Construction operations are often massive undertakings that require a diverse range of specialized equipment and machinery, recognized as fixed assets.

They bring value to the company as they help generate revenue.

However, decisions regarding consistent recording and tracking of asset-related data, calculating depreciation, managing expenses, and ensuring compliance with accounting standards can substantially impact tax liability and earnings.

Therefore, accomplishing accurate and effective fixed asset accounting carries a lot of weight, although not without its challenges.

This article aims to help you come face to face with some of the common challenges in this area, and take a proactive step towards overcoming them.

In this article...

Keeping Track of Fixed Assets

For business owners and managers, coordinating daily workflows is always a complex endeavor.

The challenge intensifies further if a company handles multiple projects simultaneously, allocating assets across different locations.

Tracking and managing a wide variety of fixed assets using traditional methods, such as spreadsheets, is a time-consuming and cumbersome manual task, often leaving room for inconsistencies and human error.

A study conducted by Ray Panko, a University of Hawaii professor, reveals that on average, 88% of Excel spreadsheets have errors.

This is primarily because spreadsheets are frequently circulated among different departments, leading to the creation of multiple versions of the same spreadsheet.

Errors in spreadsheets can lead to inaccurate fixed asset accounting, potentially resulting in significant losses, as witnessed by the JPMorgan Chase’s incident back in 2012.

Namely, the bank lost more than $6 billion, partly due to the alleged copying and pasting of incorrect information from multiple spreadsheets.

Examples like this have prompted companies to search for solutions that can enhance the overall asset management process, including fixed asset accounting.

Just as in many other aspects of doing business, technology has taken the forefront, aiding in overcoming challenges from the past.

So, if you are on a mission to establish a solid baseline for all your fixed assets—and the data associated with them—you should turn towards contemporary tech solutions.

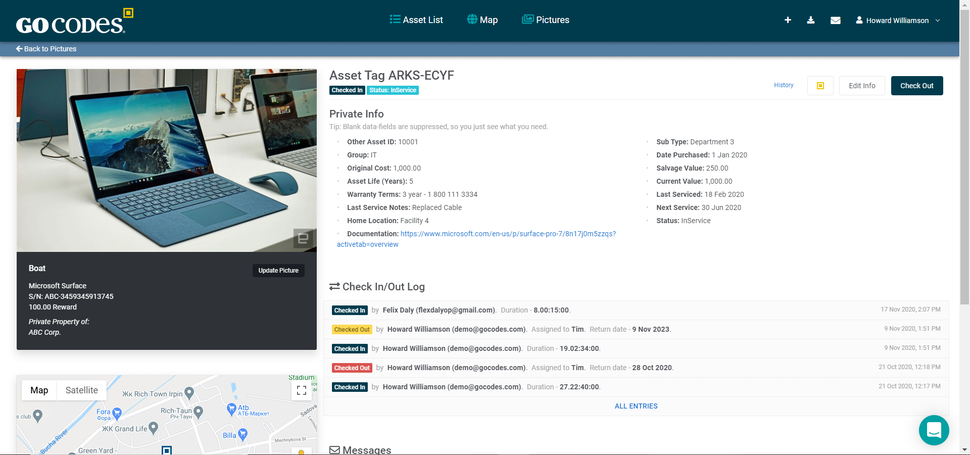

Modern fixed asset tracking software—like the one developed here at GoCodes Asset Tracking—leverages technology to significantly simplify the process, effectively addressing several issues in the area of asset management and accounting.

To begin with, fixed asset tracking enables you to stay consistently informed about the location of your construction company’s assets, who is using them, for how long, and whether they’ve been properly maintained.

This is achieved by simply attaching GPS trackers or unique identifiers such as QR code tags on your construction equipment.

A quick scan of the QR code using your smartphone opens a dedicated view in the app, providing all the essential information about an asset.

In addition to showcasing the asset’s current location and availability, the system records and presents details such as the date of purchase, original cost, utilization history, current and salvage value, maintenance logs and schedule, and more.

Simply put, this software solution substantially minimizes the likelihood of errors commonly associated with asset tracking.

Moreover, having all the asset’s relevant data just a click away enhances asset visibility and significantly streamlines record-keeping and accounting processes.

