Rising costs are a top concern for the majority of fleet managers.

If you’re in that camp, too, know that you’re not alone.

Fleet management is becoming more expensive due to numerous reasons, including more complex vehicles, increased labor rates, and general inflation.

While you may be unable to control market trends, there are still ways to optimize your operations and reduce expenses.

We’ll go over the 6 best strategies for cutting fleet costs and boosting profits.

Let’s dive in!

In this article...

Understand Total Cost of Ownership (TCO)

Many professionals focus solely on the upfront costs of adopting a new product or service.

This means they often overlook other ownership costs and can only decrease the expenses by choosing cheaper vendors.

To mitigate this and identify other costs you could reduce, focus on the total cost of ownership (TCO) instead.

TCO encompasses all costs associated with owning a product throughout its life cycle. This includes the cost of acquiring, implementing, using, and phasing it out.

Calculating TCO is especially critical for purchases that require ongoing investments, such as vehicles and equipment.

Since these products require many additional expenses throughout their life cycles, considering only the upfront costs can give you a wildly misleading picture.

But here’s the issue: calculating TCO is also very challenging.

On the surface, it seems easy.

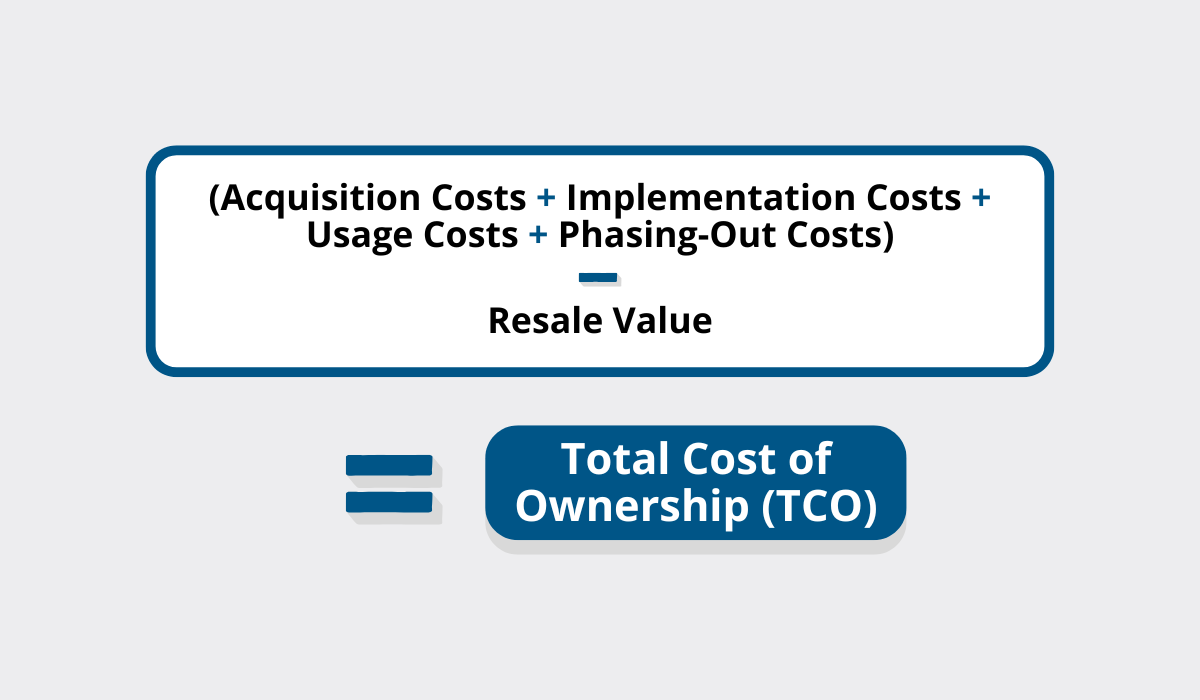

You just add the total costs, subtract the resale value, and get a conclusive total.

Sounds simple, but it’s not that easy.

To accurately calculate the TCO, you’ll need to consider various different costs, many of which can be difficult to predict or quantify.

