Key Takeaways:

- 78% of companies still use spreadsheets for managing compliance.

- Compliance can cost businesses up to 50% of their revenue.

- Keeping track of regulation changes threatens operations for more than 40% of businesses.

- Automated asset management systems streamline compliance tracking, improve accuracy, and make audits more efficient.

Is compliance just a box to check in your company?

Hopefully not.

Asset management compliance is much more than just following industry rules.

Rather, it’s about protecting your business, your employees, and your bottom line.

When done right, it keeps assets running, prevents costly fines, and builds trust with customers and partners.

But when ignored, the consequences can be severe.

From legal trouble to safety hazards, asset management non-compliance can disrupt everything.

In this guide, we’ll break down what asset management compliance really means, the challenges it presents, and how you can stay ahead of regulations without a headache.

In this article...

What is Asset Management Compliance?

At its core, asset management compliance is about ensuring that a company’s assets are acquired, used, maintained, and disposed of in line with both legal requirements and internal policies.

This applies to everything from heavy machinery in manufacturing to IT hardware in corporate offices.

But why is asset management compliance something you should pay special attention to?

Well, when companies fail to comply, the risks are serious.

Non-compliance can result in operational shutdowns, regulatory penalties, and even reputational damage.

For example, many companies refuse to work with suppliers who lack proper compliance measures, making it a business necessity.

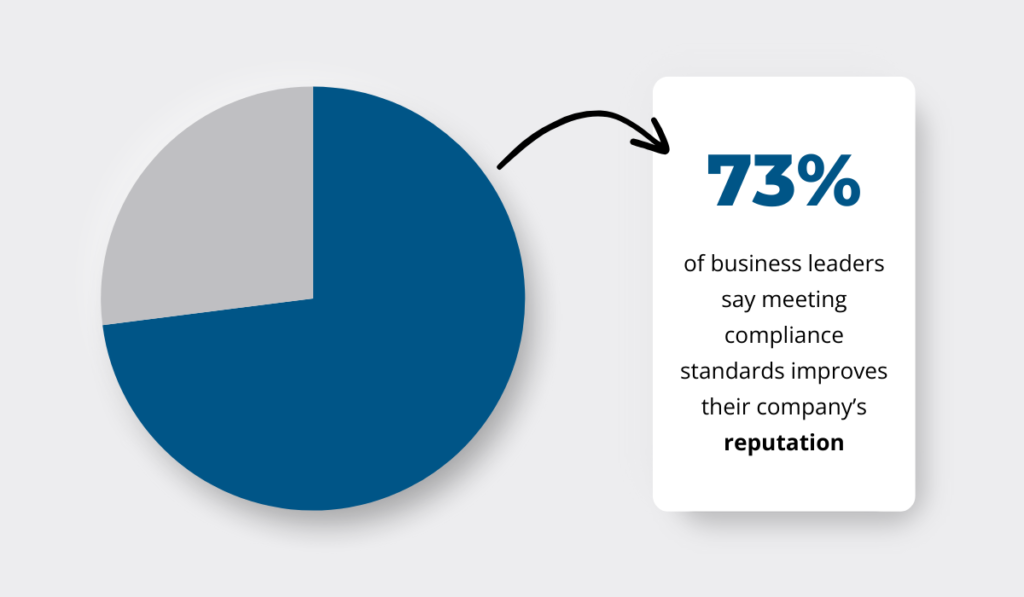

That’s why, according to a 2023 report by NorthRow, 73% of business leaders say meeting compliance standards improves their company’s reputation.

Illustration: GoCodes Asset Tracking / Data: NorthRow

Beyond reputation, poor asset management compliance can lead to safety hazards and financial losses.

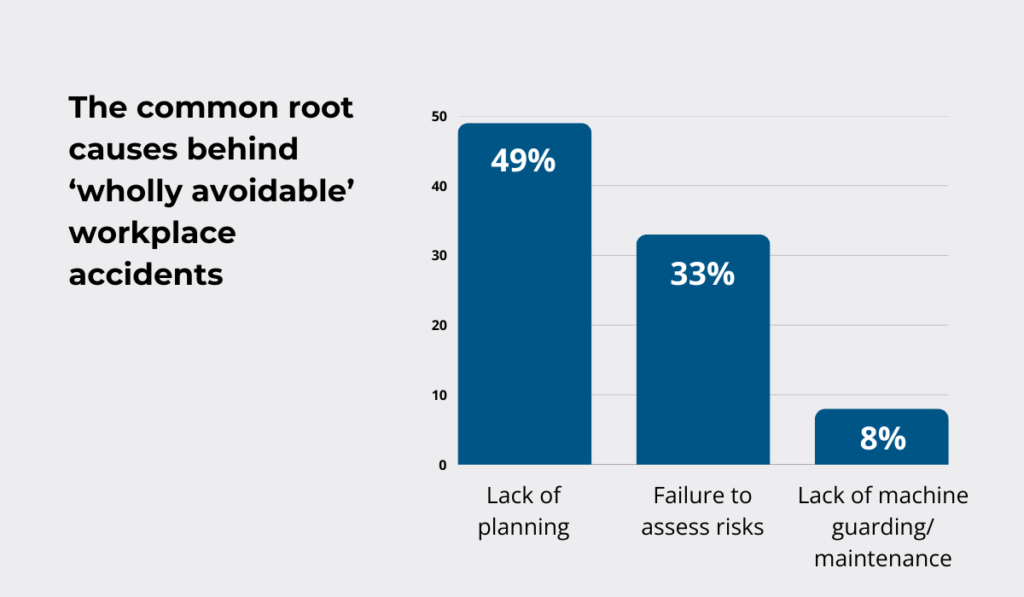

A study by WorkNest shows that more than 80% of avoidable workplace accidents happen due to poor planning or lack of risk assessments, and 8% are caused by inadequate maintenance or missing safety features on machinery.

