In the construction industry, competition is stiff, no doubt about it.

Therefore, doing anything you can to better understand your own company’s performance as well as that of the competitors is a must.

This is where key performance metrics like asset turnover and inventory turnover come in, as they provide insights into how effectively a business utilizes its resources.

In this article, we delve into the nuances of these two metrics, exploring their definitions, calculations, and significance, and by the end, you’ll have a clearer understanding of how they can empower you to assess (and improve) the health and productivity of your business.

Let’s begin.

In this article...

What Is Asset Turnover

Before we delve into this first question, let’s provide a brief explanation of what assets entail.

In the simplest terms, assets encompass all the property a company owns and utilizes to generate profit.

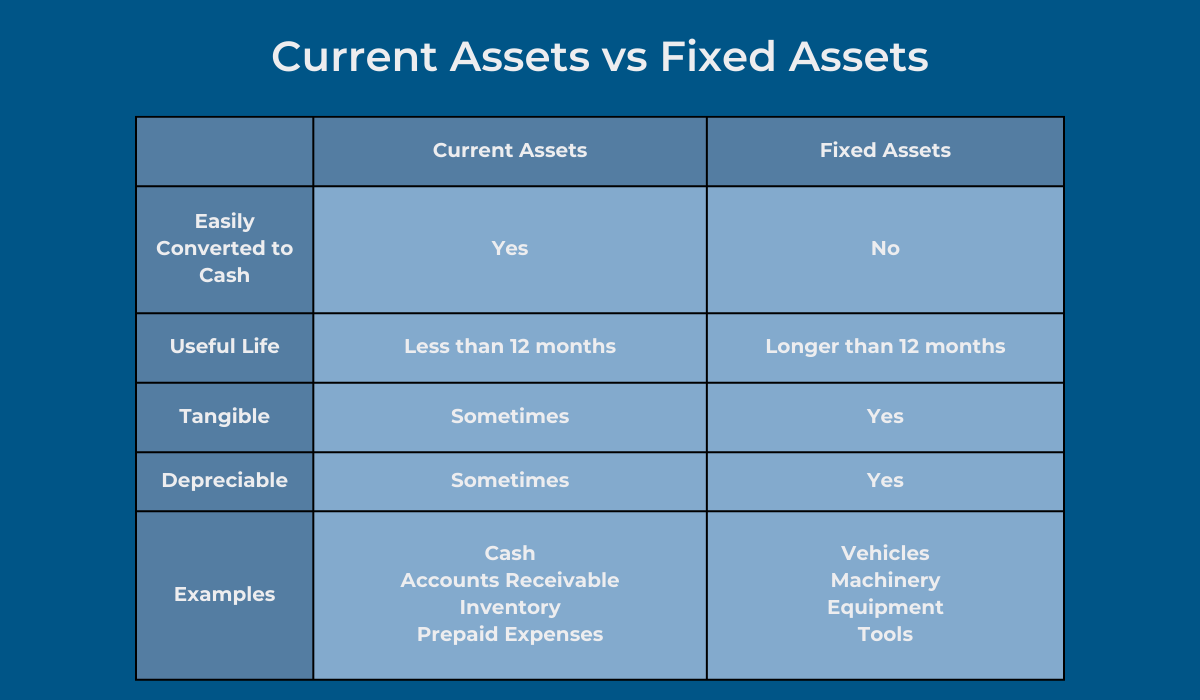

They can be categorized as either current or fixed.

Current assets can be swiftly converted into cash and have a shorter useful life, such as cash itself or accounts receivable, while fixed assets are employed for income generation over a more extended period of time, typically at least a year, and aren’t as easily liquidated.

Examples of this category include vehicles, construction tools, or heavy machinery.

Both types play equally crucial roles in enhancing the overall performance and profitability of a business, provided they’re adequately allocated and managed.

But how can you be sure that’s the case?

This is where asset turnover comes into play.

Asset turnover is a financial metric that assesses how efficiently all your resources contribute to revenue production.

It serves as a strategic tool for identifying any inefficiencies within a company, such as poor investment decisions, property mismanagement, neglecting equipment maintenance, or improper asset tracking.

