Starting a contractor business might seem overwhelming, especially if you don’t know what there is to consider.

This article will give pointers on starting a contractor business to anyone who is thinking about it.

If you want to find out more about business plans, setting up finances, and creating business websites, keep reading!

In this article...

Plan Your Contractor Business

The first step of a successful business is practical planning.

A business plan lets you state your mission, list the products and services you offer as a contractor, explain your goals, and describe your business structure, among other things.

You should explain how your business was founded and why.

Describe the goals behind the company and what made you start it in the first place.

If you’ve had any successes in the industry before starting your own business, write them down in the plan to convince potential partners and investors that your business is the right choice.

Of course, mention your business’s target market to which you are trying to appeal, and give details on the costs and number of employees.

Another essential part of a good business plan is market analysis, which shows the reader that you’ve analyzed the market and its needs and explains why your business is above its competition.

Then, of course, you can decide which product and services to offer, based on the analysis.

If you want to apply for a business loan, ensure that the business plan is detailed and well put together, as this will help you obtain it.

Once your business plan is ready, you need to register your business as a legal entity.

Create a Legal Entity

If you don’t register your business as a legal entity, you can’t have a contractor business.

Before attempting to do business, you have to register your company as a legal entity, i.e., a company with legal rights and which can enter into lawsuits and contracts.

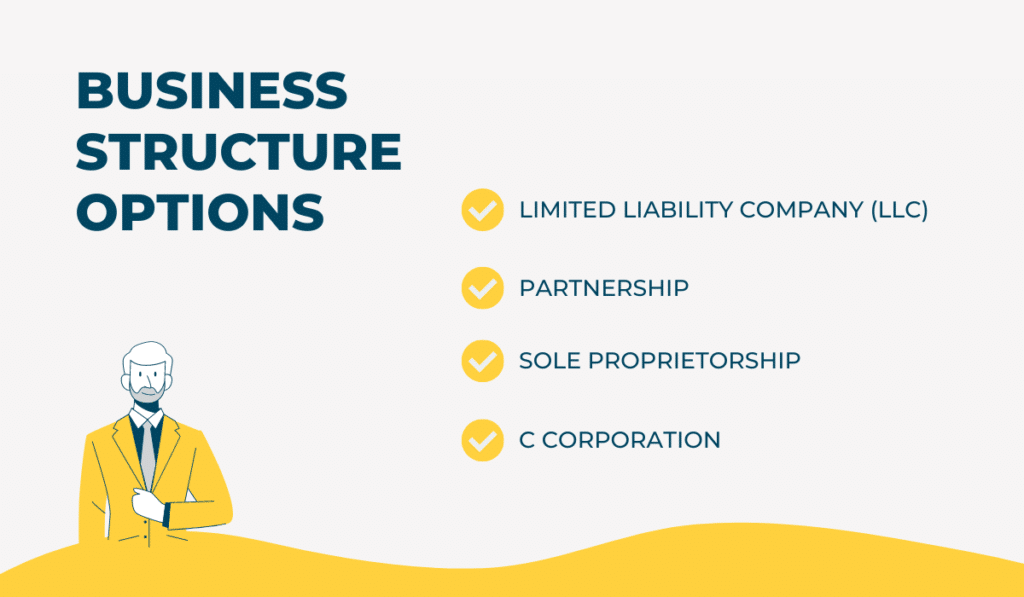

You get to choose which one of the 15 entity types is the right fit.

The most common types are sole proprietorship, partnership, limited liability company (LLC), and corporation.

The sole proprietorship is a perfect choice if you are starting the business and making all decisions independently, and you bear all responsibility for it.

You can register your business as a partnership if you have one or more partners with whom you share decision-making, risks, and profit.

The C corporation allows you to register your business and assume risks but protect your assets. However, you have to pay more in taxes and follow more regulations if you choose it.

If you want to have limited liability reassurance but not pay double in tax, you can register as a limited liability company (LLC).