Illustration: GoCodes Asset Tracking / Data: WorkNest

In other words, failing to comply with asset maintenance regulations can also put lives at risk.

Take Bio Dynamic (UK) Limited, which produces electricity from food waste by anaerobic digestion, for example.

The company was fined over £300,000 after an explosion injured two employees.

Source: HSE

The investigation found multiple compliance failures, including poor risk assessments, inadequate equipment safety checks, and a lack of employee training.

The result?

Serious injuries, legal consequences, and reputational damage that could have been avoided with proper asset management compliance.

Internal vs. External Compliance

Asset management compliance falls into two key categories: internal and external.

Both are equally important for ensuring assets are managed responsibly.

Internal compliance refers to a company’s own policies and procedures for managing assets.

This includes, but it’s not limited to:

- Preventive maintenance schedules to ensure machinery and equipment function safely.

- Asset tracking and record-keeping to maintain accurate data for audits and financial reporting.

- Usage policies that dictate how employees should handle company assets.

External compliance, on the other hand, involves following regulations set by industry bodies and government agencies.

Some of the regulations are listed below:

| OSHA (Occupational Safety and Health Administration) | Workplace safety rules, including machine guarding and maintenance standards. |

| ISO 55001 (Asset Management Standard) | Best practices for life cycle asset management, ensuring compliance with international standards. |

| EPA (Environmental Protection Agency) | Regulations on hazardous waste disposal and the environmental impact of assets. |

The Bio Dynamic case is a prime example of how both types of compliance matter.

The company failed to follow internal safety protocols (not assessing risks properly) and external regulations (breaching health, safety, and environmental laws).

More specifically, Bio Dynamic breached:

- Section 2(1) and Section 3(1) of the Health and Safety at Work etc. Act 1974.

- Regulation 38(2) of the Environmental Permitting (England & Wales) Regulations 2016 (EPR), and s.33(1)(c) of the Environmental Protection Act 1990 (EPA).

That combination led to severe consequences—financial, legal, and reputational.

Asset Management Compliance Challenges

Achieving asset management compliance is an ongoing process that requires businesses to adapt to new regulations, invest in the right tools, and ensure consistency across all operations.

However, many companies struggle with this due to evolving regulations, high costs, inefficient processes, and inconsistent policies.

Let’s explore these challenges in detail.

Evolving Regulatory Compliance Standards

Regulatory requirements are constantly shifting. New laws emerge, old ones evolve, and businesses are left scrambling to adjust.

The rapid pace of change means that even firms with dedicated compliance teams struggle to stay ahead.

But for those without in-house legal expertise, it’s even harder.

Take sustainability regulations, for example.

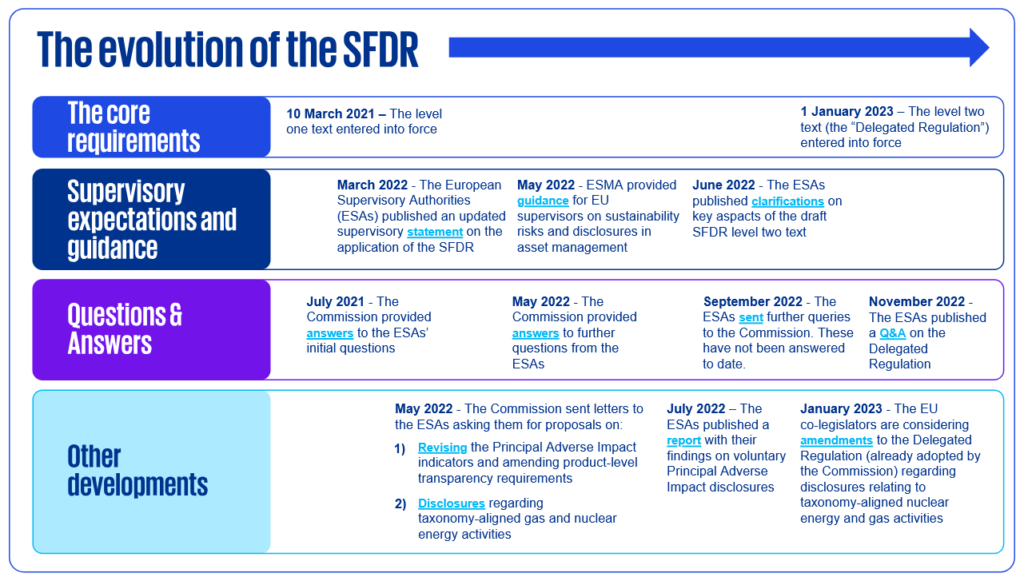

The European Union has been leading the charge with its Sustainable Finance Disclosure Regulation (SFDR), designed to increase transparency and prevent greenwashing.