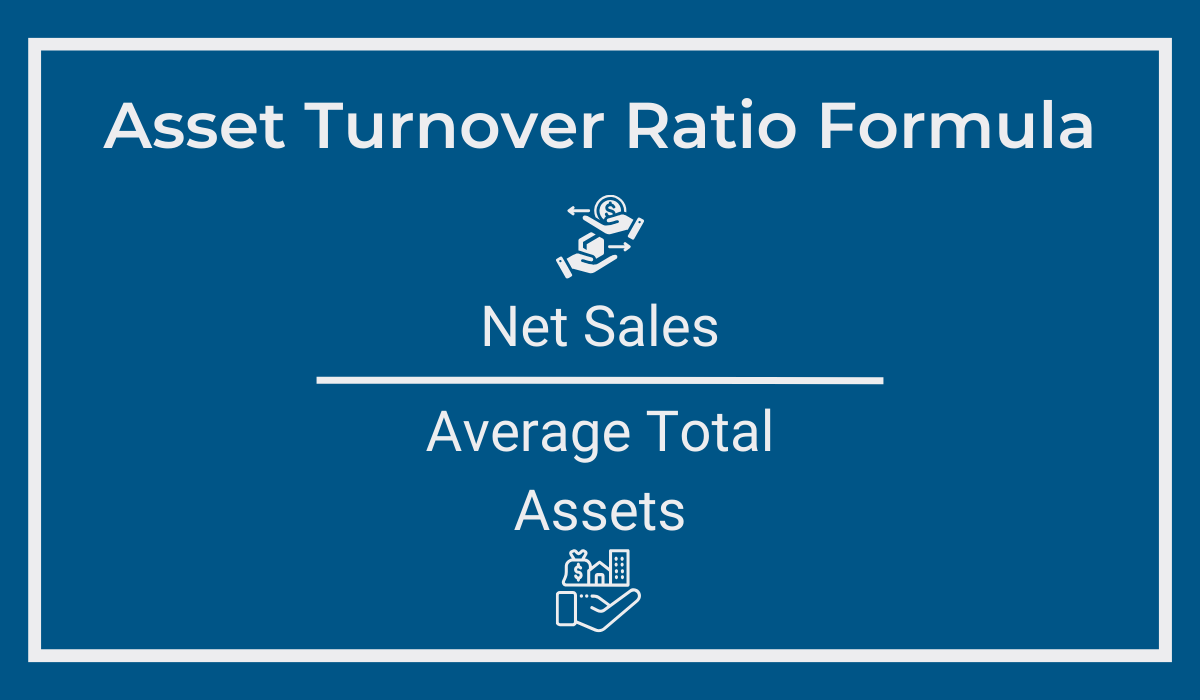

Calculating the asset turnover ratio is relatively straightforward.

Simply divide your net sales by the average total assets, which is the value of your property at the beginning and the end of an accounting period.

A high asset turnover ratio indicates that you’re investing in the right resources and allocating them effectively to turn a profit.

For example, a ratio of 2 implies that you’re earning $2 for every $1 spent.

As such, it’s considered quite high.

Conversely, a lower ratio suggests room for improvement in operational efficiency.