On that note, using a cloud-based monitoring solution not only allows you to keep a centralized digital register of your company’s assets but also keeps you in the loop of how well the equipment is performing.

Lastly, tracking your assets’ utilization throughout their useful life will enable you to make well-informed and timely decisions on whether to prolong the use of existing assets or opt for replacement.

This brings us to the next challenge—calculating asset depreciation.

Accurately Calculating Depreciation

Regardless of the frequency of preventive maintenance or the careful treatment by your employees, every fixed asset will depreciate over time.

Depreciation is a systematic accounting method that indicates the annual reduction in the value of fixed assets due to regular use.

At the end of the year, depreciation is deducted from the asset’s taxable costs.

Fixed asset depreciation is crucial for businesses as it provides insights into the anticipated lifespan of the asset and its current performance.

Foreseeing when your assets are expected to approach the end-of-life phase can assist you in making informed decisions, such as preparing for a cost-effective disposal and planning for replacement.

However, businesses often face a variety of challenges when calculating depreciation.

As mentioned earlier, many of them still use spreadsheets to keep track of their fixed asset inventory, as well as depreciation schedules.

While spreadsheets enable the input of multiple formulas per sheet, as more information is added, these documents become harder to handle and, in many cases, prone to errors.

To that point, incorrect or incomplete data can result in inaccurate depreciation calculations, tax compliance issues, and unproductive decision-making.

Furthermore, while it is advisable to conduct a comprehensive asset inventory at least once a year, few organizations adhere to this practice.

Relying on casual and ad hoc surveys to update asset records whenever the staff finds the time is insufficient and can cause gaps in record-keeping.

Consequently, companies face the risk of errors in the calculated depreciation amount and potential overstatement of fixed asset values.

This, in turn, can lead to unnecessary increases in insurance costs, given that insurance premiums are often determined as a percentage of the total current value of fixed assets.

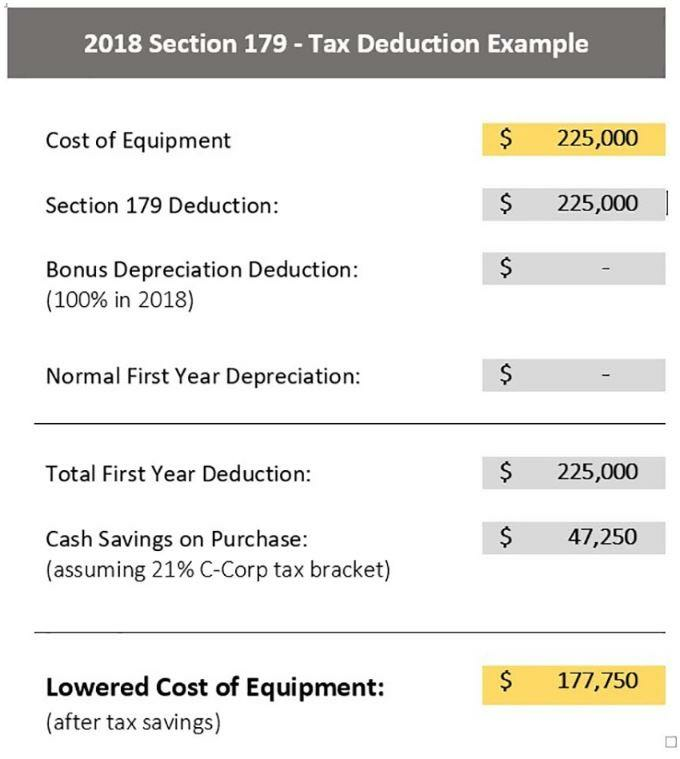

To make things worse, businesses might overlook deductions to which they are entitled, and end up paying higher taxes.

The tax reduction example below shows how much the cost of equipment is lowered after tax deductions.

All things considered, it’s clear that accurate and consistent fixed asset data is essential for effective fixed asset accounting.

The best way to overcome these challenges is to opt for an asset management solution that will help you maintain centralized data storage, as a single and accurate source of asset information.

When selecting your software package, make sure it includes a feature for automated depreciation calculations, utilizing the designated depreciation method and schedule for each asset.

This not only saves time but also ensures consistent application of depreciation rules.