However, the SFDR has undergone multiple changes in just a several months, with new clarifications issued late in the game.

Source: KPMG

This makes it incredibly difficult for asset managers to stay compliant without constantly revising their reporting processes.

SFDR is just one example.

The EU’s Corporate Sustainability Reporting Directive (CSRD), which took effect in January 2024, adds another layer of complexity.

Businesses that own and operate heavy equipment, vehicles, or industrial assets must comply with emission regulations.

By the end of 2024, half of businesses were expected to face non-compliance risks with CSRD.

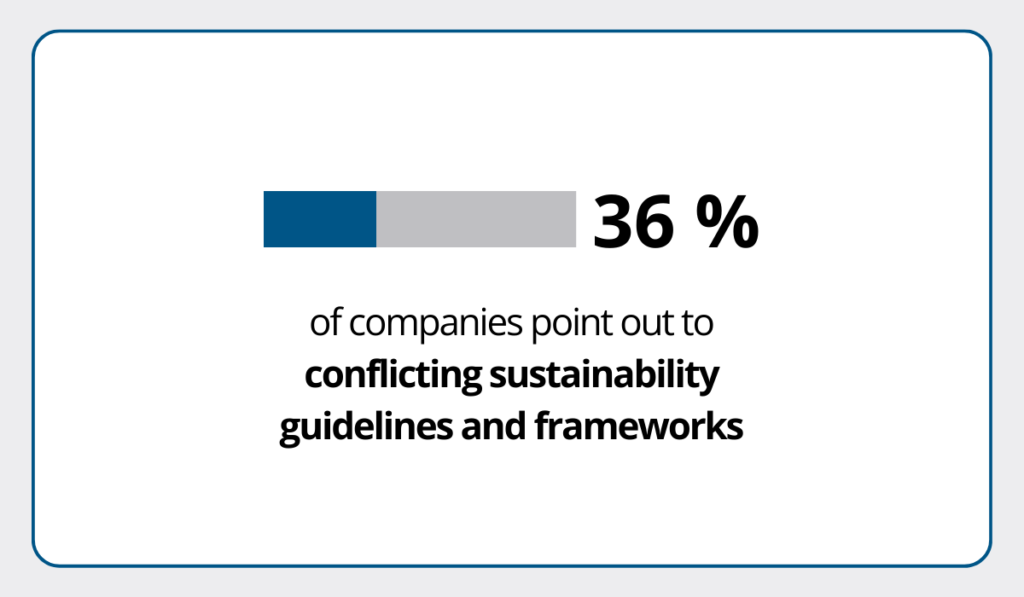

A survey revealed that among businesses not yet preparing for the CSRD, as much as 36% pointed to conflicting sustainability guidelines and frameworks, making it difficult to determine which standards to follow.

Illustration: GoCodes Asset Tracking / Data: Funds Europe

So, the challenge is not only keeping up with evolving regulations but also navigating contradictions within them.

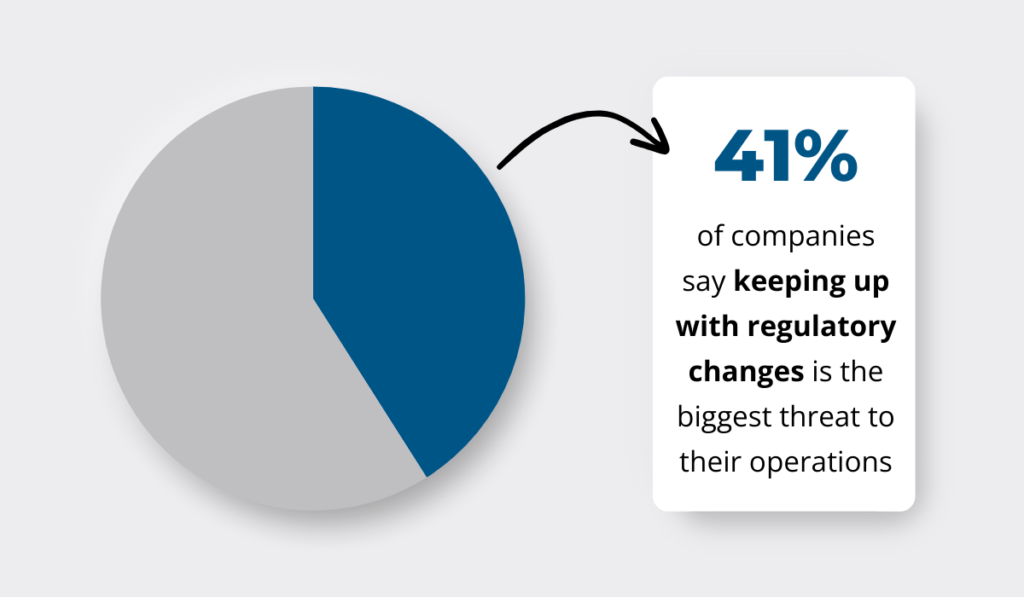

It’s no surprise then that compliance is a top concern for asset managers.

