Fixed asset accounting involves keeping precise financial records about your company’s capital assets, their value, and their current state.

Companies make substantial investments in fixed assets, as they represent the capital of the business and are intended to secure their long-term income.

To ensure your fixed assets serve your business goals, you have to keep your records in perfect order and track each asset throughout its lifecycle—from purchase to disposal.

On that note, it’s essential to consider that the value of assets tends to decline over time due to potential damage or impairment, and depreciation.

To achieve optimal fixed asset accounting that accurately reflects their current state, it’s vital to carefully document four key processes: procurement, depreciation, impairment loss, and disposal.

So, let’s take a closer look at each one of them.

In this article...

Procurement of Assets

Procurement of fixed assets involves the acquisition and management of capital assets that a company employs in its day-to-day business operations over a longer period of time.

These incorporate all tangible pieces of property, such as machinery, construction equipment, vehicles, or computer devices, and intangible assets like software, copyrights, licenses, or patents.

Investing in fixed assets is a substantial commitment for any business and it requires vigilant planning.

Therefore, it is crucial to have a comprehensive understanding of the procurement process.

This process includes several stages and it starts with recognizing the need for an asset—say, a particular piece of equipment—that would fulfill your company’s current needs.

This may require doing research to evaluate different options and make well-informed decisions.

The stages of fixed asset procurement involve sourcing, assessing potential vendors, negotiating contract and payment terms, and issuing a purchase order.

Once the fixed asset is purchased and received, you should accurately document it in your inventory system.

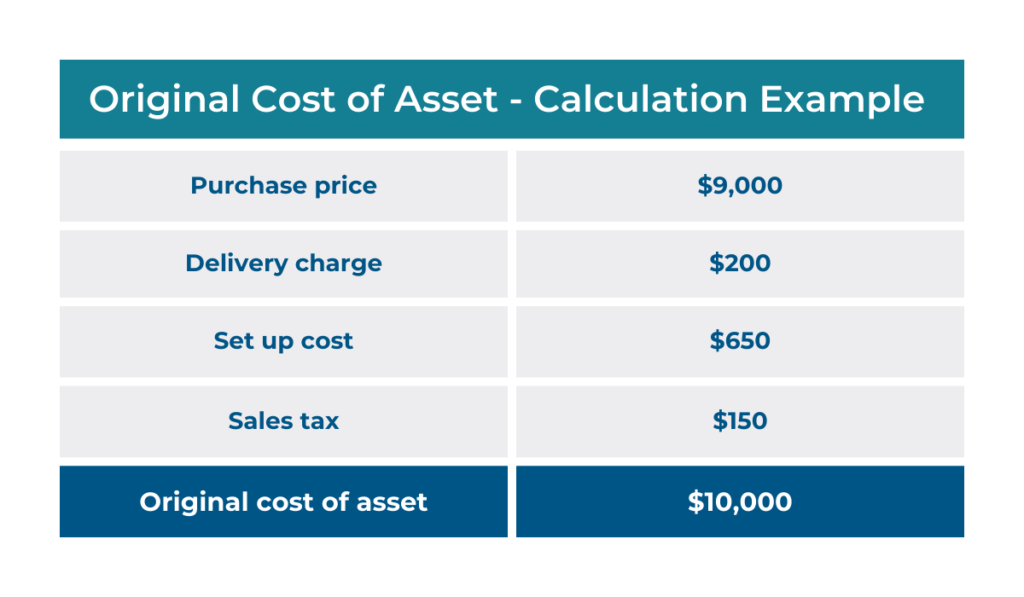

While doing so, take into account all associated purchasing costs or any other expenses essential to get your newly acquired asset up and running.

For instance, you might incur delivery fees if the asset requires transportation from another location to your facilities or job site.

Additionally, there may be installation costs or charges for professional services needed to set up and integrate the new asset into your current operations.

On top of that, it’s crucial to also factor in indirect costs, such as sales tax.

By incorporating these expenses, you arrive at the total amount you spent on acquiring the asset.

This amount represents the asset’s original cost in your accounting records.

