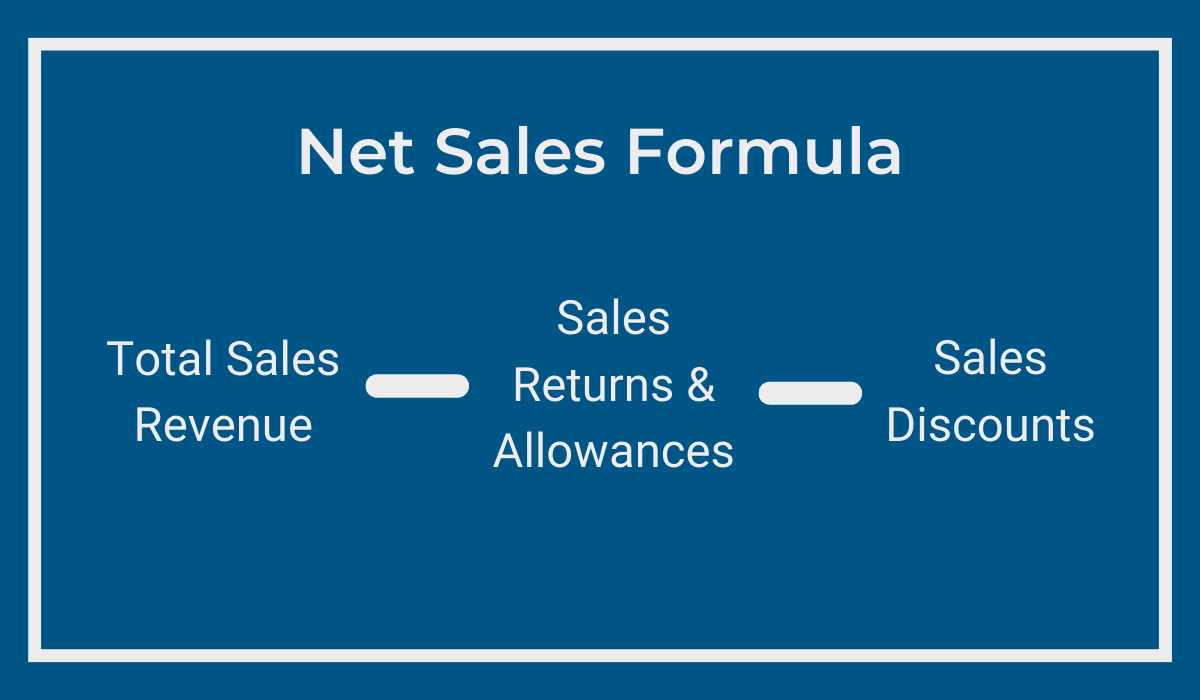

The net sales value encompasses three components:

- Total sales revenue

- Sales returns and allowances

- Sales discounts

Total sales revenue is the total amount of money a company earns from selling goods or services, while returns and allowances account for all the refunds or discounts due to customer dissatisfaction.

Sales discounts, as the name suggests, represent all the discounts provided to the clients during a specific period.

Net sales, then, are the resulting amount after subtracting all discounts, allowances, and returns from the sales revenue.

