Owning or managing a business is like conducting an orchestra. Both require a wide range of skills like planning, leadership, communication, decision-making, and a focus on improvement.

Managers need these in order to guide a large number of people with different skill sets, personalities and tools toward the same business goal, just like conductors help instrumentalists perform the same musical piece.

However, a manager’s job is a lot more multifaceted than that of a conductor.

For example, a conductor doesn’t have to ensure that everyone has their instruments, and that all are kept in perfect working order for the big show—whereas a manager’s duties include making sure that her team members have all the equipment they need to do their job properly.

Therefore, efficiently handling business assets is of vital importance for a manager.

To help you make a more harmonious workplace, we share five actionable tips to manage your business assets faster and more effectively.

Starting with asset registers.

In this article...

Keep a Comprehensive Register

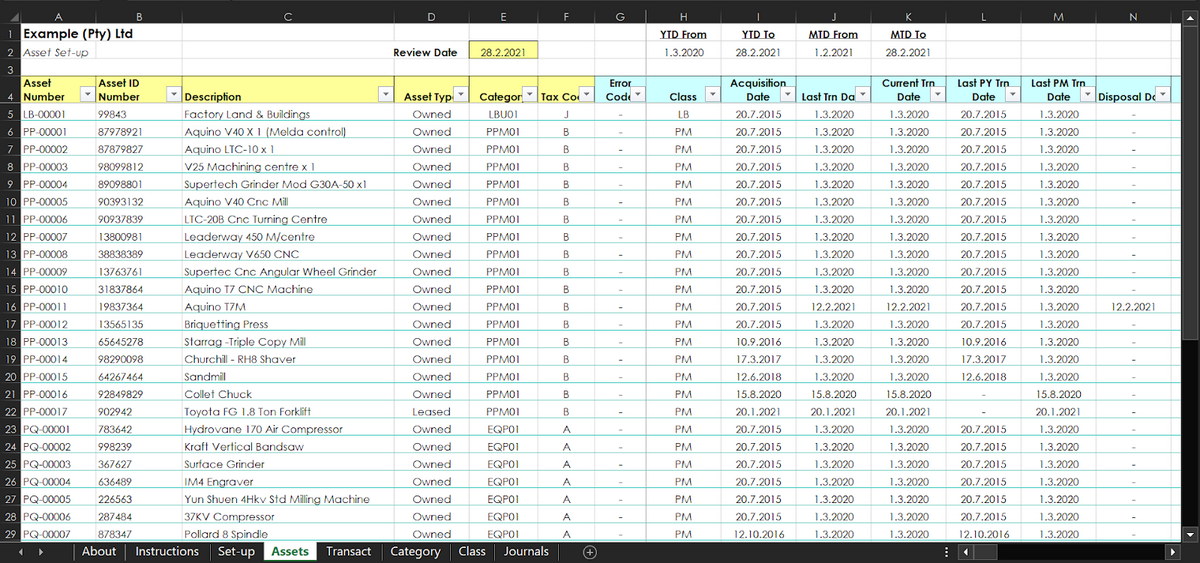

The groundwork for building any workable asset management strategy is creating and maintaining a comprehensive asset register.

Simply put, this is a database of all assets a business owns.

Everything should have an entry, from the big stuff like land, property, and vehicles, to smaller items like tools and office equipment.

Other than that, an asset register also contains accurate and up-to-date information about the assets, such as their name and description, time and location of purchase, value and depreciation rate, etc.

Here’s an example:

Basically, any information you have or your business could use should be here.

Having an all-encompassing overview of the entirety of your business’ assets is crucial for efficient management. To start, you can use it to track assets by any number of metrics.

Asset depreciation rates can give you valuable insights into your business’s financial condition.

Similarly, following the age, condition, and utilization rates of your equipment improves your understanding of how to make it produce more value for the business.

However you choose to approach the data, it will allow you to map out a more precise path forward and carve out a management strategy that leads everyone in your team down that path.

