So, you’re looking into ways to finance your equipment because you can’t afford a purchase right now?

Don’t worry, you’re not the only one.

Many construction businesses are struggling with purchasing machinery outright, which is why the equipment financing sector reported a business volume of $9.9 billion this July.

According to the Equipment Leasing and Financing Association, 13.6% of their business is coming from construction companies.

This data isn’t all that surprising if you consider that construction companies rely on machinery to do business, so it’s vital to have enough quality equipment to complete projects. Of course, not all companies have the resources to buy expensive machinery out of pocket.

In this article, we’ll provide a detailed explanation of some of the ways you can finance your machinery, so you can make an informed decision about your options.

After all, the best way to decide which type of financing works best for you is to educate yourself on what’s out there, and we’re here to help.

In this article...

Loans vs. Leases in Heavy Equipment Financing

If you can’t afford to buy heavy equipment, consider getting a loan or a lease.

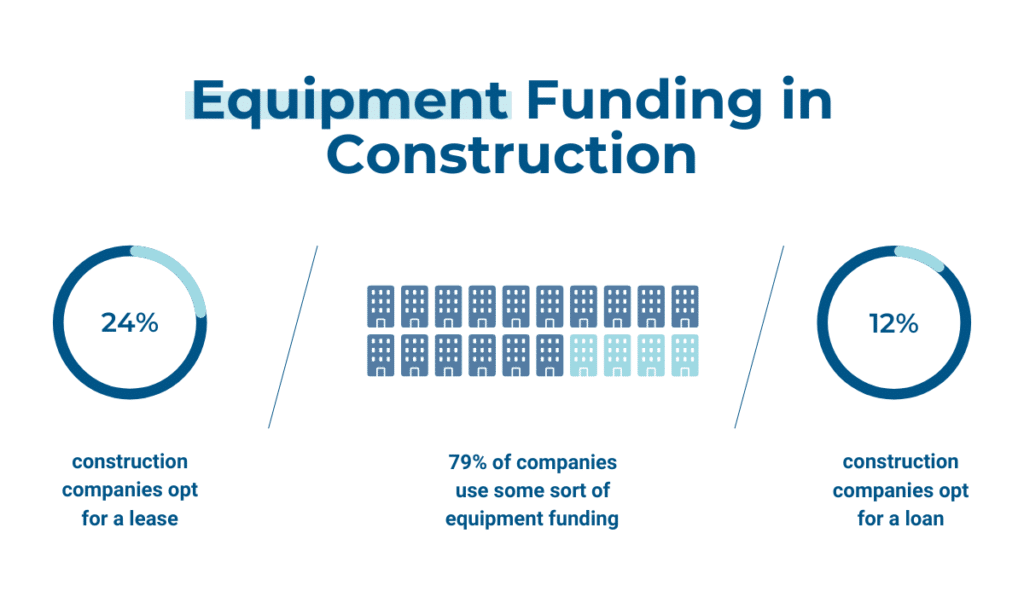

Relying on those has become a standard practice in the industry, seeing as, according to the ELFA report, 79% of construction companies use some form of financing when purchasing machinery.

So, instead of dipping into your own funds to purchase costly heavy equipment outright, you can borrow the money under certain conditions.

The two most common types of equipment funding are loans and leases. Both options provide you with the necessary resources to get your heavy equipment, but they differ in some aspects.

Equipment loans are term loans used solely to purchase equipment, and you usually pay them off within three to seven years, on average.

There are also ten-year loans available, depending on the funder and the type of machinery you’re buying.

At the outset, the loan funder will cover the large majority of the cost, but you’ll have to cover at least 10-20% as a down payment.

However, while loans have better interest rates compared to leases, they cover a smaller percentage of the total cost.

This means that in the long run, loans can cost you a lot more than the equipment itself.

Also, keep in mind that if you fail to pay the funder, they can repossess the equipment. In that sense, the machinery itself serves as collateral.

Nevertheless, if you simply can’t afford the machinery right now but need it, loans are a great option.

Equipment leases are a bit more popular among construction companies looking for funding. Around 24% of them have chosen this as their funding method. In comparison, only 12% of construction businesses opt for loans.

