The construction equipment industry is a key player in global infrastructure development. But this dynamic field is full of new technologies, shifting markets, and new trends that can be challenging to keep up with.

If you’re facing challenges like equipment selection, and investment decisions, or you’re simply trying to stay competitive, this article is for you.

We prepared a concise overview of ten key construction equipment statistics, giving you valuable insights that can guide your business strategies.

Let’s get started.

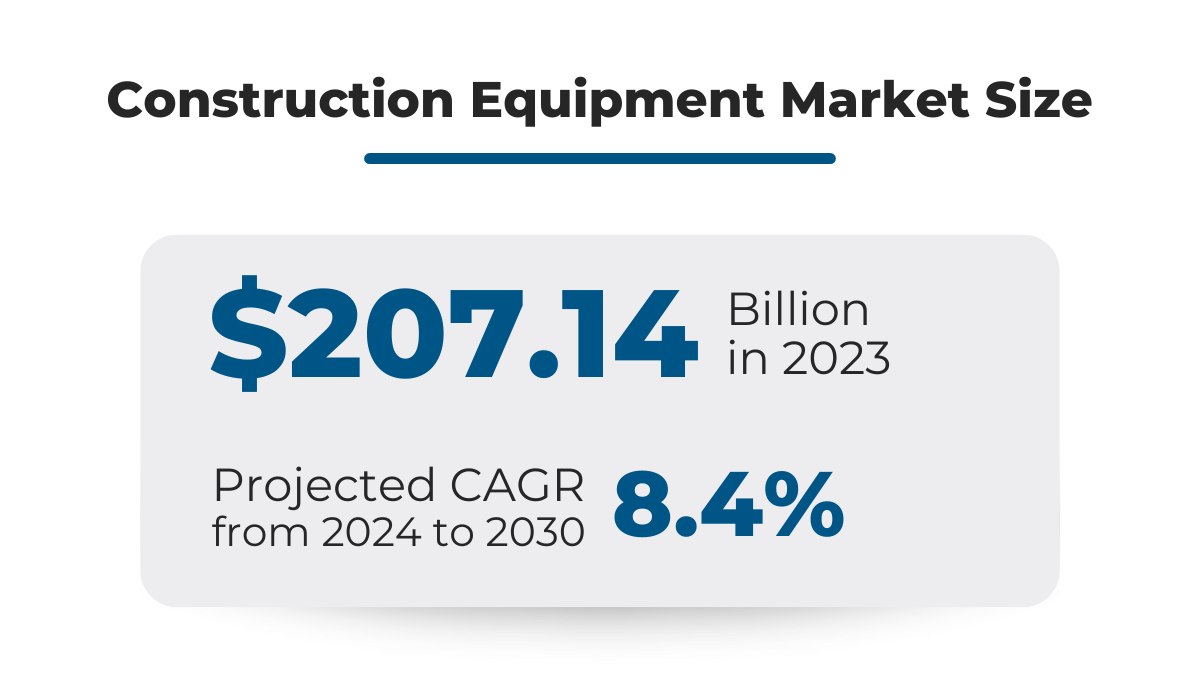

In 2023, the Global Construction Equipment Market Size Was Valued at USD 207.14 Billion

This data comes from Grand View Research, a trusted market research and consulting company with a wealth of data and research on 46 industries across 25 countries.

Their research shows the construction equipment market reached $207.14 billion in 2023.

What’s more, they project a steady Compound Annual Growth Rate (CAGR) of 8.4% from 2024 to 2030, indicating consistent and significant growth in the coming years.

The report also provides deeper insights into potential factors that can further drive this growth.

Rapid urbanization in developing countries, combined with increased government spending on infrastructure, is expected to fuel construction activities.

This, in turn, will increase demand for equipment like excavators, loaders, and dump trucks.

In essence, more construction projects around the world mean a greater need for the machinery that makes it all possible.