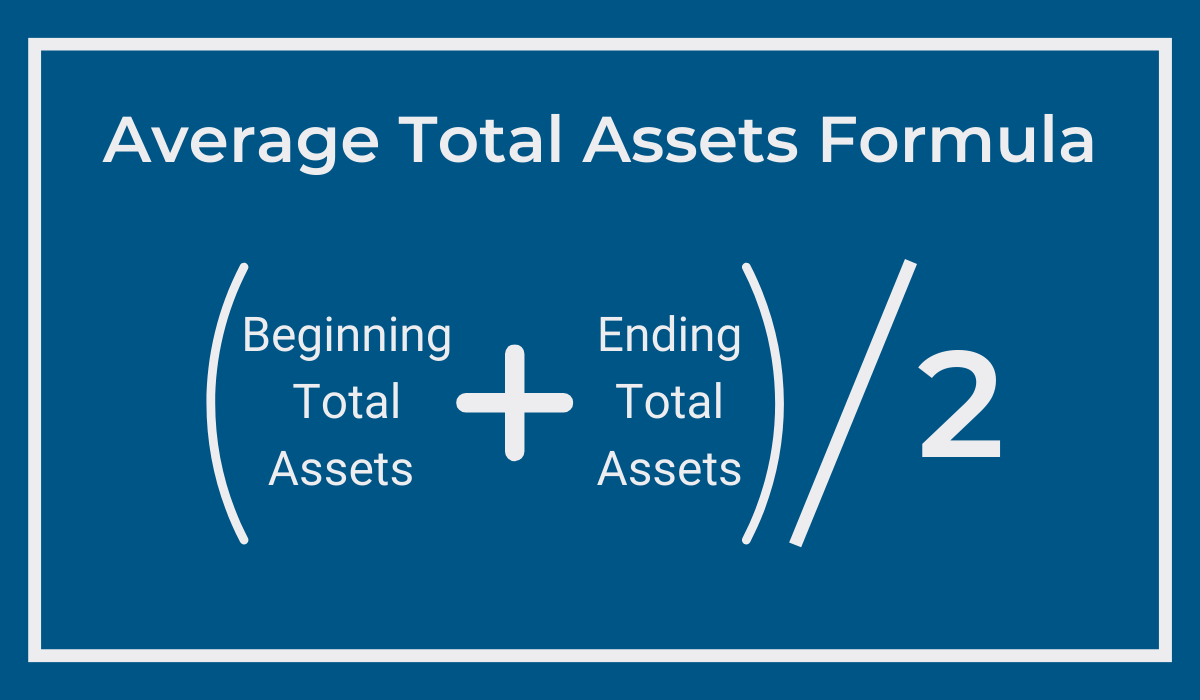

Moving on to the second part of the formula, average total assets assess the value of your business’s resources over a defined extent of time, typically a year.

To calculate this, you’ll need information on the number of assets at the beginning and end of the accounting period.

Now that we’ve outlined all the aspects of the asset turnover formula, let’s get into why exactly this financial metric is so important.

Why Should You Know Your Asset Turnover?

In the most simple terms, asset turnover measures how efficiently you use your assets to make money.

It’s a valuable tool aiding you in understanding the business’s cash flow, profitability, and operational efficiency.

A higher ratio indicates successful resource maximization and substantial returns on investments, while a lower one, on the other hand, suggests there are some inefficiencies in your operations.

Such scenarios could be attributed to misguided investments, neglected equipment maintenance, or inadequate strategic allocation of heavy machinery or other property.

Luckily, modern technological solutions can play a pivotal role in resolving these issues.

Asset tracking systems, for example, tell you exactly what’s happening at a job site, helping you identify productivity losses and determine the best course of action to optimize your resources.

Troy Dahlin, Vice President of Heavy Construction U.S./Canada for Leica Geosystems, agrees.

According to him, precise data is key to accurate forecasting and higher productivity.

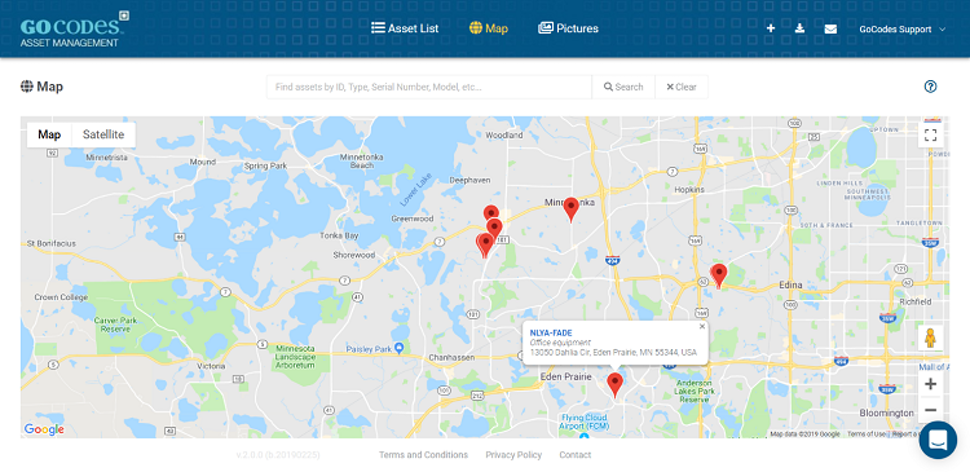

Our own equipment management solution—GoCodes Asset Tracking—doesn’t only provide all the vital asset data you need for well-informed decision-making, but it also helps establish consistent processes within the company, ultimately enhancing efficiency and profitability.

Here’s how it all works.

Tag your machines and tools with GoCodes Asset Tracking QR code asset labels and scan them to access a plethora of useful utilization metrics such as check-out and check-in dates, GPS locations, fuel use, operating hours, and so on.

Then, generate reports on equipment usage with our reporting feature, which enables you to analyze the trends and patterns, as well as make sense of all this data.

After all, this information is what empowers you to allocate assets more effectively, reduce unplanned downtime, and improve overall efficiency.

