At the end of the year, every company goes through the numbers to assess its performance.

One of the crucial financial metrics that allows business owners to evaluate the effectiveness of their asset management is the asset turnover ratio.

It offers insights into a company’s capacity to use its assets to generate sales revenue.

In this article, we will explore the concept of asset turnover: how to calculate it, why it is important, and how it can contribute to better decision-making, as well as where it falls short in providing a comprehensive analysis.

In this article...

What Is Asset Turnover

Asset turnover is a financial metric that indicates how efficiently a company is using its assets and resources to generate revenue or sales.

At its core, it’s an efficiency metric that signifies a company’s capacity to generate revenue from its assets.

Normally, the asset turnover ratio is calculated annually.

A higher asset turnover ratio points to better performance, suggesting that the company is generating more revenue for each dollar of assets.

Consider the following example as an illustration.

If your company generates $100,000 in revenue with total assets amounting to $50,000, the asset utilization ratio would be 2:1, or in financial terms 2.0.

This implies that your operations yield $2 in revenue for every $1 invested in assets.

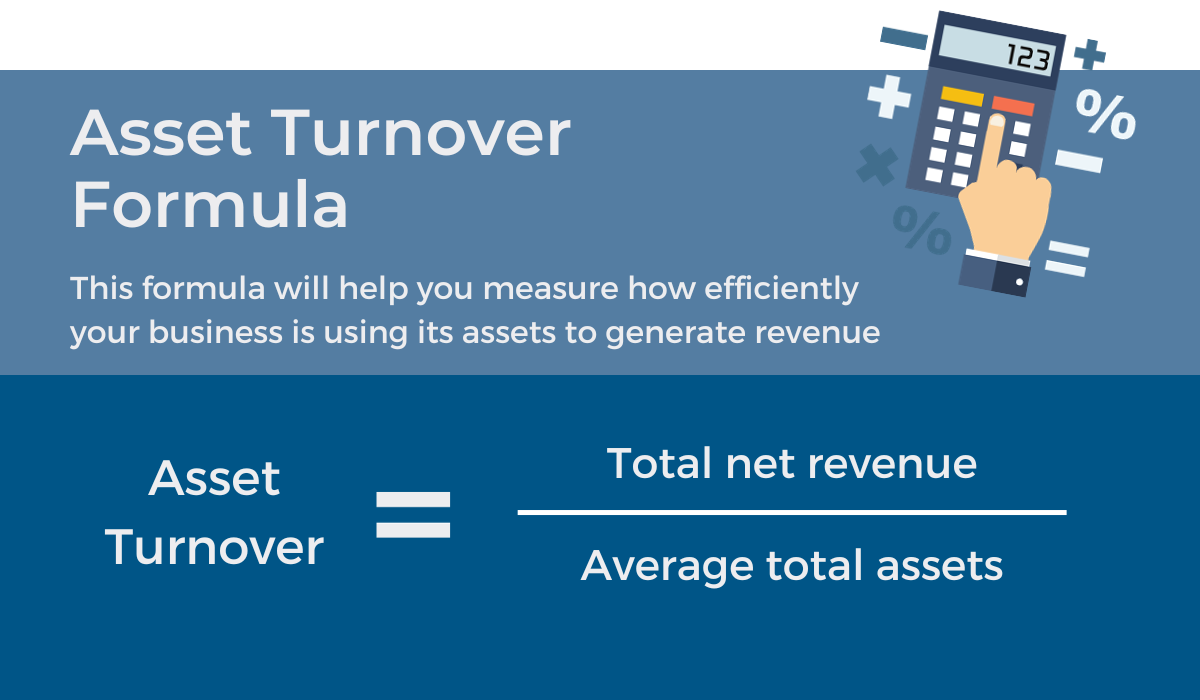

To determine your ratio, divide your company’s net sales by the value of its total assets.

Net sales are calculated by deducting any returns, allowances, or discounts from the gross sales, while total assets are equivalent to your equity minus any liabilities.

The formula looks like this:

So, what exactly does asset turnover show?

In general, a higher asset ratio is encouraging because it implies that your company is using its assets optimally and efficiently.

