Fixed assets include everything the company owns and uses to generate income, ranging from real estate and machinery to intellectual property.

As such assets aren’t expected to be sold or otherwise consumed within a year, they serve as an indicator of the company’s long-term financial viability. Because of this, it is important to track and monitor them properly.

In this article, we list some best practices for tracking fixed assets to help your company make the most of them.

In this article...

Don’t Use Inventory Management Processes

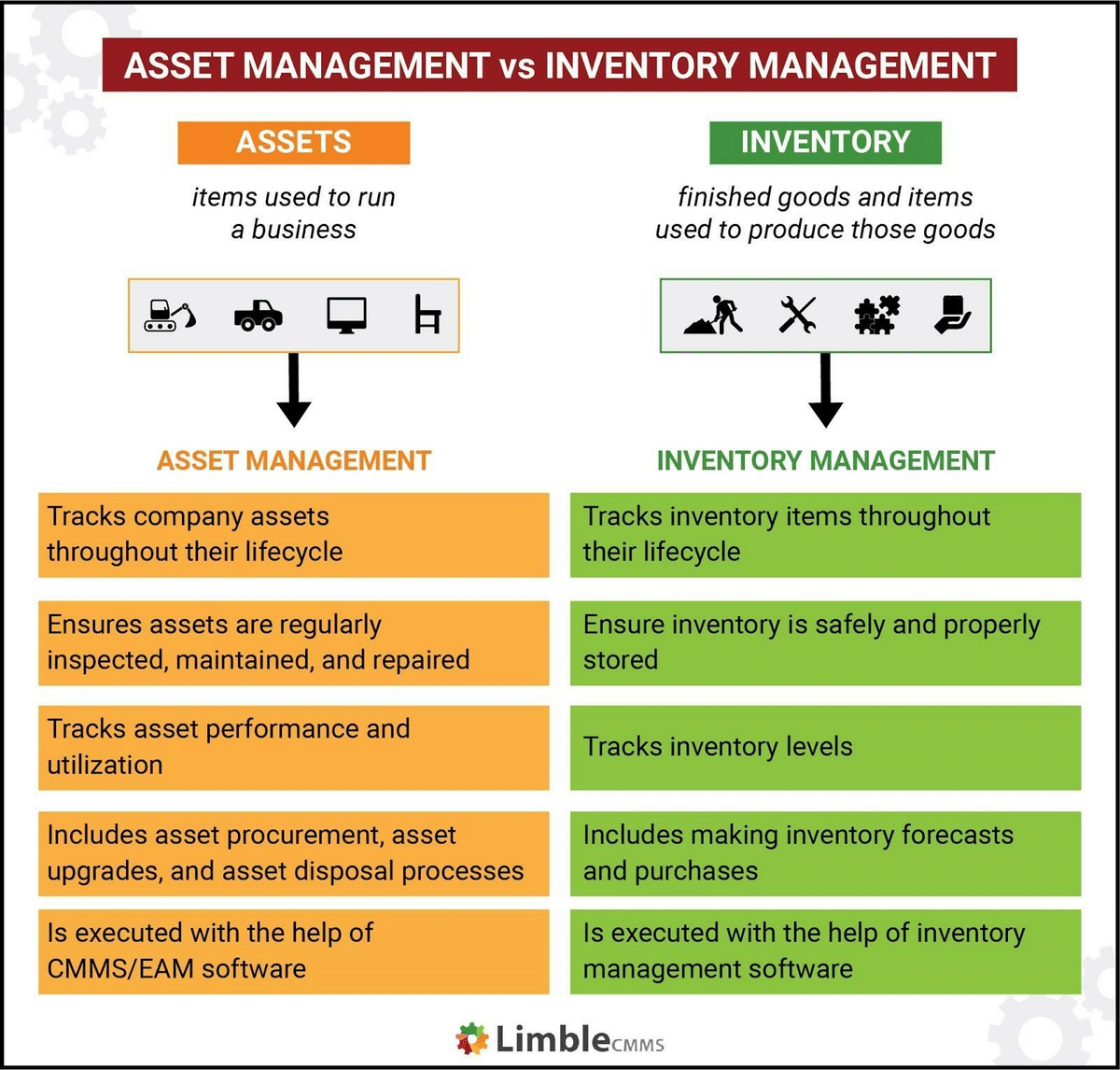

First, it’s important to understand the difference between assets and inventory.

