Construction companies generally deal with lots of fixed assets—from cranes and backhoes to hand drills and power tools.

If you operate in the same field, you’re aware that effectively managing these assets to best serve your business requires precise fixed asset accounting.

However, your efforts to achieve a streamlined accounting process can easily fall behind if you choose to rely solely on traditional methods.

This can cost you your efficiency, your profits, and your compliance with general rules and accepted standards.

In light of the above, we’re going to answer five common questions related to fixed asset accounting in this article.

Hopefully, it will help you gain a better understanding of how to optimize your fixed assets and keep your financial records in order.

In this article...

What Is a Fixed Asset?

Fixed assets are what companies use to run their daily operations and make a profit.

Let’s take a look at the definition of fixed assets:

Your land, machinery, trucks and vehicles, your computers and printers—they’re all part of your company’s fixed assets.

It’s important to note, though, that the term “fixed” doesn’t refer to their mobility, but rather to the duration of use.

It signifies that these assets will not be used, sold, or converted to cash within the accounting period.

Fixed assets primarily have a physical form and constitute a vital resource that enables the achievement of your business goals.

In the realm of accounting, fixed assets are usually referenced as PP&E, which stands for Property, Plant and Equipment.

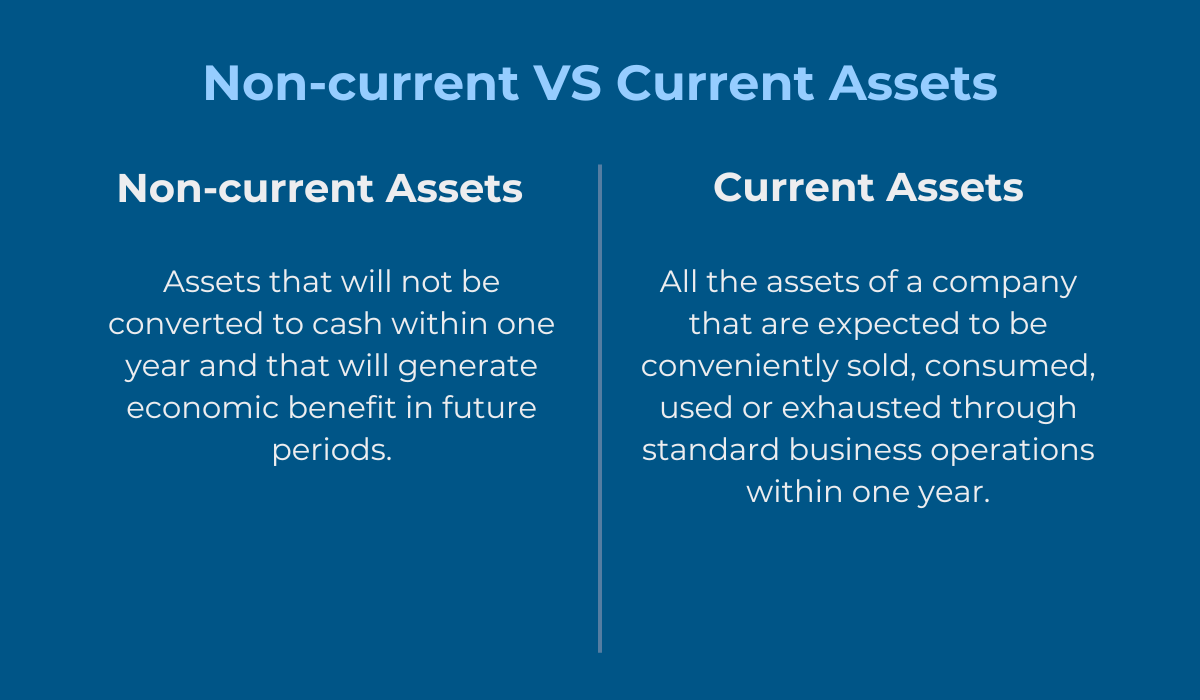

They’re also known as non-current assets, as they are intended for long-term use, unlike current assets—such as inventory, items for resale, and materials for production—which are expected to be converted to cash within one year.