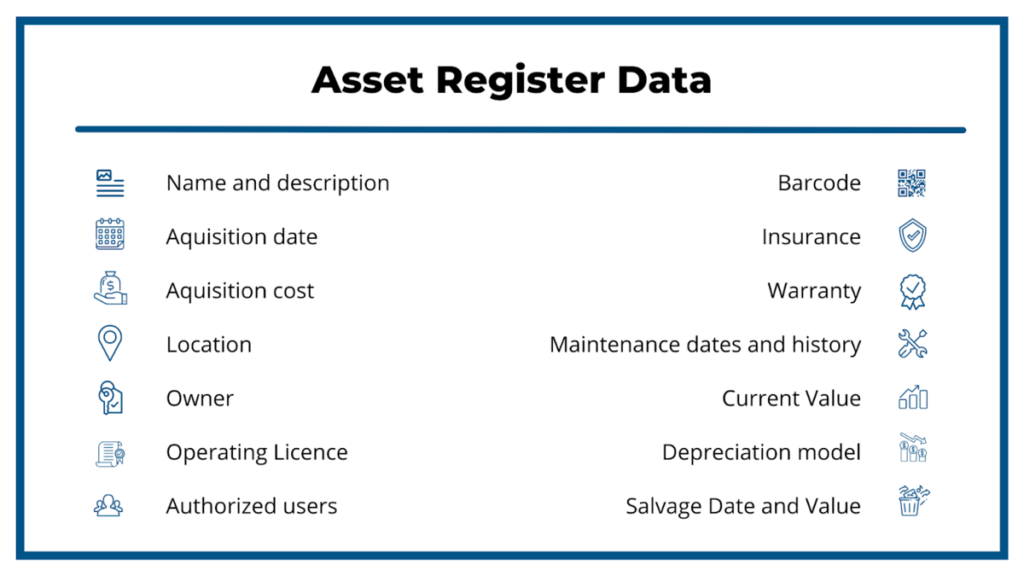

In terms of structure, there is a basic set of information common to the majority of asset registers.

Of course, every business is different, and you can add on as many data fields as you need to represent your unique circumstances.

However, be sure to start with the information below:

These data points will form a blueprint for the most common analyses at the beginning. When you streamline your procedures, it will be easier to experiment with additional details.

Ultimately, efficient management means making the best out of what you have, and an asset register helps you determine exactly what you have to work with.

Calculate Asset Depreciation

In the last section, we mentioned asset depreciation in passing. We’ll now go over what it means and how it can be applied to improve asset management.

Asset depreciation is an accounting method allowing you to tie the cost of an asset to the duration it will provide value to your business—i.e., its useful life.

Whether because they get spent due to use, or rendered obsolete by technological advancements like in the picture below, assets reach a point where they no longer hold any practical use.

With that in mind, the government allows businesses to allocate expenses for equipment in yearly increments until they reach that point.

There are two main benefits to taking advantage of that opportunity.

Firstly, it gives you more control over your business’s finances. Yearly depreciation expenses are tax-deductible.

In other words, they reduce the amount of taxable income your company has to report to the IRS, lowering your taxes.

Being able to stretch out asset expenses in self-made installments means you get to adjust them to go parallel with your expected earnings, or at least as close as you can manage.

And secondly, it provides you with an accurate, realistic value of your company.

Let’s say you do a valuation that includes a computer you bought four years ago for $2,000.

Given the quick development of that particular technology, the current value of the computer would be closer to $200, making for a 90% difference in price.