The latter two options don’t make you personally liable in your company’s lawsuits, meaning that there is a legal separation between you and your company, which many business wonders prefer.

Selecting the correct type of entity is one of the first steps in starting your business.

Get Necessary Permits and Licences

Before doing any business, you need to acquire all the necessary permits and licenses.

Otherwise, you’re operating illegally and risking hefty fines and penalties. Such actions will not only cost you money, but you might develop a bad reputation before you even start doing business.

Keep in mind that you have to have a license for each state you are working in, even if you’re not based there.

So, for example, if you’re working on a state border and do business in both states, you also have to get licenses and permits from both states.

Do your research on time and make sure you’re aware of all the required permits and licenses, as they vary from state to state.

However, most states require business owners to have a general business license and a seller’s permit to collect taxes.

In different states, licenses and permits vary on the project costs or the city of work. To be sure you have everything necessary, check with the clerk’s office.

Suppose you’re trying to obtain a construction permit.

In that case, you will have to submit an application and a worksite plan, including the blueprint, and arrange a meeting with the city or county representatives.

Of course, to ensure that you follow the rules and regulations set when given a permit, you will have to schedule regular inspections before getting final approval.

When starting a business, you have to apply for and legally obtain permits and licenses.

Set up a Business Bank Account

Setting up a business bank account helps you start a company and protect yourself.

To create a distinction between you as a private person and your company as a legal entity, you should open a separate business account for it.

The new account will allow you to pay and be paid through your company instead of your private account, which will separate you from your business even further and offer personal protection.

It will also make you more credible in the eyes of your clients and subcontractors or employees.

When you have two separate accounts—one private, the other one for the business—it’s easier to differentiate the two and pay taxes correctly.

It also protects you from losing your personal assets in case of a business lawsuit.

If you have an accountant who keeps track of all your business payments, they need access to the company account.

If you use your personal account for this purpose, you will have to give the accountant access to all of your personal assets or do everything yourself.

You will have to obtain an employer identification number (EIN) or tax ID if you want to open a business bank account.

The IRS gives you this nine-digit number to identify your company for tax purposes.

Without this number, you can’t have a legal business bank account. This number is also necessary if you plan on hiring workers and paying them.

Apply for EIN and open a bank account for your business to operate legally.

Take Care of Accounting

Accounting is essential for any kind of contractor business.

You can take this task on yourself, but you can also hire an accountant to help you take care of your finances, taxes, and accounting.

Whatever you decide, your books have to be in perfect order, so you don’t risk paying any fines or taxes.

Also, an essential part of accounting is fixed asset accounting since your capital assets are an expensive investment which you need to manage appropriately.

As a contractor, you own a lot of equipment that helps you perform your job. Bear in mind that each asset should be accounted for in your books.

That way, you can keep up with all the costs and be sure about how much a piece of equipment is worth to you and how much you spend on it.

Another thing to keep in mind is that your accounting will be project-based since you will often work on projects, usually more than one at once.

Therefore, consider using a profit and loss statement (P&L) as they let you know how much you profited off a project based on the revenues, overhead expenses, and direct and indirect costs.

Keeping your books in order helps your contractor business be successful.

Think About Insurance

Insuring your company keeps your business safe and running.

One of the most important things to consider as a contractor is liability insurance, which protects you from the costs of worksite accidents and damage to tools and equipment.

Without this type of insurance, you have to cover all expenses related to potential accidents or damage to not only your tools but the client’s equipment as well.

Also, if your client isn’t satisfied with your work and takes you to court, professional liability insurance can help you fight these claims and not lose money.

General liability insurance will protect you from damage to property or people caused by accidents.

If an accident happens and someone gets hurt, your insurance will cover related costs.

Property insurance will cover any damage to tools and equipment, while business auto insurance protects the vehicle you use for your business.

Of course, if you don’t use vehicles for business purposes nor heavily invest in equipment, you won’t need such insurance.