The procurement of a fixed asset is recorded on the balance sheet.

To decide which assets qualify to be recorded as fixed, companies often employ a value threshold.

Namely, tools used in daily operations may be classified as fixed assets if they possess a higher value.

For example, a $15 hammer might be expensed as a current asset, while a hand-held core drill worth $650 could be considered a fixed asset.

Another criterion to establish if an item is a fixed asset is its purpose.

For instance, the computers Apple, Inc. plans to sell are classified as inventory (a short-term asset), while the computers utilized by Apple’s employees for day-to-day operations are regarded as long-term fixed assets.

Furthermore, it’s important to note that fixed assets’ value decreases over time, and calculating this reduction in value is called depreciation.

This means that a certain amount of an asset’s cost is expensed on an annual basis and spread out over the asset’s useful life, thereby allowing companies to align the asset’s cost with its long-term value.

And, given that this is an important concept in fixed asset accounting, we will discuss more in-depth later in this article.

But first, let’s see what fixed accounting is.

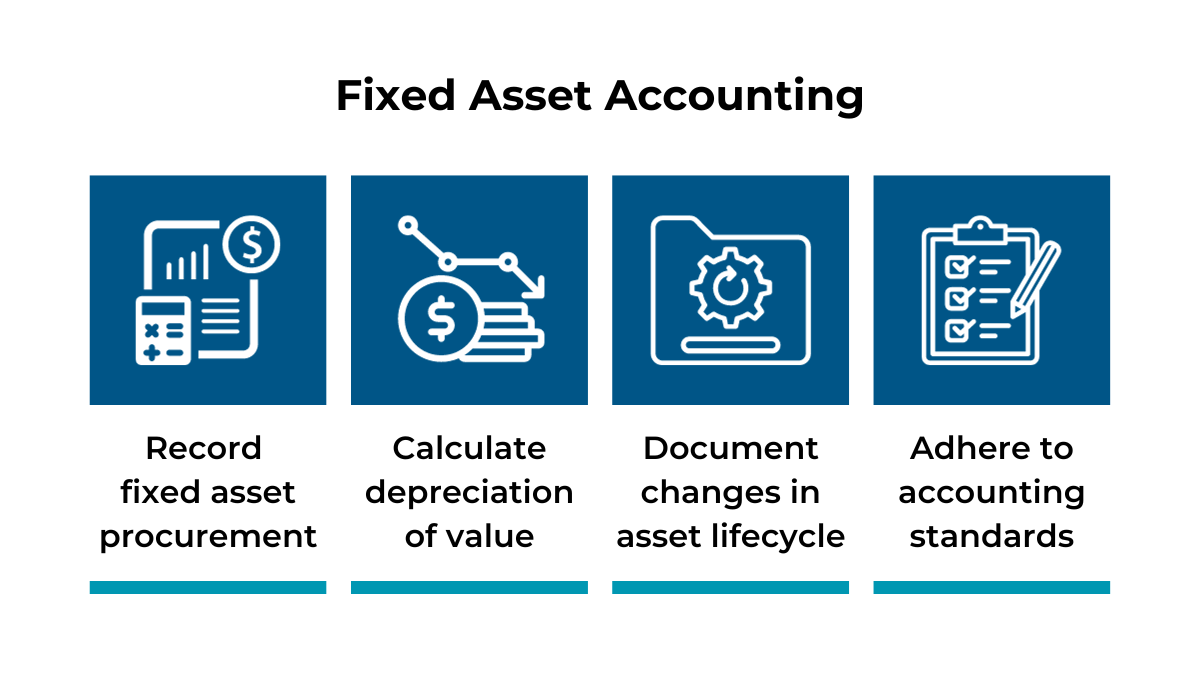

What Is Fixed Asset Accounting?