In fact, 41% of firms say that keeping up with regulatory changes is the biggest threat to their operations.

Illustration: GoCodes Asset Tracking / Data: FE fundinfo

As a spokesperson from the research team at FE fundinfo put it:

“Asset managers are facing a dual challenge. On one hand, they must navigate an increasingly complex regulatory environment, and on the other, they must do so while controlling costs in an industry where efficiency is critical to staying competitive.”

This brings us to the next major challenge: cost.

Cost of Compliance

Compliance comes at a price.

Businesses must invest in training employees, maintaining equipment, conducting audits, and upgrading systems to meet regulations.

And those costs add up quickly.

For example, businesses that rely on fleets must track vehicle maintenance, emissions compliance, and operator certifications—each requiring time, resources, and ongoing investment.

Deloitte points out that evolving regulations, legacy IT infrastructure, and overlapping compliance processes all contribute to this growing financial burden.

“Evolving regulatory expectations and technologies, competition for talent, and the need to build in resiliency—together with legacy IT infrastructure and overlapping processes, systems, and activities—conspire to continually increase the cost of compliance.”

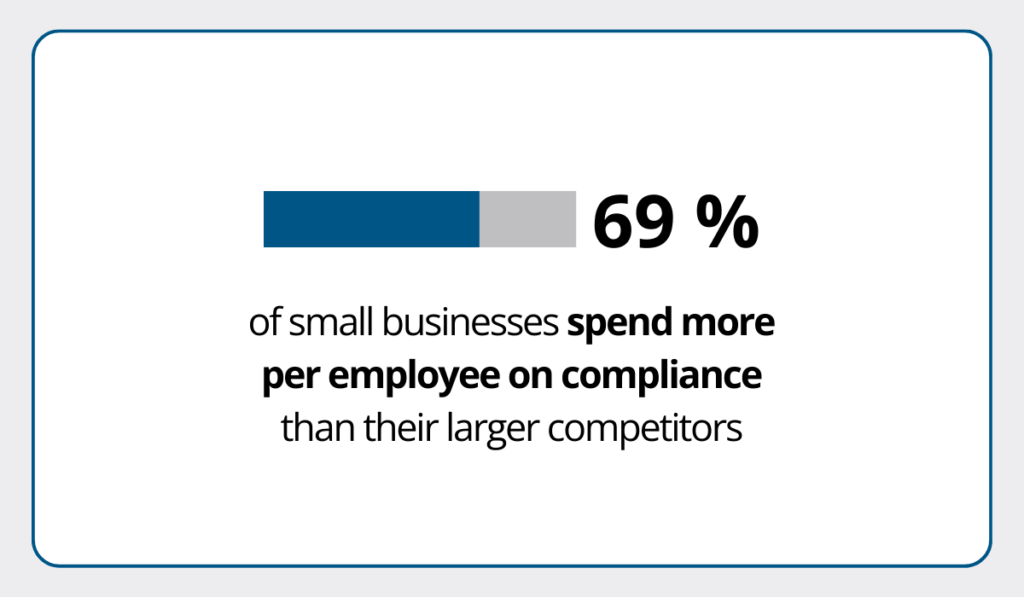

For small businesses, this is an even bigger struggle.

According to the U.S. Chamber of Commerce, 69% of small firms spend more per employee on compliance than their larger competitors, with many resorting to outsourcing just to keep up.

Illustration: GoCodes Asset Tracking / Data: U.S. Chamber of Commerce

The burden is so heavy that nearly half of small business owners say compliance requirements are actively stalling their growth.

Thomas Sullivan, Vice President of Small Business Policy at the U.S. Chamber of Commerce, connects this problem to the challenge we previously explained—too many regulations:

Illustration: GoCodes Asset Tracking / Quote: U.S. Chamber of Commerce

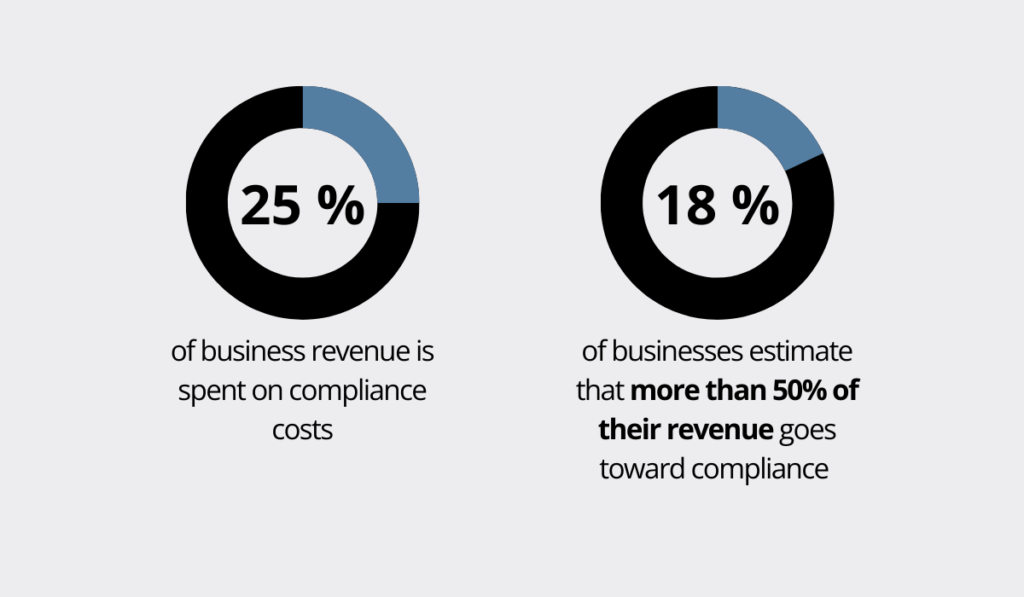

Yet, while compliance is expensive, the cost of non-compliance is even higher.