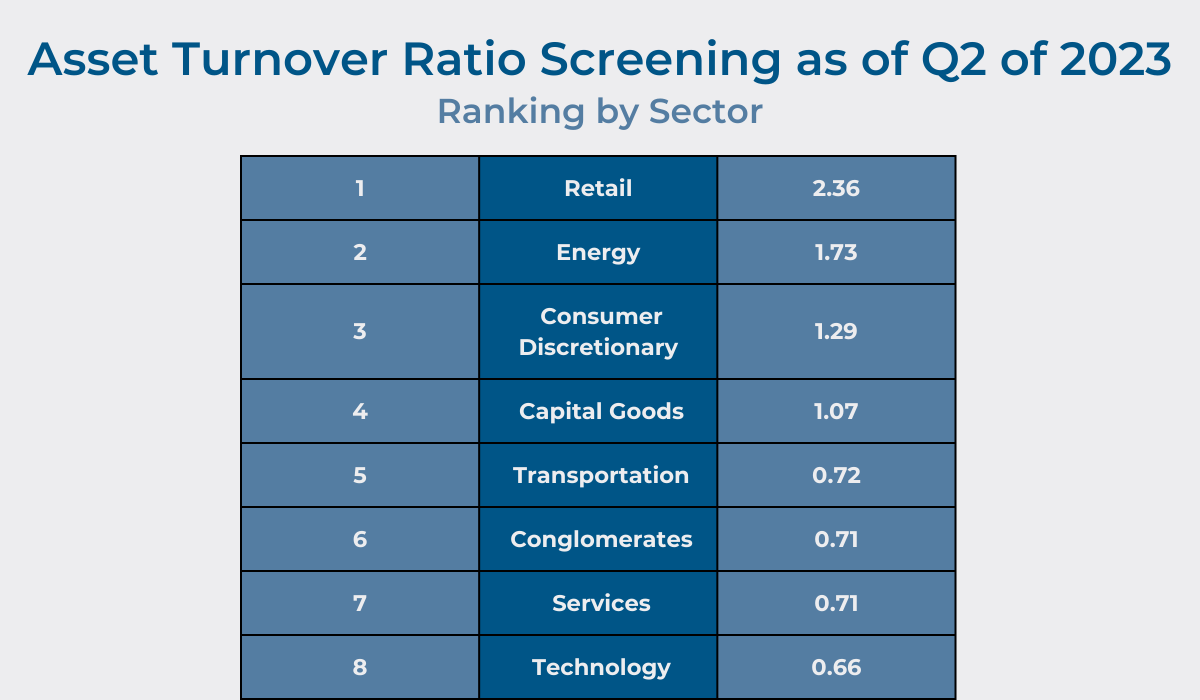

Nevertheless, it’s essential to note that what’s regarded as a high or low ratio depends on the industry.

Sectors with many current assets, like retail, tend to generate revenue more quickly, leading to higher turnover ratios, while service-based industries, for instance, may take more time to turn a profit.

Therefore, comparing your ratio to industry peers is vital for benchmarking and staying competitive, but trying to conform to other sectors’ standards isn’t advisable.

Overall, asset turnover can be a powerful tool for increasing your business’s productivity and, as such, it’s an integral part of any successful financial analysis strategy.

However, it proves most effective when analyzed alongside other financial metrics, like inventory turnover.

What Is Inventory Turnover

Yet another efficiency metric, inventory turnover measures how often a company must replenish its stock within a given period.

In other words, it reveals how many times you’ve sold or replaced your assets relative to your cost of sales.

Here’s how to calculate this metric.

Generally, across most industries, companies aim for higher inventory turnover ratios as they indicate robust sales, while, on the other hand, lower ratios may imply that sales are below expectations or that there’s an excess of stock on hand.