Let’s illustrate this by looking at the basic costs to consider when calculating the TCO of equipment and vehicles:

| Acquisition Costs | Implementation Costs | Usage Costs | Phasing-Out Costs |

|---|---|---|---|

| purchase price | fleet management systems | fuel costs | vehicle or equipment depreciation |

| financing costs | compliance and certifications | insurance | disposal costs |

| registration and licensing | driver costs (e.g. driver training) | tolls and parking | resale/salvage income |

| taxes and duties | site preparation | consumables | |

| installation and setup | software integration | technology upgrades (e.g., telematics) | |

| energy consumption | |||

| maintenance and repairs |

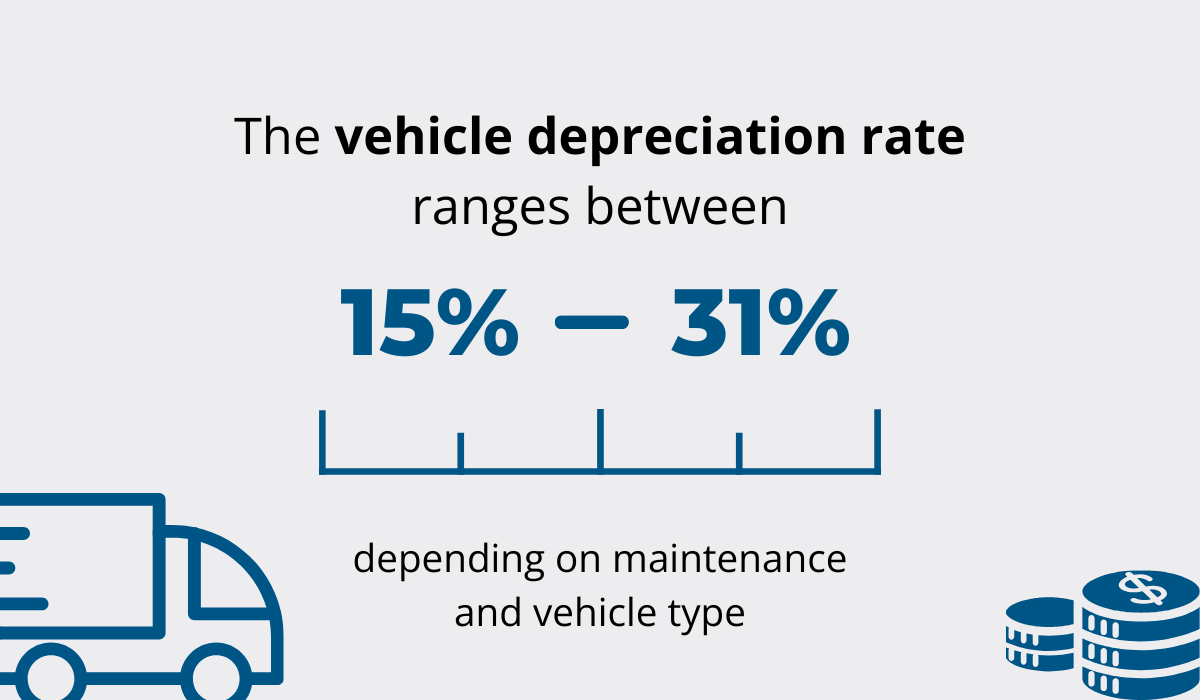

Predicting these individual costs is especially difficult if your company has no historical data.

In that case, knowing industry averages can be helpful.

For example, it may be useful to know that the vehicle depreciation rate typically ranges between 15% and 31% but can vary greatly depending on maintenance and vehicle type.

ICE vehicles, for instance, tend to depreciate less than EVs.

On that note, don’t be surprised if your TCO calculations uncover that depreciation is one of your largest expenses.

According to a 2023 report, depreciation is the biggest cost for most US fleets, accounting for about 45% of total fleet spend.

To reduce it, you may need to find ways to keep vehicles in service longer.

However, if you’re also spending a lot on maintenance, you’ll likely need to simultaneously invest in newer models.

The key here is finding the right balance and making decisions based on your fleet-specific data.

Optimize Fleet Utilization

In an ideal world, you’d utilize your fleet in the most optimal way.

Your vehicles would be neither overburdened nor idle because your fleet size would perfectly match your operational demands.

That way, you would avoid wasted resources and additional expenses of both under- and over-fleeting:

| Over-fleeting | Under-fleeting |

|---|---|

| Unnecessary Insurance Premiums | Accelerated Wear and Tear |

| Higher Depreciation Costs | Increased Downtime |

| Additional Storage Costs | Operational Delays |

All you have to do is right-size your fleet.

