Fixed assets like real estate, machinery, or vehicles owned by the company are crucial for determining the financial health and long-term viability of a business, so it is important to monitor and care for them properly.

This article will provide you with some valuable practices that can help you manage fixed assets more effectively so you can get the most out of them and grow your business at a faster rate.

We’re bringing you insider advice and practical tips, as well as some concepts that may surprise you!

So read on to find out why ghosts and zombies can cause huge problems for fixed asset managers, and how as much as 10-30% of a company’s fixed assets can vanish into thin air.

Let’s start with our first best practice: coming up with an accurate list.

In this article...

Create an Accurate List of Assets

For an asset manager, there’s hardly anything more important than having an accurate list of the company’s fixed assets.

After all, you can’t manage something you don’t know you own.

However, it seems that many companies don’t put a big enough emphasis on tracking their assets.

That’s evident from the fact that, according to industry experts, up to 65% of fixed asset data in asset-heavy companies is incomplete, inaccurate, or simply missing.

So if you want to create an accurate list of your assets, it might be wise to assume that your current data isn’t correct and start from scratch.

That means carefully cataloging and labeling every asset you have. Once you’ve done that, you have an accurate baseline that you can work from.

Here is some of the information you should collect while doing inventory:

- Location of the item

- Status and condition

- Information on the necessary assessments and checks

- Expiry dates

- Other data specific to your industry and company practices

With a complete list, you may notice that your records show assets that aren’t really there or aren’t in working order.

These are called ghost assets, which is another word for fixed assets that a company cannot account for.

This might be because they were stolen (e.g., from a construction site), lost (for instance, in a move), sold with no record, or otherwise rendered unusable, perhaps because they were damaged or stopped working.

However, what makes them “ghosts” is that the company in question is unaware that anything is out of order because those assets are still listed on its balance sheet and/or marked as active in its fixed asset management system.

Ghost assets are one of many reasons why it’s critical to establish an accurate list of fixed assets. That’s because you could still be paying insurance and upkeep premiums for them, thus putting an unnecessary drain on your finances.

Therefore, removing ghost assets from your inventory is a basic asset management task.

Remember, keeping accurate inventory is necessary if you want to be certain which assets your company has and how they’re being used. And that’s why it’s number one on our list.

Choose the Right Tools for Fixed Asset Management

To build on our last argument, it’s important to note that your list of fixed assets needs to be a part of a larger system for fixed asset management. That goes double if you’re operating a big company which owns a lot of them.

For a very long time, the main tool used for this purpose were spreadsheets. And while the merits of spreadsheets are numerous and they helped build the modern business world, they also come with a lot of problems.

The biggest being that they’re extremely prone to errors.

So, what kind of system inherited the important task of fixed asset tracking? The answer, in a word, is software.