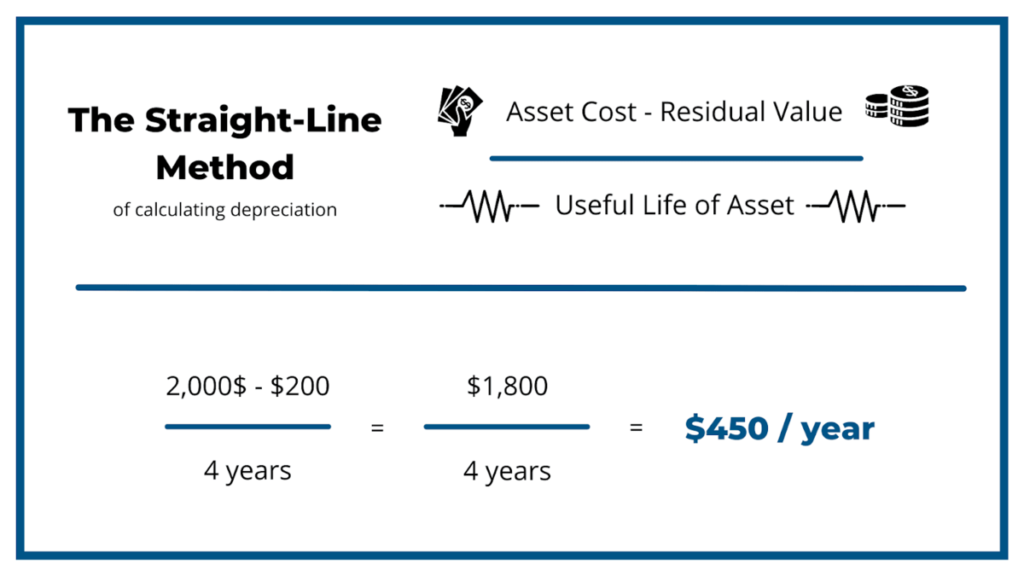

Here’s a simple way of calculating depreciation:

This is called the straight-line method. For a quick explanation, let’s go back to that $2,000 computer. We’ll give it a useful life of four years, and a generous salvage value of $200.

That leaves us with 1,800$ to report in expenses over four years. The straight-line method allocates them equally across the duration of the depreciation.

Therefore, you would have a yearly depreciation rate of $450 a year.

There are more methods of calculating asset depreciation.

Still, the straight-line method is the most widely used, along with double-declining balance (DDB), sum-of-the-years’ digits (SYD), and units of production.

Be sure to learn more about the other ones before deciding which one best fits your company’s income and long-term goals.

Overall, asset depreciation is a topic worth exploring, as managers can use it to distribute asset-related expenses more effectively and reduce taxes in the process.

Schedule Preventive Maintenance

Efficiently managing your assets includes ensuring they stay in optimal working order for as long as possible.

For that, you need to consider employing a preventive maintenance strategy.

Commonly speaking, maintenance is predominantly understood as a reactive measure, something to do after a problem or damage occurs.

However, in many cases, it is possible to avoid more severe outcomes if you react as soon as the symptoms appear, leading to cost savings and increased productivity.

Don’t take our word for it.

Pacific Northwest National Laboratory (PNNL), one of the nation’s leading research centers, confirmed it in their Guide to Achieving Operational Efficiency, conducted by the US Department of Energy:

By performing the preventive maintenance as the equipment designer envisioned, we will extend the life of the equipment closer to design. This translates into dollar savings.

The guide goes on to list a lower number of unexpected equipment breakdowns and, consequently, fewer interruptions of the daily maintenance schedule as additional benefits of preventive maintenance.

As Jim Whittaker, engineering services lead at JLL, said for Buildings.com:

In their guide, PNNL found that all of this adds up to preventive maintenance providing a 12% to 18% cost reduction compared to reactive maintenance.

Therefore, it’s important to take a preventive approach to maintenance.

Now, every asset is specific in how it is used, thus requiring different service frequencies: Therefore, you should go through this process one step at a time.

To begin, you will need an asset register or an inventory of your assets.

From there, make a list prioritized by risk factor, i.e., the chance of malfunctioning or developing problems in performance. The higher the risk, the more maintenance it will need.

Using this list, you can approximate service intervals for each asset, which you must fit into a schedule spanning over several months.

While this might seem like tedious work, it is ultimately worth it. And if you don’t like working with spreadsheets, a solution awaits you in the next section.

Track All of Your Business Assets

If you want to take your asset management to the next level, implementing tracking technology will be a giant step in the right direction.

The first advantage of asset tracking is boosting workplace productivity by allowing you to identify underutilized assets and put them to use better.

There are several ways to explain asset utilization.

