When your construction company buys a brand-new or used piece of equipment, one of the first things accountants will ask is how they should calculate equipment depreciation.

Although this might seem like an accounting and tax-related technicality, applying the right depreciation rate has much broader effects on your company’s bottom line.

In other words, depreciation influences decisions related to equipment replacement, resale value, maintenance schedules, and even the overall efficiency of your construction operations.

Against this background, here are five best practices when calculating equipment depreciation.

In this article...

Choose the Right Depreciation Method

The first step is choosing the right depreciation method, which can be better understood when it’s clear what equipment depreciation is.

So, here’s a definition by the IRS:

Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property.

Simply put, if the equipment you bought is going to be used for more than one year and its useful life can be determined (e.g., 10 years), the IRS prescribes that its full purchase cost (e.g., $100,000) can’t be written off as a business expense in the year you bought it.

Instead, you’re obliged to spread it across the equipment’s useful life, for example writing off $10,000 per year for the next 10 years.

This brings us to different depreciation methods, each offering specific ways to allocate these costs over time.

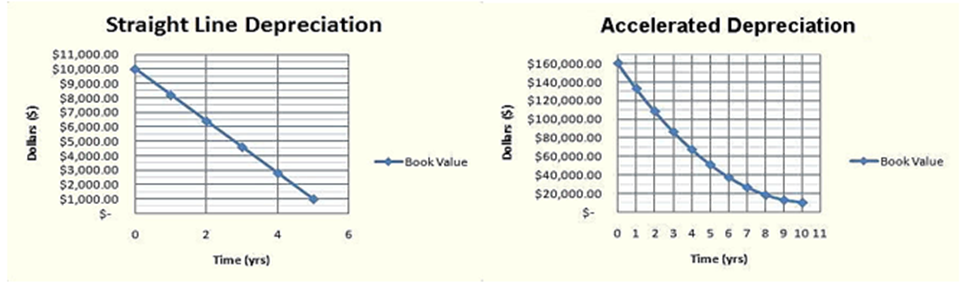

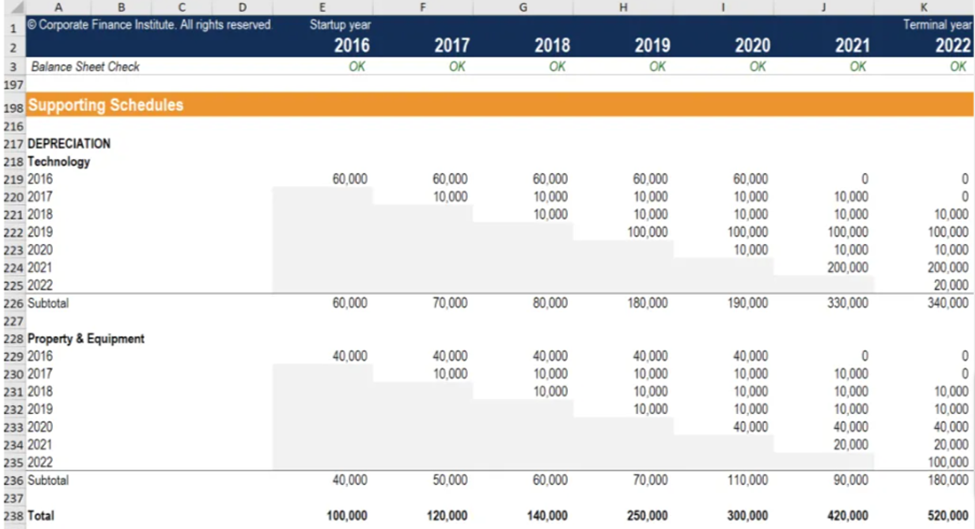

The two most common methods are straight-line and accelerated depreciation, which you can see here.

When equipment is depreciated in a straight line, it means its total purchase cost (including transportation and setup costs) will be deducted in equal amounts during its useful life or before it’s resold.

The above example with $100,000 spread over 10 years in $10,000 increments represents simplified straight-line depreciation when the end-of-life equipment’s salvage value is estimated as zero.