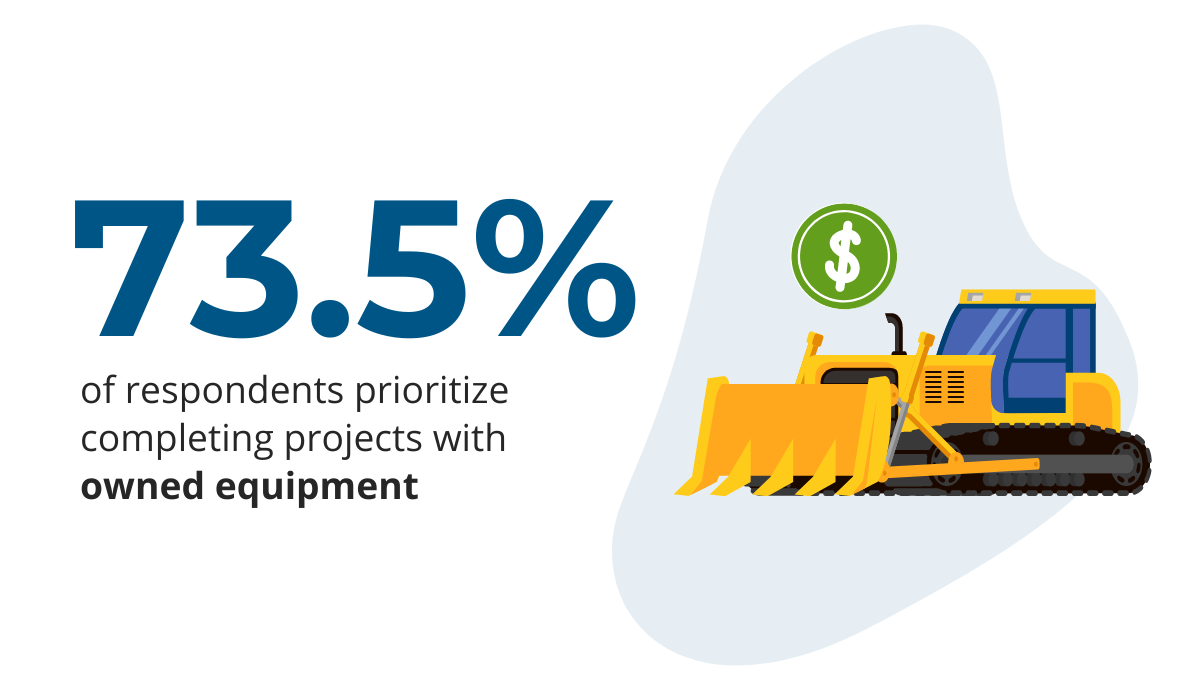

73.5% of Construction Companies Prefer Owning Construction Equipment Than Renting It

The recent EquipmentWatch State of the Construction Equipment Economy report, published May 2024, reveals interesting data about equipment ownership.

EquipmentWatch, a trusted source for heavy equipment data for over 60 years, conducted this survey in March 2024 with over 100 participants. It aimed to understand current issues, habits, and future plans of equipment owners and operators.

A key finding is that the majority of respondents prioritize completing projects with owned equipment.

This clear preference for ownership highlights a strong commitment to having better control over their fleet and managing their assets, which are some of the many benefits of owning equipment instead of renting or leasing it.

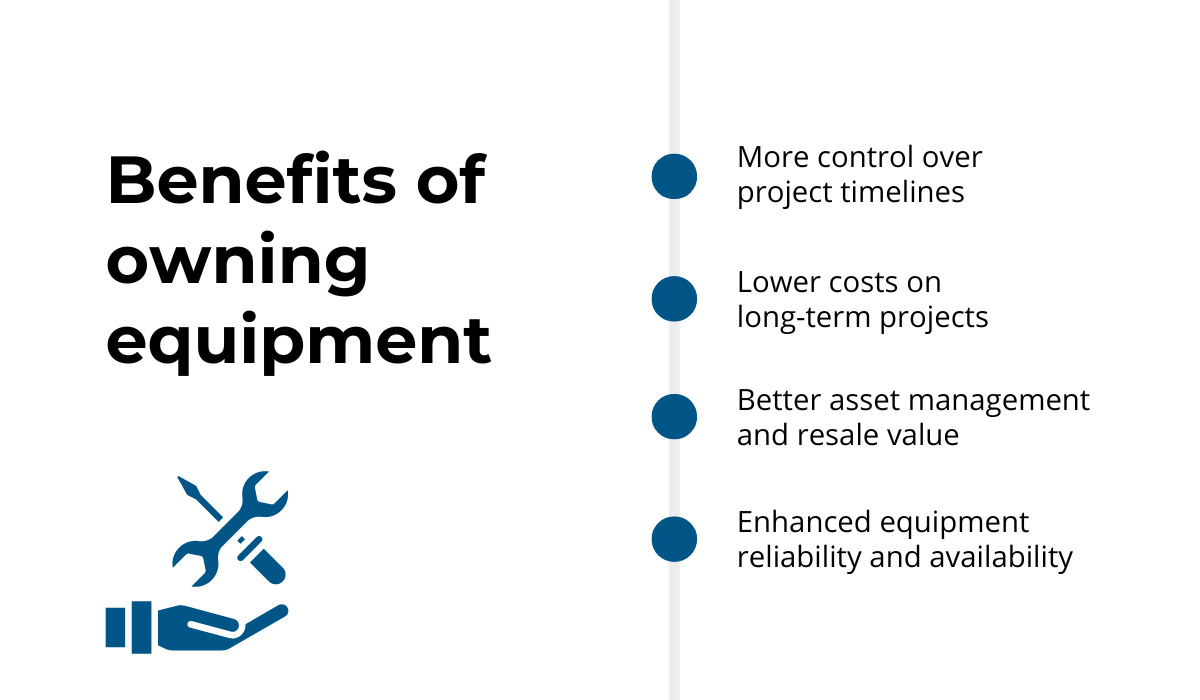

Owning equipment can give you more control over its availability and lower costs on long-term projects compared to ongoing rental fees. It also offers resale value, as equipment can be resold when no longer needed.

Essentially, this approach is popular as it allows companies to build equity in their assets while ensuring they have the right tools readily available.