Easier said than done, right?

Well, even if you never get fleet size perfectly right, you can almost always improve how you use it.

This requires implementing strategies that help you:

- Reduce idle time

- Maximize vehicle use

- Improve fleet scheduling and routing

To do so, you’ll need to know exactly how vehicles are being used, when they are active, and which routes are most efficient.

Technologies like telematics and GPS trackers can be extremely helpful in this process.

GPS trackers collect important geospatial data, while telematics systems collect it together with additional information, such as fuel consumption and vehicle diagnostics data.

Such data can provide invaluable insights into vehicle performance, driver behavior, and overall fleet efficiency, helping you make smarter, data-driven decisions.

And smarter decisions usually translate to reduced costs.

Reduce Vehicle Downtime

Downtimes are expensive.

According to industry experts, they cost fleets between $448 and $760 a day per vehicle.

Costs add up fast, primarily because there are so many of them. It’s just that we often fail to recognize them, especially when it comes to indirect costs.

| Direct costs | Indirect costs |

|---|---|

| Repairs | Lost revenue |

| Parts | Missed opportunities |

| Labor | Wages to idle drivers |

With this in mind, reducing downtime won’t just help you save money on repairs, but also help your operations run smoother and allow you to generate more revenue.

But how do you go about it?

Start by implementing these three best practices that go hand in hand:

- Regular fleet diagnostics

- Early issue detection

- Preventive maintenance

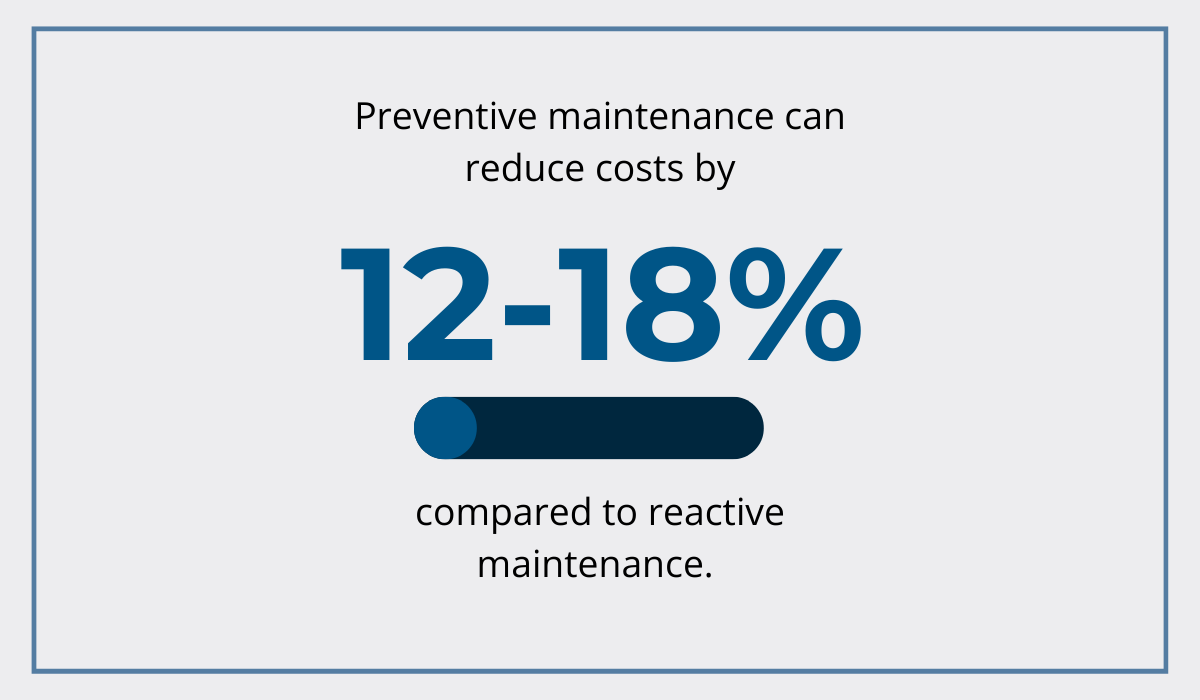

Regular fleet diagnostics help you stay ahead of potential issues and enable early issue detection.

They fall under the umbrella of preventive maintenance, which ensures that any detected issues are resolved proactively.

