Key Takeaways:

- Depreciation impacts equipment resale value and tax liabilities.

- Major equipment upgrades can extend equipment life and adjust depreciation.

- Leasing offers flexibility but requires careful financial planning.

- Tracking depreciation ensures accurate project pricing and profitability.

Your construction company depends on heavy equipment—excavators, bulldozers, loaders, and cranes—to keep projects moving.

But over time, these machines gradually lose value, affecting their resale price and financial impact on your business.

This loss in value is called depreciation—an accounting method used to spread the cost of equipment over its useful life.

Understanding how depreciation works can help you manage costs, plan equipment purchases, and reduce tax liabilities.

In this guide, we’ll break down equipment depreciation, explain how it affects your business, and show you how to use it for smarter decision-making.

Let’s get started.

In this article...

What Is Equipment Depreciation?

Depreciation is the gradual loss of equipment value over time.

It’s different from a sudden breakdown or accident.

Even if your bulldozer is in perfect working condition, it won’t be worth the same five years from now.

Several factors contribute to this decline:

- Regular usage

- Aging components

- Market shifts

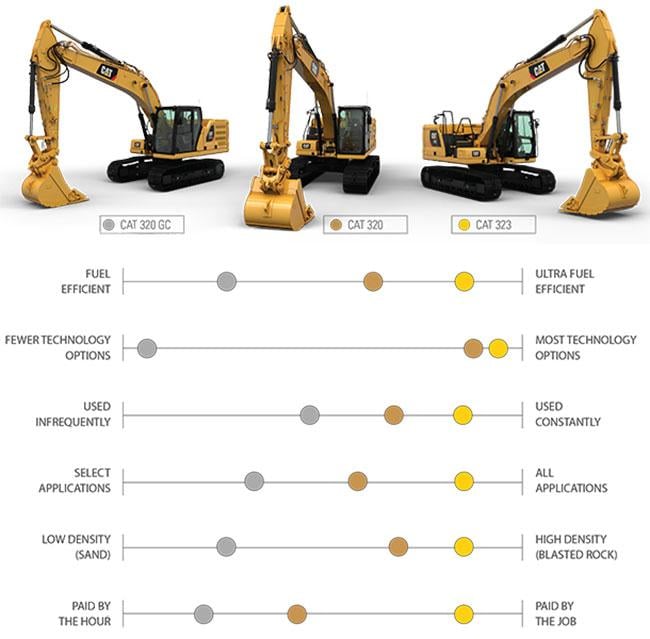

For example, if a newer, more fuel-efficient excavator enters the market, older models may lose resale value faster because buyers prefer the newer version.

Source: Hawthorne Cat

To calculate depreciation, certain factors must be considered.

Here are the key ones:

- Original purchase price

- Estimated useful life of the equipment

- Expected salvage value (what you can sell it for at the end of its life)

- Method used to spread its cost over time

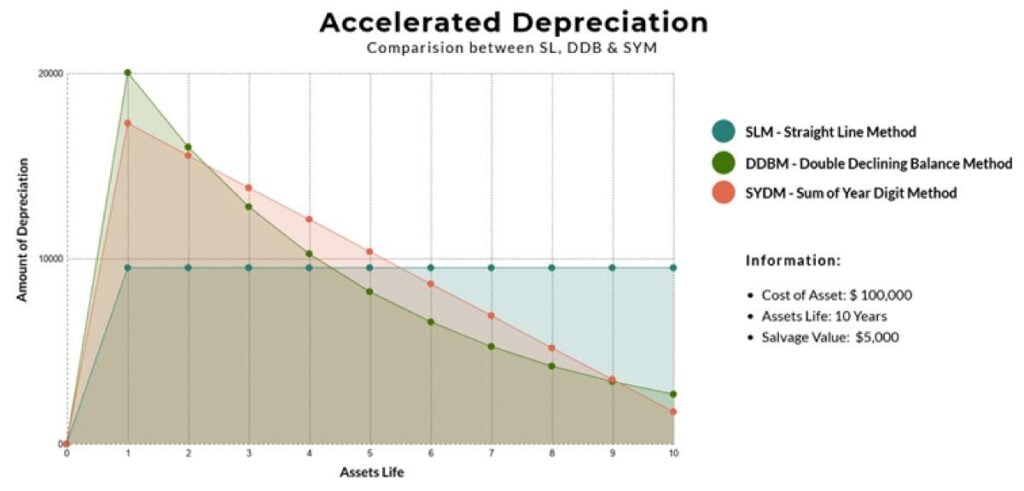

Now, there are different ways to calculate depreciation, such as straight-line and accelerated methods, each affecting your financial statements and tax liabilities differently.