In other words, if it’s estimated that the equipment will be, for instance, worth $10,000 at the end of its lifecycle (when resold as a whole or for parts), then the cost to write off would be $90,000 paid in ten $9,000 increments.

As for accelerated depreciation, this method is used when it’s assumed that the equipment’s value, due to its usage, wear and tear, or obsolescence, will decline considerably during the first few years.

Under this scenario and depending on different calculation methods, such as sum-of-the-year or double-declining balance, larger portions of the equipment’s acquisition cost will be written off in the first few years of its useful life.

For instance, for a $100,000 piece of equipment with a 10-year useful life, the depreciation in the first year might be $20,000, followed by $16,000 in the second year, $12,000 in the third year, and so on.

Overall, choosing the right depreciation method can help you make more accurate financial projections, balance the books, manage tax savings, and ensure your equipment-related decisions align with your business objectives and profitability goals.

Get an Accurate Estimate of Useful Life

As we’ve just seen, the equipment’s purchase value should be spread over its useful life, so getting an accurate estimate is crucial for calculating depreciation more efficiently.

So, what’s the equipment’s useful life?

According to Investopedia:

The useful life of an asset is an accounting estimate of the number of years it is likely to remain in service for the purpose of cost-effective revenue generation.

Therefore, it’s not the actual number of years that the equipment will remain in use, but an estimate of how long using it will be profitable for your company.

To get an accurate estimate of useful life, it’s best to begin with the IRS’s publications and tables where estimates are provided for different types of assets (including construction equipment).

The IRS’s estimates are a good starting point for determining your equipment’s useful life, enabling you to choose an appropriate depreciation method.

However, there are more factors to consider when estimating useful life.

For instance, the equipment’s useful life might be longer or shorter than the IRS estimated due to the equipment’s usage intensity, maintenance practices, and technological obsolescence.

Therefore, although the IRS’s estimate might say 10 years, you and your team might conclude that the machine will lose its profitability in 8 years, or that it will generate profit for 12 years.

In summary, using a correct useful life estimate for your equipment is directly related to accounting and tax benefits that equipment will generate, so it’s best to make the estimate as accurate as possible.

Keep Track of Your Equipment’s Condition

Naturally, a lot can happen to your equipment that might shorten its useful life (or end it abruptly), from a major breakdown to a natural disaster.

Equally, prudent equipment utilization and diligent maintenance can prolong its life, preserving its performance and profitability over an extended period.

That’s why accountants and managers regularly update the depreciation schedule, as we’ll see in the next section.

And that’s why it makes sense to keep track of your equipment’s condition.