On the opposite, a lower ratio may suggest that a company is not using its resources productively which could be stemming from underutilized assets, ineffective collection methods, poor inventory management, or other related issues.

Nonetheless, there’s no fixed rule of what a good asset turnover ratio is, because acceptable ratios vary across industries.

The size of the company and the operation environment should also be taken into account.

For instance, a construction business needs substantial assets, including costly machinery, in contrast to a service-oriented business, like a marketing firm, with a relatively small asset base.

In this case, the construction business will show significantly lower asset turnover, but that’s nothing to worry about. It’s just a matter of apples and oranges.

This only emphasizes the importance of comparing asset turnover ratios among companies within the same industry, but we’ll come to that later on.

Meanwhile, take this as an example—in the retail sector, a favorable asset turnover might be around 2.5, whereas investors in utility stocks typically shouldn’t anticipate an asset turnover ratio exceeding 0.5.

Why Is Asset Turnover Important

The asset turnover ratio is a crucial financial metric for business owners and analysts, offering valuable insights into a company’s financial performance and highlighting potential areas for improvement.

To that point, a low ratio may indicate that the company should review its asset management strategies or explore ways to increase its sales.

In the following sections, we discuss how measuring the asset turnover ratio can contribute to improving your business strategy and execution.

First and foremost, it helps make the right decisions.

Helps With Decision-Making

Now, if assets are not used properly and effectively, they will not generate the desired income.

If the turnover ratio significantly drops, it may be a red flag signifying there is an issue with the assets and you should take a closer look.

In other words, to be able to make the most of your assets you have to make sure they’re well taken care of and in full operational capacity.

Therefore, it’s vital to monitor the utilization of your business equipment, not just occasionally but on a daily basis.

An asset management software solution proves very helpful in this area, as it allows you to keep detailed maintenance logs and equipment records in your main database.

GoCodes Asset Tracking’ scannable QR codes can provide you and your maintenance staff with quick and easy access to a wealth of information related to the equipment, including a maintenance history.

This will keep you in the loop about how well your assets are performing and aid your decisions on when to schedule regular maintenance.

Additionally, the software also allows you to set and assign future service dates, ensuring preventive maintenance is never missed.

In the long run, establishing a robust preventive maintenance schedule will guarantee the smooth operation and extended lifespan of your critical assets, and with it a good turnover.

Measures Business Performance

Knowing how to calculate the asset turnover ratio will help you know where you stand in the business and how well your company is doing.

You will be able to assess your business performance and identify inefficiencies in your company’s operations. That way you’ll be able to determine if your capital is efficiently utilized to generate profits.

To put it differently—the better your company is performing, the higher the ratio.

Moreover, analyzing asset turnover over prolonged periods reveals trends.

Namely, if your company’s turnover ratio is increasing or remaining stable it means your efficiency is improving.

If it’s declining, it may signal potential issues.

Calculating returns on assets makes asset management way simpler and enables you to establish how well your team is employing resources to maximize revenue.

Or, in the words of Peter Drucker:

You can’t improve what you don’t measure.

Rightfully, this financial tool, though simple, is one of the key drivers of a company’s profitability.

Enables Comparison to Competitors

As mentioned earlier, comparing your asset turnover to other companies only makes sense if they are within the same sector.

While considering variables, such as the high cost of machinery and equipment depreciation, it’s essential to assess your business performance relative to competitors.

This entails determining the typical asset turnover ratio for a construction company of your size within your industry.

This will give you an idea of how well your company is doing in a wider business context.