Such an approach can reduce costs by 12% to 18% compared to reactive maintenance.

Truth be told, resolving issues in advance won’t always be possible.

In such cases, it’s important to have a contingency plan.

Backup vehicles will help you minimize service disruption and keep things running smoothly during unforeseen breakdowns or delays.

Let us remind you, though, that you still want to avoid over-fleeting. Striking the right balance and knowing your fleet’s needs is key.

Invest in Fuel Efficiency

A report by Element Fleet Management showed that fuel was the second-largest spend item for most fleets in 2023.

Reducing it can help your fleet significantly decrease expenses and become more sustainable.

Some ways to reduce fuel consumption include:

- Improving driver behavior by encouraging smooth driving habits, such as avoiding harsh acceleration, braking, and idling.

- Optimizing your routes to minimize mileage and reduce fuel-wasting detours.

- Selecting fuel-efficient vehicles to lower fuel costs and emissions over time.

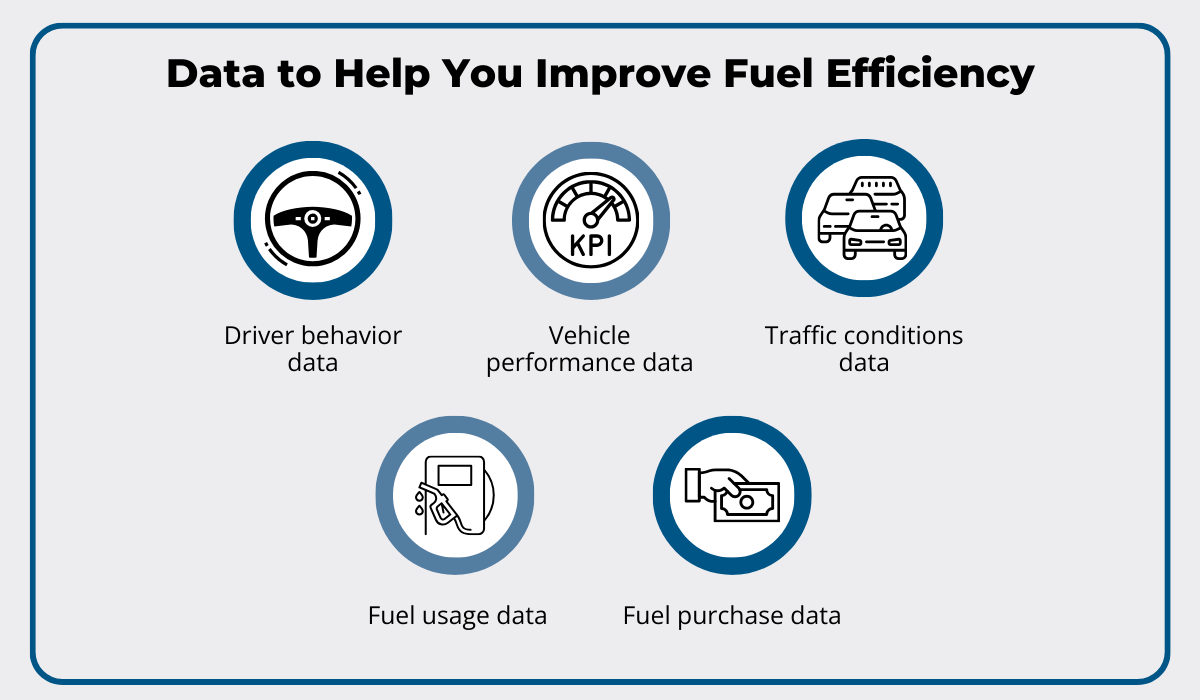

Technology can help you achieve these goals.

For example, telematics systems can:

- Monitor driving habits to provide feedback to drivers

- Detect the most efficient routes based on real-time traffic conditions

- Collect fuel usage data you can use for further planning and training

Fuel cards can also be helpful.

Most fuel cards collect data on how much fuel was purchased, where and when, and how much it cost. You can use that information to further optimize your vehicle routes.

Alternative fuel vehicles, i.e. EVs and hybrids can also help reduce fuel costs, especially in the long run.

For example, Coltura’s report shows that EV drivers saved around $90/month on fuel compared to those with gas-powered vehicles in Q3 of 2024. This translates to around $1,100 in yearly savings.