Assets can be intangible, such as copyright to intellectual property, or tangible, like tools or machinery. What they have in common is that the company needs them to conduct business efficiently and professionally, so they are usually not for sale.

Inventory, on the other hand, typically refers to the items a company has for sale (like cars, computers, or food items) or uses to make the finished product.

Here’s a visual representation of the difference:

These items can seem closely related, so it might be tempting to track them in the same way. However, this is an inefficient way to go about it. That’s because assets and inventory have different relationships to an organization’s planning processes.

Since they tend to go through production quickly and then undergo dispersion to customers, items that fall under the category of inventory should be managed as a short-term, flexible operation.

This enables decision-makers to quickly adjust to such disruptions as supply chain slowdowns, weather events, and mechanical failures.

Assets, on the other hand, belong to long-term planning.

Because they can include investments that might take many years to show a profit—stocks, real estate, and so on—assets require different handling.

To rely on the same form of organization and tracking doesn’t make much sense, as, with inventory management practices, stakeholders are not given the kind of data that helps them make solid long-term decisions.

Create a Database of All Your Fixed Assets

It’s extremely important to set up a good baseline of all fixed assets. Tangible fixed assets usually remain in one place, so they are also referred to as PP&E (Property, Plant and Equipment.)

In short, they are typically larger pieces with a long life cycle. They might contribute to manufacturing, building maintenance, or client care. Examples include conveyor belts, HVAC systems, or day spa equipment.

Setting up a strong database baseline depends on good equipment documentation. This facilitates monitoring and caring for your fixed assets for years to come, making it more efficient, and better optimized.

A database helps to ensure documentary compliance, ensures good preventive maintenance, and makes documentation scalable.

While recreating or beginning your fixed asset database, include these steps:

Eliminate ghost assets | Delete any items that remain in the system, but are not under company control. |

Conduct physical asset inventories | Dedicate time and resources to ensuring numbers in the system match the physical count. |

Train employees | Ensure each person taking part in updating the database receives proper training. |