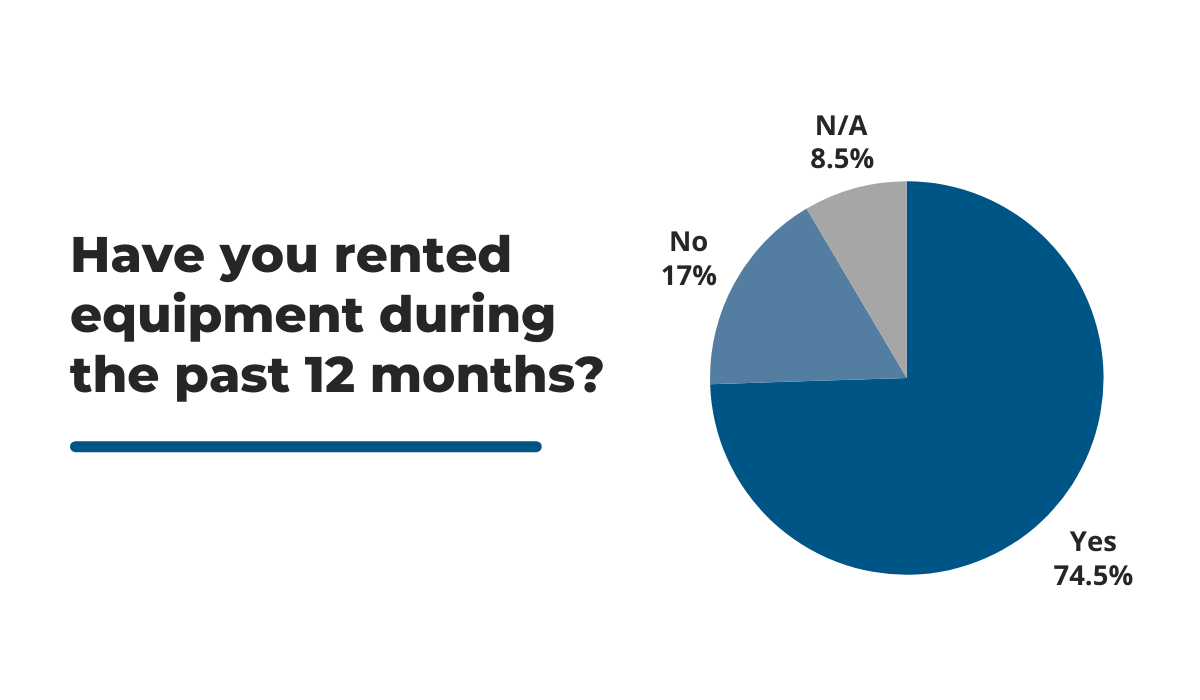

74.5% of Construction Companies Report Renting Equipment Within the Past Year

The preference for equipment ownership doesn’t mean equipment is not being rented.

In fact, most survey respondents reported renting equipment in the past year, according to the same EquipmentWatch report.

While only 17% haven’t rented at all, a significant 74.5% have done so. In other words, despite the clear benefits of owning, renting remains unavoidable for most companies.

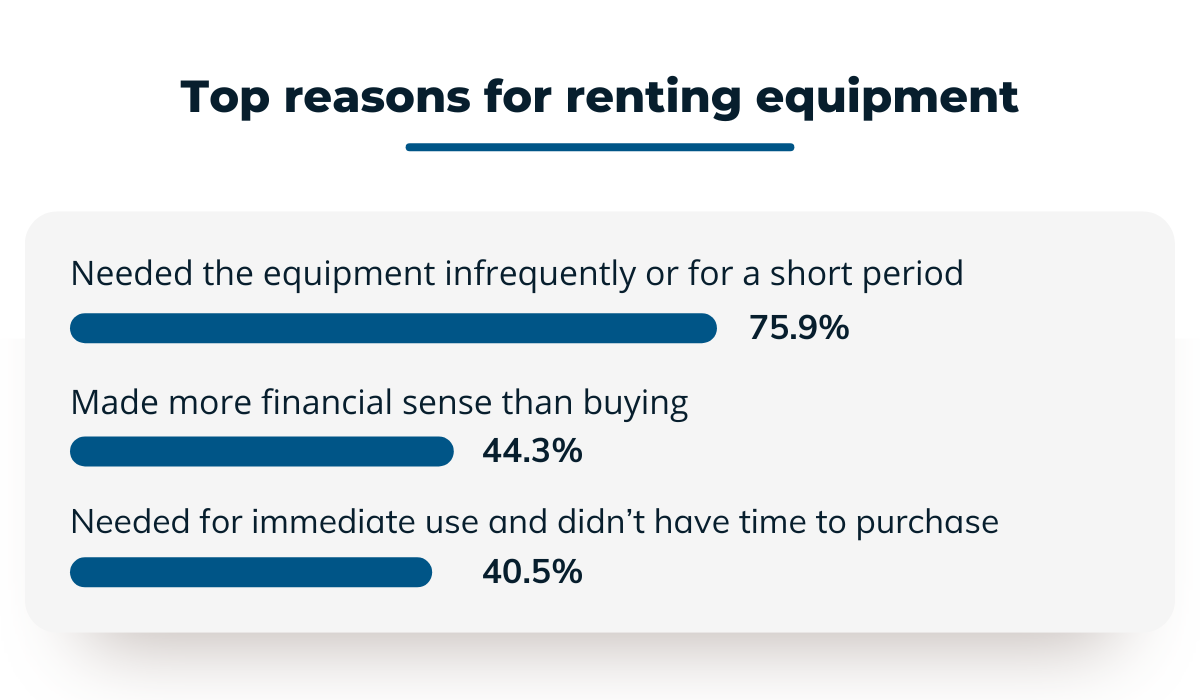

The survey data also reveals the main drivers for renting.

Convenience and short-term equipment use are the most common reasons.

There will always be a need for renting when it simply makes more financial sense to do so, like for specialized equipment needed for a single project or when facing budget or time constraints.

So, for now, the equipment rental market is alive and well, but we should watch for the emerging ownership trend and how it might reshape the rental industry.

