As the year draws to a close, businesses face the critical task of conducting year-end inventory audits and asset reconciliations.

These processes are essential for ensuring the accuracy of financial statements, identifying discrepancies, and providing a solid foundation for the upcoming year’s operations.

To help streamline this process, here are five tips to ensure a smooth, efficient, and accurate year-end audit and reconciliation.

In this article...

1. Prepare Early and Plan Ahead

The foundation of a successful year-end inventory audit and asset reconciliation is early preparation.

Waiting until the last minute to organize inventory data, financial records, and asset logs can result in mistakes, missed discrepancies, and delays.

Start by reviewing your company’s inventory management systems, financial records, and asset logs well in advance.

Create a detailed checklist of tasks and deadlines and assign responsibilities to the relevant team members.

This might include verifying stock levels, reviewing asset depreciation schedules, and ensuring all inventory and assets are accounted for.

Early preparation also gives you the opportunity to resolve any discrepancies or missing documentation before the year-end rush.

2. Conduct a Physical Count of Inventory

A critical component of any year-end inventory audit is performing a physical count of all inventory.

While many businesses rely on perpetual inventory systems to track stock levels in real time, discrepancies can still arise due to factors like theft, damage, or human error.

A physical count helps verify that the quantities recorded in your system match the actual inventory on hand.

To minimize errors, conduct the inventory count in phases rather than all at once.

Assign different teams to count different sections or categories of inventory, and make sure they follow standardized counting procedures.

Cross-check results for consistency and document everything meticulously.

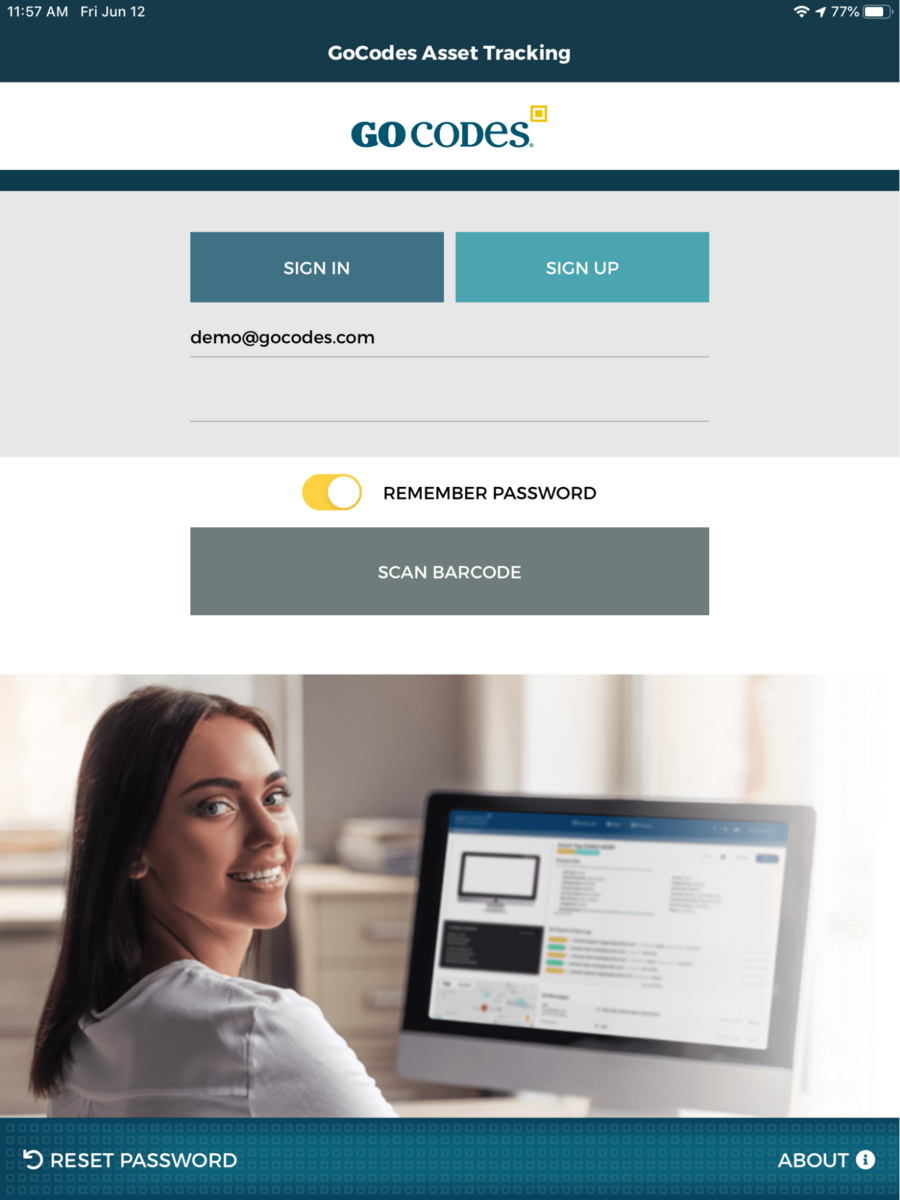

If you have a solution like GoCodes Asset Tracking, use the barcode scanning features to ensure an accurate count.