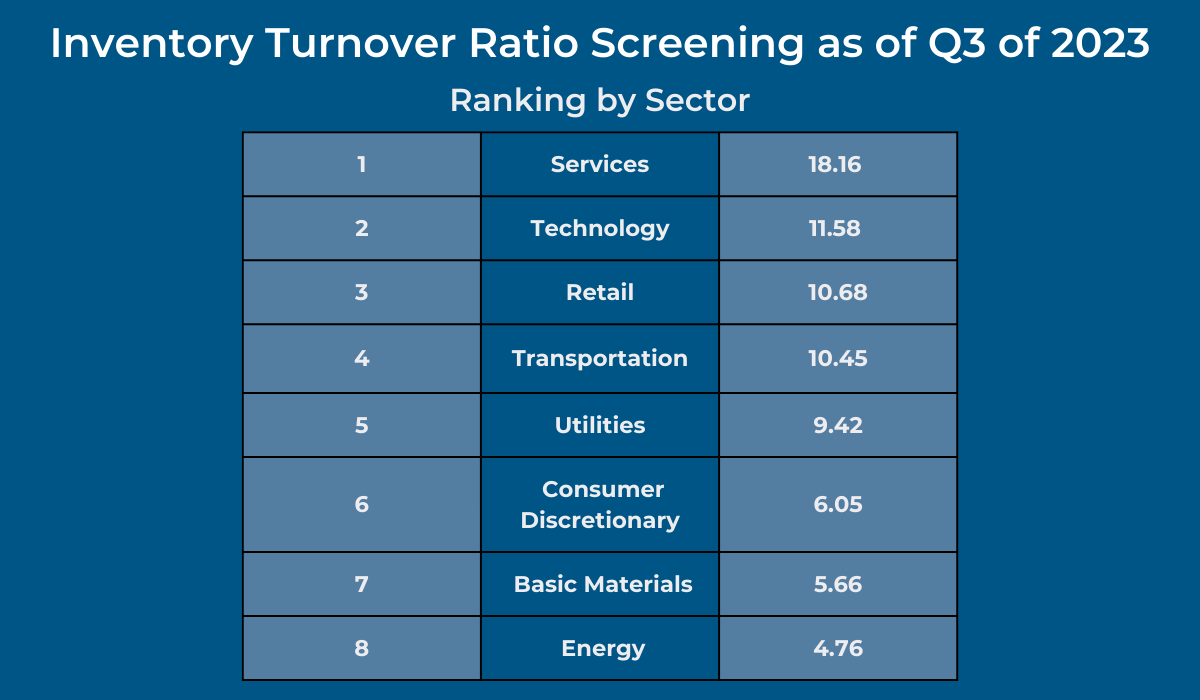

Still, similar to asset turnover (if not even more so), inventory turnover benchmarks vary significantly from one sector to another.

Just to illustrate, businesses like florists, grocers, or others dealing in perishable items tend to have much higher turnover rates, driven by the need to sell products quickly to avoid losses from spoilage.

The construction industry, in contrast, operates under different dynamics.

Just consider the scenario of having to replace your tools or equipment frequently; a high turnover ratio here would suggest poor management practices, suboptimal purchasing decisions, or a lack of adequate maintenance.

Therefore, a high ratio isn’t always an ideal situation.

Nonetheless, this doesn’t imply that, as a professional in the construction industry, you should aim for the lowest possible turnover ratio.

Keep in mind that inventory carries various expenses beyond just the price tag of tools, construction materials, or machine parts.

All these items need storage space, and the longer they remain unused in a warehouse, the higher the risk of stock obsolescence, causing additional, unnecessary costs.