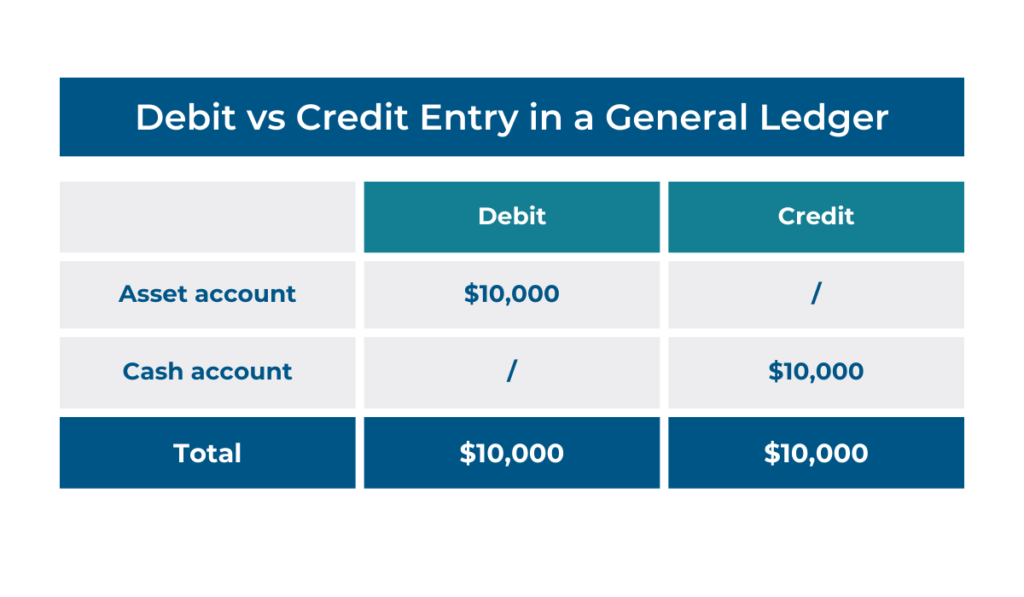

Now, for accounting and recordkeeping purposes, you should enter an account for each purchased asset in your general ledger.

The original cost of a fixed asset is considered a debit entry.

When recording this cost, debit the asset account for the purchase amount and credit the cash account—the account payable section—for an equivalent sum.

Put simply, when you purchase an asset for $10,000, you are expending $10,000 in cash or credit, but you are acquiring an asset worth $10,000, as shown below:

To ensure a balanced general ledger, the total credits and debits must be equal.

In this context, debits increase asset, expense, and dividend accounts, whereas credits decrease them.

Essentially, the relationship between debits and credits more precisely conveys the financial transactions within your business.

Thoroughly documenting the costs of fixed assets procurement in your accounting system provides valuable insights into the cumulative capital invested in each asset over time.

This data empowers you to determine the return on investment (ROI) for purchased assets, facilitating informed decision-making for future ventures.

Asset Depreciation

Considering fixed assets are used in regular business workflows and operations, they are susceptible to wear and tear, thus losing their value over time.

To that point, every asset has its useful life span.

For instance, the average life span of computers is 5 years, while wheel loaders would last for about 10 years.

The process of spreading the cost of an asset over its useful life, and calculating the corresponding decrease in its value is called depreciation.

Put another way, fixed asset depreciation is a metric that illustrates the annual loss in value your equipment experiences due to regular use.

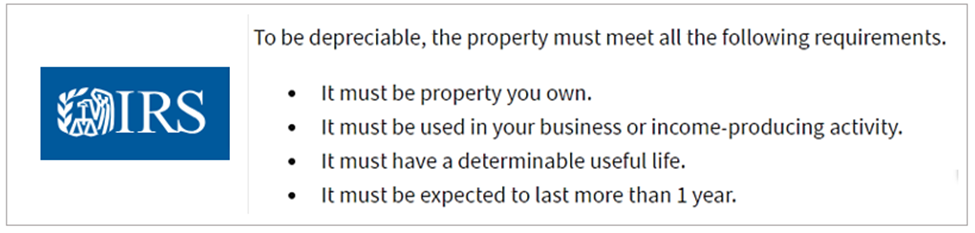

One of the main reasons why it is important to calculate fixed asset depreciation is rooted in specific tax requirements.

Namely, acquiring high-value items has the potential to significantly decrease a company’s tax liability, creating opportunities for manipulation with annual income tax deduction claims.

As a response to this, and given the fact that fixed assets get used for many years, the Internal Revenue Service (IRS) has implemented stringent guidelines for companies to systematically allocate the purchase cost of an asset over its useful life.

Depreciating your fixed assets will help your future planning, as well.

Knowing your capital assets are approaching the end of their useful life can signal you when the right time to purchase new ones is.

It will also enhance your maintenance planning, as it may not make financial sense to invest in the upkeep of assets that have already depreciated significantly.