If possible, perform this count outside of normal business hours to reduce the risk of errors caused by ongoing sales and shipments.

3. Reconcile Asset Records

Asset reconciliation is an essential step in ensuring that your company’s fixed assets are properly accounted for.

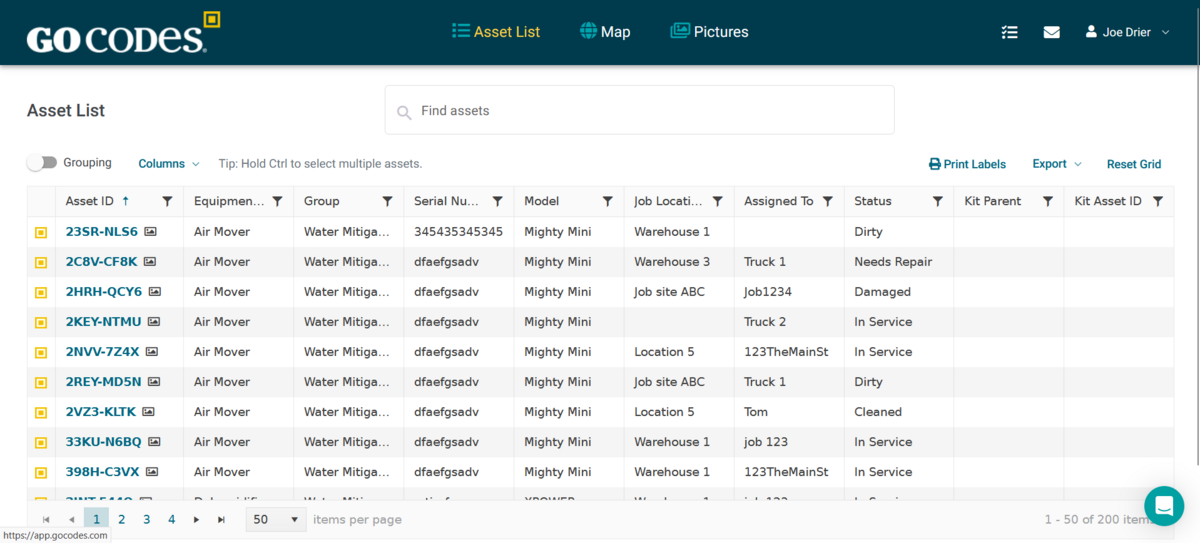

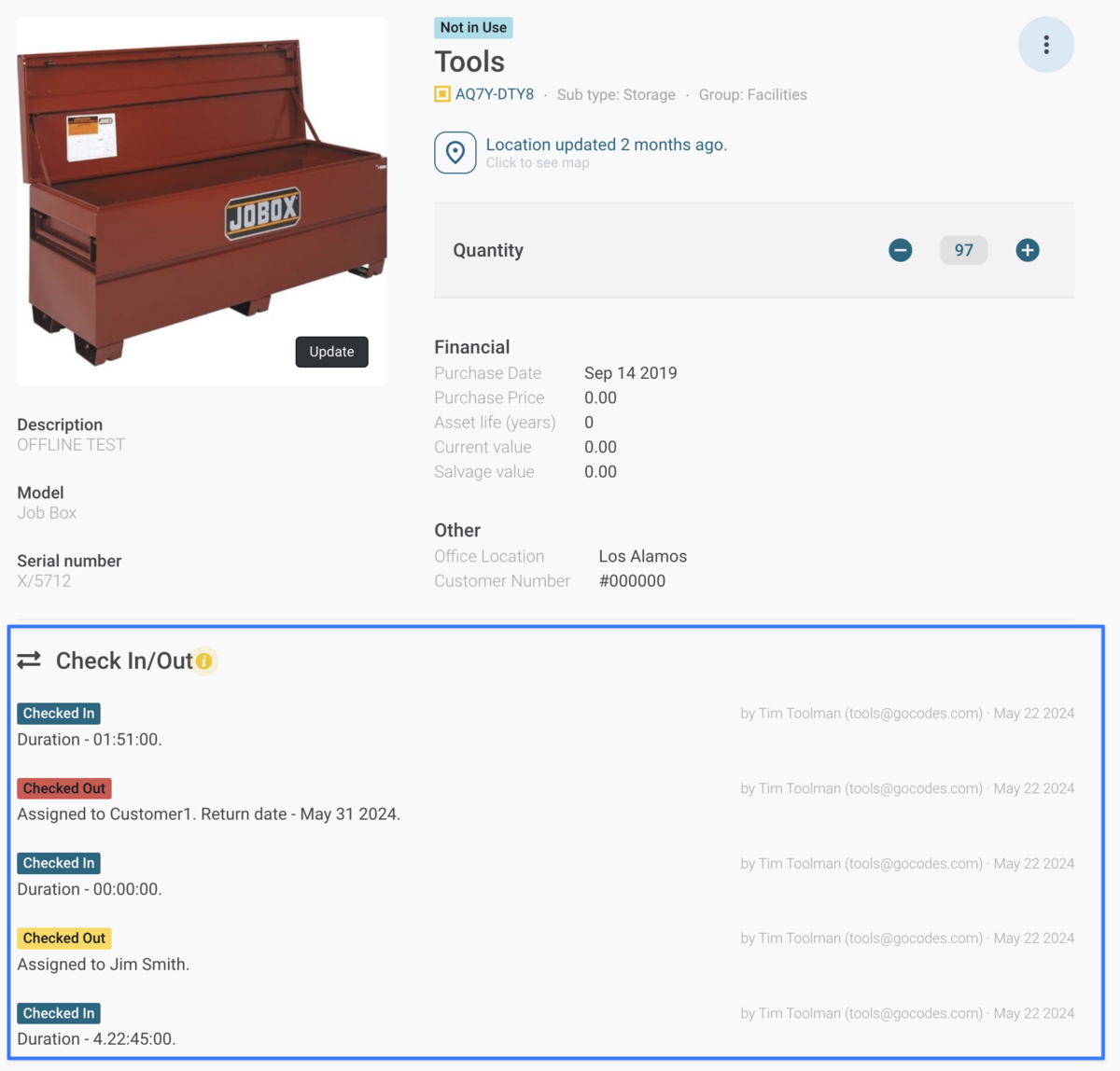

This includes reconciling the asset register to verify that all physical assets are recorded in the accounting system, and that depreciation has been applied accurately.