Ultimately, the integration of flexible depreciation options, automated calculations, and detailed reporting in an asset management solution helps minimize errors and ensures the accurate allocation of fixed asset expenses.

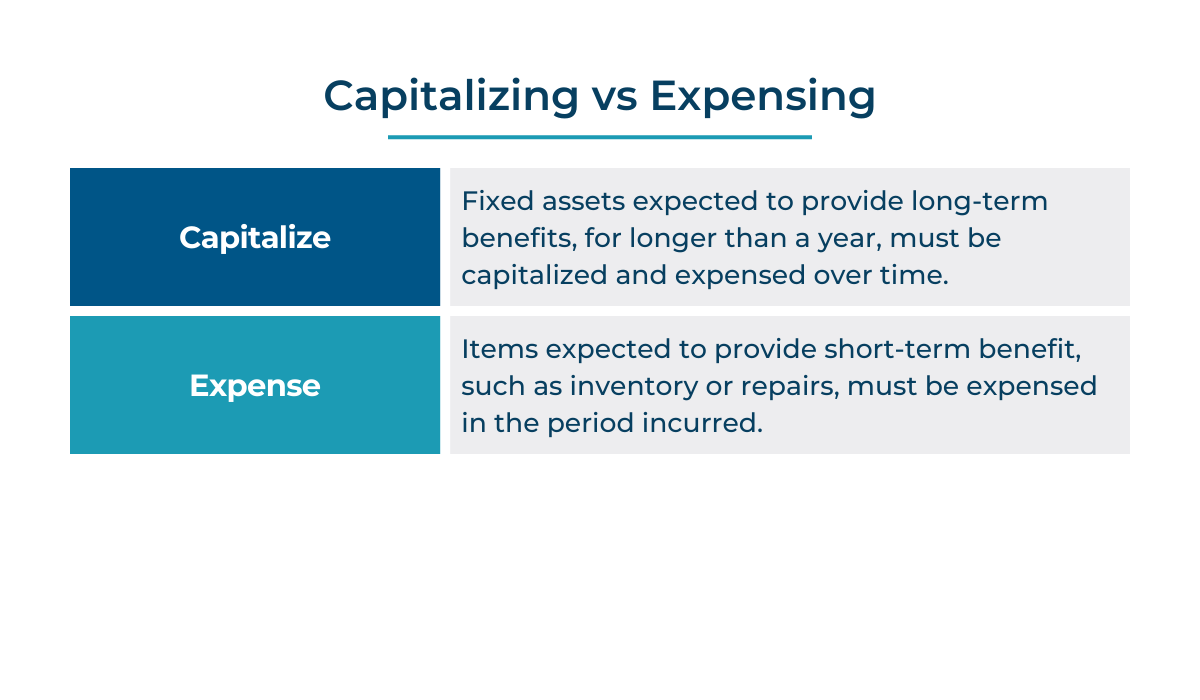

Deciding between Capitalizing and Expensing Costs

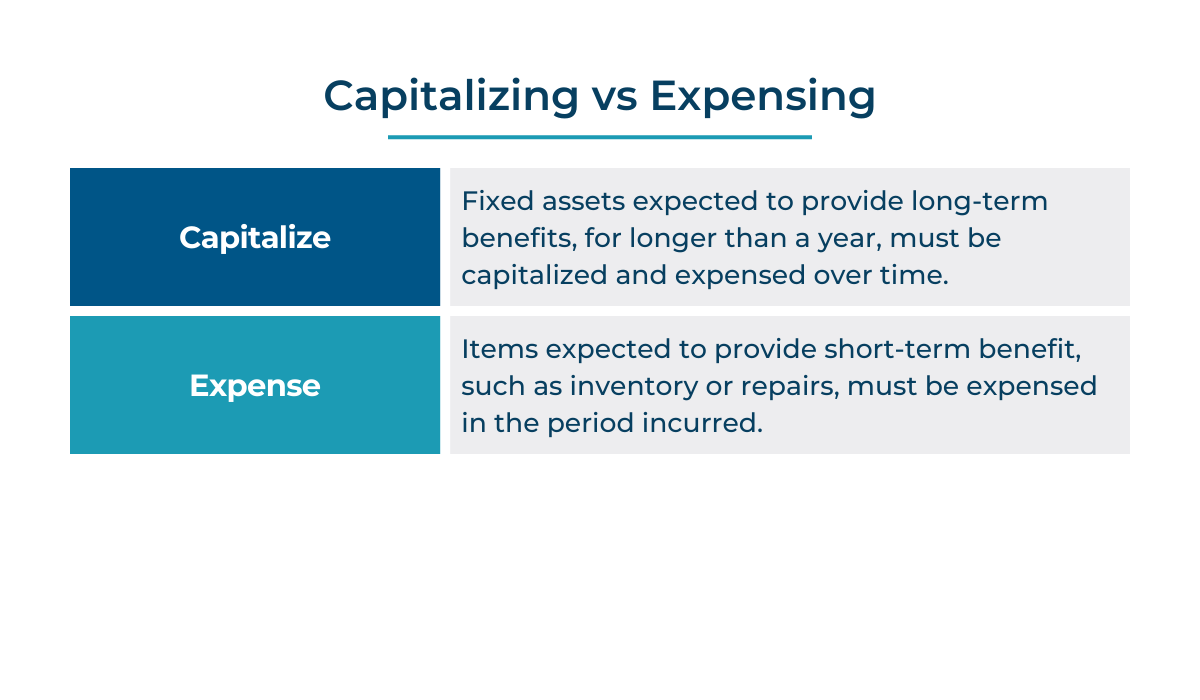

Understanding the distinction between capitalizing and expensing costs related to fixed assets is vital for effective fixed asset accounting.

While companies and accountants adhere to specific classification rules, in practice, this remains a gray area requiring individual judgment.

Most of them follow a simple rule where any purchase exceeding a specific dollar amount is categorized as a capital expenditure, while anything below is considered an operating expense.

Nevertheless, understanding and accurately implementing this concept can significantly impact your company’s profits.

Now, here are the basics:

Expensing and capitalizing is all about how a cost is handled in financial statements.

When you capitalize a cost, it means that the expense is considered a capital expenditure—an investment made in long-term fixed assets—and is recorded on the balance sheet.

In other words, capital expenditures are not entirely expensed in the period they are incurred, but rather recorded on the balance sheet as assets and gradually expensed through depreciation.

On the other hand, expensing a cost means it’s included on the income statement and deducted from total revenue to calculate profit.

For instance, repairs and maintenance costs aimed to preserve the asset’s good operating condition will be written off as an expense.

To sort out capitalizing and expensing, companies usually rely on the following simple paradigm:

To put things in perspective, let’s assume that your company has just recently bought a piece of construction equipment worth $50,000 with an expected useful life of 10 years.