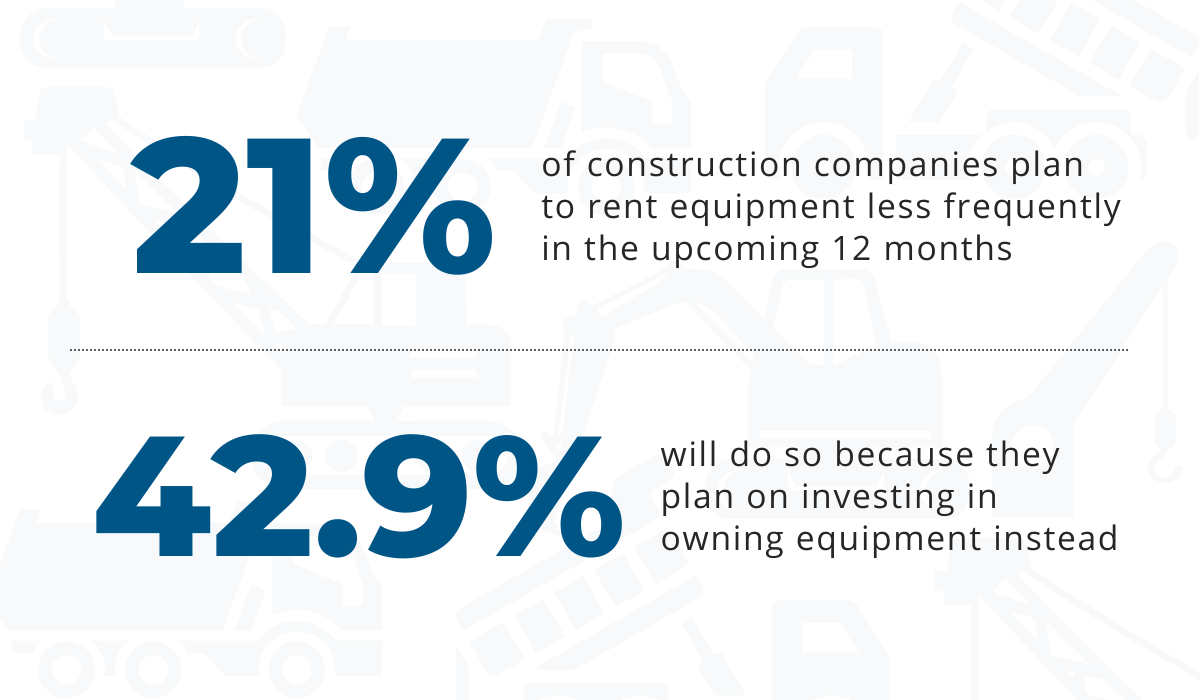

21% of Construction Companies Plan to Rent Equipment Less Frequently In the Upcoming 12 Months

In fact, as the data shows, companies are slowly making a transition toward equipment ownership.

Out of all the surveyed construction companies, one-fifth of them are planning on renting less frequently in the coming year.

This trend might be emerging due to several factors, such as increasing financial stability, a desire for better equipment availability management, or a long-term cost-benefit analysis favoring ownership.

In fact, 42.9% of companies want to rent less because they intend to invest their resources in owning equipment instead.

Considering the benefits of owning equipment, it’s clear that construction professionals are thinking long-term.

This means that we might see more companies prioritizing this practice as they grow and seek to optimize their operations.

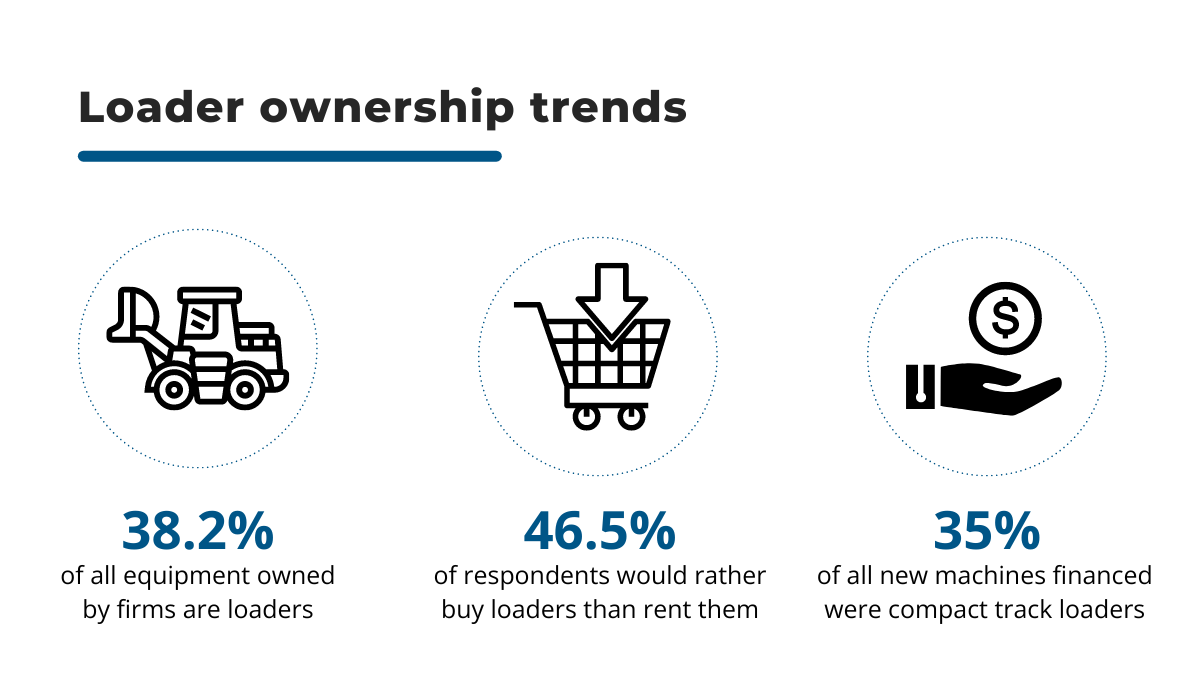

Loaders Account for 38.2% of Equipment Owned by Construction Companies

In terms of equipment ownership, statistics show that loaders take the spotlight among construction equipment.