Any discrepancies whether due to asset misplacement, disposals, or failure to update records—should be identified and corrected before the year-end.

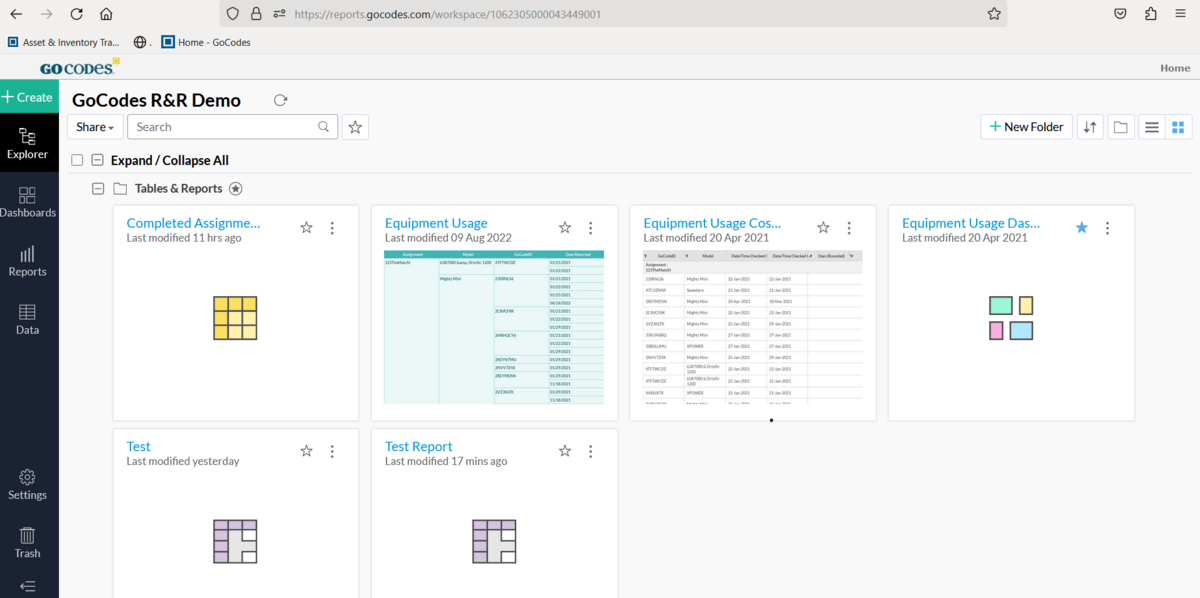

A solution like GoCodes Asset Tracking will help you capture and maintain an accurate fixed asset register and when combined with automated barcode scanning, can streamline reconciling your audit results with your asset register’s records.