Leases are also used to get equipment, but the main difference between a loan and a lease is that, after paying off a loan, you own the equipment. That is not the case with leases.

However, leasing is still the top choice of the companies that don’t have the capital necessary for a loan or don’t want to commit to the same piece of equipment long-term.

Leases are generally divided into two categories: operating and capital leases.

Operating leases typically don’t last as long as capital ones.

This type of lease gives you not only the option of buying the equipment but also renewing your lease or returning the machinery. Therefore, operating leases give you more options, which can come in handy if you’re still on the fence about whether to keep the piece of equipment.

The main difference between the two is that operating leases don’t transfer any ownership to the lessee (in this case, you) and are instead contracts that let you use someone else’s equipment for a fee.

Capital leases, however, transfer some of the rights to you, and you’re obligated to include the equipment in your financial statements and depreciate them, among other things.

If you opt for a capital lease, the funder presumes that your end goal is to buy the machinery after the end of your lease. There are no down payments, unlike for loans, meaning that the financer covers all of the costs, so you don’t have to have the initial capital to invest in machinery.

Usually, the funder will offer you some of these purchasing options after the lease ends:

- $1 buyout option: buy the equipment for $1

- 10% purchase option: purchase the asset for 10% of its original value

- fair market value option: acquire the machinery for its fair market value

Think long and hard about which one of these options suits you best if you’re trying to purchase the machinery after your lease ends.

How Heavy Equipment Loans and Leases Work

Now, let’s look into how exactly both loans and leases work, so you have a better understanding of what you’re getting yourself into by financing heavy equipment.

If you need heavy machinery but don’t have enough money to buy your own, whether new or used, you can borrow the money from another entity and pay them back monthly over an agreed period.

After this period, you either get to keep the machinery (loan) or buy it off the financer (lease). In case of a lease, you don’t have an obligation to purchase the equipment. Instead, you can renew your existing lease or get a new one.

So, how do leases and loans work precisely?

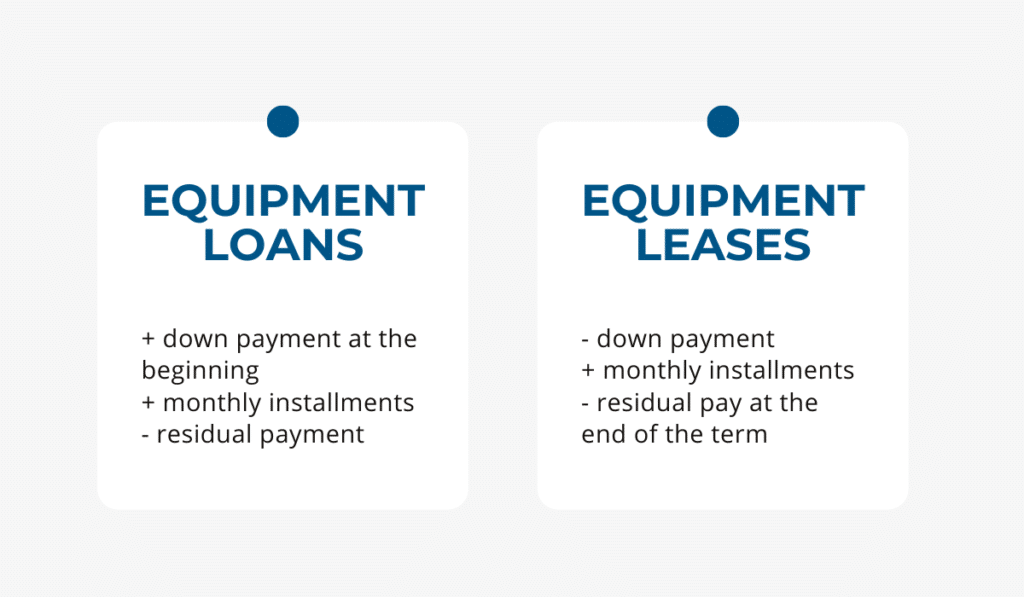

Both options are based on monthly installments and require you to pay some interest, but we’ll touch on that point later.