Additionally, as Coltura also suggests, the maintenance costs for EVs have decreased in Q3 2024, further increasing the total savings.

This trend will likely continue as sustainability initiatives keep ramping up.

So, now might be the best time to start investing in alternative fuel vehicles. The ROI could be huge.

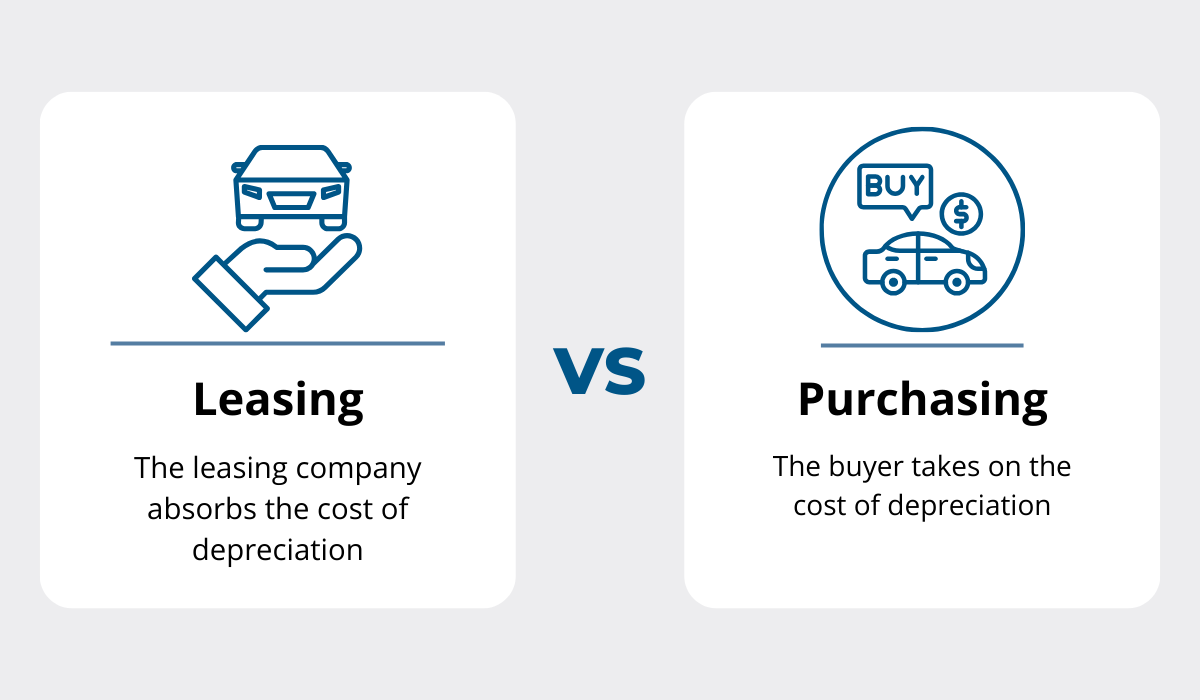

Evaluate Leasing vs. Purchasing

Most people would say that purchasing a vehicle is always better than leasing it.

But is that really true?

We wouldn’t be so sure, especially when you consider that depreciation is the largest expense for most US fleets.

When you lease a vehicle, the leaser absorbs this cost instead of you, allowing you to keep more money in your pocket.

So, it’s worth assessing if leasing could be more cost-effective for your fleet.

Of course, the cost of depreciation is not the only factor to consider.

Both leasing and purchasing have other pros and cons.

Leasing:

- Possible tax advantages, depending on your location.

- Lower upfront costs and predictable monthly payments.

- Frequent upgrades to newer models, reducing maintenance costs.

Purchasing:

- Long-term value, especially for low-use vehicles.

- No mileage restrictions and potential for customization.

- Ownership eliminates ongoing payments after the loan is paid off.