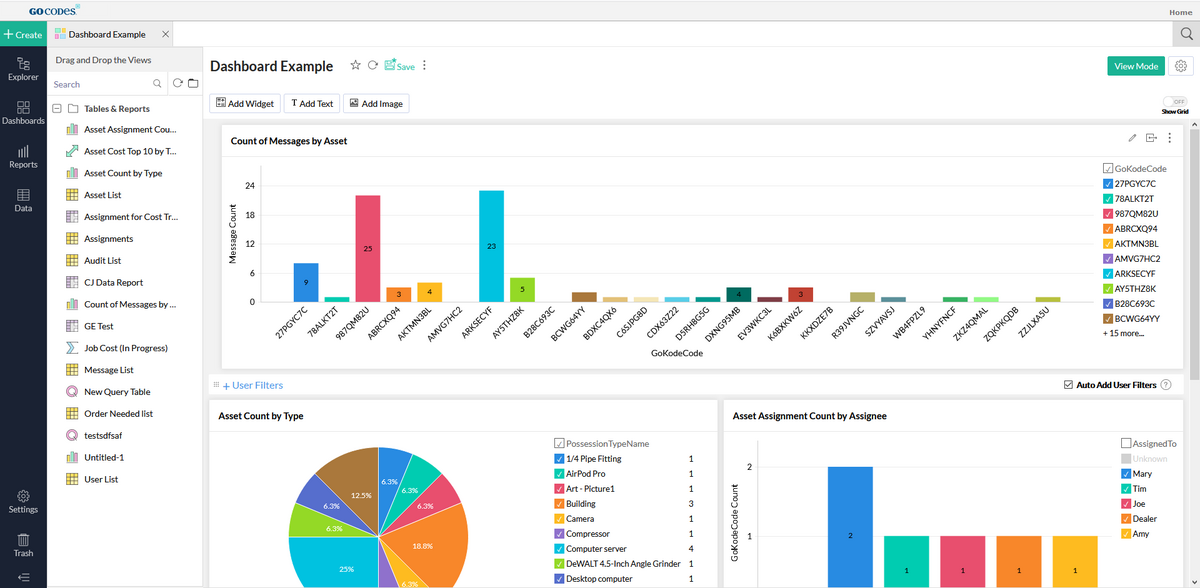

The GoCodes Asset Tracking solution can provide automated reports that show any discrepancies.

Start by reviewing the company’s fixed asset register, ensuring it includes information such as asset description, purchase date, cost, location, and current condition.

Be sure to account for disposals or impairments that may have occurred during the year and adjust your depreciation schedules accordingly.

Any assets that are no longer in use or have been sold or written off should be updated in your asset register.

4. Resolve Discrepancies Promptly

During the audit and reconciliation process, discrepancies are bound to arise.

Whether it’s a mismatch between physical inventory and recorded inventory, or a difference in asset valuations, resolving these issues promptly is crucial.

Leaving discrepancies unresolved can lead to inaccurate financial statements, compliance issues, and potential audit findings.

When discrepancies are identified, investigate the cause and correct the records immediately.

For inventory, this might mean conducting a recount or reviewing past transactions to uncover errors.

For asset discrepancies, check purchase orders, invoices, and asset transfers.

Additionally, ensure that your team is trained to detect and resolve these issues efficiently.

If necessary, work with your external auditors or accounting team to ensure all discrepancies are appropriately addressed.

5. Leverage Technology and Automation Tools

In today’s business environment, manual inventory audits and asset reconciliations are becoming increasingly inefficient.

Technology can play a significant role in improving the accuracy and efficiency of these processes.

From barcode scanning systems to automated asset tracking software, there are numerous tools available that can streamline inventory counting, asset tracking, and reconciliation.

Investing in software that integrates your inventory management system with your accounting platform can significantly reduce the risk of human error and ensure more accurate reconciliations.

These tools can automatically update records in real-time, track depreciation, and generate reports that make year-end processes easier to manage.

Additionally, cloud-based solutions enable multiple teams to collaborate seamlessly, providing real-time access to information regardless of location.

Conclusion

Year-end inventory audits and asset reconciliations are vital to the health of any business.

By following these five tips—planning ahead, performing a physical count, reconciling asset records, addressing discrepancies promptly, and leveraging technology—you can ensure a smooth and accurate year-end process.

A well-executed audit and reconciliation not only provide valuable insights into your company’s financial standing but also set the stage for more efficient operations in the year ahead.