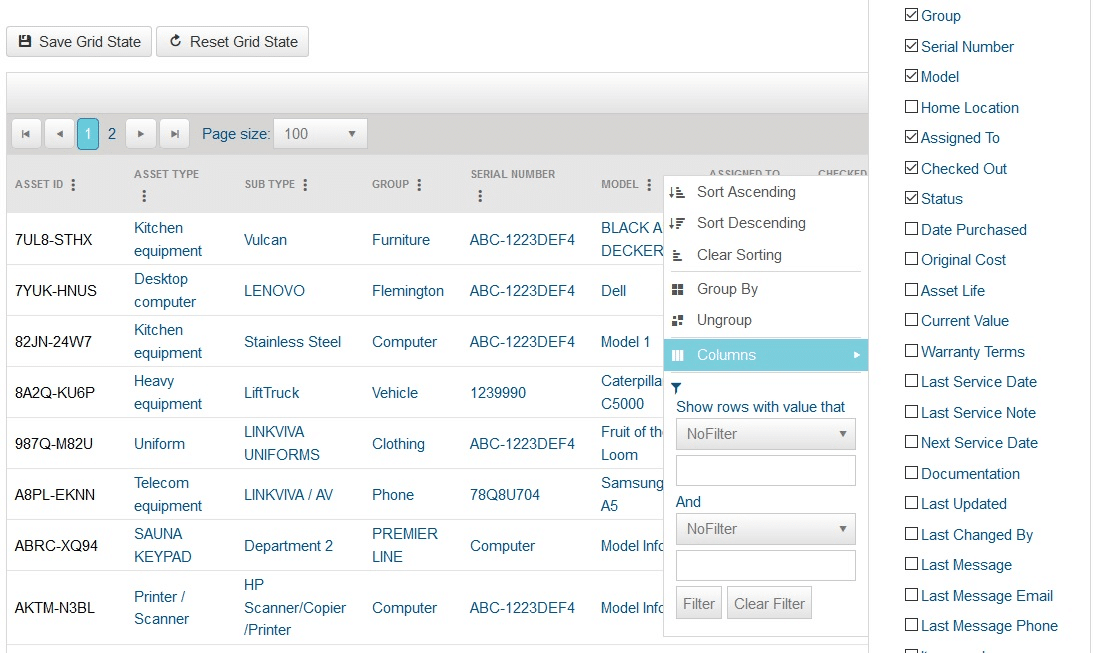

It is also a good idea to include a unique code for each item. Here is an example of a GoCodes Asset Tracking ID generated for a fixed asset:

Since the code is unique to the item and the company, there is no chance of confusion or overwriting information with a similar item.

As long as you update your organization’s database regularly, your staff can call up a wealth of information about your valuable assets with just a few clicks.

Monitor Your Fixed Assets’ Life Cycle

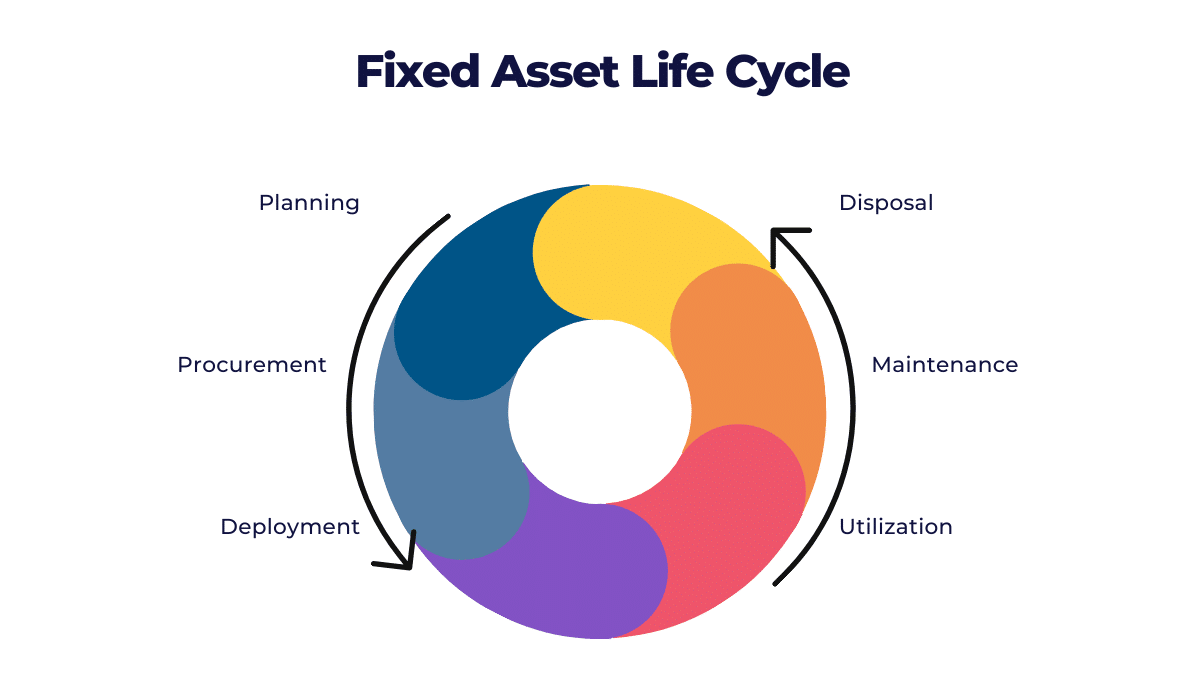

What is the life cycle of an asset? It is the way a physical resource ages. The life cycle of a physical asset begins with research into its purchase and ends with its eventual discard.

These are the usual stages of an asset’s life cycle:

If the company has planned and researched well, a fixed asset will spend most of its life in the utilization phase. This refers to the asset’s role either in the field or indoors, performing its intended purpose.