Companies that fail to meet regulatory requirements face hefty fines, legal actions, and reputational damage.

According to the above-cited report by NorthRow, 18% of businesses estimate that compliance-related expenses eat up as much as 50% of their revenue.

Illustration: GoCodes Asset Tracking / Data: NorthRow

But when you consider the alternative—lawsuits, operational disruptions, or a major security breach—the cost of falling behind can be catastrophic.

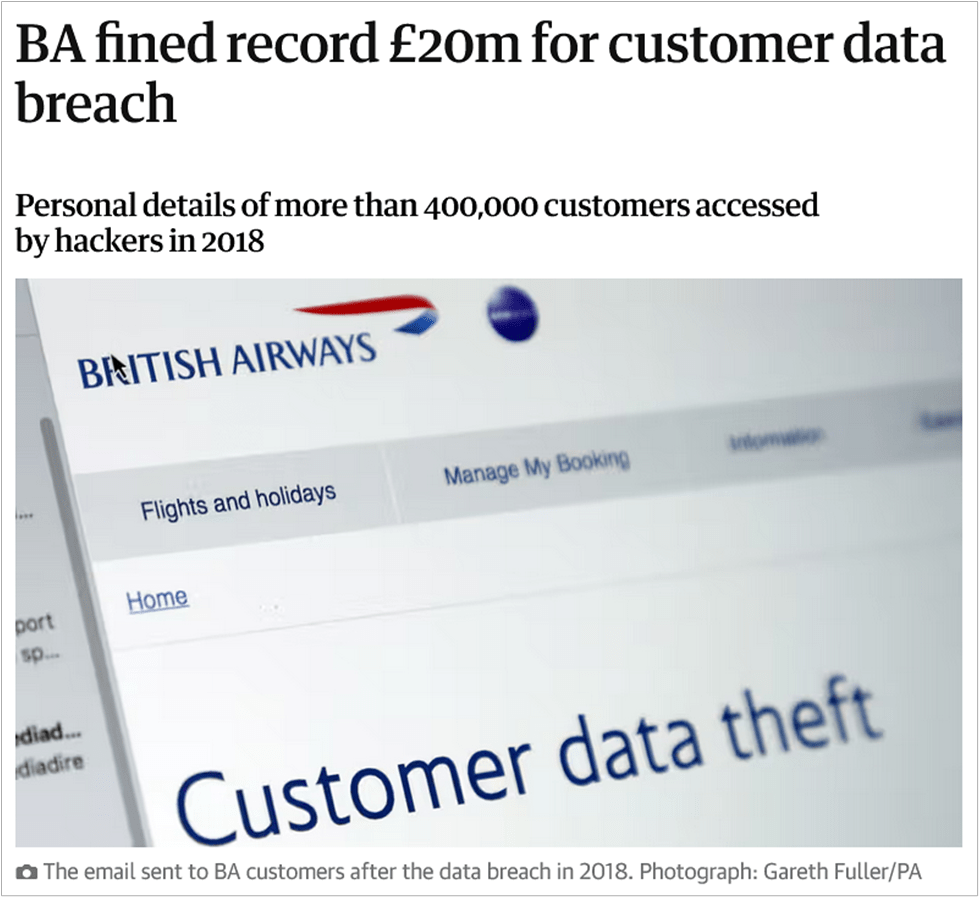

British Airways, for example, was fined £20 million (reduced from the initial £183 million!) after a data breach exposed personal and financial details of 400,000 customers.

Source: The Guardian

The airline failed to meet IT asset compliance requirements under GDPR, resulting in a massive penalty that could have been avoided with stronger data security and compliance measures.

That’s why companies that take a proactive approach to asset management compliance at every stage of the asset life cycle don’t just avoid penalties—they also position themselves for long-term stability.

But that’s easier said than done, especially when outdated, inefficient processes get in the way.