A significant 38.2% of all equipment owned by companies are loaders, and more than one-third of newly financed machines are a type of loader, according to EquipmentWatch.

That’s because loaders are versatile machines used in various construction tasks, from moving materials to site preparation, making them valuable assets for many companies.

Their frequent use and adaptability make them good equipment to own rather than rent.

This is confirmed by the fact that 46.5% of the survey respondents would rather buy this piece of equipment rather than rent it.

So for readers who own loaders, this trend might mean increased competition for used loader sales, but also potentially better resale values.

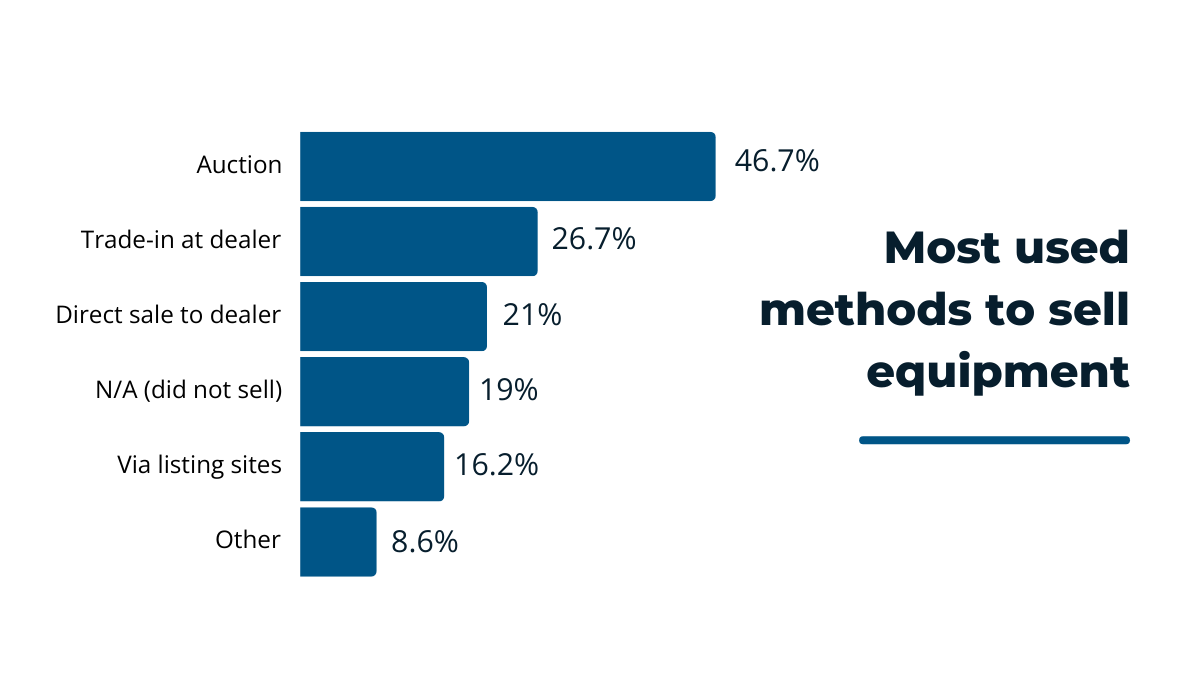

46.7% of Construction Professionals That Sold Their Construction Equipment Did So Through Auctions

Speaking of ownership and resale value, it’s important to consider how firms are selling their equipment.

The survey data illustrated below reveals that auctions are the most preferred method, used by almost half of all companies.

Auctions are a great option for several reasons.

They offer a quick and efficient way to sell equipment, often reaching a wide audience of potential buyers. Additionally, auctions can create competitive bidding environments, potentially leading to higher sale prices.

In contrast, trade-ins at dealerships or direct sales to dealers, preferred by 26.7% and 21% of respondents, respectively, might offer more convenience but could result in lower prices due to the dealer’s need for profit margins.

This means that if you’re looking to sell construction equipment, consider exploring auctions, as they are the most popular choice and can provide the most options.