For example, if the organization has purchased a washer and dryer set, these appliances hopefully spend several years providing reliably washed and dried items as needed.

If this phase is to last as long as possible, employees must undergo detailed training on how to use an asset, and preventive maintenance should take place as necessary.

No matter the length of time your asset remains with your organization, eventually, it will move into other areas of its life cycle.

Each asset will spend at least part of its life in maintenance, if only to update it and ensure its mechanical health as much as possible. Eventually, however, it will accelerate towards disposal, either because it no longer serves its purpose and is too expensive to maintain, or because it is outdated.

Keeping track of each asset along its lifecycle not only ensures that preventive maintenance happens on schedule and within local regulations, but it also helps decision-makers make informed choices about when to dispose of the asset.

Given the high cost of many fixed assets, along with the fact that long-time employees get comfortable using a specific item, some might hesitate to take this step.

However, when your fixed asset’s life cycle is tracked and monitored, data will inform your decision.

In addition, you are much better equipped to know the weaknesses of the original asset—for example, poor air return—and to look to remedy this with the replacement item.

Ensure Accurate Depreciation Calculations

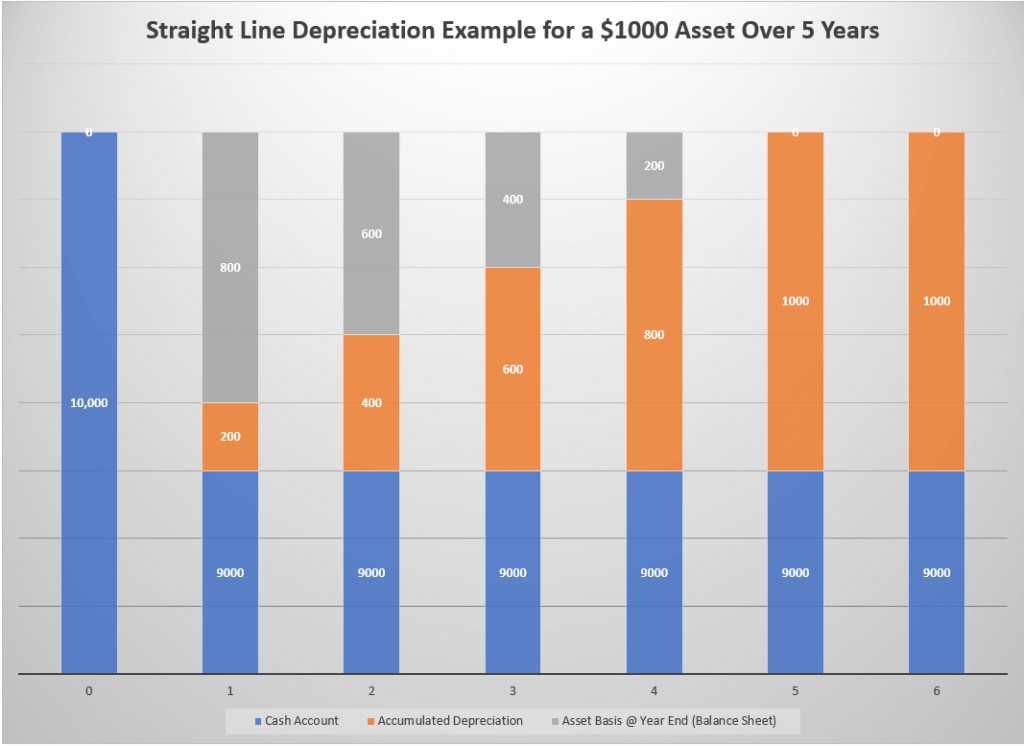

No matter how often the asset receives preventive maintenance or how gently employees treat it, over time, it will undergo depreciation.

Depreciation is the reduction of the value of an item deducted from its tax costs.

Hopefully, your asset will continue serving your company long after the company finances it.

However, sometimes rapid technological advancements or even government mandates can force the retirement of an older fixed asset.

Taking depreciation into account is important because it gives your organization a good idea of how long the asset might last, as well as how well it’s performing for its age.

