Businesses that understand their inventory through proper forecasting will realize immense business growth, profitability, and ultimately, success in the industry.

Unfortunately, many organizations still do not understand the importance of inventory planning in today’s hypercompetitive markets.

Case in point, businesses across the world lose a staggering $1.1 trillion to inventory distortion, including stockouts and ghost assets.

Businesses are resorting to overstocking as a solution to stockouts—an attempt that does nothing considering the average U.S. retailer is sitting on roughly $1.43 of inventory for every dollar they make in sales.

These inventory management challenges are a bane to businesses. They eat up profits by inflating operating costs unnecessarily while hampering the satisfaction of customers who can’t get what they want.

In online stores, along with inventory forecasting, It is also important to forecast a strategy to sell potential products. There are online merchandising tools to optimize the visitor engagement conversion which saves operation costs.

The bigger the scale of businesses, the harder it is for business owners to manage their inventory and maintain operational efficiency.

This is the reason why organizations must pay attention to inventory forecasting today.

By doing so, they avoid most—if not all—of the challenges associated with inventory management, thus giving them a major advantage in the market over less competent rivals.

We will go over the nitty-gritty of inventory forecasting, its advantages, as well as practical tips for businesses to plan their inventory more efficiently.

In this article...

What Is Inventory Forecasting?

Inventory forecasting is a process that gives businesses insights over future customer demand so they can make informed decisions over their inventory.

These forecasts are gathered through a combination of analyzing sales data, looking at trends and patterns in customer purchase behavior, as well as assessing the performance of previous inventory volumes across different demand levels.

Inventory forecasting also includes analyzing data outside of the company like industry trends and media coverage.

The forecasted data helps companies make informed decisions in managing their purchases, which also includes companies that manufacture their own stock.

This benefits supply chain and logistics management, and helps businesses know the precise amount of resources they need to transport goods and services.

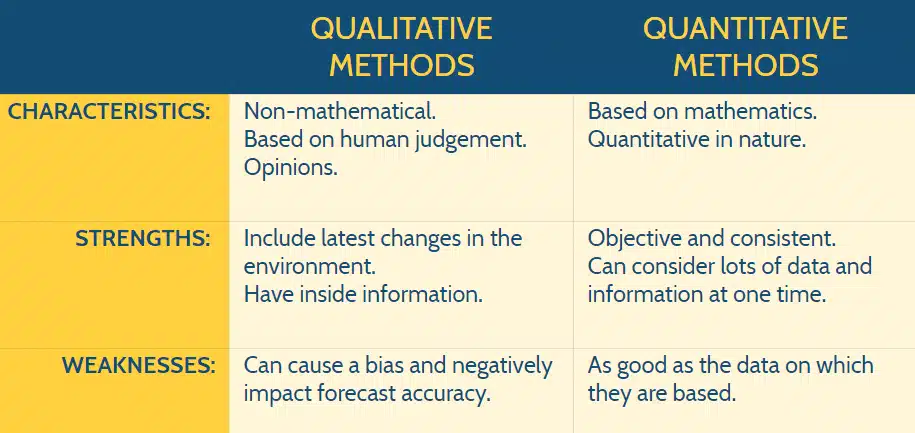

The two main types of inventory forecasting are qualitative and quantitative forecasting.

Qualitative inventory forecasting predicts demand based on the broad perspective of the industry and economy the business is operating in.

Macro factors like the current industry performance, regulation changes, technology shifts, and evolving customer demand are assessed rigorously by experts to determine future outcomes.

Qualitative analysis, however, needs to complement quantitative analysis in order to work well.

Quantitative inventory forecasting involves analyzing historical sales data to estimate customer demand.

Analysts often look at sales history through different timelines and demand to get an accurate estimate of inventory levels.

The more data that is analyzed, the more precise forecasts will be, especially if the processed data is high quality.

The Common Challenges Businesses Face in Inventory Forecasting

Forecasting comes with its own set of challenges that can throw the business off-course, if not addressed on time.

Here are the most common ones.

Unorganized Data Across Multiple Sales Channels

For any inventory forecast to happen, a retail reporting system must exist as a source of historical sales data. Unfortunately, many businesses still use outdated reporting systems—some even recording sales manually—which presents a huge obstacle for inventory forecasting.