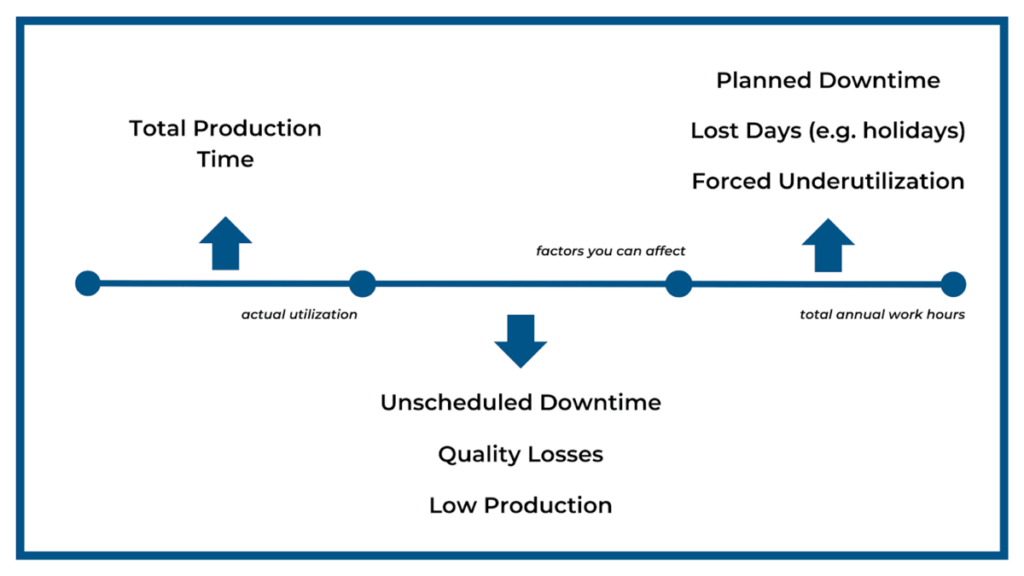

Here’s a simple formula:

In short, it takes the maximum amount of annual work hours, and deduces weekends, holidays, and other days on which the asset isn’t supposed to be working.

By dividing that number by the actual production time, you get the asset’s utilization rate.

It’s an excellent method to identify your business’s weak points so that you take appropriate action to strengthen them.

However, it’s hard to keep track of all assets without a dedicated tracking system like the one GoCodes Asset Tracking offers.

Firstly, GoCodes Asset Tracking provides QR-code tags you can use to significantly facilitate your asset-tracking efforts.

For office equipment, you can go with water and chemical-resistant poly labels. They come with permanent adhesive, so you don’t have to worry about them peeling off.

For an even more durable solution, there are metal foils like the one below.

Special cases, like vehicles and heavy equipment, have the option of 60mm aluminum tags with holes for additional bolts.

When you apply the tags to your assets, tracking is as easy as scanning QR codes with a scanner or a smartphone. This process can be helpful to your businesses in various manners.

For example, we mentioned utilization rates. GoCodes Asset Tracking’ check-in/check-out feature is a perfect tool to help you track exactly how much time assets spend in the hands of the employees.

Let’s say you manage a construction site with lots of tools, vehicles, and heavy equipment.

With the check-in/check-out feature, employees would just have to scan the piece of equipment when taking it out of storage and check it back in upon return.

Because all information is automatically and permanently stored in the cloud, you can use it to see the in-production hours of every asset across different periods or any number of categories.

You can even use it for location tracking. The system saves the time and location of every scan so you can periodically check on your equipment status.

Recently, GoCodes Asset Tracking even started offering Bluetooth Beacons, which continually send out a readable signal 300ft in diameter.

All in all, asset tracking can be integral to boosting your productivity, which is particularly true in case you opt for asset tracking software.

Perform Regular Asset Audits

Finally, efficient management means investigating and adapting to new information.

Therefore, to make better business moves, you need to ensure the state of your assets is accurately reflected in the books, done by performing regular audits.

