The equipment rental market is constantly evolving.

We looked into various sources, compiled key data, and distilled them into must-know statistics on equipment rentals.

Companies that stay on top of the latest industry insights can better predict the future and prepare for inevitable changes.

So join us in exploring key market insights concerning construction equipment rentals and confidently map your path to success!

In this article...

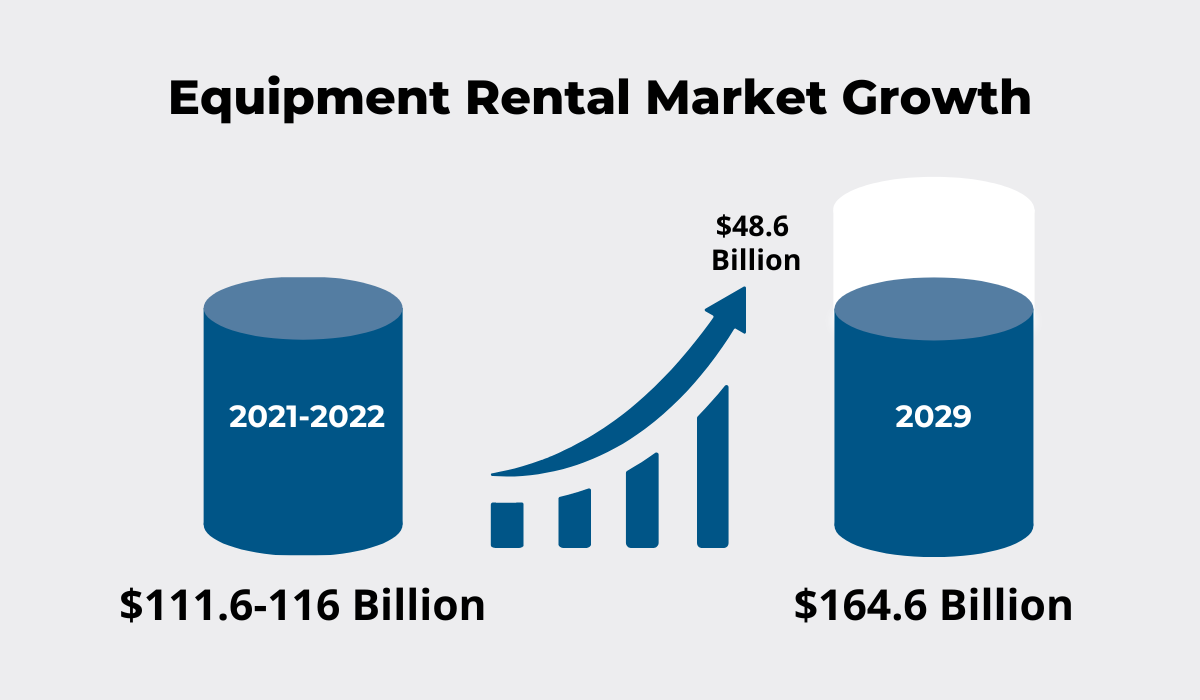

The Global Construction Equipment Rental Market Size Is Projected to Grow to 164.6 Billion USD by 2029

The Fortune Business Insights report indicates that the global equipment rental market is set to reach $164.6 billion by 2029.

This substantial increase is highlighted by the comparison to the market values from 2021 and 2022, which ranged between $111 and $116 billion, and the $48.6 billion growth projected between 2022 and 2029.

The 48.6 billion increase during the forecast period corresponds to a compound annual growth rate (CAGR) of 5.1%.

To put these findings into perspective, let’s go back in time for a bit.

In 2020, the equipment rental market shrunk due to the coronavirus pandemic, but then it witnessed substantial growth in 2021.

It seems that rental businesses took advantage of the uncertainties caused by the pandemic, as Fortune Business Insights reports.

The construction companies preferred to stay flexible in those volatile times, renting instead of owning equipment so the rental equipment market grew.

Based on the high inflation, climbing construction costs, and the ongoing shortage of skilled labor, this growth trend is expected to continue in 2024 and beyond, and equipment rental companies need to be ready for it.