The time and effort it takes to go through siloed, hard-to-access historical inventory and sales data are severely wasted.

The resources spent on pulling and analyzing data from disparate systems take up most of the forecasting budget allocated by enterprises—without a single cent spent on the actual research yet.

Disparate data can also result in inaccurate analysis, leading businesses to a false sense of security when making stock-related decisions.

Wrongly estimating demand and missing the opportunity to capitalize on trends in the market are just two of the issues caused by inaccurate inventory forecasting.

This challenge is further amplified by the growing relevance of omnichannel sales. Businesses today are expected to sell offline and online through a variety of mediums (e.g. social media, e-commerce platforms, B2B sales) regardless of the industry they’re in.

As you can imagine, handling inventory across multiple locations and sales channels is not easy to manage without the right tools and technology, let alone forecasting.

Making Inaccurate Demand Predictions

While data analytics seems like the be-all-end-all for inventory forecasting, there is a decent amount of guesswork involved even for businesses with huge teams armed with sophisticated software.

Inventory forecasting is an excellent tool to predict demand 6 to 12 months ahead but it takes instinct to come up with truly accurate forecasts for two, three years down the line.

Here’s a scenario to consider: a business researching demand levels for a product they’re stocking for the first time.

It’s tough to forecast demand accurately since there is no historical data to work with. In this case, analysts would have to rely on external factors and their industry experience to come up with accurate forecasts for the new product.

Making wrong guesses can result in companies stocking products that customers don’t need, or the opposite, not stocking enough inventory to keep up with surging demand.

These mistakes cripple revenue and profitability—never a good thing for business growth.

Using Incomplete Datasets in Forecasts

Many businesses make the mistake of using incomplete datasets when performing analyses.

The goal of inventory forecasting is to estimate demand, but that can only be achieved if businesses understand their customers’ deepest wants and needs, which is why comprehensive datasets are important.

It’s not enough to rely solely on research from past experiences and internal data to forecast demand levels.

External data (the macro factors mentioned earlier) should also be accounted for in forecasting projects to help companies understand market demand better and make better inventory decisions.

Tips Every Retailer Should Know to Make Inventory Forecasting More Successful

Retailers may struggle with forecasting the demand and handling their inventory well, but the following tips can help smooth things out a bit.

Understand the Difference Between Sales and Demand

Forecasting does not revolve solely around sales; it is an assessment of market demand. Planning inventory forecasts based on sales figures is a fatal error that affects the accuracy of predictions.

Let’s take an example of a product that has been out of stock for three months.

The sales volume for the product is zero for the period when it was out of stock. Would it make sense if the company dropped the product just because it made no money in three months?

No, and that’s the reason why demand and sales carry different meanings in inventory forecasting.

Sales is what customers buy, demand is what they actually want.

Smart businesses understand that for inventory forecasting, demand is the key factor since sales numbers can be skewed for a number of reasons, including promotions and strategic product placement.

Does this mean sales figures are worthless in planning inventory? Absolutely not!

Inventory forecasting primarily analyzes macro factors in the marketplace to determine interest levels for a product.

That said, micro factors like sales matter just as much in helping companies estimate future demand accurately. Sales are part of the equation but companies should not treat it as the only important metric in crafting inventory forecasts.

Forecast Techniques Vary Between Companies

Forecast requirements, as well as the challenges faced, vary between companies. Each organization has different business models, cultures, target audiences, operating locations, and industries.

As a result, there is no one size fits all solution for inventory forecasting. The forecasting techniques that work well for one company may not work as well in another.

Any organization that wants to pursue demand planning must analyze their business from top to bottom and define their forecasting objectives first.

Businesses have several forecasting options to choose from depending on their available resources and quality of data.

These options include:

- Time-series analysis: assessing historical data to come up with accurate projections.

- Regression analysis: examining historical data and events to identify relationships among key variables (e.g. seasons and customer trends).

- Heuristics: a discovery, learning and problem-solving approach that relies on well-defined rules to find a “good enough” estimate for inventory forecasting.

- Consensus approach (Delphi method): a forecasting method that derives outcomes from a panel of experts, usually used for products with little to no historical data.

Understand Your Reorder Points and Safety Stock Values

Determining the reorder points is a crucial requirement in successful inventory planning strategies.

