For the trades and industry sectors, equipment is a significant investment that plays a crucial role in operational efficiency.

As equipment ages, its value decreases—a process known as depreciation.

Understanding how to calculate equipment depreciation is vital for accurate tax filing, enabling businesses to reflect true expenses and take advantage of potential tax deductions.

This article outlines the key concepts and the most common method for calculating equipment depreciation.

In this article...

Understanding Depreciation

Depreciation represents the reduction in value (cost) of tangible assets (equipment) over time due to wear and tear, obsolescence, or other factors.

For tax purposes, depreciation allows businesses to spread the costs of an asset over its useful life, reducing taxable income.

The IRS provides guidelines for how to depreciate equipment, outlining various methods, depending on the type of asset and its intended use.

In practice, virtually all organizations use Straight-Line Depreciation, as it’s the simplest.

The cost is spread evenly over the life of the equipment.

Steps to Calculate Straight Line Depreciation

1. Determine the Equipment Cost:

Gather all costs associated with acquiring the equipment, including purchase price, taxes, shipping, and installation.

2. Estimate the Useful Life:

Refer to IRS guidelines or industry standards to determine the appropriate useful life for the equipment in years.

3. Select a Depreciation Method:

Choose the method that best suits your financial strategy and the nature of the equipment.

Usually, Straight Line Depreciation is used.

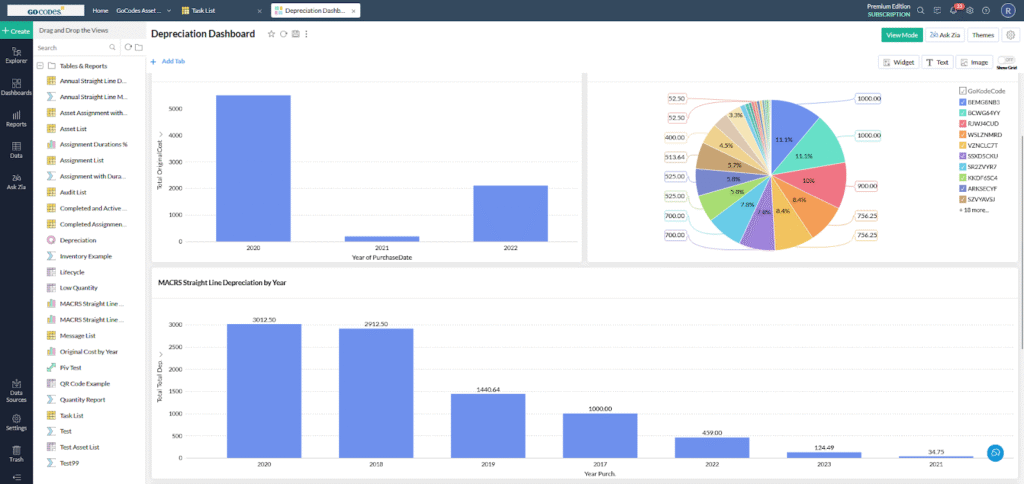

Source: GoCodes Asset Tracking

4. Calculate Annual Depreciation:

Use the chosen method to compute the Annual Depreciation expense.

Here’s a simple example:

Say a piece of equipment costs $5,000 and its useful life is 5 years; the cost of the equipment would be spread equally over its life.

Thus, the depreciation would be $1,000 per year for 5 years.

5. Document Everything:

Maintain detailed records of calculations, assumptions, and any changes in the equipment’s use or condition.

Conclusion

Calculating equipment depreciation for tax filing is a crucial process for trades and industry professionals.

By understanding the various methods of depreciation and following a systematic approach, businesses can ensure accurate financial reporting and maximize tax benefits.

Properly managing equipment depreciation not only enhances financial planning but also contributes to a better understanding of asset value over time, ultimately supporting informed decision-making and strategic growth.

And of course, using software like GoCodes Asset Tracking to automate depreciation calculations literally takes the sting out of the process, too.