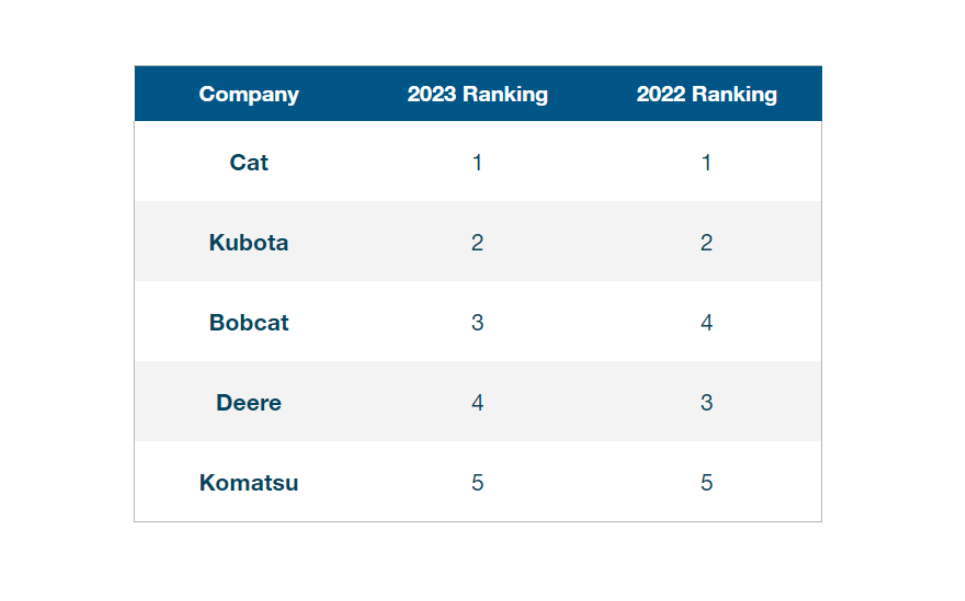

Accounting for 21.5% of Total Sales, Caterpillar Was the Top Construction Equipment Manufacturer in the US in 2023

Construction equipment manufacturing was booming in 2023, with nearly 135,000 new pieces of construction equipment being financed in the United States alone.

With that, it’s worth considering who manufactures this equipment.

Illustrated below are the top construction equipment manufacturers by newly financed sales.

Caterpillar holds the number one spot, accounting for 21.5% of all total equipment sales in 2023, maintaining its lead from 2022.

Often known as “Cat,” Caterpillar is a global leader in construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives.

The other four top spots, in order, belong to Kubota, Bobcat, Deere, and Komatsu. While all rankings remain the same as 2022, Bobcat surpassed Deere by moving into the third spot.

This data shows the continued dominance of the established construction equipment brands on the market.

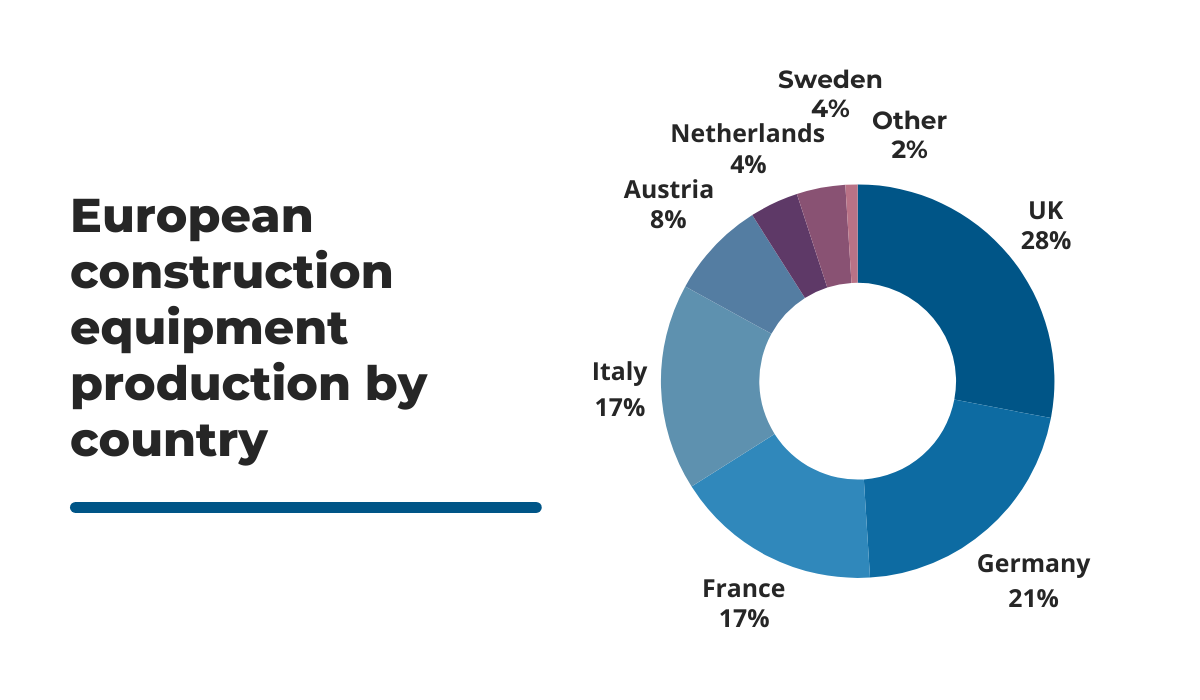

In 2022, the UK Accounted for 28% of Europe’s Total Construction Equipment Production

Switching to Europe now, we can take a look at the big players in construction equipment production there.

We’ll be using data from the Construction Equipment Association’s (CEA) 2023 UK Construction Equipment Sector report.

The CEA is the trade association representing the UK construction equipment industry since 1942, offering valuable market insights and resources.

Their report shows the following data on equipment production by country.

As you can see, the top country in terms of construction equipment production is the UK, accounting for 28% of Europe’s total production. That’s a 7% higher share than the next on the list, Germany, with 21%.

The UK’s dominance in this market can be attributed to several factors, including a strong manufacturing base, a skilled workforce, and a long history of innovation in the industry.