Projecting the asset’s entry into the end-of-life phase will help your team make sound decisions, research a sensible replacement, and make preparations for safe and cost-effective disposal.

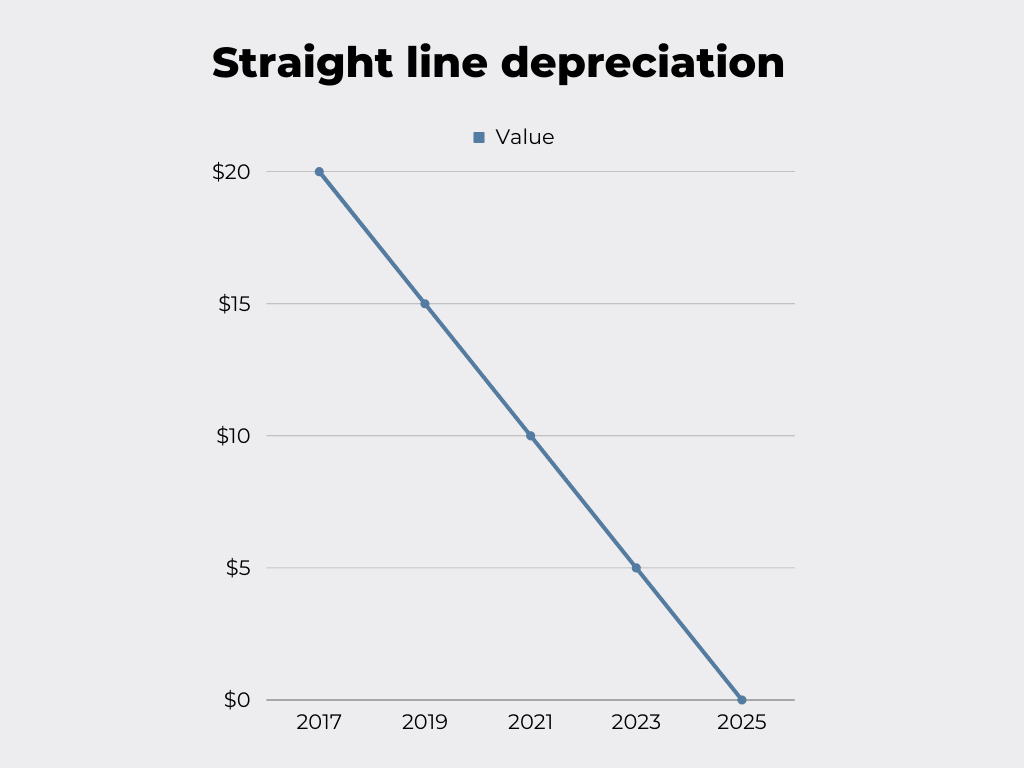

Companies can turn to several ways to calculate the depreciation of an asset. The below graph shows one approach, known as a straight line:

Other strategies might include the following:

Declining Balance 200% | Complex to calculate, but may reduce taxes |

Declining Balance 150% | Also complex to calculate, but with less emphasis on upfront use |

IRS PATH Act Bonus Depreciation | Encourages investment, but possibly increases taxes |

IRS Section 179 | Allows more depreciation for tax purposes, but is complex for tax reporting |

When deciding which form of asset depreciation calculation is best for your organization, keep in mind that this number impacts profits, taxes, and cash flow. A small but growing company that owns several fixed assets will require different forms of calculation from a medium-sized static company that deals mostly with the inventory.