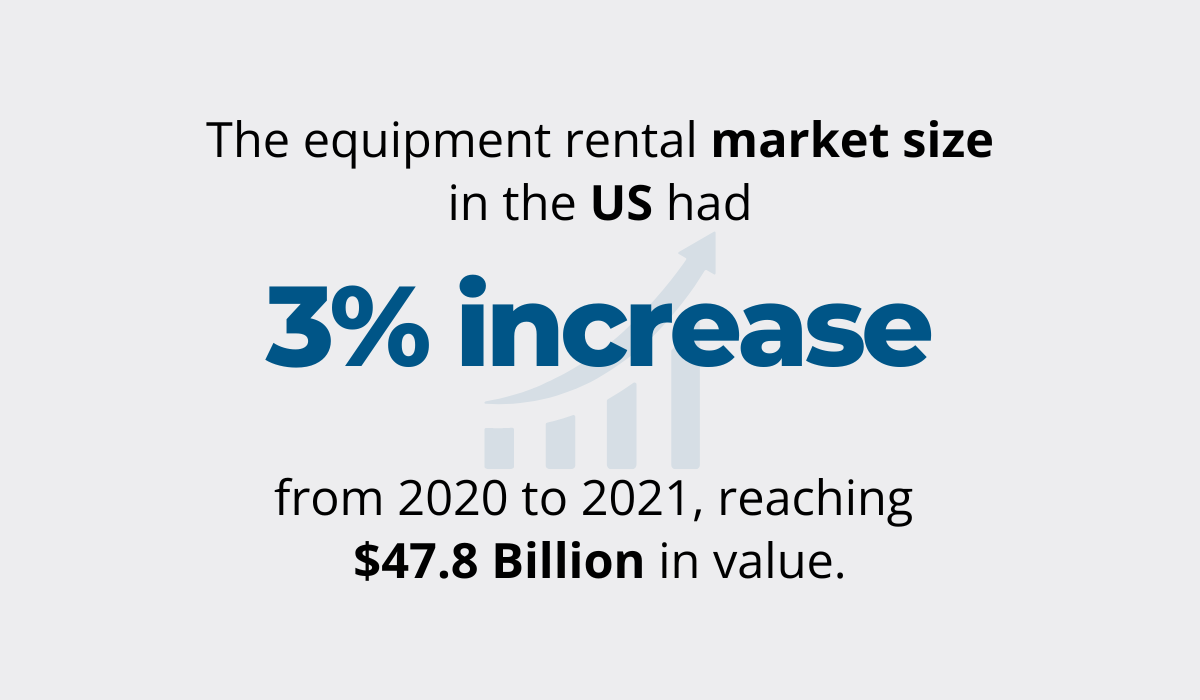

In 2021, the Equipment Rental Market Size in the US Grew by 3% From 2020, to 47.8 Billion USD

If we zoom in on the US equipment rental market only, we see an increase in market size in the same 2020-2021 period, evidenced by Statista’s data.

In a time span of one year, the US equipment rental market increased by 1.6 billion, from 46.2 to 47.8 billion USD in value.

The upward trajectory is bound to continue, and in 2024 surpass the level recorded in 2019.

What does this mean for your equipment rental company?

The ongoing growth trend indicates that the high demand for construction rental equipment won’t be stopping any time soon.

Given that technological advances in heavy equipment are among the biggest drivers of global equipment rental market growth, acquiring smarter, safer, and more efficient assets is one direction that’s sure to attract companies who wouldn’t want to risk large purchases.

Keeping in mind these opportunities for increased profit is vital for the ongoing success of your business.