That way, challenges like equipment hoarding or idling become a thing of the past.

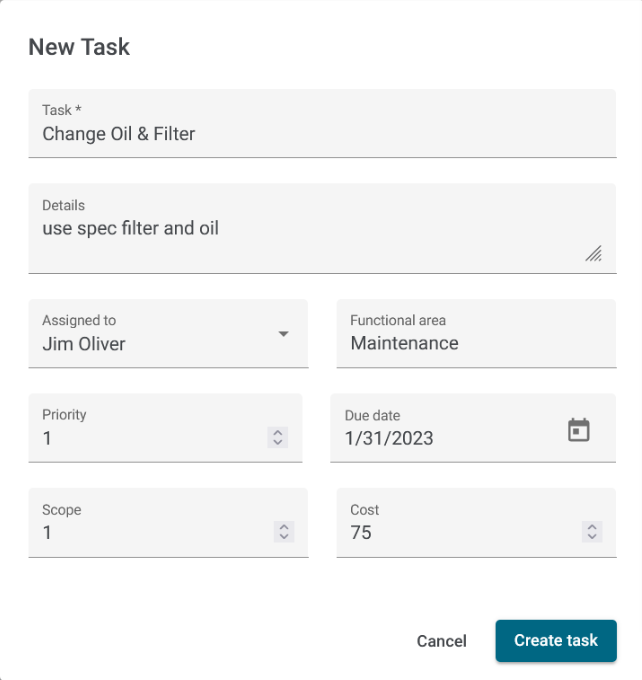

Moreover, to further streamline workflow, the GoCodes Asset Tracking Tasks feature enables you to set up assignments, appoint them to specific workers, and monitor their progress, ensuring everyone stays on top of their responsibilities.

There will be no more missed machine inspections with our system.

All in all, while the asset turnover ratio is an important metric, don’t panic if you encounter a less-than-desirable number.

There are ways to maximize an asset’s utility and its profit-generating capabilities.

By implementing efficient asset management systems like GoCodes Asset Tracking, you can take proactive steps to enhance your company’s activities, which will ultimately be reflected in your turnover ratio.

What Is Considered a Good Asset Turnover?

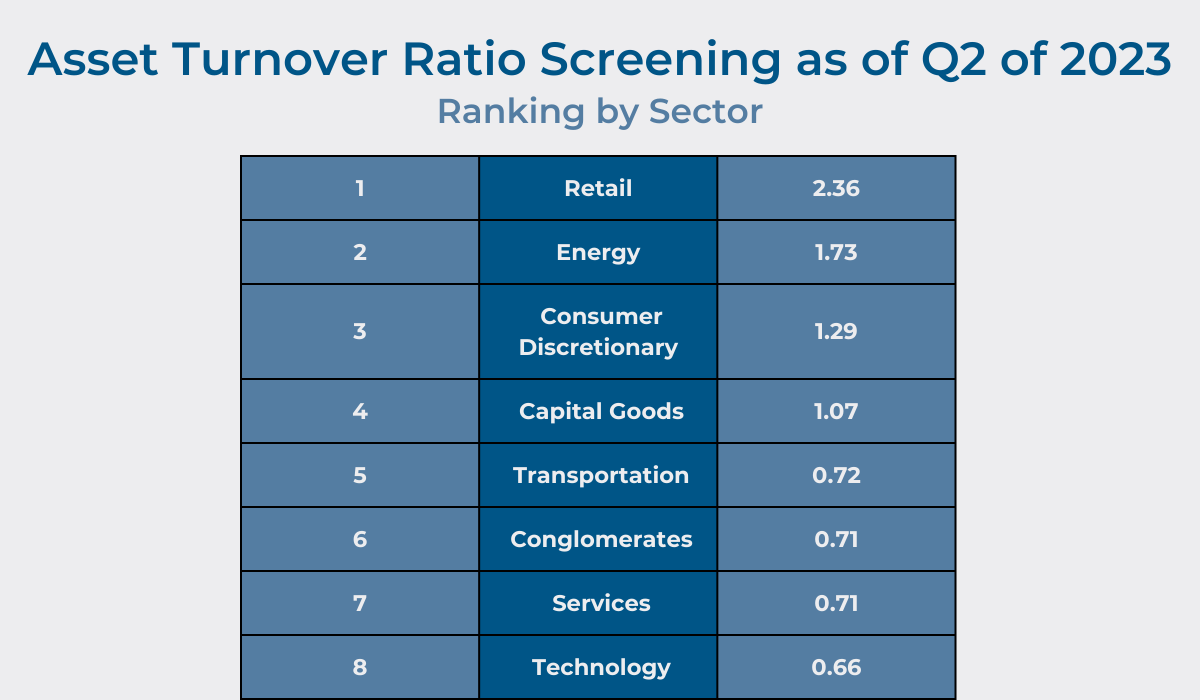

An ideal asset turnover ratio will vary from industry to industry, or from sector to sector, but the general rule of thumb is this: the higher the ratio, the better.