Before that, businesses must figure out their lead demand and safety stock values first to calculate optimal reorder points.

Lead demand represents the estimated level of consumer demand for a product between now and the delivery date from suppliers for a restocking order.

Lead time is the time taken for purchases to physically arrive after an order is made. A tractor that is bought on the 3rd of November and delivered on November 10th has a lead time of 7 days, for example.

Lead demand is determined by the following formula:

Most suppliers provide estimated lead times but that is not always on the mark.

For the sake of accuracy, it’s best for businesses to calculate their own lead times.

This is done by evaluating the average lead time of suppliers based on historical purchase data. Adding a day or two to lead times is recommended to account for delays.

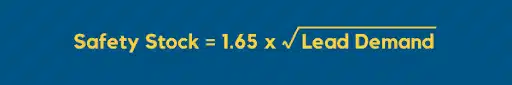

Safety stock, meanwhile, is the additional inventory held to prevent stockouts in times of unexpectedly high demand.

It also helps companies determine the right amount of inventory to hold as backup without wasting too much money on unnecessary stock volumes.

This metric is calculated by taking the square root of lead demand and multiplying it by 1.65, as shown below:

The reorder point is then identified by summing the lead demand and safety stock values:

The calculated value is the optimal reorder point, which is the minimum threshold of inventory held before a replenishment order is made.

This ensures that businesses have enough inventory on hand to sustain themselves during reorder lead times to avoid the risks of overselling and understocking.

Always Have a Backup Option

One thing that all businesses agree with is that unexpected events happen all the time, even when things are planned out well enough. The best companies have backup plans for worst-case scenarios in inventory management.

By planning for the worst, businesses reduce the risks they face when dealing with emergencies. Backup options are important considering 25% of businesses shut down shop as a result of poor disaster management and recovery.

They should also have backup plans for every event.

- What to do if the supplier cannot be contacted for a replenishment order?

- How to notify customers if their orders cannot be fulfilled?

- What is the standard procedure for stockouts and overstocking?

At the very least, businesses should ensure they have the ability to obtain products from backup suppliers that can fulfill rush deliveries and work with logistics companies and transportation services that promise the shortest lead time without sacrificing safety and quality.

Segment Forecasts to Gain Deeper Insights into Customer Demand

Segmentation is important in any type of data analysis.

It’s the process of breaking down forecasts into parts that represent different demographics and data types.

A sample forecast segmentation would look something like this:

- Customer geography: Analyzing the locations of customers (which regions or countries do customers come from?)

- Sales channel: Assessing which channels sales come from (do they come from the company’s online store or on external e-commerce platforms?)

- Customer purchase behavior: Determining the buying habits of customers (are they heavy or infrequent buyers?)

With segmentation, businesses gain deeper insights into where their sales are coming from, the impact on revenue for each segment type, as well as identifying the types of customers that need to be targeted more.

For instance, if a company identifies a lack of demand from millennials and Gen Z, they could allocate more marketing resources towards that demographic to raise their interest to pry them away from its rivals.

Segmentation often involves the marketing and sales departments as they provide necessary customer data.

These departments also benefit from segmentation as they can utilize the findings to build better sales processes and marketing campaigns, making it a win-win scenario for everyone involved.

Invest in the Right Tools and Technology

Successful inventory forecasting campaigns must work around inventory management and asset tracking tools.

The magnitude of number-crunching and data analysis involved in inventory forecasting is not suitable for manual work as it takes up a sizeable amount of human resources, not to mention the possibility of human error.

This problem also exists in businesses that utilize outdated inventory management technology that is not designed to work with big data and advanced analysis techniques.

Hence, it’s important for organizations to invest in the right tools and technology to enable accurate inventory forecasts.

The benefits of modern tools extend beyond inventory forecasting, as retailers gain more visibility into their entire supply chain which further empowers businesses in making smart inventory decisions.

Start with Inventory Forecasting Now to Gain an Edge in the Market

Inventory forecasting is essential for businesses to succeed in today’s competitive markets.

There’s no reason to delay customer forecast demands any longer, especially with the number of tools and technology available today.

By consistently reviewing stock levels, customer demand, and market trends, businesses will be able to accurately plan their inventory for both the short-term and long-term, ultimately leading to increased revenue and profitability.