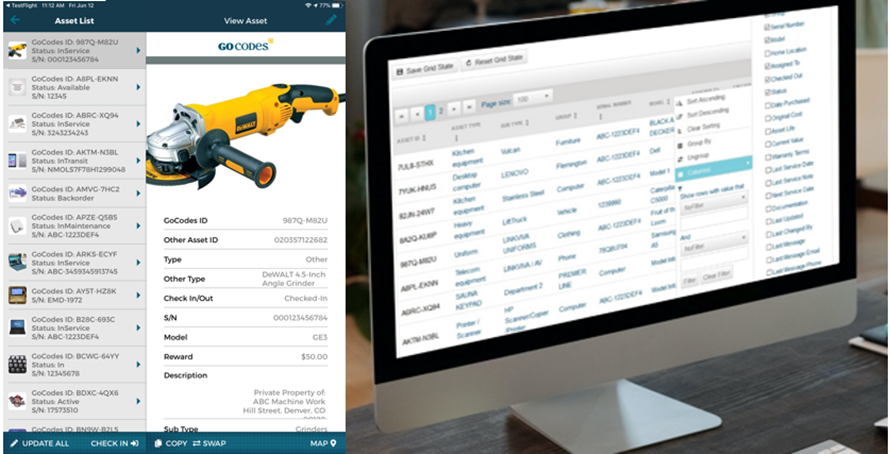

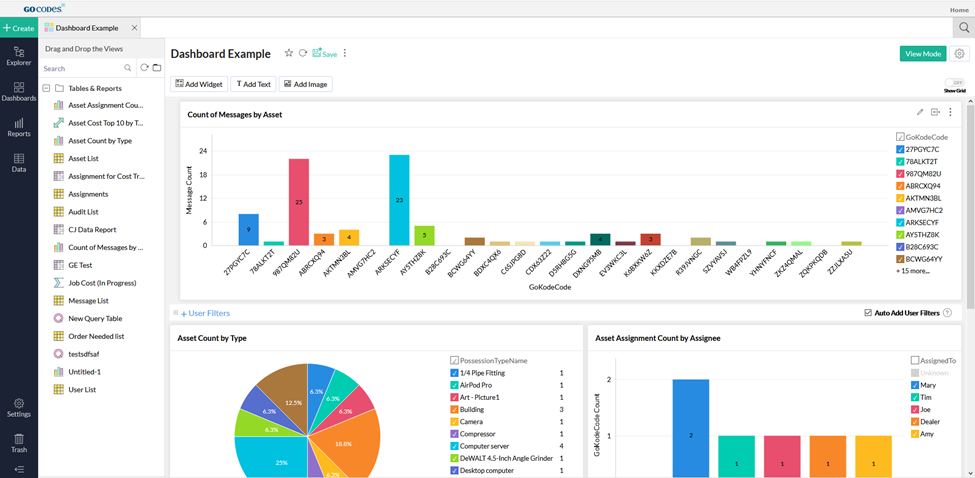

Recognizing that paper lists and spreadsheets are an inefficient and time-consuming way to track various equipment data, construction companies turn to cloud-based, mobile asset-tracking solutions.

That way, those responsible for depreciation adjustments can access all the relevant information related to equipment in one place, which accelerates and improves their decision-making.

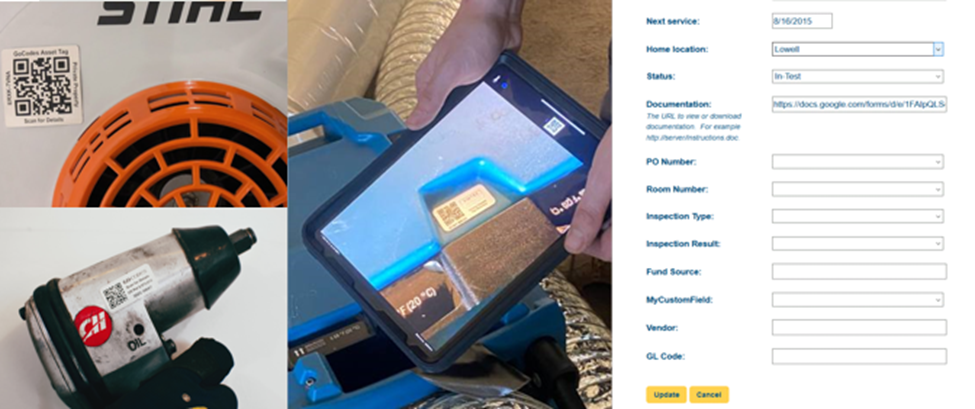

For example, all the equipment-specific data (e.g., users and locations, repair and maintenance history, inspections, current depreciation method, and useful life estimate) can be tracked and stored in a cloud database.

Users can access the central database by scanning a QR code label attached to equipment using their smartphone or tablet or by logging into the tracking app on any internet-connected device.

For example, this allows service technicians to easily record what inspections and regular maintenance were performed on each piece of equipment from any location (construction site, repair shop), i.e., without the need to fill out paper forms back in the office.

Concurrently, managers can track the condition of all tracked equipment and make better-informed maintenance and replace-or-repair decisions.

Lastly, accountants can access the database and consult managers on the equipment’s condition, so they can reevaluate the depreciation accordingly.

And this is only one of the many features that equipment tracking software, an in-app scanner, and QR codes enable when joined together in one simple and cost-effective solution like GoCodes Asset Tracking.

In a nutshell, GoCodes Asset Tracking allows construction companies to track the location, usage, and maintenance status of their equipment.

It does so by using rugged QR codes attached to each piece of tracked equipment, and cloud software with a smartphone app scanner, allowing users access to equipment info on-site, as well as automatically capturing the equipment’s current location.