Think about the needs of your business, analyze the risks, and opt for the most suitable type of insurance for your business.

Business insurance helps you save money on potential accidents or damage.

Invest in a Website

A good website helps propel your business.

You might not think an online presence is as vital for your company as your potential and quality of work are, but you’re wrong—an astonishing 97% of customers search for local businesses online to get more information!

Unfortunately, this means that you’re losing clients if you’re not online.

However, simply being online doesn’t cut it in this day and age.

Your website has to be professional, informative, and customer-oriented if you want clients to stay on the page, read about your offers, and contact you.

Here’s an example from beachcitybuilders.com, contractors in San Diego County.

While creating a website might seem expensive, it doesn’t have to be.

When you’re just beginning, you don’t have to go all out. You can find website templates online or hire professionals to do it for you.

Whatever route you take, consider that people use mobile phones for web searches, so your website has to be mobile-friendly.

In 2015, 30-35% of web traffic came from mobile phones. In 2021, the number is up to almost 59%, showing steady growth and pointing to the necessity of businesses to adjust.

On top of being mobile-friendly, your website has to state the services and products you offer, your location, and your contact information.

The latter has to be visible so potential clients can quickly contact you and ask for more information or request an offer.

Also, consider highlighting some of your customer’s positive reviews since 93% of people trust reviews to determine whether a business is good.

Having a quality website promotes your business and attracts potential clients.

Hire Professionals in Your Team

Having a good team helps start and keep your business afloat.

No matter how competent you are, you probably won’t be able to do every part of the job on your own.

You will need help in terms of permanent employees, subcontractors, or independent contractors.

The difference between such employees lies in the degree of independence and control you have over them, and it’s vital for your company.

An employee is a person who works only for you under the conditions stated in their contract, with you having control over how, when, and where they do their job.

However, you have to pay a lot of taxes and hold responsibilities for such employees.

On the other hand, an independent contractor is someone you hire to do a job for you with specific products, duties, and deadlines, but you don’t get to dictate how they get the job done.

Because of this, you don’t have to spend a lot on taxes as such people pay most of them themselves.

If the IRS finds out that you’re reporting someone as an independent contractor when they’re actually an employee, you’re subject to expensive fines and penalties.

Read more about the distinction and how to protect yourself in this IRS guide.

Whichever option you choose, ensure that you’re working with a professional who understands what you expect of them.

Hiring competent employees and subcontractors helps you do more than you could on your own.

Keep Good Track of Your Equipment

Keeping track of your equipment helps you start a successful business.

You might want to get into the construction industry because of the high rewards. After all, it totaled $1.362 trillion in 2020 alone. That’s why so many people rush into it, hoping for profit.

However, it’s not as simple as it sounds.

When you’re just starting, you need to pay close attention to all expenses, including those related to equipment—you can’t afford to invest in the same equipment over again because you keep losing or misplacing it.

Even if it doesn’t seem like much, equipment costs can rack up.

Not knowing where your assets are can also be confusing, and stop work until you find the equipment, particularly if you’re a smaller business and don’t have multiples of the same equipment.

This downtime can be very costly, especially if you have deadlines to keep.

You should also regularly check equipment to ensure that it’s functioning correctly and fix minor issues before they can cause problems.

To prevent equipment breakdown and loss, which results in expensive downtime and last-minute purchases, considering using a tool and material tracking software.

It will help you know where your equipment is, how many assets you have, and enable you to monitor their condition.

On top of that, you will keep track of the asset’s maintenance and schedule it regularly to be sure your equipment is in an optimal state.

Tracking the state, the whereabouts, and the use of your equipment improves the functioning of your business.

Conclusion

A successful contractor business starts with a foolproof business plan and reliable documentation like permits, licenses, and insurance.

You have to register such a business as a legal entity, have a separate business account, and hire a team to work with you.

To be even more sure of the success of your business, take good care of accounting to avoid unnecessary costs and invest in a quality website to attract clients.