Fixed asset accounting involves documenting all financial activities associated with your company’s fixed assets, spanning from purchase throughout the asset’s lifecycle until the point of disposal.

In accounting records, each fixed asset receives an account, where all the financial activities related to it are recorded.

When purchased, fixed assets are included in the company’s balance sheet.

However, you don’t just write down the purchase price—you need to account for all the costs incurred to place the asset in service, including shipping, installation, training, insurance, and taxes.

This brings you to the total cost of a fixed asset, also known as historical or original cost.

Given that fixed assets typically constitute a substantial investment for your company, it is essential to monitor and record changes in an asset’s value over time.

As mentioned earlier, tangible assets undergo periodic depreciation, indicating that the asset’s value decreases along with its depreciation amount on the company’s balance sheet until it reaches the end of its useful life.

Approaching your fixed asset accounting with deliberation and precision is important, as this process plays a crucial role in maximizing the benefits derived from your assets.

So, in order to maintain consistency in your company’s financial statements, it is advisable to follow the established accounting regulations and standards.

These procedures encompass documenting financial records, estimating fixed asset value, calculating revenue, and ensuring compliance with tax laws.

Companies in the United States adhere to the Generally Accepted Accounting Procedures (GAAP) developed by the United States Securities and Exchange Commission (SEC).

GAAP uses a rules-based approach that includes specific details and guidelines for handling financial statements and reporting on financial results.

On the other hand, the International Financial Reporting Standards (IFRS), used in more than 160 countries worldwide, follow a principles-based approach that only provides general guidance and common accounting practices.

In essence, fixed asset accounting focuses on documenting, analyzing, and summarizing critical data related to your fixed asset transactions, providing valuable insights into your capital assets value and current state.

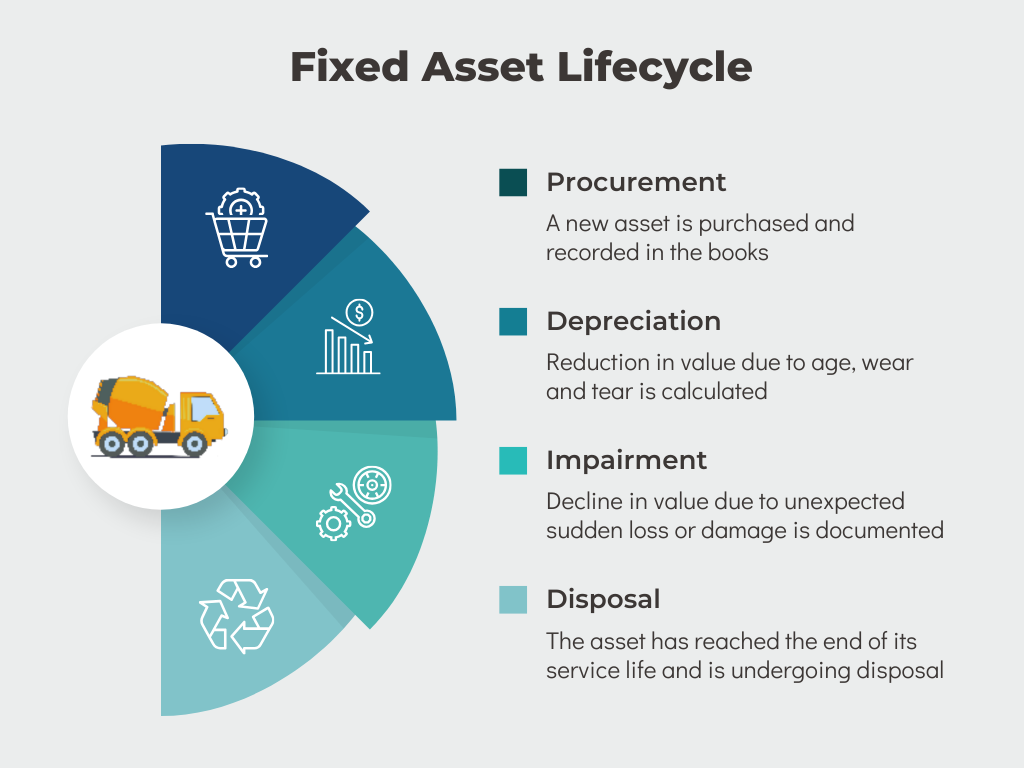

What Is the Fixed Asset Accounting Cycle?

