A “ghost asset” is essentially an asset that appears in your general ledger, but it cannot be accounted for because it is missing or unusable. There are many ways in which something can become a ghost asset, but the good news is that you can prevent this from happening in a few simple ways.

In this article...

Why Ghost Assets are Bad for Business

- Higher insurance premiums – If your assets don’t exist, then they don’t need to be insured. Imagine all of the premiums you’ve paid on things that you don’t even own anymore. It’s probably a lot of money.

- Higher taxes – Many states force you to pay personal property taxes on heavy machinery and equipment. If you’re paying the IRS taxes for assets you don’t have, it’s money down the drain.

- Wasted resources – If you’re sending your employees out to track down assets that don’t exist, it’s easy to imagine the amount of wasted time.

- Budgeting issues – Your company may be budgeting based on the presumption that you have certain assets available to you. When those assets don’t exist, the unexpected expenses associated with replacing them can throw a carefully-balanced budget off track.

As you can see, just one of these things is bad enough for business. The combination of all four can be detrimental.

Keep Better Track of Your Assets

If you want to completely eliminate ghost assets, the best way to do this is with asset tracking. Rather than using paper lists or spreadsheets, and instead of buying expensive barcode readers, consider using QR codes and your smartphone. Simply add labels to your assets and scan them with your smartphone to get all of the information you could ever want. If you want even further protection, consider using built-in GPS tracking labels. They’ll allow you to track your equipment and inventory anywhere, so if something goes missing, it’s not a wild goose chase to find it again.

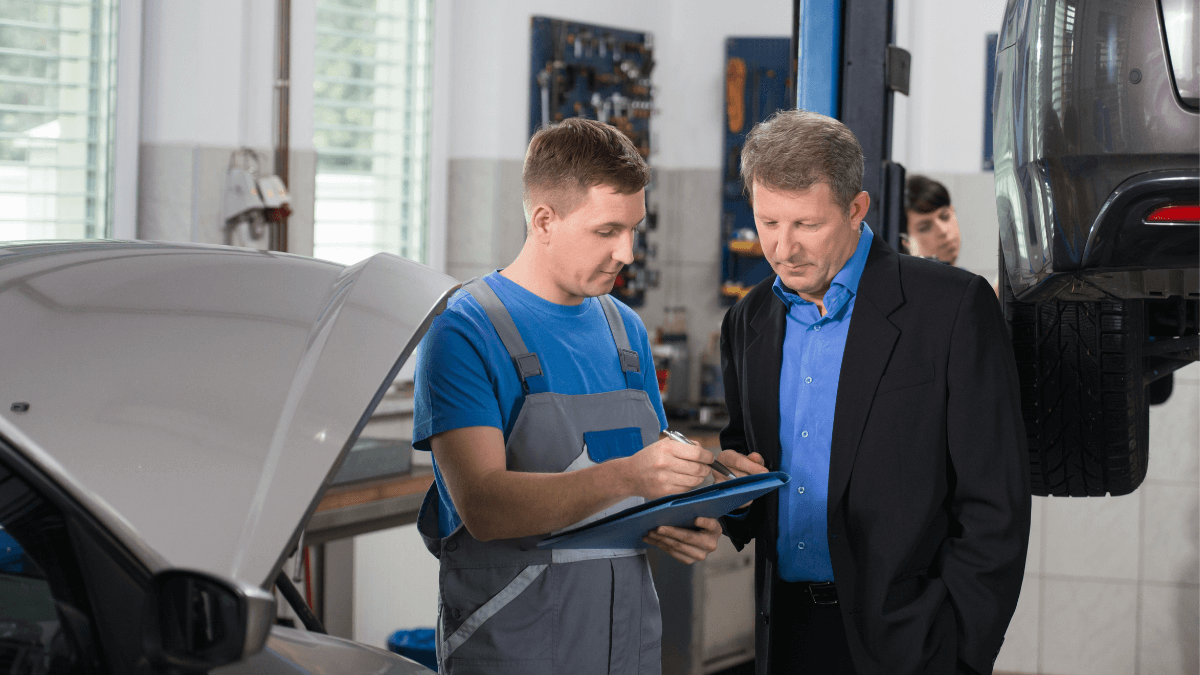

Automate Servicing when Possible

A ghost asset can also be defined as any asset that is rendered unusable, and failing to properly maintain your equipment due to lack of information can certainly render it unusable in short order. The good news is that you can use asset tracking to at least partially automate your equipment’s servicing. By simply scanning the equipment, you can find out when it was last maintained. If it’s due for maintenance, just tap a button on the screen, and you’re scheduled. It’s just that simple. Keeping your equipment well maintained is by far one of the best ways to reduce ghost assets and improve your company’s revenue.

Ghost assets are problematic across all industries and businesses of all sizes. They can cost you a small fortune simply because they’re often overlooked for long periods of time. The best thing to do is keep better track of your assets from the start. When you know where they are and how they’ve been taken care of, the chances of them “going ghost” are drastically reduced.

Curated by Nadine Penny