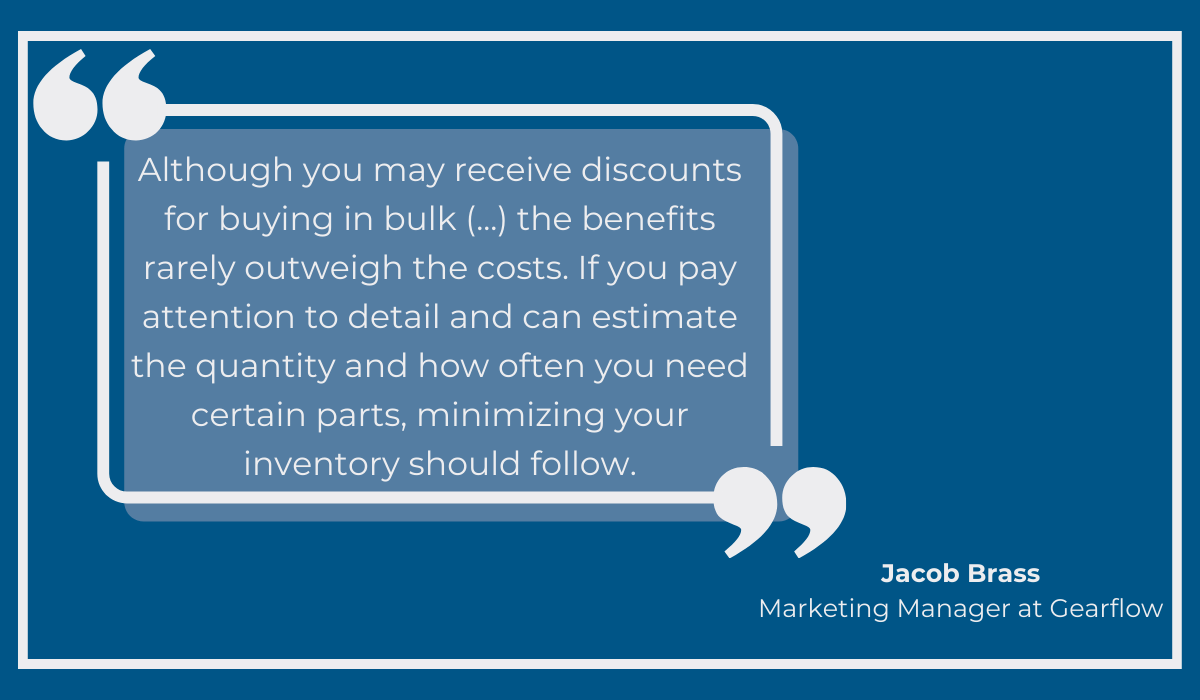

Jacob Brass from Gearflow underscores the importance of tailoring your approach to your specific needs, typically involving minimizing inventory and implementing more effective tracking mechanisms.

This ensures you have just enough supplies for successful project completion without tying up too much capital in unused inventory.

This is why inventory turnover monitoring is important—it helps you determine the right amount of assets for you specifically and calibrate your inventory management practices.

When it comes to industry benchmarking, however, the turnover ratio works only when comparing yourself to companies that are very similar to yours.

Even luxury car dealerships, for example, cannot reasonably compare themselves to economical car dealers, given the substantial differences in how and at what prices they sell their products.

Besides, both high and low inventory turnovers can have positive or negative implications, depending on industry standards, as well as your own requirements.

A high turnover may indicate increased sales or inadequate inventory, while a low turnover may hint at lower sales or strategic bulk inventory purchases aimed at reducing long-term acquisition costs.

Despite these challenges, this metric remains valuable, especially when used in conjunction with other financial and operational indicators.

It provides a snapshot of efficiency but should always be interpreted in the context of the unique circumstances and characteristics of your business.

Asset Turnover vs Inventory Turnover: Key Differences

Finally, we delve into the central question of this article: what sets asset turnover apart from inventory turnover?

While both metrics play crucial roles in assessing a company’s financial health and performance, their key distinction lies in the fact that they measure different things.

Inventory turnover concentrates on the frequency with which items are sold or replaced, whereas asset turnover evaluates a company’s assets’ efficiency and revenue-generating capabilities.

Consequently, the latter offers a more comprehensive view of a business’s overall productivity and compares different asset costs to the value these assets produce.

The former, on the other hand, is specifically geared toward evaluating the effectiveness of stock management.

Analyze them together, and you get a full insight into your asset utilization, enabling you to make better-informed decisions and ensure profitability.

How these two are calculated also differs: asset turnover incorporates net sales and the value of property at the beginning and end of an accounting period, while inventory turnover divides all items sold or replaced by the average value of resources available.

Moreover, interpreting the results of these calculations is more straightforward with asset turnover—simply put, a higher ratio is better.

The ideal ratio may be influenced by the industry; for instance, retail might anticipate high values, while service-based businesses might expect lower ones, but generally, all companies strive for better returns on investment and thus higher ratios.

This simplicity contrasts with the more nuanced interpretation of inventory turnover, which is most effective when used for comparing yourself to similar businesses.

In other words, both high and low inventory turnover ratios can have varied implications, as a high ratio could signify either increased sales or insufficient stock, while a low ratio could indicate fewer sales, excess resources, or cost-saving bulk purchases.

To sum it all up, although these are two different elements, a successful financial analysis strategy necessitates studying both of them together, along with other financial metrics.

This synthesis of asset and inventory turnover provides a more complete perspective of your company’s financial well-being, essential for strategic decision-making and long-term success.

Conclusion

In conclusion, understanding the difference between asset turnover and inventory turnover is crucial for businesses aiming to optimize their operational efficiency and financial performance.

Hopefully, this article managed to illustrate this difference.

While both metrics serve to demonstrate a company’s ability to generate sales relative to its assets, they focus on different components of the balance sheet.

Ultimately, a balanced approach that considers both ratios alongside other relevant financial metrics is advisable.

Regularly monitoring and analyzing both asset turnover and inventory turnover will definitely empower you to make informed decisions, streamline operations, and adapt to market dynamics, fostering long-term sustainability and growth.