Fixed asset accounting is about keeping up-to-date records of the business’s diverse capital assets and their respective values.

This process trails and reflects the changes in these values as the assets advance through their useful lifecycle.

Hence, the fixed asset accounting cycle involves at least three of the key stages in the asset’s life—procurement, depreciation, impairment, and disposal.

Each stage is accompanied by a journal entry that covers the transactions related to the fixed asset lifecycle.

So, let’s take a closer look at the significance of each of these stages:

Procurement

At the time of purchase, a new fixed asset is recorded in your accounting system.

Input the original cost of the asset in your books, encompassing delivery, set-up, sales tax, or any other expense ensuring the asset’s safe and functional use.

This cost is considered a debit entry.

In parallel, you should credit the cash account—the account payable—for the equal sum, so that your books are balanced.

The journal entry should also detail whether the asset is acquired outright, through installments, or an exchange.

Depreciation

As your assets age, their value goes down and needs to be recalculated accordingly.

Fixed asset depreciation indicates the annual decrease in the value of your equipment as a result of regular use.

It also allows you to spread the asset’s original cost throughout its useful life, reducing your taxable earnings.

When calculating depreciation, you have to make sure you choose the right depreciation method that will enable you to make the best use of your assets.

In this journal entry, you record periodic depreciation or the decline in net book value.

Impairment

Imapirment implies a sudden change or decline in the asset’s value as a result of unforeseen circumstances, such as damage, market changes, or the asset becoming obsolete.

Also known as writing down, impairment denotes the period during which an asset’s market value is less than the net value entered on the company’s balance sheet.

In other words, when you identify an asset as impaired, you have to reflect the change in value on the balance sheet and recognize a loss in the income statement.

Disposal

This stage means the asset has reached the end of its lifecycle and you should decide if you are going to sell it, give it away, or scrap it.

In this phase of fixed asset accounting, you delete the assets from your accounting records.

However, depending on the chosen disposal method, you may record either a gain or loss on the asset disposal transaction.

It’s important to note, however, that not every stage is relevant for every fixed asset.

For instance, depreciation typically does not apply to land.

Likewise, certain fixed assets, such as vehicles, may require periodic reassessment based on fluctuating market values.

This process, known as revaluation, can result in both increase and decrease in the asset’s recorded value.

What Types of Technology Are Used in Fixed Asset Accounting?

Traditionally, accountants have depended on manual bookkeeping methods to manage financial records, navigating through countless folders and cabinets overflowing with financial information.

This practice entailed time-consuming tasks such as manually recording expenses in handwritten ledgers and organizing paper receipts.

However, the accounting profession has evolved significantly in recent years, stepping away from outdated processes and embracing new technologies instead.

Innovative tech tools offer many advantages in accounting, such as improving accuracy, boosting efficiency, and saving time.

One of the first advanced tools to emerge in the bookkeeping landscape is accounting software, such as Enterprise Resource Planning (ERP).

Tools like this can help perform a variety of tasks, like recording financial transactions, managing inventory, paying taxes, or generating financial statements.

Accounting software applications provide businesses with more control over their financial records, improved data accuracy, and enhanced data security.

Furthermore, data visualization platforms, such as Excel and Tableau, offer the option to summarize extensive datasets into pie charts, bar graphs, maps, and other visual formats.

These visualizations enable you to quickly assess financial information, identify trends, and detect deviations in the data.