This is because a high asset turnover implies that you’re able to generate more profit from your assets, thus ensuring better returns on investment.

To put it in perspective, if your ratio is 2, it signifies that you’re producing $2 for every $1 invested, marking a commendably high turnover.

An important thing to note is that, while you should compare your turnover to other industry peers in order to stay ahead of the game or ensure you meet industry standards, trying to match benchmarks from other industries isn’t advisable.

Industries like retail, for example, which have much more current assets, and sell their goods faster, tend to have higher turnover rates, and ratios that are as high as 2 are more common for them.

On the other hand, service-based businesses produce income more slowly.

However, if your turnover is too low, even compared to the industry standard, it indicates there’s some room for improvement.

In this case, it’s necessary to first identify the source of the problem.

Let’s take a look at some potential culprits.

What Factors Influence Asset Turnover?

There’s a multitude of factors, both internal and external, that play a role in influencing your asset turnover, and their understanding is vital for grasping your business’s financial well-being.

Some internal influences to consider include:

- Sales volume

- Asset management

- Industry dynamics

For starters, sales volume is one of the most direct factors, and its connection to asset turnover is pretty straightforward.

Essentially, an increase in sales leads to a higher turnover ratio.

In other words, selling goods or services at a larger volume implies effective and successful utilization of your equipment, tools, heavy machinery, and all the other revenue-generating resources.

Furthermore, efficient asset management is equally important, as it prevents excess inventory accumulation and capital tied up in underutilized equipment.

This means that, through mismanagement, you risk investing in assets you don’t really need, thus limiting your cash flow, which then hinders you from allocating funds to other, more critical areas.

Industry dynamics constitute a factor that was already covered in the previous section and it refers to the varying turnover standards that differ from sector to sector.

Comprehending these dynamics is a must for any profitable business.

Moreover, external factors beyond your control can impact asset turnover, such as:

- Economic conditions

- Competitive landscape

- Technological advancements

To illustrate, during economic downturns, many companies experience decreased ratios as a result of their sales declining.

On the flip side, better economic circumstances bring about buyers who are inclined to spend more, raising businesses’ asset turnover.

Additionally, your competitors can affect pricing and sales strategies, thereby affecting the profitability and productivity of your own company.

In these cases, vigilance and adaptability in response to competitive changes are key.

Technological progress, yet another influence on asset turnover, is a double-edged sword.

While adopting new technologies can enhance the operational efficiency of a company, failure to keep up with the times may lead to a decline in productivity and, consequently, lower turnover ratios.

In conclusion, it’s crucial to be able to adapt to the ever-changing conditions, both within and outside your business, to maintain a healthy asset turnover ratio.

Regularly reassessing and adjusting strategies as an answer to economic and industry shifts, as well as developments in the technology field will contribute to your company’s sustained success.

How Does Asset Turnover Affect Net Profit?

After deducting all operating, interests, and tax costs from the earnings within a specific accounting period, what remains is referred to as net profit.

So, how exactly does asset turnover affect it?

The connection between the two is actually very important for financial analysis and can provide valuable insights into a company’s fiscal performance.

Let’s see why.

A higher turnover usually manifests in two key aspects:

- Effective asset utilization

- Reduced costs

As we already established, a heightened turnover ratio suggests optimal usage and allocation of your resources.

This implies that none of your assets are either underutilized or overutilized in the process of revenue generation.

The ripple effect of increased productivity and efficiency then extends to a decrease in ownership, maintenance, replacement, and depreciation costs, contributing to higher profit margins and a boost in net profit for the company.

This enhanced profitability provides the opportunity to allocate resources to other critical areas, such as research, marketing, or business development, which, in turn, opens up additional business opportunities, further augmenting the total income.

In short, the positive cycle of constant profit surge allows for diversification and growth in various dimensions of your company.

Conclusion

In conclusion, the significance of asset turnover tracking should not be underestimated when analyzing a company’s financial performance, as it provides invaluable insights into efficiency and resource utilization.

By addressing these six common questions, we’ve attempted to highlight the nuanced nature of this metric and to show just how useful of a tool it can be.

Therefore, make sure not to overlook asset turnover in your financial analysis strategy.

Instead, harness its power to make informed decisions and drive sustainable growth.