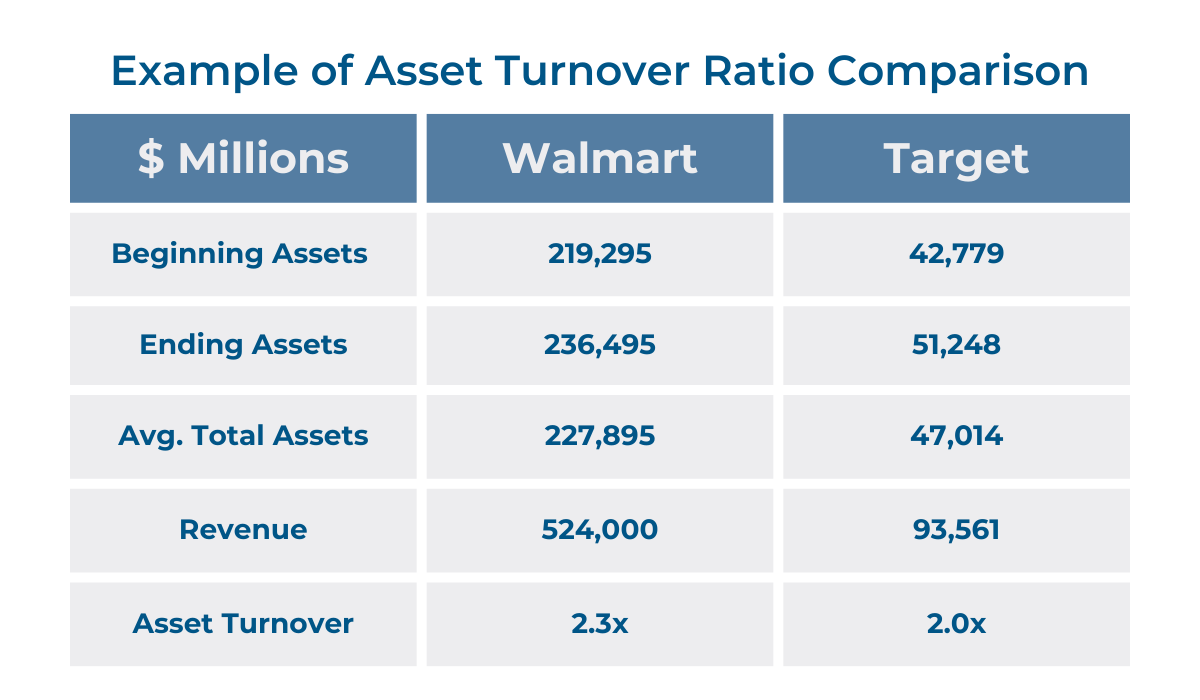

Let’s take a second to review how two of the biggest retailers in the U.S. compare in terms of their asset turnover ratio.

The table above shows that for every dollar put into assets, Walmart generated $2.30 in sales, while Target generated $2.00.

Therefore, the figures suggest that Walmart achieves higher sell-through rates on its inventory and optimally utilizes its assets.

Target’s lower turnover, on the other hand, might suggest that the retail company faced slow sales or is holding old inventory.

Additionally, it could indicate lax collection methods, resulting in an extended collection period and higher accounts receivable.

There’s also a possibility that Target is not using its assets to their full capacity, with fixed assets like property or equipment potentially remaining idle or underutilized.

In any case, such comparison can motivate companies to investigate and analyze the root causes of the asset turnover ratio and implement measures for improvement.

Essentially, examining your business’s financial trajectory enables you to predict future growth and make informed decisions that can enhance your competitiveness.

How to Calculate Asset Turnover

Let’s make it clear—numbers never lie. But, sometimes, you have to read between the lines.