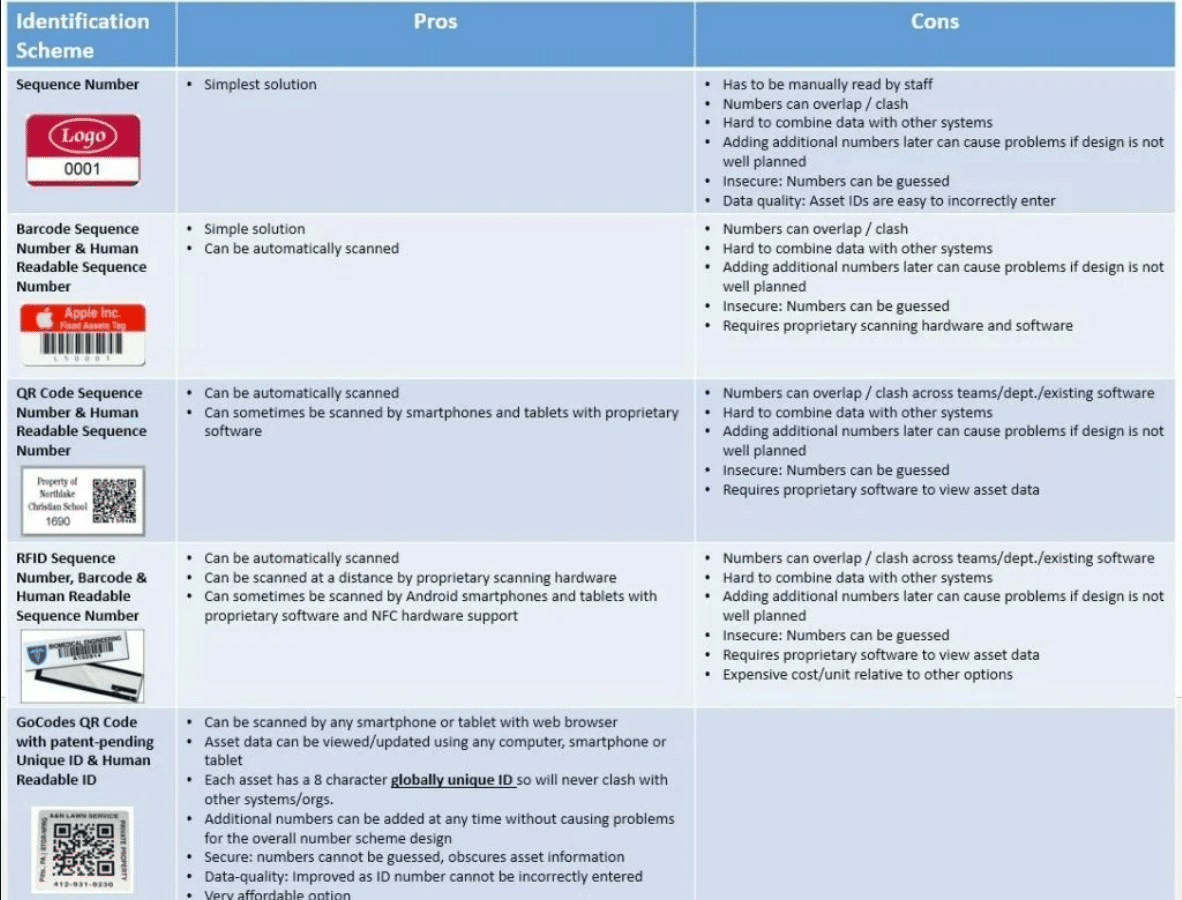

Tag Your Assets With the Right Labels

Few decision-makers think of labels when instituting a fixed asset tracking system. However, choosing the right labels is a vital moment in making the most of your asset’s data.

Fortunately, you are not bound to one type of label for every item.

Here’s an example of the various kinds of asset labels:

After all, what might serve an indoor scanner well might not last long on a piledriver.

For example, a tiny, lightweight coffee maker probably won’t need a heavy outdoor tag, but one that is waterproof is probably a good idea.

On the other hand, permanently affixing a heavy metal tag to equipment that spends its life outdoors in extreme conditions is likely the best choice.

Tamper-evident labels are available for valuable assets requiring an extra level of security.

Heavy-use labels can receive permanent anchoring with welding or small screws, while less robust tags might apply with strong adhesive or attach to the item with a keyring.

What’s most crucial is that the tag is easy to access for technical advisors or employees, and that it is made of a material appropriate to the conditions.