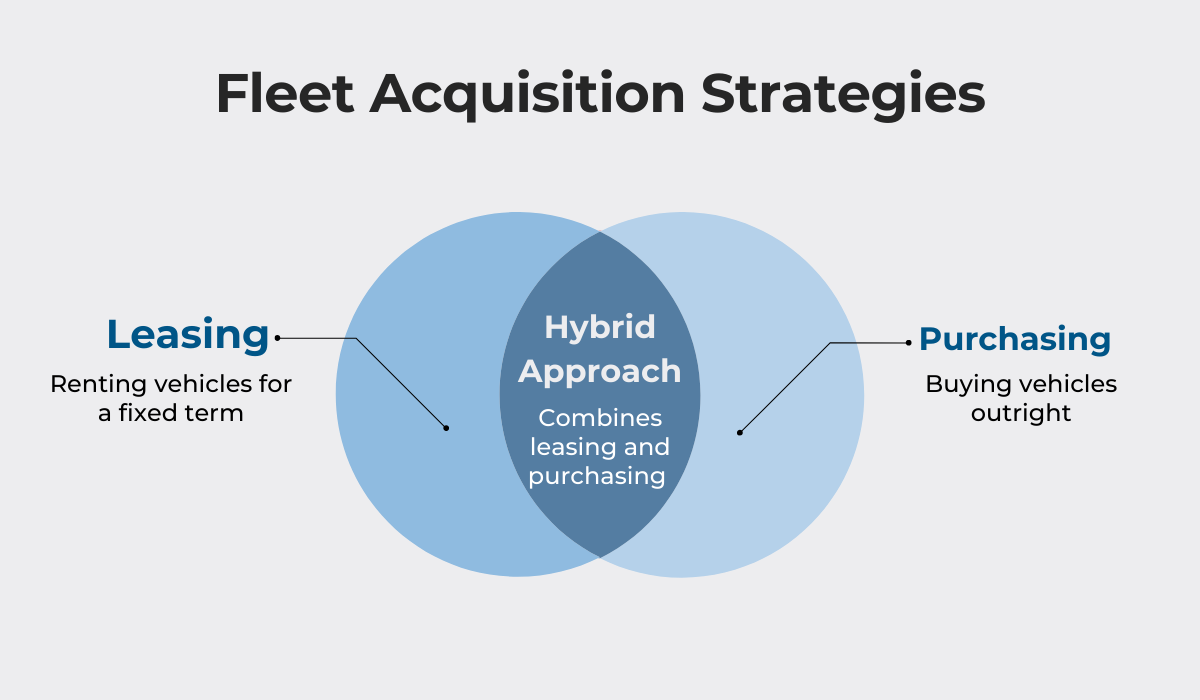

Additionally, if neither option sounds right for you, consider taking a hybrid approach.

A hybrid approach typically implies leasing some vehicles and purchasing others.

In most cases, the most cost-effective strategy for fleets is:

- Leasing high-use or short-term vehicles

- Purchasing low-use or long-term vehicles

This way, you’re avoiding high depreciation and wear and tear costs and maximizing your ROI.

Implement Driver Safety Programs

When trying to reduce costs, most fleets focus on providing training that improves driver efficiency or fuel savings.

They often don’t recognize that safety programs play an equally critical role in reducing costs. This is especially true if we look at the insurance premiums that are often based on the risk profile of the fleet.

For example, NTSI’s defensive driving programs reportedly reduce accident rates by 21% and traffic violations by 63%.

Consequently, this leads to lower insurance premiums, lower traffic fines, and other cost savings.

So, how can companies promote safe driving?

Well, offering the aforementioned defensive driving programs is one way.

Such programs help drivers anticipate risk, avoid distractions, and generally behave in ways that are safer for them and others.

Telematics can also improve driver safety in various ways.

For example, telematics systems can monitor driver behavior, identify their weak spots, and allow you to prepare personalized tips for drivers based on these insights.

A third alternative is partnering with insurance providers that offer incentives for safe driving and robust safety measures.

Some providers may be open to providing discounts, while others may offer reward programs, cashback, or reduced deductibles.

Though drivers should be self-motivated to avoid harming themselves or others, we know that we can all sometimes use extra motivation.

Ensuring they get something tangible from it can keep them engaged and committed.

Conclusion

Rising expenses are squeezing fleet budgets, but there are ways to control and reduce them.

Strategies like calculating TCO and optimizing fleet utilization can boost profitability.

On top of that, proactive measures, like preventive maintenance and driver safety programs, also keep your operations running smoothly.

The benefits of these strategies are clear: less downtime, more efficient vehicles, and leaner and more profitable fleets.

The time to act is now. Your first step can be doing a fleet audit or exploring beneficial technology like telematics.

Don’t wait to start cutting costs. Your bottom line will thank you.