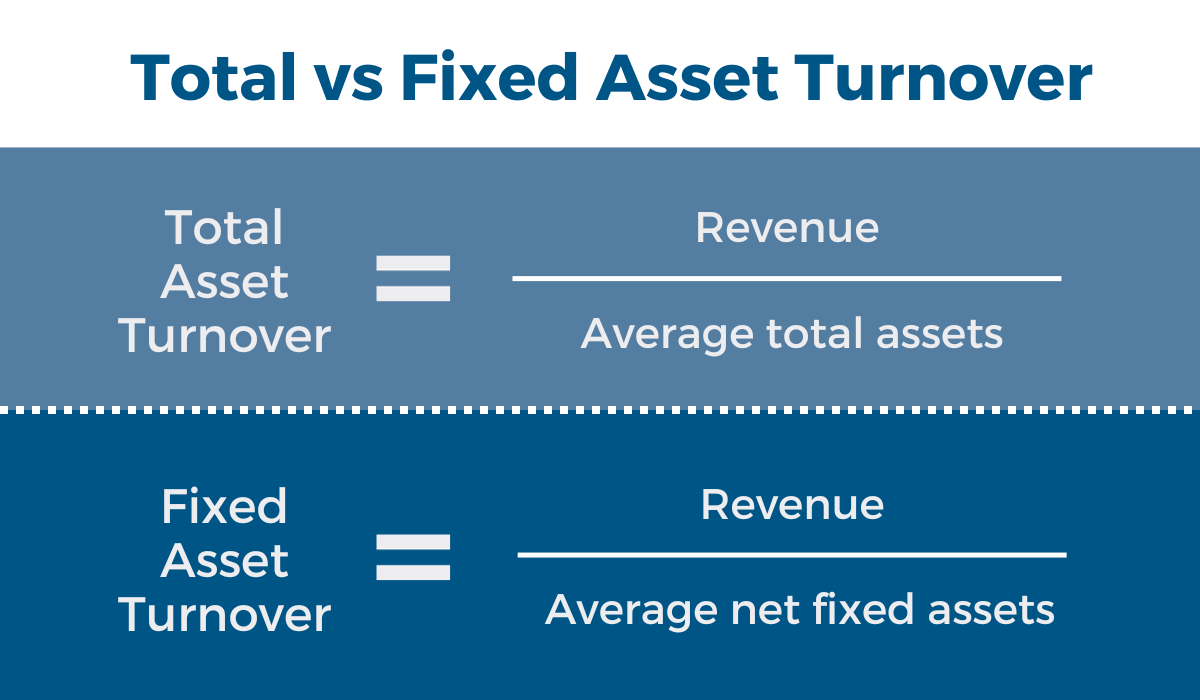

To be able to calculate your asset turnover ratio and determine if there’s an area where efficiency is lacking, you should consider both your company’s total and fixed asset turnover.

Total assets include both fixed assets and current assets.

And they can tell a very different story about your business performance.

Total Asset Turnover

The total asset turnover ratio measures the revenue that a company generates from every dollar of the total assets.

Here’s how you can calculate it.

Your balance sheet reveals your company’s assets at the beginning and end of the year.

To get the average value of assets throughout the year, add the two asset values and divide the sum by 2.

Then, use the formula provided above to compare this average to the total annual sales or revenue, as indicated on the income statement.

Your company’s total asset turnover can serve as a proxy for its profitability.

It can help you expose underlying problems and scale your business performance.

It can also indicate your company’s standing relative to competitors.

However, there are limits to the accuracy of the total asset turnover rate.

For instance, if a significant new asset is purchased or an old one is disposed of, it may not provide a true reflection of the situation.

Fixed Asset Turnover

Similarly, you can calculate your fixed asset turnover, but in this scenario, only the fixed assets are compared to the total revenue.

Fixed assets encompass all tangible long-term assets, such as land, buildings, machinery, equipment, and vehicles.

In essence, fixed asset turnover measures how efficiently a company can convert its fixed assets into cash flow, in addition to its operating performance.

A high fixed asset turnover indicates effective utilization of fixed assets in creating value.

Efficient fixed asset management is crucial for enhancing business productivity and efficiency.

It involves the upkeep of your company’s fixed assets, evaluating their condition, and ensuring they remain in optimal working order.

Moreover, fixed asset turnover not only reveals if new fixed assets contribute to increased sales but also whether existing assets are still fulfilling their intended purpose.

One downside of this metric is that it may provide a misleading image of the financial health of companies with seasonal or cyclical income streams.

Even with a high fixed asset turnover ratio, there is no assurance of a steady cash flow, and the business might still incur losses.

Conclusion

Asset turnover is a key metric for assessing how efficiently a company is managing its assets.

Analyzing how much sales revenue a company generates from its assets provides business owners and analysts with insights into its operational performance.

Understanding and monitoring asset turnover ratios can enable you to identify potential areas of concern, perform better financial analysis, and take actions for adjustment or improvement.

Furthermore, by comparing your asset turnover ratio to one of your competitors you will get an idea of where your business stands in terms of profitability and success.