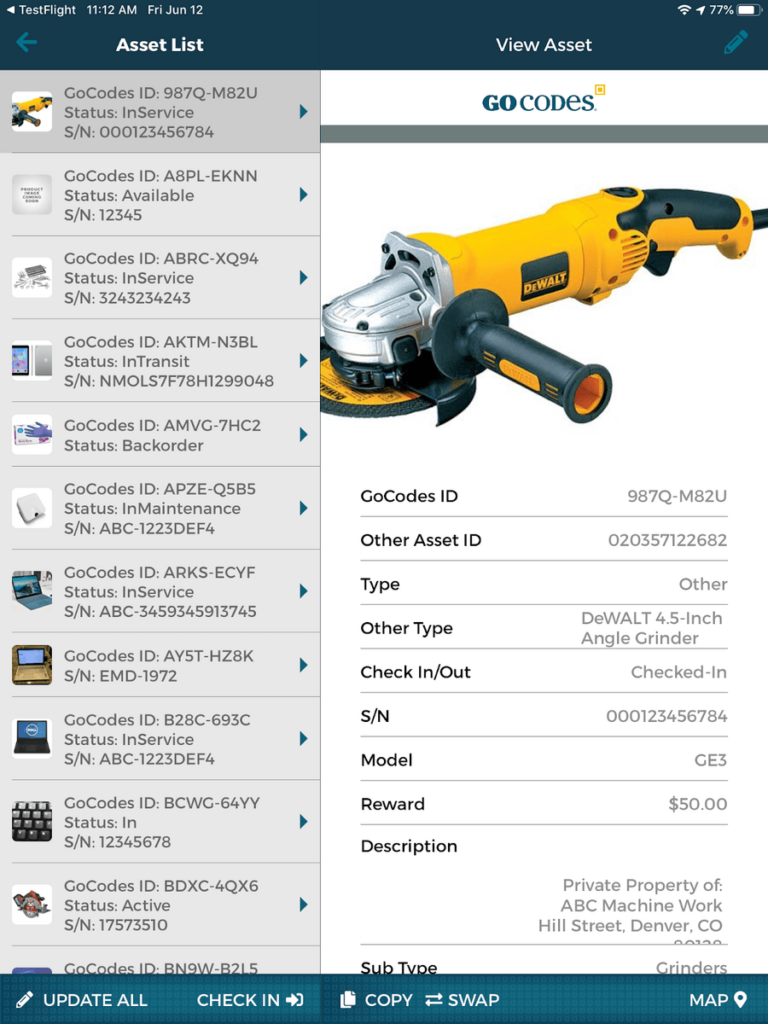

Quality asset management software, such as GoCodes Asset Tracking, will enable you to track your assets in real-time, allowing you to reap the benefits from both sides of the aisle—financial and operational.

Among its many benefits, fixed asset management software will:

- Tag your assets and prevent identical items from getting mixed up

- Help eliminate ghost assets

- Make the entire fixed asset life cycle visible and traceable (more on that later)

- Streamline regular inventories and reconciliations across the company (more on that also later)

In addition to that, asset management software can be integrated with the company’s other systems like accounting, maintenance, project management, scheduling, etc. This will simplify their use and make scaling easier.

The key takeaway here is that modern business requires modern solutions to stay in the race with the competition.

This is definitely applicable to fixed asset management, which is made so much easier when you’re armed with the right tools—namely quality asset management software.

Establish Consistent Operating Practices

Next on our list of best practices is establishing consistent standard operating procedures (SOPs).

If done right, SOPs will make sure that everyone in your company follows the same guidelines for handling and managing fixed assets.

They represent a set of step-by-step instructions that employees should follow when performing routine operations. Their purpose is to increase efficiency, enhance quality and achieve uniformity of performance.

At the same time, they also reduce regulatory non-compliance and miscommunication within your company.

A company should establish these standard procedures to ensure coherent and correct accounting and management in all aspects of dealing with fixed assets.

Let’s enumerate some common SOPs to illustrate what they are and how they work.

A good example of an SOP is setting the threshold for capitalizing fixed assets.

Quite simply, this means establishing a set of criteria for what is and what isn’t a fixed asset.

That typically depends on whether an asset is going to be used longer than one year, since that’s the basic definition of what a fixed asset is, but there are other criteria as well.

With this SOP you’re establishing rules for what can and cannot be a fixed asset, making the task of fixed asset management easier on your managers, as well as accountants.

Another, more practical SOP is ensuring that fixed assets are clearly labeled.

This is a must if your company is asset-heavy or operating from more than one location.

As for labeling, you can use barcodes or more advanced tracking solutions like QR codes, which are one of the essential features of our own software solution, GoCodes Asset Tracking.

Finally, establishing approvals for acquisitions, transfers, and disposals is a great SOP for keeping a company’s finances in check.

If your employees know they need to get approval before acquiring or disposing of an asset, it’s much easier to avoid overspending.

As you can see, standard operating procedures are a way of safeguarding your company, as well as your assets, which makes them an important principle of efficient fixed asset management.