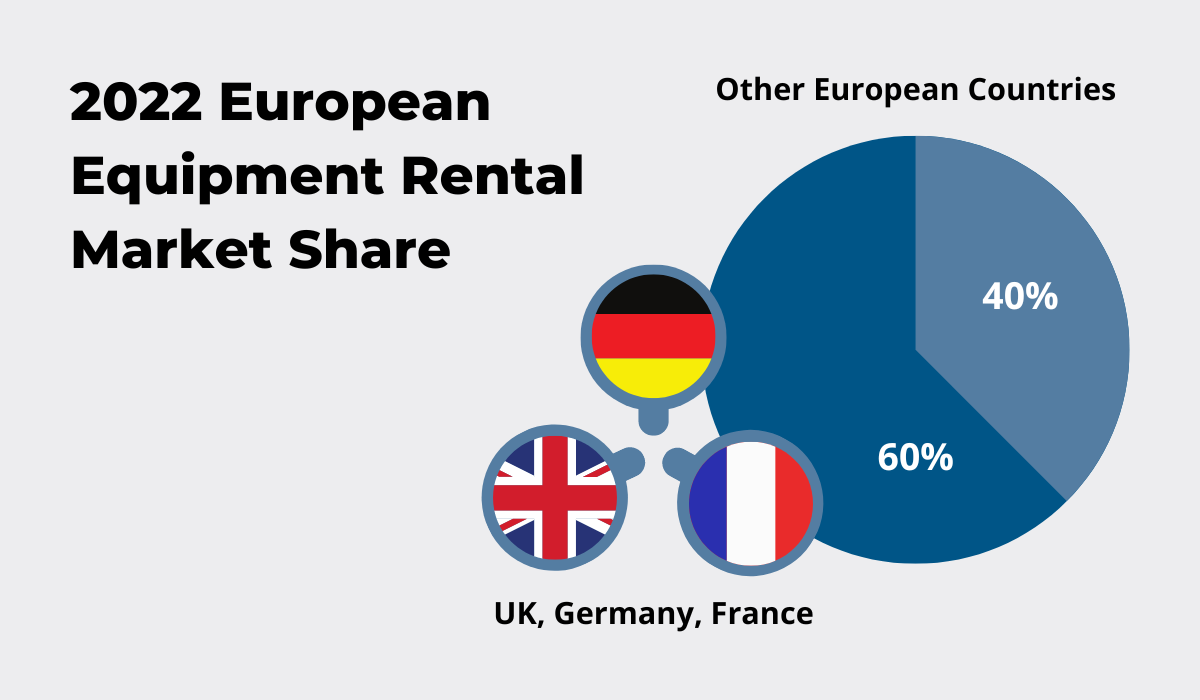

UK, Germany, and France Made Up About 60% of the European Equipment Rental Market in 2022

ERA’s 2022 report showed that the European equipment rental market is also concentrated heavily in just three countries.

Namely, 60% of the equipment rental market share falls to the UK, Germany, and France.

The only countries close to the leading three are Italy and Spain, which are expected to experience more significant growth in 2024.

These markets are either highly consolidated or moving toward it, and the demand for rental construction equipment drives further development.

In addition to the insights that you can apply to the US context, observing these trends in the European markets can also guide your strategy for international expansion.

With middle and large-size companies already dominating the more mature markets, and posing strong competition, knowing where to turn for strategic partnerships or growth opportunities makes a world of difference.

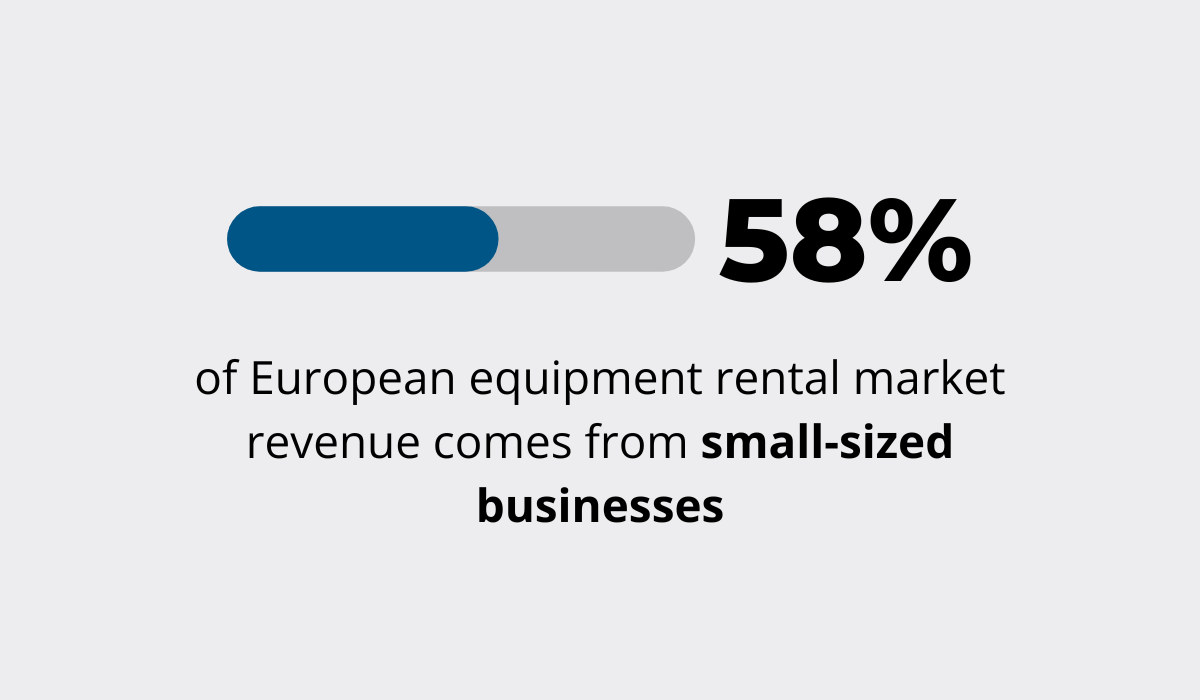

58% of European Equipment Rental Market Revenue Comes From Small-Sized Companies

Despite the prevalence of the middle and larger-sized players in bigger European markets, the ERA 2022 report shows that most of the revenue is brought in by smaller equipment rental companies.