Source: Limble

We won’t get into the technical details here, but if you want to learn more about depreciation methods and tax benefits, check out our article on the topic.

The Difference Between Depreciation and Wear & Tear

Depreciation and wear and tear both reduce the value of equipment, but they are not the same.

Wear and tear refers to physical deterioration from regular use, while depreciation is an accounting method that spreads the cost of an asset over time.

Think about a truck on your job site.

Over time, its tires wear down, the paint fades, and the engine may require repairs.

These physical changes affect resale value, but they are not depreciation.

Depreciation occurs even if the truck is in perfect condition—it’s a scheduled reduction in value recorded for accounting and tax purposes.

Tim Nygaard, a retired accounting professor from the University of Kentucky, explains it well:

Illustration: GoCodes Asset Tracking / Quote: Quora

In other words, while your equipment is out there working and helping you complete jobs, its value is being adjusted in the books to reflect its decreasing worth.

This is important because depreciation affects your financial statements.

It’s recorded as an expense, which lowers your taxable income.

But it also plays a role in determining when to sell or replace a machine—if you wait too long, its resale value may be too low to justify keeping it.

Some business owners ask whether maintenance is part of depreciation.

And the answer is no:

Routine maintenance costs, like oil changes or minor repairs, are recorded as expenses when they occur and don’t affect depreciation.

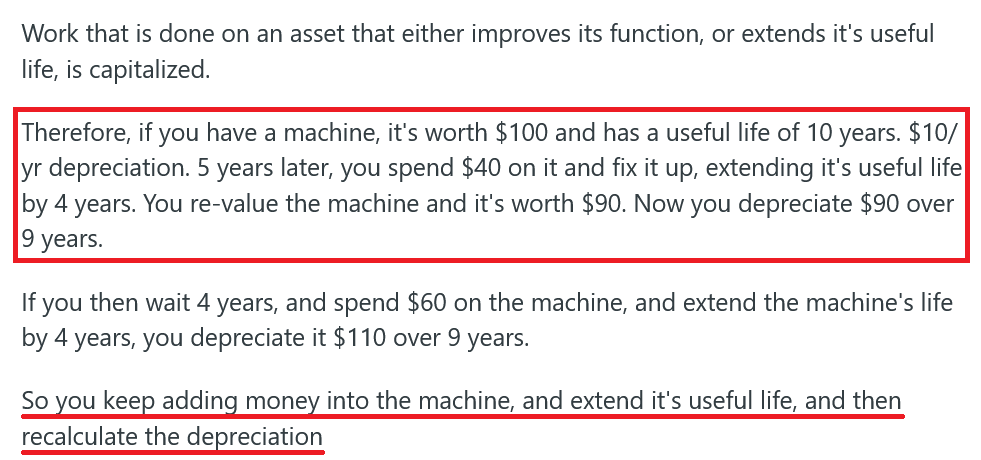

However, major repairs or upgrades that extend a machine’s useful life can change its depreciation calculation, as this Reddit user explains:

Source: Reddit

Let’s adjust the numbers for the construction industry.

For example, imagine you purchase an excavator for $100,000 with a 10-year depreciation schedule (losing $10,000 per year).

After five years, you invest $40,000 in upgrades that extend its life by four more years.

Instead of sticking to the original 10-year plan, you must now adjust depreciation to reflect the new total lifespan of 14 years.

If more upgrades are made later, depreciation is recalculated again.

This means that, while basic maintenance preserves equipment value, major improvements can actually impact how depreciation is recorded.

In short, regular maintenance helps protect your investment and resale value, but only significant upgrades that extend useful life change depreciation calculations.