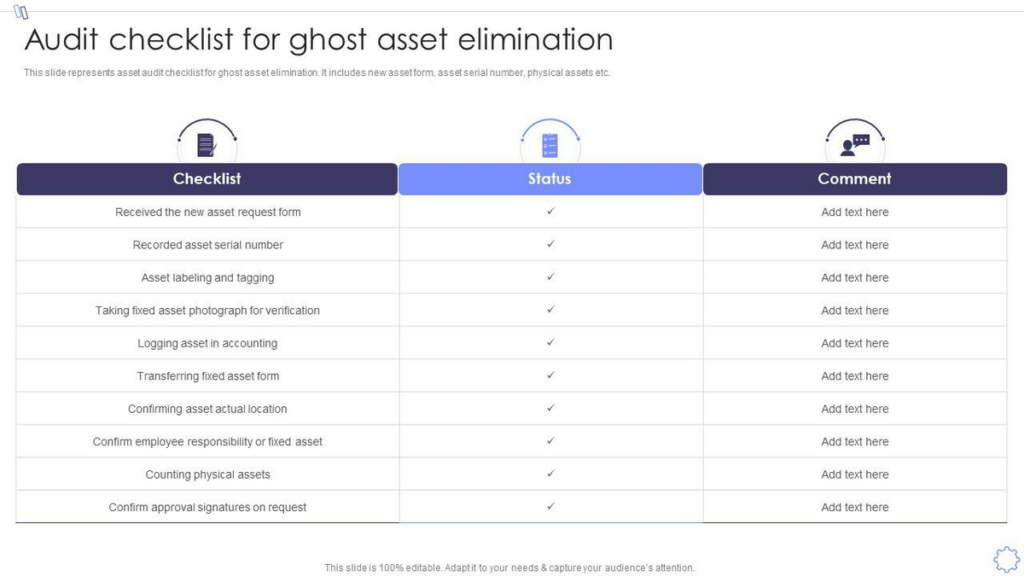

The most tangible benefit of periodic internal audits is checking if the assets are still present. There are many reasons a business could have so-called ghost assets.

Equipment that is stolen, lost, or out of service could still be in the system, although it is not producing anything for the business other than higher tax rates.

Asset audits carried out in reasonable intervals, looking similar to the example below, will reveal any ghost assets and allow you to flush them out of the system.

Not only will this make a more profitable business, but it will also provide a clear and accurate overview of a company’s belongings, making any management decision easier in the process.

To make it better, audits can help you track the condition of your assets as well.

Even with a preventive maintenance schedule in place, it’s a good idea to update the information and subsequent calculations to be able to make more accurate predictions and business decisions.

To perform asset audits, you have two choices.

Small businesses with little equipment can take a list of all inventory and check entry by entry, making sure that you mark notable changes in condition or usability.

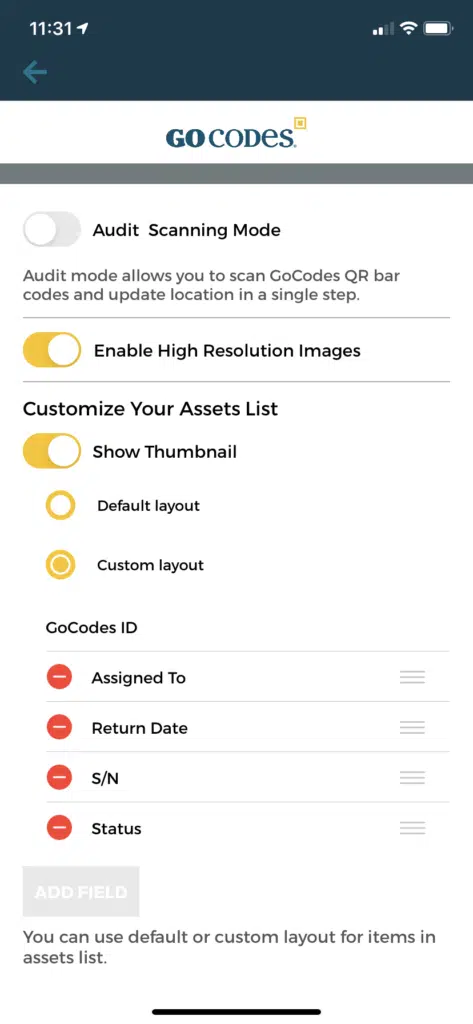

Businesses using tracking software can use the audit mode.

This allows you to create and check by scanning barcodes or QR tags. Most of them also allow images, which is great for tracking conditions across extended periods.

In summary, companies can use audits to check their internal state and reset and remodel their subsequent approach to management.

Conclusion

All of this may seem like a lot to take in at once, so take your time. Think about the measures that would be the most helpful and not too demanding to implement and start from there.

If you, for example, make an asset register, it will automatically make every piece of advice outlined in this article easier to try out. The same goes for equipment tracking.

Soon enough, every detail will fall into place to form a management strategy so well-tuned, you can almost play music to it.