Now, to properly document depreciation in your financial records you have to make accurate journal entries, i.e., general ledger entries.

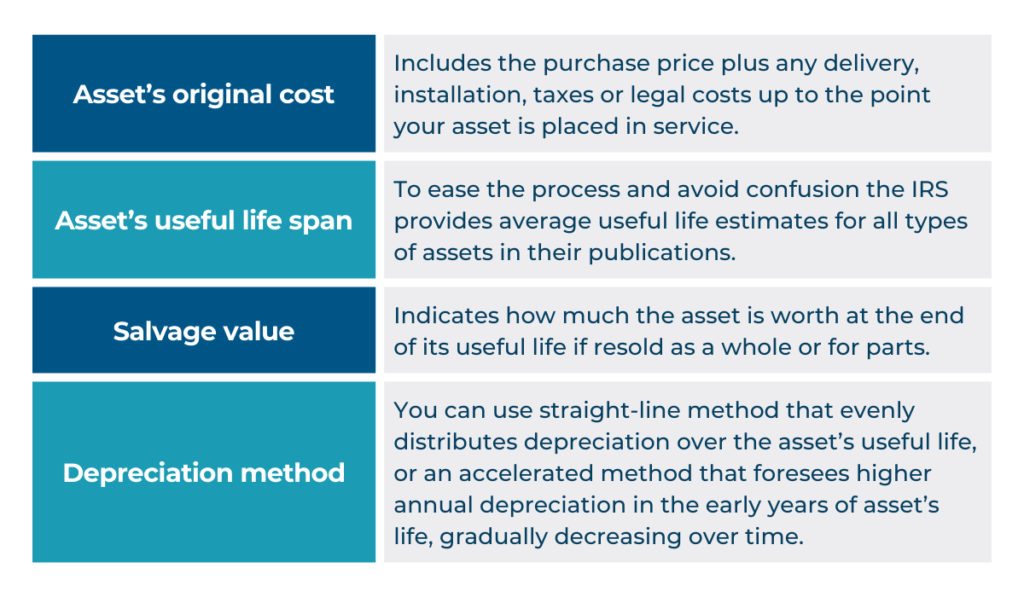

This means that, upon acquisition, assets are initially recorded at their original, or historical cost, in an asset account on the balance sheet.

At the conclusion of each accounting period, a depreciation journal entry is documented as part of the routine periodic adjusting entries.

Hence, to be able to calculate your fixed asset depreciation you need to gather the following information:

The straight-line method stands out as the simplest approach to depreciation, as it ensures a consistent and predictable decrease in the asset’s value year after year.

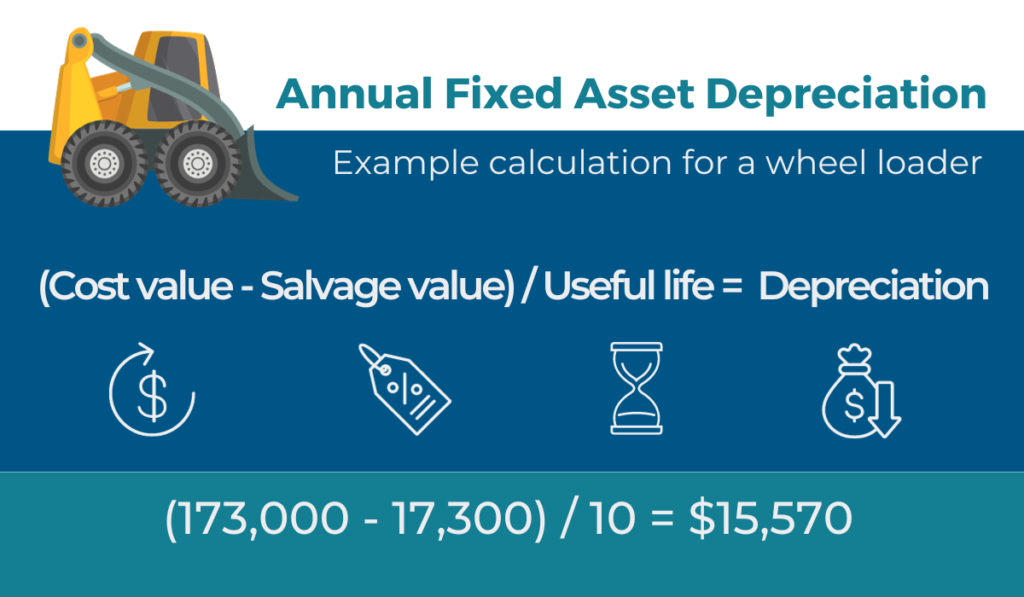

For a more practical understanding, let’s delve into the following example:

If you buy a new wheel loader at a price of $173,000, after 10 years of useful life its salvage value will be 10% of the original cost.