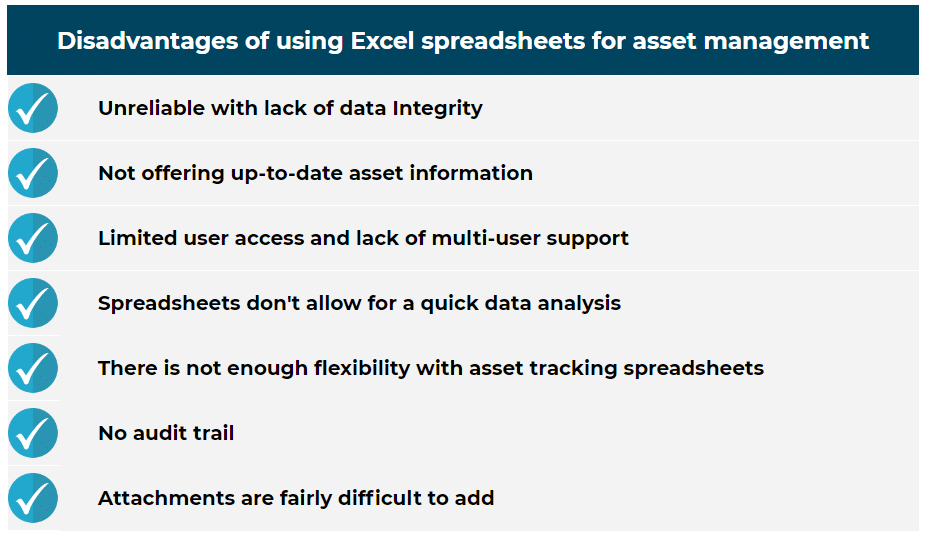

Move Away From Spreadsheets

Some high schools or basic business classes teach that spreadsheets are the go-to method for tracking information. However, where fixed asset tracking is concerned, that’s not always the case.

Asset tracking on a spreadsheet usually limits viewing to an in-office computer. At the same time, the spreadsheet is vulnerable to hacking and human error.

More importantly, spreadsheets are cumbersome and time-consuming to update, and not all update automatically, meaning that multiple versions of them might exist at the same time.

They don’t provide an easy audit trail, and it’s often difficult to use them.

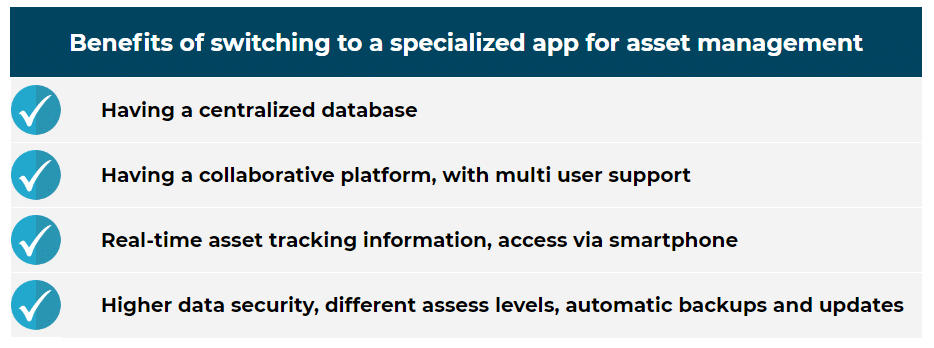

Because of all this, a software solution like GoCodes Asset Tracking is a better alternative.

The right fixed asset tracking software will provide a centralized database that employees can access and update anywhere they are via their smartphones.

That way, everyone involved can see the updates and track the items in real time, and all data is instantly backed up in the cloud.

Since decision-makers can assign different authorization levels to various stakeholders, such a solution also provides better security and improved accountability within the organization.

Conclusion

Fixed asset tracking is well worth any resources dedicated to standing up your company’s system. Using these practices will help create a comprehensive database that serves all employees well.

When asset tracking is conducted separately from inventory management practices, it’s easier for decision-makers to plan with the data at hand.

Monitoring a fixed asset’s lifecycle and ensuring accurate depreciation calculations will help make the most of your investment, and tagging your assets with the right labels will enable you to track them with ease.

Finally, focusing on appropriate cloud-based asset tracking systems will point the way to optimizing asset-related decisions.