If you’re a construction company owner or manager, you might feel inclined to leave all matters related to fixed asset depreciation to your accountant.

And your instincts would largely be right, as the accountants and tax advisors should be involved in making depreciation-related decisions.

However, your understanding of what fixed asset depreciation is, how it’s calculated, why it’s important, and how to track it can help you manage your company assets more efficiently, allowing you to profit from improved decision-making.

In this guide, we’ll cover all the essentials, so read on.

In this article...

What Is Fixed Asset Depreciation

To better understand what fixed asset depreciation is, let’s first split the term.

So, what are fixed assets?

Among many similar definitions that differ from each other only in minor details, here’s one by Thomson Reuters tax and accounting professionals:

Fixed assets are physical or tangible items that a company owns and uses in its business operations to provide services and goods to its customers and help drive income.

For construction companies, this usually means heavy machinery, vehicles, and other items of certain value used in everyday construction operations, including smaller tools, IT equipment, and office furniture.

Additionally, fixed assets cover any owned office buildings or warehouses, improvements made on the owned land (roads, infrastructure), or when refurbishing leased properties.

Let’s stop here for now and see what depreciation is.

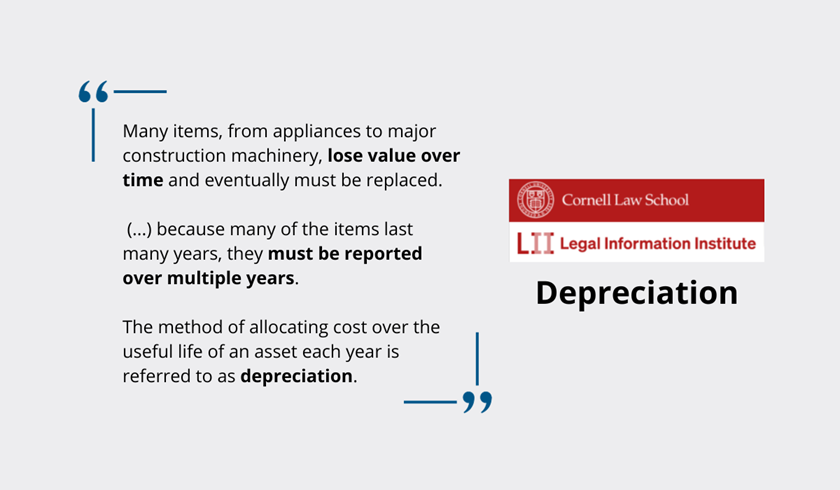

Again, out of many definitions out there, the Cornell Law School one is perhaps the clearest.

It starts by saying that most items (fixed assets) will lose value over time.

Then, it moves to say that the purchase of high-value items might seriously reduce the amount of income tax a company should pay, leaving room for manipulation.

Because of this, and since many of these items are used for many years, the Internal Revenue Service (IRS) has strict rules on how companies should allocate the purchase cost of an asset over its useful life and claim annual income tax deductions.

This process is called fixed asset depreciation.

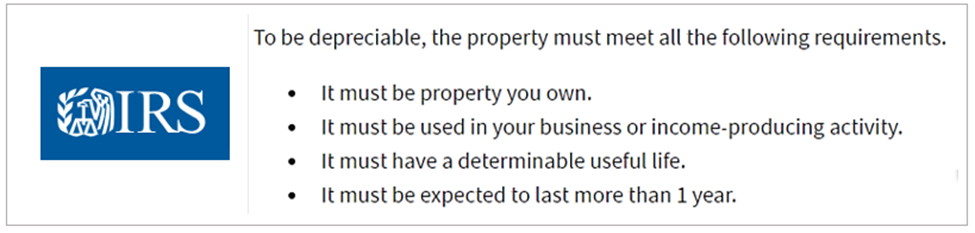

Since depreciation calculation methods are covered in the next section, we’ll close with what property (fixed assets) can be depreciated, courtesy of the IRS:

To recap, fixed assets are heavy machinery, vehicles, equipment, facilities, and other items your company uses to generate profit over an extended period.

Due to tax implications, their purchase cost can’t be expensed all at once, but must be spread over their useful life, and tax benefits claimed in that period.

Let’s see what useful life is and how depreciation is calculated.

How to Calculate Fixed Asset Depreciation

To explain how fixed asset depreciation is calculated, let’s say you just bought a brand-new or used bulldozer.

To calculate depreciation for this fixed asset you now own, you’ll first need to determine its purchase cost and date.