This equipment is considered a long-term fixed asset since it’s intended to be used in your company’s daily operations for an extended period of time.

Recording the entire capital expenditure at once would distort financial results and lead to inconsistencies.

Therefore, the generally accepted accounting principles (GAAP) require the cost of the equipment to be allocated over its useful life, i.e., the period in which it will produce revenue for your business.

The primary goal is to match revenue with expenses, and capitalizing the equipment allows for this to occur.

Upon dividing the equipment’s cost by the useful life assumption, we arrive at a depreciation expense of $5,000 per year.

This means that the original cost of the equipment would decline by $5,000 each year across the next 10 years until there is no balance.

Depreciation costs will be expensed as incurred.

In essence, capitalizing involves delaying the full recognition of an expense on the balance sheet.

This approach, particularly for long-term fixed assets, helps minimize income fluctuations and increases the company’s asset balance without impacting its liability balance.

Staying Compliant with Accounting Standards

Ensuring compliance with relevant regulations, including tax and financial reporting requirements, presents a continuous challenge for construction companies handling a wide variety of fixed assets.

While performing fixed asset accounting, companies need to adhere to certain standards and ensure transparent processes for recording and verifying their financial transactions, including revenue, expenses, assets, and liabilities.

Staying compliant not only enhances your financial tracking and reporting, but also enables timely detection of financial irregularities, thus helping you avoid potential legal issues or penalties.