Track Assets at All Life Cycle Stages

Being aware of the life cycle of different fixed assets can help you make better purchasing decisions, improve your procurement process, and meet your maintenance needs.

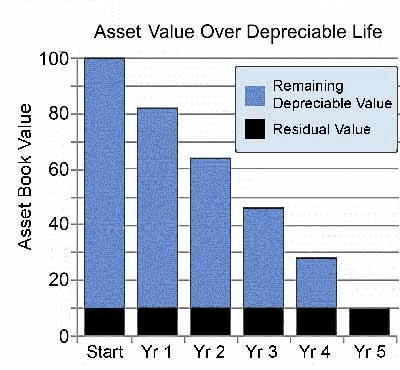

Since the primary goal of asset management is to ensure that costs over the lifetime of an asset are minimized, it makes sense to track it through the five main life cycle stages:

- Acquisition: you have just bought a new fixed asset

- Deprecation: your asset loses value over time (use, wear and tear)

- Revaluation: your asset’s value is revaluated to reflect major changes in its fair market value

- Impairment: your significant asset has unexpectedly lost its value due to different events and you need to record it in your books

- Disposal: your asset has reached the end of its life cycle; you can either recycle it, sell it or dispose of it

One of the things lifecycle tracking can help you with is setting the right depreciation start date.

This may seem like a small thing, but many companies have struggled with it.

For some assets, it’s clear when their depreciation should begin—as soon as they’re acquired.

For others, it may not be that easy. This situation can help you financially because the later you start depreciating your asset, the less money you’re going to lose on it over time.

This is why the depreciation date is an important part of efficient asset accounting. Pay close attention to it, and you might save a lot of money which can be used to improve other aspects of your business.

It’s evident that your asset’s life cycle has a great bearing on your asset management practices. Keeping a close eye on it will tell you when it’s time to get rid of equipment and restart the cycle, but it can also help you save money.

Periodically Review Your Asset Listing

There’s no getting around it, assets can get misplaced, stolen, or broken without you even knowing about it.

Remember the quote about 65% of incomplete fixed asset data?

That’s where periodic reviews of your assets come in. Periodic reviews are essentially regular inventories and reconciliations.

In a nutshell, they help you find both your “ghost” and “zombie” assets.

As we said, ghost assets are still on the books, but nowhere to be found.

As for zombie assets, they’re the things your company has, but no one knows how it got them because they’re not on the books.

This means that:

- they’re not included in the depreciation schedule

- they’re not covered by insurance

- taxes for them are probably underpaid

To avoid that, establishing a schedule for periodic inventories is a practice you should pick up right away. These inventories are used to identify gaps in fixed asset records, their location, and their condition (operational or non-operational).

They’re carried out at specific intervals and usually involve doing a physical inventory of, in this case, fixed assets.

Keep in mind that the periodic inventory system differs from the perpetual inventory system.

The other element of reviewing your assets are reconciliations, which are more concerned with getting everything right on paper, rather than physically accounting for every asset.

More specifically, fixed asset reconciliation is a method for joining two datasets and ensuring that the figures match.

The resulting statement shows a fixed asset’s book value, credits and debits, as well as accumulated depreciation.

This is critical for reconciling a company’s fixed asset balance and fixed asset register.

In the case of software solutions, it’s paramount to ensure that the software a company selected can be integrated with its accounting software to make reconciliations easier.

Keep in mind that it isn’t enough to catalog and record your assets just once. A lot can happen within one business year, so make sure you review your assets periodically and consistently.

Conclusion

As a category, fixed assets on a company’s balance sheet usually represent the majority of its investments.

So, if up to a third of its capital assets might be missing, this creates a host of issues, among

which overpaid taxes and insurance are just the beginning.

Remember that a company can easily have a lot of equity in untracked assets if it fails to closely monitor and regularly analyze the life cycle of its assets.

That’s what fixed asset tracking software is here for.