Therefore, such equipment tracking solutions will not only automate the depreciation process but also protect equipment from theft and misuse while improving maintenance practices and increasing operational efficiency.

So, considering that the equipment’s useful life can change due to various circumstances, it’s wise to keep track of your equipment’s condition, preferably by using a tracking app to streamline equipment management processes, including the depreciation schedule.

Regularly Update the Depreciation Schedule

Staying on top of your depreciation schedule is not only a matter of accurate accounting but also a requirement for regulatory compliance and taxation.

Moreover, it can have an impact on the timing and magnitude of tax deductions related to depreciation and allow you to make informed decisions about equipment maintenance, replacement, or resale.

Therefore, when your equipment’s conditions or usage patterns change, the resulting adjustments of their estimated useful life and salvage value should be reflected in your depreciation schedule.

For example, a seldom-used piece of equipment might be intensely utilized on the next project, leading to higher wear and tear, which shortens its useful life, and therefore increases its depreciation rate.

When such depreciation adjustments are calculated accurately and consistently, this ensures your financial statements provide a realistic portrayal of your company’s assets value.

This is crucial for complying with tax laws and regulations and for accurately calculating tax benefits.

In many cases, accountants will update the depreciation schedule on an annual basis to align with tax and financial reporting requirements.

This annual update ensures that the equipment’s depreciation expense accurately reflects its usage and value over the year.

However, updates can be done more frequently, which typically depends on factors like your company’s accounting practices, the types of equipment you own, and any relevant tax regulations.

To recap, regularly updating the depreciation schedule enables construction companies to keep their financials accurate, meet regulatory requirements, and make better-informed equipment management decisions.

Automate the Depreciation Process

Given the intricacies involved in equipment depreciation calculations and the potential factors that can influence them, it’s best practice to automate the depreciation process.

In other words, after you and your accounting team decide on the most appropriate depreciation method for a newly purchased piece of equipment, you can automate the tracking of depreciation changes and adjustments by utilizing asset-tracking software.

That way, both managers and accountants can use a range of pre-built depreciation reports they can easily generate.

This report-generation feature allows managers to make data-based equipment management decisions while aiding accountants in ensuring the accuracy of financial statements and compliance with tax regulations.

In this example, all the data you need to create and/or update the depreciation schedule is the equipment’s purchase cost and date, and its estimated useful life (typically 3, 5, 7, 9, 10, or 15 years).

Next, you need to select the depreciation method from a range of options aligned with IRS rules and conventions, meaning such reports can be exported in different file formats and used when filing financial statements and tax returns

The software takes this information and uses it to calculate equipment depreciation, including:

- annual depreciation

- current year depreciation

- prior year depreciation

- total depreciation to date

- amount remaining to depreciate

When alterations in the equipment’s condition or usage patterns necessitate adjustments to useful life and salvage value, this software feature can automate the process of calculating the corresponding changes.

Naturally, such software solutions enable managers to track equipment utilization, maintenance schedules, and other relevant data points and generate custom reports.

When the depreciation process is automated, and all relevant changes in equipment usage and conditions are captured by software, it’s easier for both managers and accountants to keep track of equipment management factors and their depreciation-related effects.

Moreover, it’s easier to implement and track a range of measures that help you minimize the equipment’s real-life loss of value, such as conducting operator training and rotating equipment usage.

To recap, it’s highly recommended to automate the process of calculating equipment depreciation as it enables you to streamline financial reporting, ensure regulatory compliance, and make well-informed equipment management decisions.

Conclusion

Lastly, we should say that three of the best practices covered here—choosing the depreciation method, estimating the equipment’s useful life, and updating the depreciation schedule—are best done in close collaboration between equipment managers, accountants, and tax advisors.

The remaining two practices—tracking your equipment’s condition and automating depreciation—can streamline the above procedures, giving all involved instant access to relevant information.

This enables improved decision-making, which can generate time and cost savings.

Moreover, the right software tool will go beyond enabling easy calculation of equipment depreciation, such as automating equipment allocation and maintenance, lowering the risk of theft and negligent operation, and increasing overall productivity.