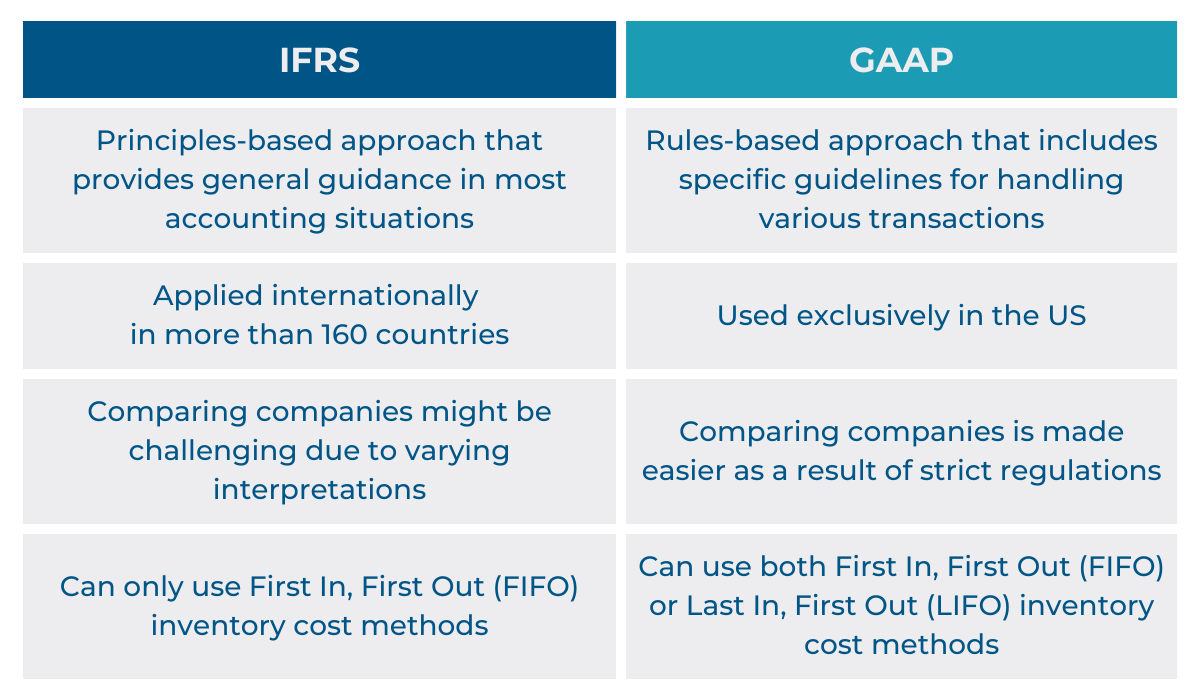

The most widely used compliance standards are the Generally Accepted Accounting Principles (GAAP), which encompass the complexities, details, and legal aspects of business and corporate accounting.

Another accounting framework is the International Financial Reporting Standards (IFRS).

Unlike GAAP, which is used exclusively in the United States, IFRS is applied internationally in more than 160 countries.

This set of global standards provides guidance to companies in preparing their financial statements and reporting on their financial results.

It also ensures that investors receive clear and reliable information regarding a company’s financial strength, market position, and performance.

The most significant differences between the two sets of accounting standards are as follows:

Substantial strides have been taken to align the two standards, particularly in crucial areas like revenue recognition.

However, the most notable disparity between the two lies in aspects such as research and development.

Cecil Nazarath from Nazarath Global Accountants highlights how the difference in the way R&D is treated changes the whole picture:

Under US GAAP, all R&D costs are expensed. Under IFRS, however, only the research component is expensed — development is capitalized. As a result, companies using IFRS will appear to be more profitable than they would be under US GAAP.

Nonetheless, to keep your books in order and allow your business to thrive, you have to keep your fixed asset accounting streamlined and compliant.

Conclusion

Effectively overcoming common challenges in fixed asset accounting is essential for construction companies aiming to optimize their asset management processes and maximize the value of their fixed assets.

Establishing a reliable system for financial tracking and reporting, while addressing challenges in data accuracy, compliance, depreciation calculation, and managing expenses will significantly enhance your fixed asset accounting processes.

Equipped with the right approach and tools, you can ensure that your fixed asset accounting contributes to your company’s enhanced financial performance, informed decision-making, and long-term success.