Simple, right? Both the price and date should be on the invoice.

Although that’s true, it’s very likely your accountant will use neither when calculating depreciation.

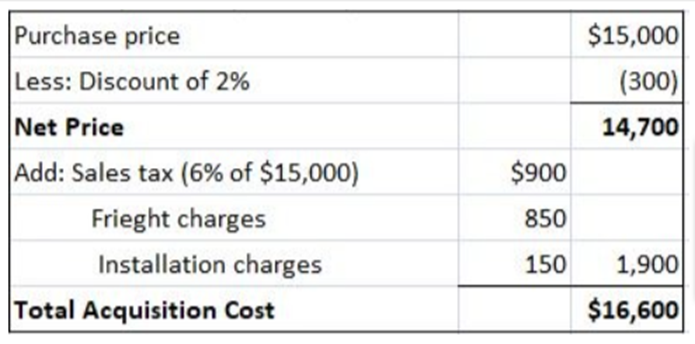

That’s because the “purchase price” actually covers all expenses incurred to make the bulldozer ready for use, which might not be on the original invoice.

Examples include transportation, installation and setup, inspection and testing costs, legal and regulatory fees, and any other expenses that were directly related to putting the bulldozer into operation.

Here’s an example of the total acquisition cost for a $15,000 piece of equipment, courtesy of Finance Strategists:

Hence, your accountant will ask you about any additional expenses, beyond the purchase price, you incurred when preparing the bulldozer for operational use.

These costs will be aggregated to determine the total acquisition cost of the bulldozer subject to depreciation.

As for the “purchase date”, it’s actually the date when the bulldozer was first put in use, which is usually different from the invoice date.

Now that the bulldozer’s acquisition cost and put-in-service date are identified, it’s time to estimate its useful life, i.e., the number of years your company will use it to generate profit.

To make this estimate, your accountant will first consult the IRS’s publications where average useful life estimates are given for all types of assets.

For example, the IRS typically considers the useful life of a bulldozer to be around 5 to 7 years for tax depreciation purposes.

However, this is only a general estimate, meaning that the specific useful life of a bulldozer can vary based on factors such as the model, usage intensity, maintenance, and technological advancements.

Long story short, you and your accounting team should estimate the useful life of your bulldozer in alignment with IRS guidelines and, if necessary, provide evidence and documentation to support your chosen useful life estimate.

The last thing you need is to estimate how much that bulldozer might be worth at the end of its useful life if resold as a whole or for parts.

This is the bulldozer’s estimated residual value, commonly known as the salvage value.

The salvage value is often expressed as a percentage, for example, 10% of your bulldozer’s original acquisition cost.

When the bulldozer’s useful life and salvage value are estimated, you can move to choosing an appropriate depreciation method based on your company’s goals and policies, and current tax regulations.

There are many depreciation methods, but the two most well-known examples are straight-line depreciation and accelerated depreciation.

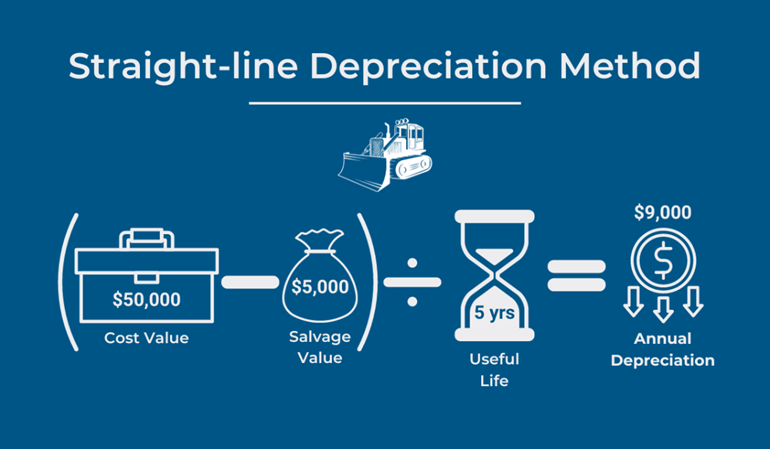

Straight-line depreciation is the simplest method, involving an equal annual depreciation expense over the estimated useful life, providing a consistent and predictable reduction in the asset’s value year by year.

Here’s an example of how it’s calculated for a $50,000 bulldozer with a $5,000 salvage value and a 5-year useful life.

In this case, the annual depreciation will remain the same, $9,000 a year written off over five years.