Some major UK construction equipment manufacturing companies include JCB, Caterpillar UK, and Komatsu UK.

Overall, this data highlights the UK’s significant role in the European construction equipment landscape.

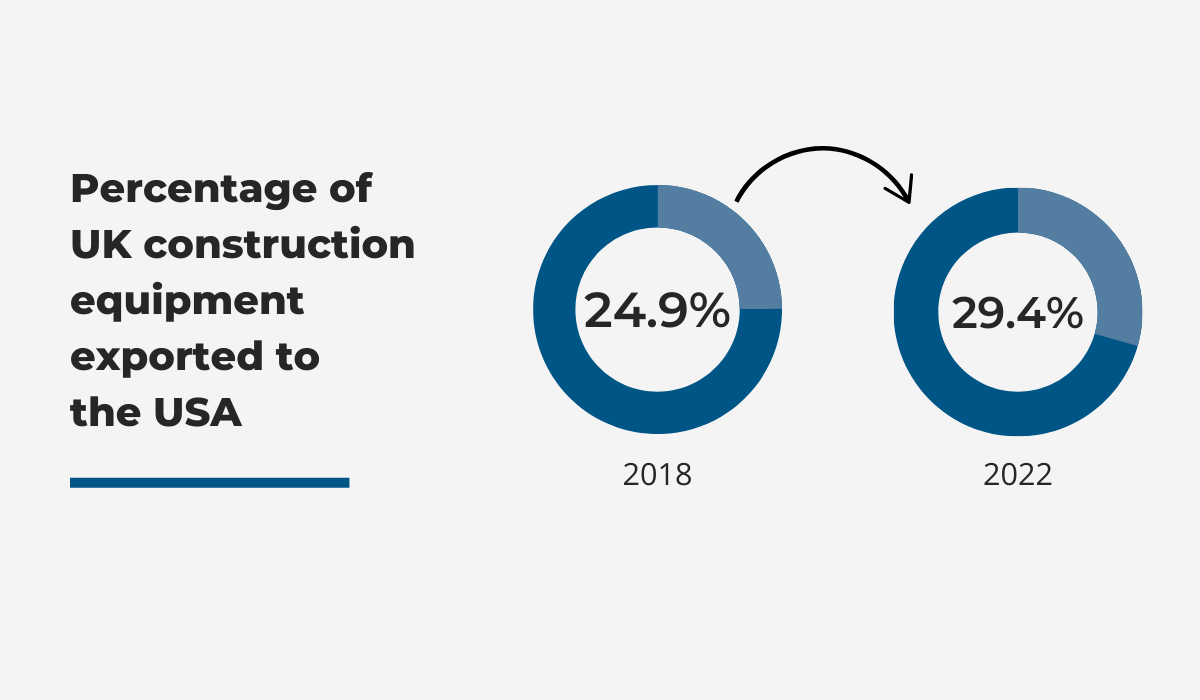

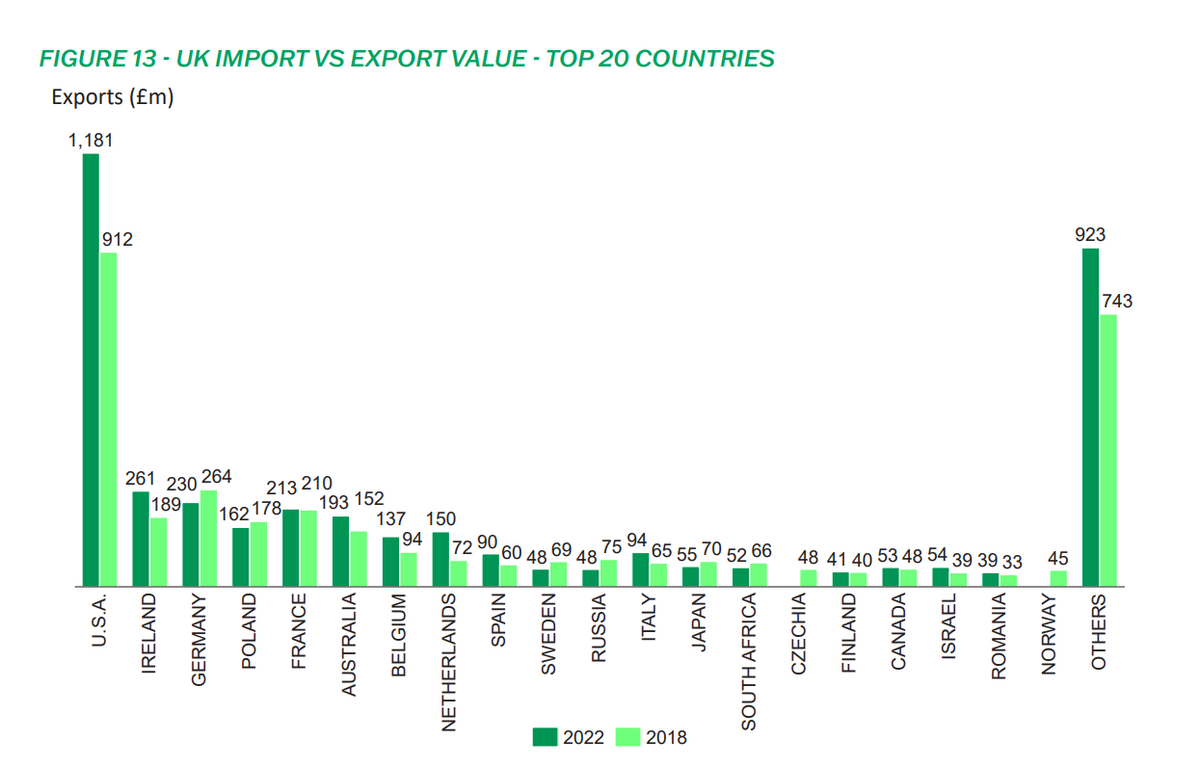

29.4% of Construction Equipment Made In the UK Was Exported to the USA In 2022

The CEA report also shows that while the UK is the largest construction equipment manufacturer in Europe, it’s also a major player in the USA.