Inefficient Compliance Processes

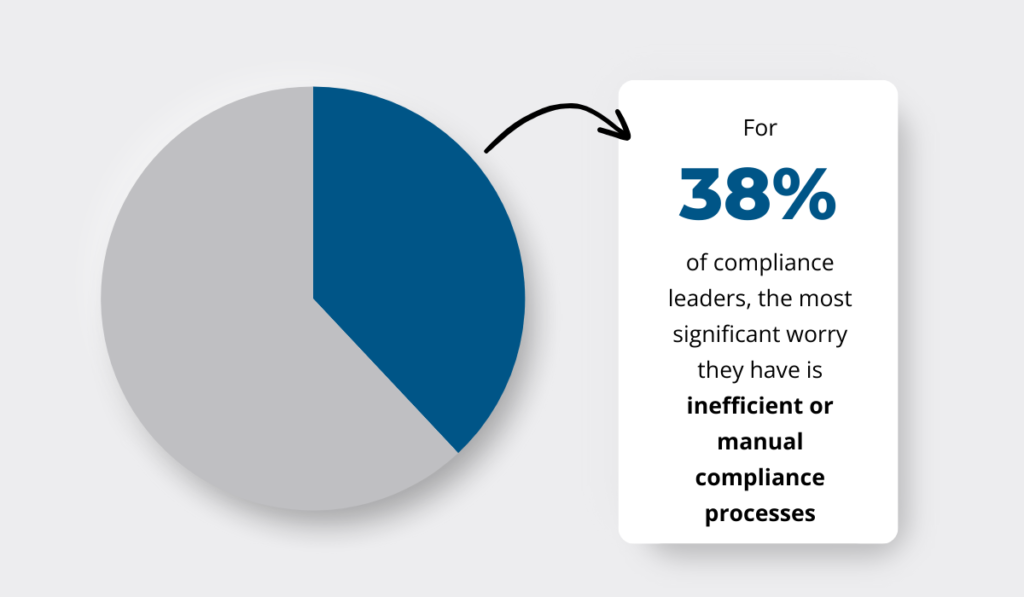

A 2024 NorthRow State of Compliance Trends Report revealed that 38% of compliance leaders cite inefficient or manual compliance processes as their biggest concern.

Illustration: GoCodes Asset Tracking / Data: NorthRow

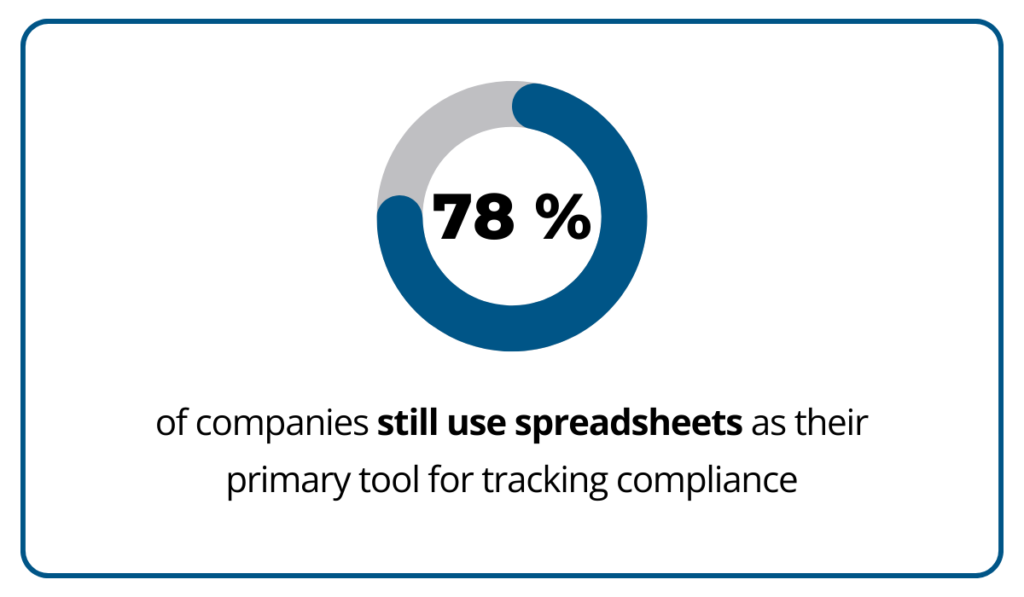

The big part of the problem is that many businesses still track compliance manually, relying on spreadsheets, paper records, or outdated software.

A recent report found that 78% of companies still use spreadsheets as their primary tool for tracking compliance, despite the availability of modern software solutions.

Illustration: GoCodes Asset Tracking / Data: Funds Europe

Why is this a challenge?

Well, manual tracking makes it harder to prove compliance during audits and increases the risk of human error.

For example, if maintenance schedules for critical assets like manufacturing equipment or safety gear are logged inconsistently, businesses risk non-compliance with safety regulations.

A single missing maintenance record could mean a failed audit, hefty fines, or worse—a preventable accident.

Beyond outdated tracking methods, many businesses also struggle with inconsistent compliance processes.

Without standardized procedures, different teams may follow different approaches, creating gaps in asset management.

Some may log every detail meticulously, while others overlook key steps, creating gaps in asset management compliance.

This lack of uniformity makes it harder to enforce compliance across an organization and increases the likelihood of errors slipping through unnoticed.

Bottom line?

Compliance processes do not always need to be costly or complex, but they do require consistency.

As Scott Crichton, former Principal Health and Safety Consultant at WorkNest H&S, points out, compliance often comes down to taking reasonable precautions and implementing simple, standardized checks.

Illustration: GoCodes Asset Tracking / Quote: WorkNest

By establishing a baseline compliance process for all assets, such as mandatory inspections and automated reminders, businesses can ensure consistency and reduce compliance risks without overspending.

Best Practices for Achieving Asset Management Compliance

Asset management compliance may seem complex, but with the right approach, you can minimize risks and ensure your business meets regulatory standards.