However, for financial reporting and tax benefit purposes, this simple method often fails to accurately portray the actual value of an asset as its value declines over the years.

That’s why, if an asset’s value is expected to diminish more rapidly in its early years, accelerated depreciation methods might be a better option.

For instance, under the double-declining balance (DDB) method (one of the accelerated depreciation options), your annual depreciation would be higher in the early years of the asset’s life and then gradually decrease over time.

For your bulldozer ($45,000 to be depreciated over five years), this means you would write off approximately $18,000 in the first year, followed by a declining amount in subsequent years.

In summary, to calculate fixed asset depreciation, the chosen depreciation method should be applied to an asset’s purchase cost, estimated useful life, and estimated salvage value.

Now that we know how it’s calculated, let’s see why fixed asset depreciation is important.

Why Is Fixed Asset Depreciation Important

Fixed asset depreciation isn’t just an accounting concept; instead, it has real-life implications for your financial reporting compliance, tax benefits, and decision-making.

In this section, we’ll explore how depreciation provides an accurate depiction of your assets’ value, aids in making well-informed business decisions, and delivers valuable tax benefits, all of which can impact your bottom line.

Provides an Accurate Depiction of Value

By applying fixed asset depreciation, you ensure the current value of your assets is more accurately reflected.

This is essential for financial reporting, ensuring a company’s compliance with laws and regulations, transparency of business operations, and trust of investors, creditors, and governing authorities.

Without strict rules on how assets are depreciated, and their value reported, a company could overvalue or undervalue its assets to manipulate the balance sheet, thus misleading the above stakeholders and the general public.

In other words, everyone relies on a company’s financial statements to be accurate.

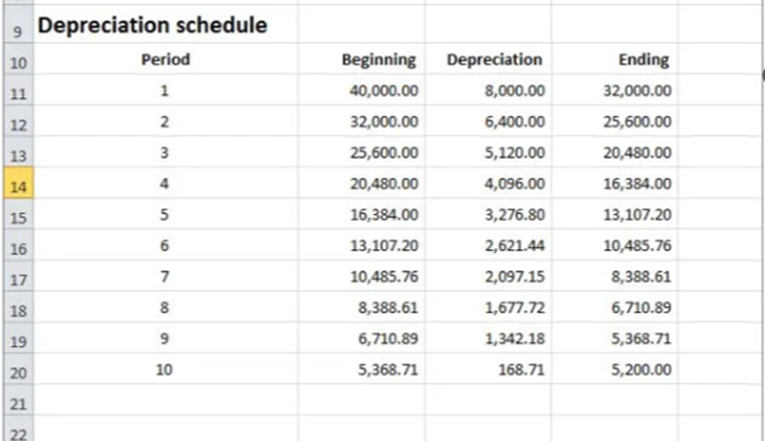

This includes the value of the company’s assets, which changes year over year, as shown in this depreciation schedule for one asset.

Incorrect asset values can lead to an inflated or understated net worth, potentially affecting lending decisions, credit ratings, and stock prices.

Conversely, depreciation enables the value of your fixed assets to be accurately reflected, ensuring legal compliance, and helping maintain transparency and trust among your company’s stakeholders.

Helps With Making Informed Business Decisions

Knowing where your assets are in their depreciation cycle can help you make informed business decisions, such as when to replace or upgrade your construction equipment.

In other words, accurate asset depreciation data can guide you in deciding whether it’s more cost-effective to repair, rebuild, or replace a piece of equipment.

For instance, if your bulldozer is in its fourth year of heavy usage, it might require higher maintenance costs to prevent potentially more frequent breakdowns due to excessive wear and tear.

Given those costs and other factors like diminished performance or technological obsolescence, it might be better to rebuild or replace the bulldozer.

Naturally, knowing the depreciation schedule allows you to plan for such investments, and make better informed business decisions.

Provides Tax Benefits

As explained, the annual amount of depreciation calculated for your fixed assets will reduce the amount of income tax your business has to pay every year.

Therefore, understanding depreciation and different calculation methods enables you to take advantage of these tax deductions according to your company’s financial needs and goals.

For instance, you might want most of the asset’s purchase cost to be written off at an accelerated rate in the first few years to maximize immediate tax savings.

Alternatively, you may choose a method that better aligns with the asset’s actual decline in value over time.

To recap, depreciation is a great tool for planning the procurement of equipment and other assets while optimizing tax strategies to maximize deductions and minimize tax liability.

Having covered how depreciation is crucial for your business’s legal compliance, improved decision-making, and tax benefits, let’s see what companies can do to track depreciation of their assets.