However, these platforms still largely rely on manual entries, creating room for errors and discrepancies.

On the other hand, asset management software solutions offer the convenience of a centralized asset data system, making the tracking of assets and associated information much more efficient.

These software solutions store detailed information for each piece of property, plant, or equipment your company owns, including:

- physical location,

- purchase date and price,

- useful life,

- asset class category,

- depreciation method,

- net book value, and more.

Moreover, asset management software is cloud-based, eliminating the need for individual device installations and enabling you to access asset information from any device and location.

With such a tool at your disposal, you can streamline fixed asset accounting, thus ensuring greater accuracy and consistency in your financial records.

Now, let’s see how that works in practice.

How Does Asset Tagging Help with Fixed Asset Accounting?

One of the most effective ways to stay on top of your fixed asset management and accounting processes is to opt for a software solution specifically designed to ease these tasks.

With a significant number of fixed assets to account for, it’s essential for construction companies to track their condition and useful life, as various factors can affect their functionality and value.

This is easily achieved with asset tagging.

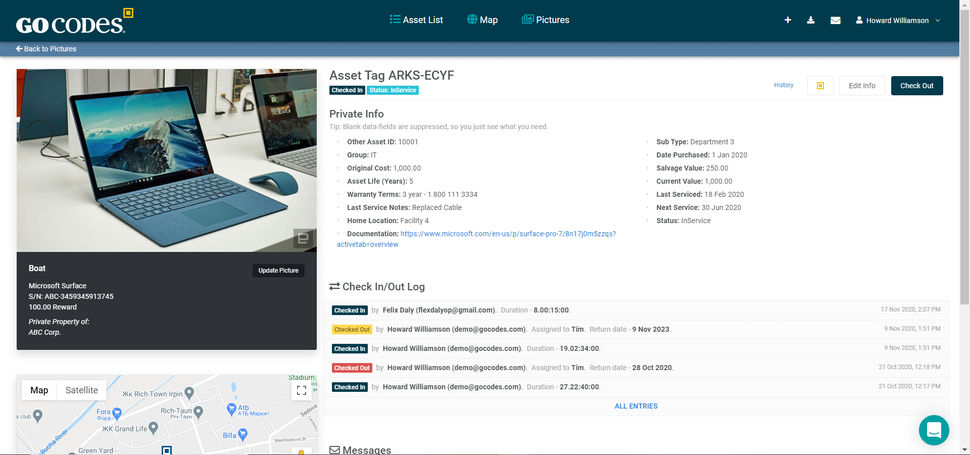

A fixed asset management solution, such as GoCodes Asset Tracking, consists of cloud-based software and durable and tamper-proof asset tags and labels that carry unique QR codes.

These easily scannable QR code tags contain all the information pertinent to the asset, including its location, utilization, maintenance history, and scheduled service dates.

This organized information enables you to maximize the utilization of your assets and make sure they’re well taken care of, thus prolonging their useful life.

Furthermore, each asset’s record includes details such as the asset’s original cost, date purchased, expected lifespan, current and salvage value, and all other data crucial for the accounting process.

Considering that the solution is cloud-based, it enables mobile and remote access and seamless management of your assets and the associated data.

Lastly, the GoCodes Asset Tracking asset management software runs automatic depreciation calculations using the appropriate depreciation method and generates detailed reports that can be easily applied in audits, filing of financial statements, or tax returns.

These features, and the fact that they’re all managed from one central point and accessible through simple scanning of the asset’s QR code tag, enhance asset visibility and ensure continuity and accuracy in fixed asset accounting.

Conclusion

Fixed assets, such as machinery and equipment, are one of the main pillars of business that enable construction companies to generate revenue.

That is why it’s important to have a clear understanding of what fixed asset accounting is, the elements encompassed in the fixed asset accounting lifecycle, as well as what tools you can use to improve your accounting processes.

We hope that this article has successfully answered these common questions and will serve as a helpful tool in propelling your construction business forward.