The key is to move away from outdated tracking methods and inconsistent processes in favor of structured, proactive compliance strategies.

Here’s what you can do to establish a strong foundation for asset management compliance.

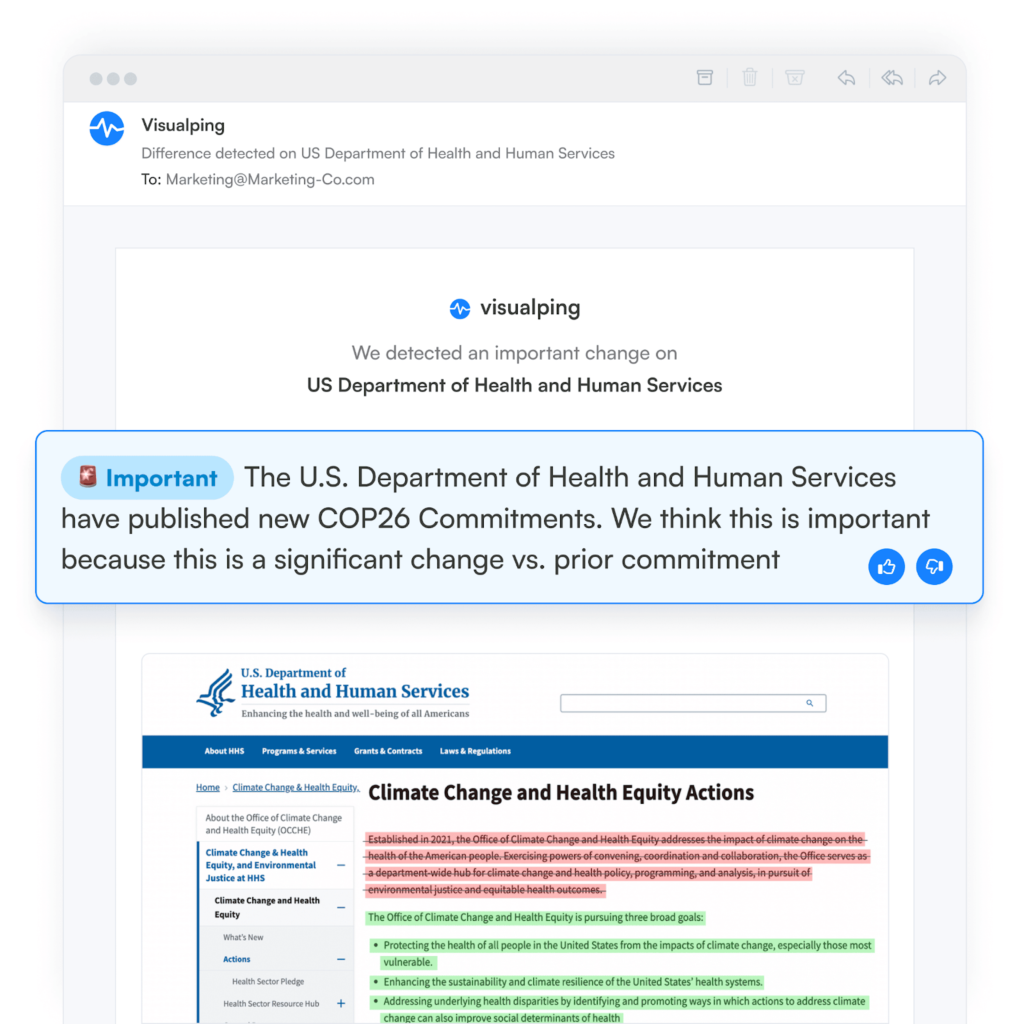

Know the Relevant Laws and Regulations

Before anything else, identify the regulations that apply to your industry and keep track of updates.

Build a compliance team or assign key employees to monitor changes, and invest in regulatory tracking tools to stay ahead.

Various platforms provide real-time alerts when laws change, helping businesses adjust their compliance strategies before problems arise.

Source: Visualping

Subscribe to government and industry newsletters, follow regulatory bodies, and attend compliance seminars to stay informed.

But simply knowing the rules isn’t enough—your entire organization must understand them.

Invest in ongoing training so your team understands their responsibilities.

Research by Limble CMMS shows that 72% of companies ensure compliance by fostering a compliance culture, and 69% invest in staff training to do so.

Illustration: GoCodes Asset Tracking / Data: Limble

When employees know the rules, compliance becomes second nature.

Automate Data Entry

Instead of relying on spreadsheets or paper records, use automated asset management software to maintain accurate records and track compliance in real time.

Our GoCodes Asset Tracking may just be the solution you need.

With GoCodes Asset Tracking, you equip assets with QR codes, Bluetooth beacons, RFID tags, or GPS trackers based on your needs.