Let’s take a look at the UK market as an example.

Almost 60% of UK rental market employees work in middle or large-size businesses, but when it comes to the country’s rental turnover, 54% of it comes from smaller firms.

The report states that “there is an appetite for further consolidation in the market as smaller companies are looking for buyers.”

However, it also shows that smaller construction rental businesses are actively carving out a place for themselves in a competitive market.

These insights into market dynamics reveal specific customer preferences or needs in the European landscape.

At the same time, they can propel you to evaluate your company’s performance and positioning within the US market, as well as the next moves.

After all, if smaller businesses leverage their strengths and adapt their business model to answer the demands of their local market, they’re sure to grab the attention of both customers and larger companies.

With a 56% Market Share, Earthmoving Machinery Led the Global Construction Equipment Rental Market in 2023

A recent report by Precedence Research showed that earthmoving machinery was the most sought-after piece of equipment on the market in 2023.

Earthmoving machinery such as excavators, wheel loaders, and backhoe loaders has widespread application in different industries, leading to a high worldwide demand.

The material handling machinery takes up 27% of the share, which leaves concrete and road construction machinery at 17%, but with a good projected growth rate.

Nevertheless, the earthmoving machinery’s top spot remains uncontested, which sends a clear signal to equipment rental companies.

Whether you typically rent more specialized machines for a particular industry or have a large selection of widely used equipment, earthmoving machinery gives your fleet a more universal appeal.

And with such high demand across multiple industries, having this equipment can help draw in new customers outside of your target audience, boosting revenue to new levels.

7.6% Was the Expected Increase in Fleet Spending in 2022

The AC Business Media’s findings on the outlook of the rental equipment industry pointed in the direction of increased fleet spending.

The 7.6% increase estimated for 2022 corresponds to the market’s recovery after the pandemic and growth, but also highlights the rental companies’ priorities.

Fleet spending doesn’t translate just to new assets, but also to technology investments and new maintenance trends that require greater expenses.

The report identifies maintenance as one of the key areas of increased spending, with 40.2% of surveyed fleet managers reporting that “their organization was increasing maintenance budgets to extend the useful life of the equipment.”

Budgeting and cost-saving measures remain high priorities for equipment rental businesses, and one way of achieving that is by tracking efficiency and asset utilization.

Josh Nickell, the Vice President of the American Rental Association’s equipment segment, also emphasized that guesswork is no longer an option:

“You can’t just assume that there’s a piece of equipment on your lot or hope one will be back in time; you have got to do a lot more planning, and use analytics to forecast what your needs are going to be.”

By turning to telematics, analytics, and other advanced technologies, equipment rental companies are finding ways to turn spending into profit.

In 2022, 30% of American Rental Association Members Felt That the Equipment Rental Industry Was Trending Worse

The industry’s growth in post-pandemic years isn’t without its obstacles, and ARA’s annual survey seems to confirm that, with 30% of ARA’s members expressing that the equipment rental industry is taking a turn for the worse.

The relatively high percentage is particularly puzzling if compared to 2020, the height of the pandemic when less than 20 percent of the members said that the industry was trending worse.

Here’s why it’s important to examine where this is coming from and shed more light on the research.

Construction rental company owners have been dealing with supply chain disruptions, labor shortage issues, and high inflation, causing ongoing fatigue and frustrations.

ARA’s Nickell believes that these “multi-year problems” dampened the optimism that would otherwise be there, and notes that the members’ expectations about increased revenue give a more optimistic and accurate view of the state of the industry.

Conclusion

Equipment rental statistics are shining a light on the ever-changing industry, helping businesses navigate the market that witnessed growth on both the US and global levels.

The European market is dominated by three big economies, with most of its revenue coming

from small-sized rental companies.

Globally, earthmoving machinery is the most in-demand type of rental, and although fleet spending is bound to increase, fleet managers work to improve assets’ lifespan and efficiency.

No matter your outlook on the future of the equipment rental industry, we trust this article helped you map key trends and solutions for making your business thrive!