With this information at hand, you can determine your fixed asset’s annual depreciation using the straight-line method, as shown below:

The calculation indicates that every year, your wheel loader is depreciated for an amount of $15,570, written off over 10 years.

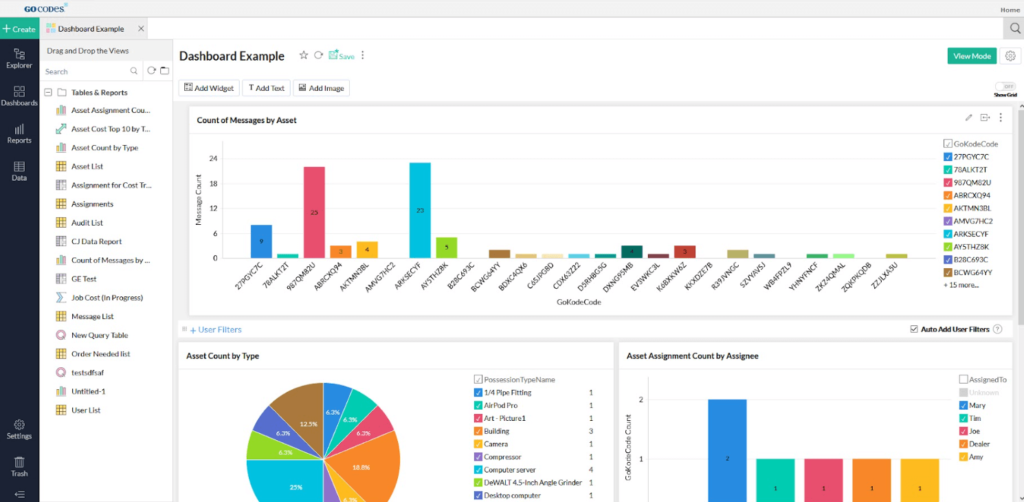

Nowadays, specialized software makes these calculations far easier.

Business transactions are automatically entered in the correct accounts in the balance sheet, reducing the need for accountants to make numerous manual journal entries.

For instance, the GoCodes Asset Tracking software allows for automatic depreciation calculations based on the basic asset data entered, such as the cost of the asset, date purchased, and asset life span.

It then generates detailed reports that include data like annual depreciation, current or prior year depreciation, total depreciation to date, and balance left to be depreciated.

This information can be used in the filing of financial statements and tax returns.

Impairment Loss

Asset impairment occurs when there is a sudden decline in the usability of a fixed asset or if the asset undergoes a change that could potentially impact its value or performance in the future.

An asset may become impaired as a result of physical damage, legal restrictions on asset use, or a substantial drop in the asset’s market value due to shifts in consumer demand.

Another sign of possible impairment is when an asset becomes obsolete and is more likely to be disposed of before its time has come.

Essentially, an impaired asset is one whose market value is lower than the net value listed on the company’s balance sheet.

In other words, impairment occurs when the cost of owning the equipment exceeds the returns, even though your earlier calculations suggested otherwise.

Now, to calculate the impairment of an asset, first, you need to establish its net book value.

You will come to this figure by deducting the asset’s accumulated depreciation from its original cost. The formula looks like this:

Once you have the net book value, subtract its fair market value.

If the asset’s fair market value is less than the net book value, you’re going to have to record an impairment loss for this difference.

In other words, when you identify an asset as impaired, you need to write down the decrease in the asset’s net value on the company’s balance sheet to reflect its current market value and recognize a loss in the income statement.

For instance, a construction company could face substantial damage to its outdoor machinery and equipment resulting from a natural disaster.

This event would be recorded on its financial books as a sudden and significant decrease in the market value of these assets, falling below their net value.

Nevertheless, given that impairment is often prompted by unforeseen events beyond your control, it is advisable to routinely test your assets for impairments.

This practice ensures that you stay in the loop on the current costs and value of your assets and by that—the value of your business.

Disposal

As fixed assets depreciate with time, they reach a point where they no longer serve your company’s needs.

In such cases, you either sell them or send them to the landfill, or even better—dispose of them by recycling.

Disposal is the final stage of an asset’s life, and documenting the disposal of fixed assets correctly is crucial for ensuring tidy and accurate balance sheets.