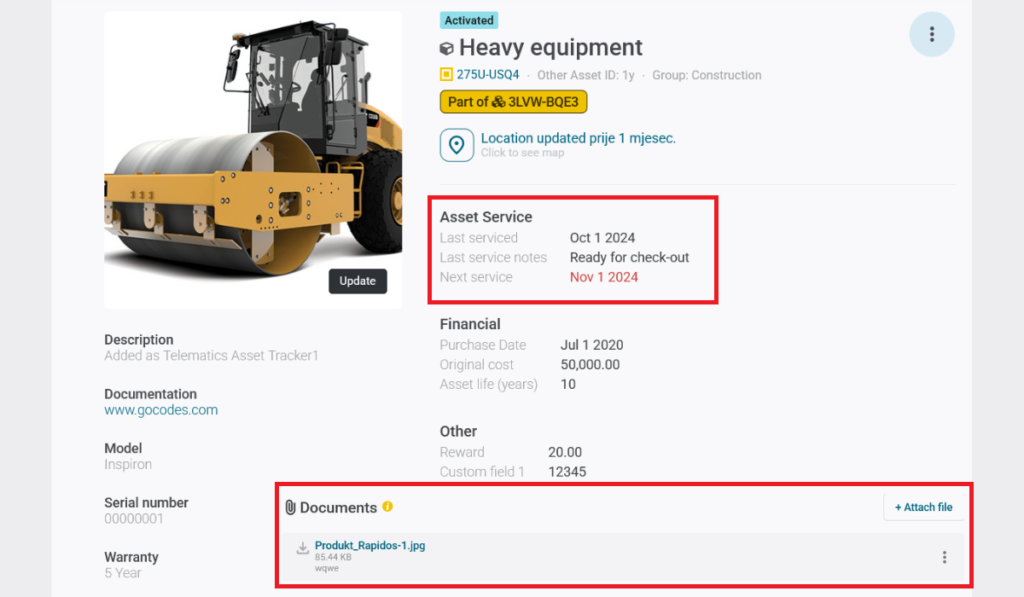

You then create a digital inventory of all assets in your system, as well as attach any important documents, like manuals, warranties, and safety instructions, to them.

Every time an asset is scanned or used, the system will automatically log its location, user, and status.

Source: GoCodes Asset Tracking

On top of that, you can easily schedule maintenance tasks and inspections, ensuring that all records are kept in one place and that maintenance meets regulatory standards and it’s done on time.

GoCodes Asset Tracking can also assist you during audits, which is the next thing you should do.

Regularly Audit Your Assets

Conduct routine audits to verify that all assets meet compliance standards.

Missing or unaccounted-for assets, overdue maintenance, or incomplete documentation can all lead to compliance failures.

Take IT assets, for example.

Marie Joseph, Senior Security Solutions Engineer at Trava, warns that failing to track every connected device can create security vulnerabilities:

“Cybersecurity compliance standards require that you track and harden all your assets. If you’re missing one because you don’t know it exists, or if a device isn’t kept up to date, it creates a hole in your security architecture.”

Internal audits help businesses catch these issues before regulators do.

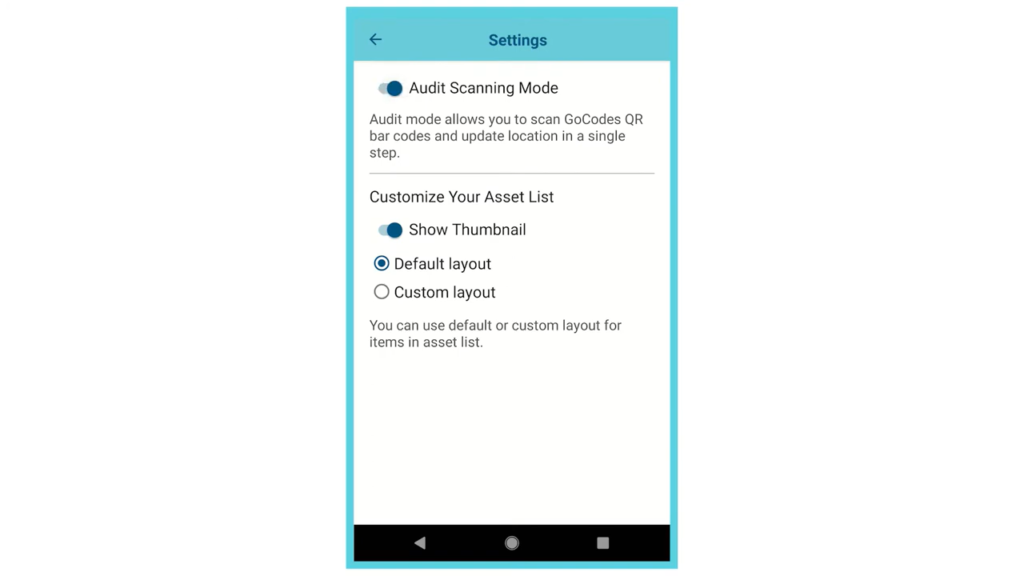

You can use GoCodes Asset Tracking Audit Mode to streamline this process.

Simply scan QR code labels to update asset locations instantly.

The system records who last scanned the asset and when, creating a clear audit trail.

Source: GoCodes Asset Tracking

Audits ensure no assets, whether physical or digital, are overlooked, reducing both regulatory and cybersecurity risks.

Conclusion

Asset management compliance doesn’t have to be complicated.

By knowing the regulations, automating processes, and conducting regular audits, you’ll be on your way to staying compliant and reducing risk.

Make compliance a part of your business culture and motivate your team to take ownership.

Taking action today can save your business from future challenges.