In fact, almost 30% of UK-produced equipment is exported to the USA.

This is a 4.5% increase in exports from 2018 and places the USA as the top destination for this type of UK export.

This rise in exports likely reflects the strong demand for high-quality construction equipment in the US market and the UK’s ability to meet that demand.

The value of this export is also worth mentioning.

As you can see from the data below, 2022 UK exports to the USA were worth 1,181 million pounds, crossing the billion-value markup from 2018’s 912 million.

Compared to other top countries highlighted, the USA export value far exceeds others, indicating the USA’s importance as a key market for UK construction equipment.

This strong export performance underscores the competitiveness of UK-made equipment in the global market and the particular appeal of British engineering and manufacturing quality to US buyers.

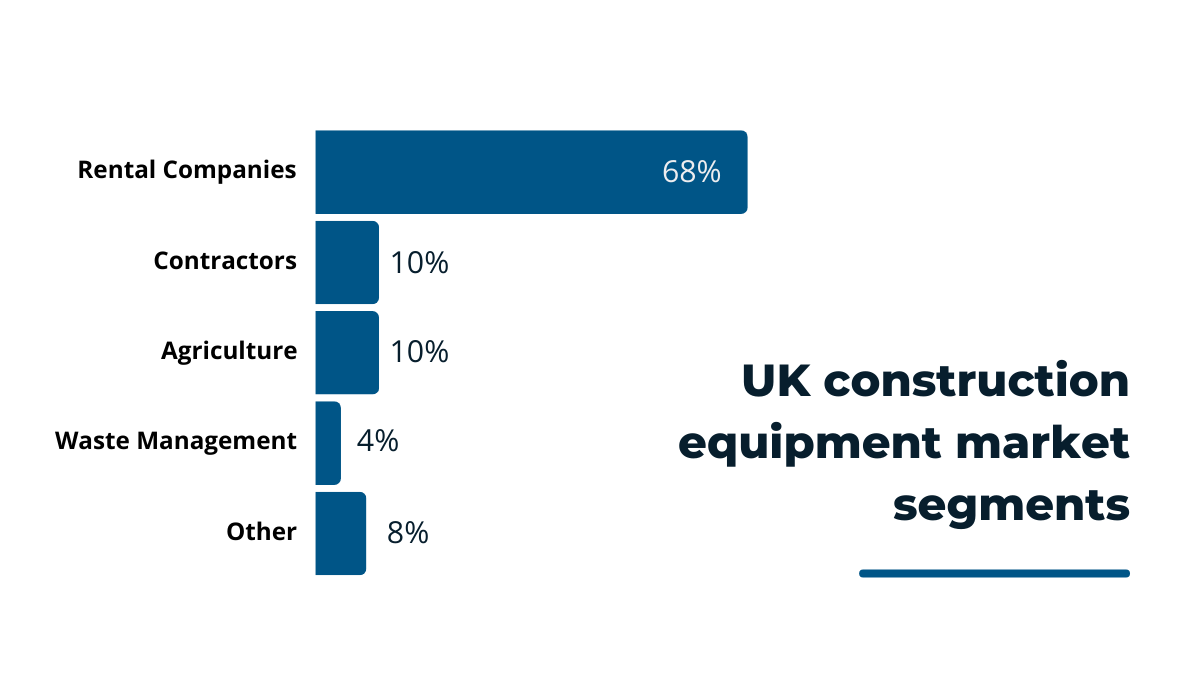

With a 68% Share, Rental Companies Dominate the UK Construction Equipment Market

Finally, we have the CEA’s data on UK construction equipment market segments.

With all of this talk at the beginning of this article about equipment ownership, it’s interesting to see that the biggest market segment in the UK is rental companies, with a 68% share.

This significant share comprises major construction equipment rental and leasing players in the UK, including Sunbelt Rentals, Speedy Hire, and HSS Hire Service Group.

The CEA report notes that UK rental companies are highly adaptable to client needs and overall trends, which helps them stay competitive.

For instance, rental companies have increasingly shifted towards low-carbon and zero-emission efforts, focusing on sustainability and environmentally conscious practices.

This shift reflects a growing awareness of environmental issues in the construction industry and demonstrates how rental companies are positioning themselves to meet changing market demands.

All in all, the dominance of rental companies in the UK market suggests that, despite trends towards ownership, there’s still a strong preference for flexible equipment solutions in the UK construction sector.

Conclusion

We’ve covered a lot of ground, from the rising trend of equipment ownership and the most sought-after types of machinery to the leading manufacturers in the industry.

We’ve even explored some UK-specific data on production, export, and renting.

Hopefully, this information has given you a better understanding of the current state of the construction equipment market.

Use it to make better-informed investment decisions, guide operations, and anticipate future trends.

Staying informed is key to success in this industry.

So, keep up with the trends and use them to your advantage to ensure your business thrives.