Using Depreciation Data for Smarter Equipment Decisions

Now that you understand what depreciation is, let’s talk about how you can use it to make smarter business decisions.

Buying vs. Leasing Equipment

One of the biggest considerations you’ve probably faced is whether to buy or lease machinery.

Purchasing equipment is a long-term investment that builds company assets, but it also means accepting depreciation costs.

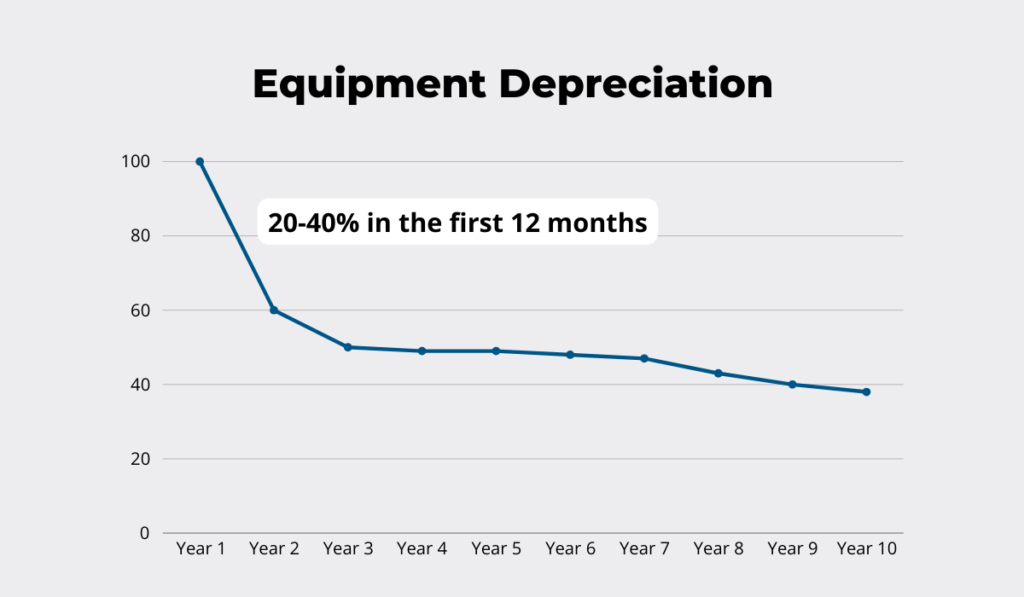

However, not all heavy machinery depreciates at the same rate.

While some types of equipment can lose 20–40% of their value in the first year, others hold their value longer depending on market demand, brand, and maintenance.

Illustration: GoCodes Asset Tracking / Data: JLG

One financial advantage of ownership is that depreciation provides tax benefits.

Businesses can deduct depreciation expenses over time, reducing taxable income.

However, since depreciation is recorded below EBITDA on financial statements, it does not directly affect a company’s operational profitability.

This matters for businesses with debt agreements tied to EBITDA, as depreciation may lower net income but not impact EBITDA-based financial ratios.

That being said, high depreciation expenses can still influence investment decisions, especially when companies evaluate cash flow for future purchases.

Leasing, on the other hand, offers flexibility and lower upfront costs.

Instead of tying up capital in large equipment purchases, companies can lease machinery that has already depreciated significantly.

This reduces the risk of owning assets that may become outdated or lose value quickly.

Leasing also makes it easier to upgrade to newer models without dealing with the hassle of selling old equipment.

However, under ASC 842 and IFRS 16 accounting rules, most lease liabilities must now be reported on balance sheets, and lease expenses appear above the EBITDA line, which can make a company look less profitable.

Source: Weaver

The only exception is short-term leases of 12 months or less, which remain off the balance sheet.

So, for companies that prioritize long-term value and tax benefits, purchasing equipment is often the better option.

But for those who need financial flexibility and want to avoid the risks of ownership, leasing can provide a strategic advantage—especially when equipment needs change frequently.

Understanding how depreciation impacts each option is key to making the right decision for your business.

When to Sell or Replace Equipment

Deciding whether to sell or repair equipment is one of the biggest financial decisions construction companies face.