How to Keep Track of Fixed Asset Depreciation

So, how does a construction company with so many equipment, tools, and other assets keep track of their depreciation?

More precisely, how does one ensure that accurate data is easily available to managers for decision-making and accountants for financial reporting?

The answer is software, namely cloud-based, asset-tracking software that contractors increasingly get to protect assets from loss and theft and streamline equipment management processes.

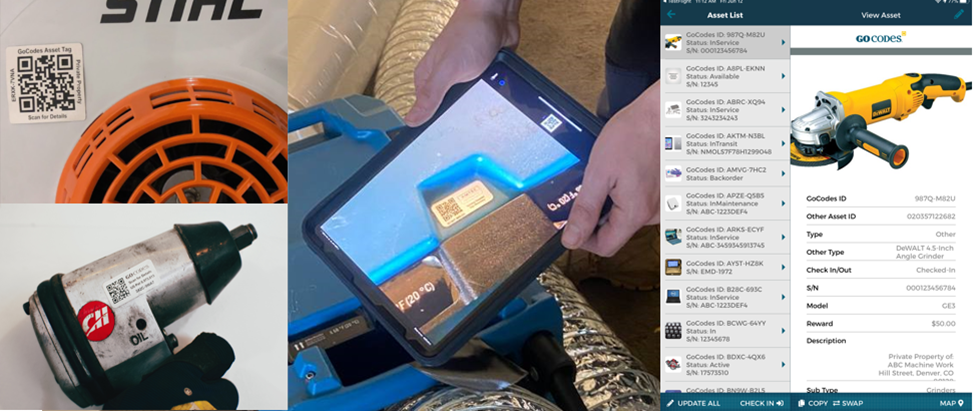

For instance, our asset-tracking solution, GoCodes Asset Tracking, uses QR code labels attached to equipment which, when scanned with a smartphone or tablet, take users to the web-based portal where they can view or update various asset information.

Naturally, this central asset database can be accessed from any internet-connected device and the information can be searched and filtered.

This way, construction company managers and accountants can instantly access all the relevant depreciation data we discussed, such as the purchase price and date, estimated useful life, and salvage value.

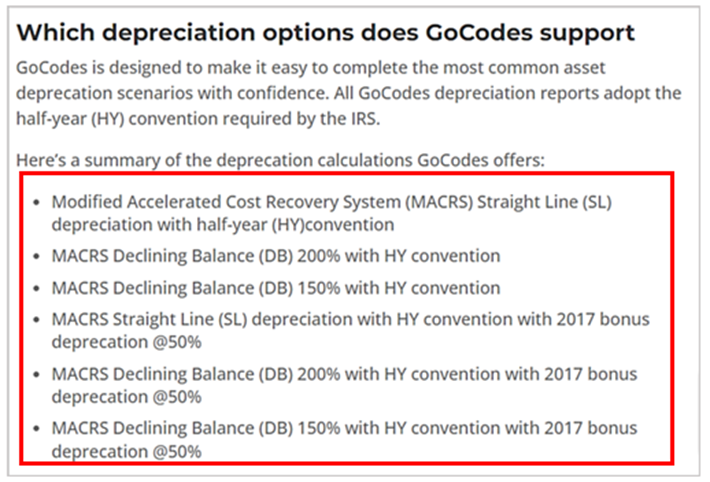

Moreover, they can use GoCodes Asset Tracking to input the above info and calculate annual depreciation rates according to the different most common IRS depreciation conventions.

These calculations can also be formalized when depreciation schedules and values of different assets are grouped and exported as a depreciation report that can be attached to financial statements and tax returns.

Overall, solutions like GoCodes Asset Tracking enable managers to make informed equipment repair and replacement decisions not only based on depreciation, but a range of other factors that can be tracked, like usage, operating environment, and maintenance.

At the same time, asset locations and users are tracked by software, increasing worker accountability, and reducing asset theft and loss.

Lastly, accountants can use depreciation data and custom calculation reports to track depreciation for regulatory compliance, tax benefits, and improved decision-making.

Conclusion

In summary, it’s clear that fixed asset depreciation can involve complex calculations and that close collaboration between company management and accounting is needed.

However, understanding the importance of depreciation and how it affects your tax liability and asset management decisions can, coupled with the right depreciation-tracking tool, make all matters concerning depreciation much clearer and simpler.

Ultimately, understanding depreciation can help you improve decision-making in different financial and operational aspects of your business, increasing your company’s productivity and profitability.