Asset disposal takes place when a company removes an asset from its accounting records.

Erasing all traces of the asset from the balance sheet typically involves recording any associated gain or loss.

For instance, if your company sells an asset, you would need to report the money received at the time of the sale.

To paint a better picture of how asset disposal is documented, we’ll go through three common journal entry scenarios.

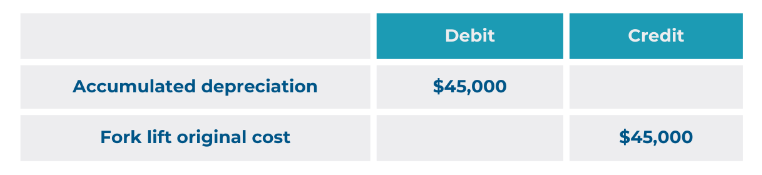

First, let’s assume your company buys a forklift for $45,000 and recognizes $4,500 of depreciation per year over the following ten years.

At that time, the forklift is fully depreciated and you decide to give it away.

In this case, you will record the following entry:

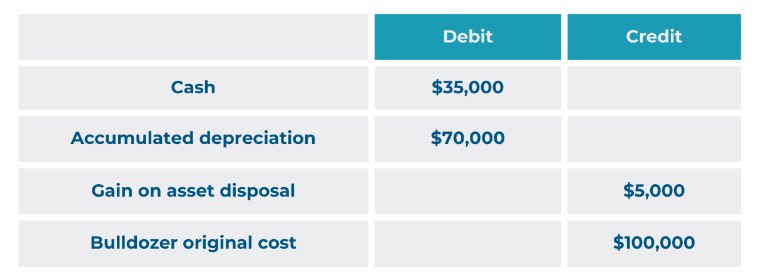

In our second example, your company sells a $100,000 worth of bulldozer for $35,000 in cash, after having accumulated $70,000 in depreciation over time.

The journal entry would look like this:

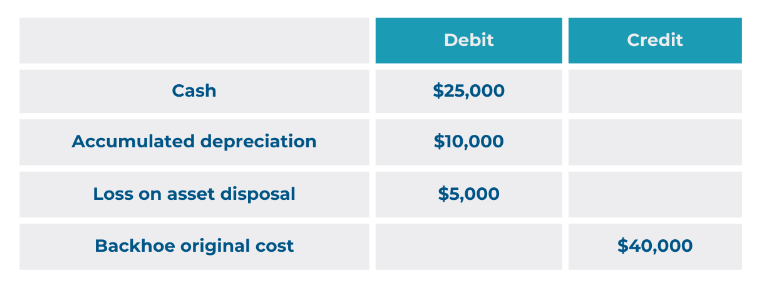

And in the third example, your company sells a backhoe with an original cost of $40,000 for $25,000 in cash.

Meanwhile, it had compiled $10,000 of accumulated depreciation.

The entry in this situation would be:

In summary, when the asset is fully depreciated and there’s no sale involved, you should debit the depreciation and credit the asset.

In the other two scenarios, involving either a gain or a loss, you need to credit the fixed asset and debit cash for the amount received, including all accumulated depreciation.

The key distinction between the two is that you should credit the gain if you made a profit on the sale, but you should debit it if you incurred a loss.

Finally, keeping track of asset disposal is an essential aspect of accounting for most businesses.

Knowing how to handle this properly can save you valuable time and energy during your record-keeping processes and audits.

Bonus Tip: Audit Your Previous Records

Conducting audits at the end of each fiscal year enables a thorough check of your company’s accounting records and assets.

Regular audits assist in identifying errors or inconsistencies between recorded information and the actual state of your assets.

They also aid in assessing whether you are incurring losses on specific purchases.

On top of that, they promote transparency and help you keep your company compliant with regulations.

Therefore, to achieve a well-rounded and accurate fixed asset accounting you should complete the process with auditing of your previous records.

The most straightforward method to accomplish this is by using asset management software equipped with an audit feature, which saves valuable time and resources in detecting and addressing potential discrepancies in your financial records.

Conclusion

Understanding the relevant accounting principles, your cash flows, and operations is key to running a successful business.

And when it comes to addressing your fixed asset accounting, you need to thoroughly document all stages of your assets’ life—from procurement, through depreciation and impairment, up until their disposal.

So, make sure to maintain accurate financial records of your fixed assets, as this is key for keeping track of income and expenditures, as well as getting well-informed before making critical business decisions.