On one hand, keeping older machinery in use can maximize its remaining value and delay expensive replacements.

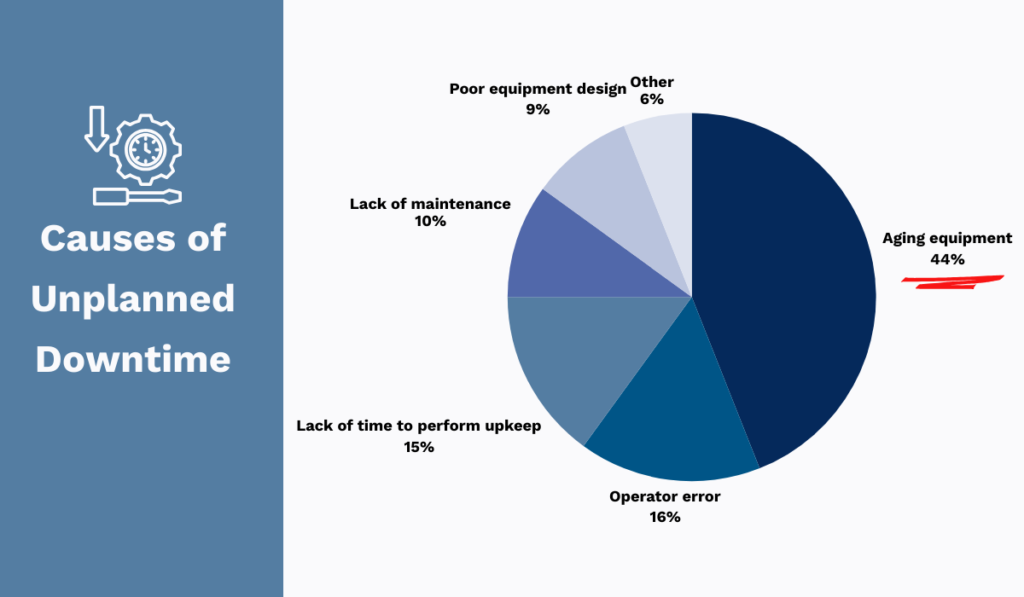

On the other hand, aging equipment becomes less reliable, with rising maintenance costs and an increasing risk of unexpected breakdowns.

In fact, statistics show that aging equipment is the leading cause of unplanned downtime, as you can see below:

Illustration: GoCodes Asset Tracking / Data: Plant Engineering

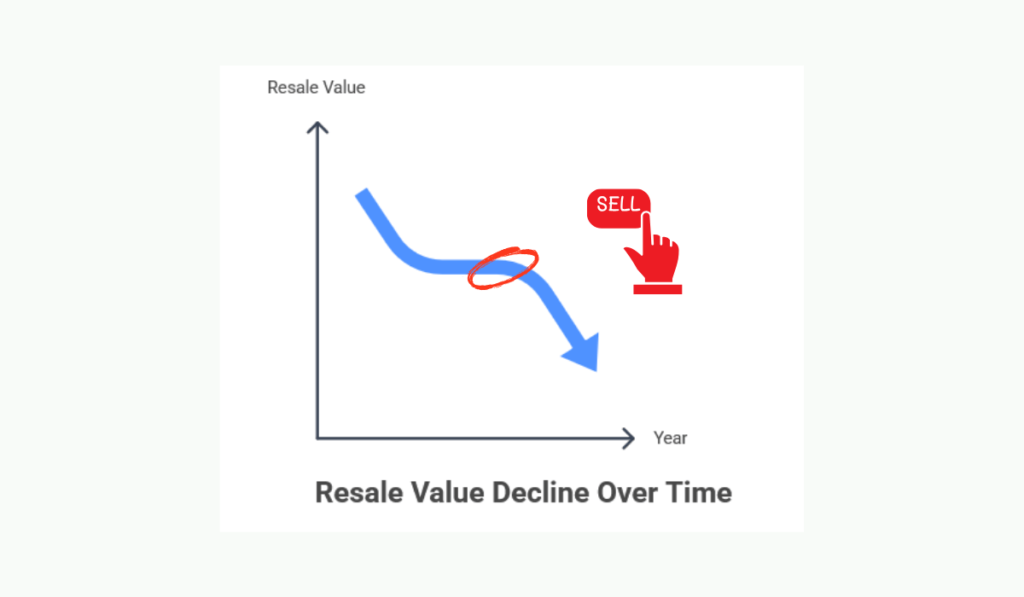

This is where depreciation data becomes crucial.

Depreciation helps companies estimate how much value a machine is losing over time, which is essential for deciding whether it’s still worth keeping.

Let’s say an excavator was purchased for $200,000 and has depreciated to $80,000 after five years.

This means that the company needs to consider whether it makes financial sense to continue using it or sell it before its value drops further.

Source: GoCodes Asset Tracking

One of the most effective ways to make this decision is by comparing annual maintenance and repair costs to depreciation trends.

If a machine is still losing significant value each year and repair costs are rising, it may be more cost-effective to replace it.

However, if depreciation has slowed down and the machine is still performing well, keeping it may be the better option.

For example, say a bulldozer is now worth $50,000, but annual repair costs have risen to $15,000.

If the bulldozer is expected to lose only $5,000 more in depreciation over the next year, keeping it might be worth it.

But if depreciation is expected to accelerate due to market conditions—or if unexpected breakdowns could cause costly project delays—it might be better to sell before its resale value drops further.

Hidden costs also play a major role in this decision.

When equipment breaks down unexpectedly, the cost isn’t just the repair bill.

As Dan Corbett, equipment manager at Lancaster Development, explains, emergency repairs often cost far more than planned replacements.

Illustration: GoCodes Asset Tracking / Quote: For Construcion Pros

Not because of the repair itself, but because of lost productivity and rental expenses.

With depreciation tracking and proactive maintenance, companies can avoid these hidden costs and replace equipment at the right time—before it becomes a financial drain.

How Depreciation Affects Profitability

Properly accounting for depreciation also plays a critical role in financial planning and project profitability.

Since depreciation is a non-cash expense, it lowers reported profits on financial statements without affecting cash flow.

However, if a company does not track depreciation correctly, it may overestimate its profits, miscalculate project costs, or face tax-related issues.

For example, if a bulldozer is expected to depreciate by $50,000 over five years, that means a $10,000 annual depreciation expense.

If this cost isn’t factored into project bids, a company might unknowingly undervalue its services, reducing overall profitability.

Therefore, depreciation should be treated as part of total equipment ownership costs when estimating project expenses.

Source: GoCodes Asset Tracking

Beyond project pricing, depreciation is also essential for budgeting and long-term financial planning.

Equipment doesn’t last forever, and companies need to set aside funds for future replacements.

As The Hartford’s Business Owner’s Playbook notes, businesses can use depreciation data to plan how much of their revenue should be allocated for replacing machinery over time.

Illustration: GoCodes Asset Tracking / Quote: The Hartford

Without doing this, a company may suddenly face large capital expenditures with no reserves to cover the cost, forcing it to take on debt or delay essential equipment upgrades.

So, by treating depreciation as a real cost—not just an accounting entry—construction companies can make smarter financial decisions.

In short, proper depreciation management allows businesses to protect profitability, maintain healthy cash flow, and ensure long-term financial stability.

See how crucial depreciation is?

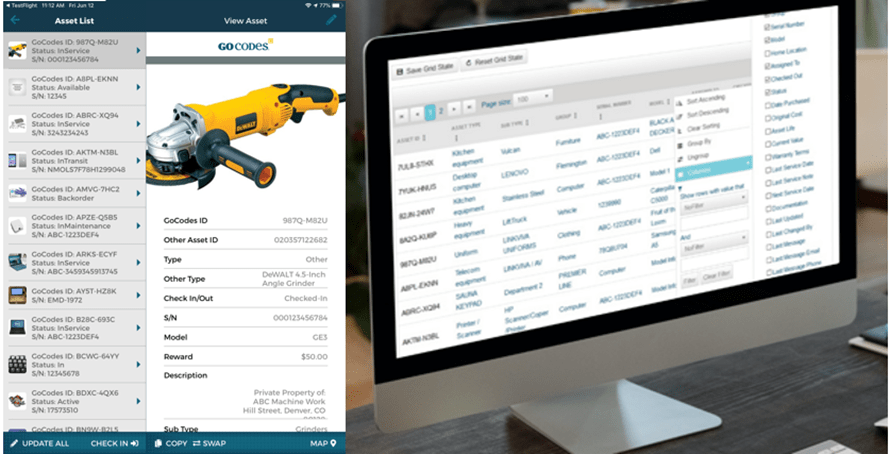

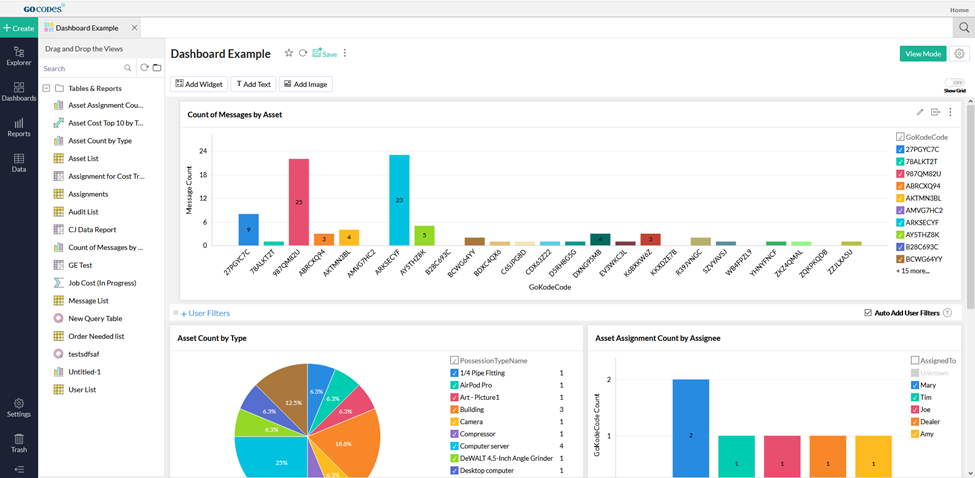

How GoCodes Asset Tracking Simplifies Equipment Depreciation Tracking

Keeping track of equipment depreciation can be a headache.

You already have enough on your plate: managing job sites, handling crews, and keeping projects on schedule.

The last thing you want is to spend hours digging through spreadsheets just to figure out how much your excavators or bulldozers have depreciated.

And you don’t have to—with the tools like GoCodes Asset Tracking.

GoCodes Asset Tracking is an asset management software that centralizes all your asset data in one place.

You can store every detail about your equipment—purchase costs, acquisition dates, warranties, and even maintenance history—in one centralized system.

Source: GoCodes Asset Tracking

Since all this information is already in the system, GoCodes Asset Tracking automates depreciation tracking and reporting, making the entire process much simpler.

The system can automatically generate IRS-compliant depreciation reports using the Modified Accelerated Cost Recovery System (MACRS), including Straight Line (SL) and Declining Balance (DB) methods.

The system calculates:

- Annual depreciation

- Prior-year depreciation

- Current-year depreciation

- Total depreciation to date

- Remaining balance to be depreciated

When tax season rolls around, you can generate Excel-compatible reports in seconds, ready to hand off to your accountant.

Source: GoCodes Asset Tracking

That means fewer headaches, fewer errors, and no more last-minute scrambling to pull financial records together.

Bottom line?

GoCodes Asset Tracking saves you time, eliminates errors, and gives you the financial clarity you need to keep your business profitable.

If you’re managing multiple high-value assets, this is the tool that will help you stay ahead.

Conclusion

Now, you hopefully understand that equipment depreciation is much more than just an accounting concept.

It’s a powerful tool for making smarter business decisions.

Understanding how depreciation affects buying, leasing, selling, and project pricing enables business owners to make choices that boost profitability and promote sustainable growth.

So, if you want to optimize your decisions and maximize profitability, make sure you have a simple and efficient way to track your equipment’s depreciation.

A proper asset management solution will make that happen.