Loans include down payments which are typically paid at the beginning of the loan. As already mentioned, they can be pretty substantial, which means you’ll have to have some savings to give the funder at least 10-20% of the total cost upfront.

The rest of the money will be paid in monthly installments throughout the agreed term.

On the other hand, leases have residuals paid at the very end of the leasing term instead of a down payment. If you decide to return the equipment instead of purchasing it, you might not have to pay a residual, but that depends on the financing entity.

On top of that, you will also need to deposit monthly payments during the one to five-year leasing period. However, keep in mind that leases generally don’t last as long as loans do.

The terms of loans and leases alike depend on the funder, as they can set up their own rules.

Since you’re in the construction business, you have to find someone who can give you enough money to obtain costly heavy machinery but also enough time for you to buy it off them, if that’s your aim.

Costs, Terms, and Fees in Heavy Equipment Financing

The next step is figuring out how much a loan or a lease will cost you.

You may have assumed you will have to pay back only the amount you borrowed, but there are additional fees and costs inherent to both these models.

In the following section, we’ll help you understand which of them you will have to cover and under what terms.

Terms

Two factors directly affect the terms of your loan/lease:

- the equipment’s useful life

- whether you want to purchase the piece

The equipment’s useful life often determines the length of your contract. It’s rare to find someone who will give you either a loan or a lease for a period longer than the machinery’s lifespan.

After all, equipment’s useful life marks the time frame during which you can use the machinery for its original purpose.

Therefore, you should expect five years per loan on average, as that’s the average useful life of a piece of construction equipment.

As we’ve explained before, a lease is usually a lot shorter than a loan due to the option of returning the equipment afterward. When leasing, you don’t have an obligation to buy the asset. On the other hand, you become an owner of the machinery after the end of your loan.

Don’t forget that you always have to pay your loan on time! You’ll find this term in any type of financing contract you sign, along with a fine in case of late payments.

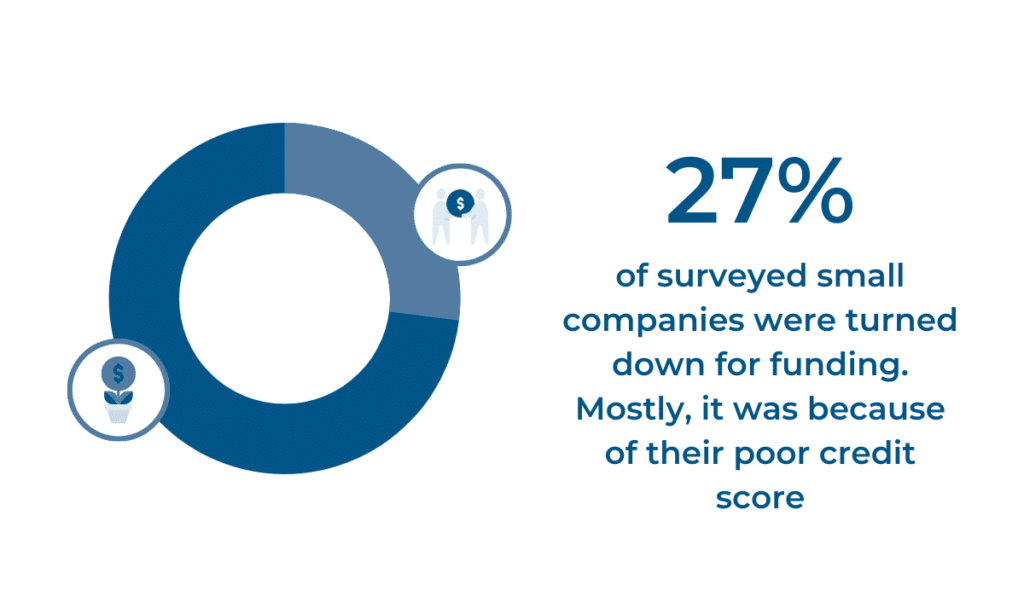

When you don’t pay back your funder, you’re risking not only having to pay late payment fees but also your business credit score taking a hit.

Don’t take this consequence lightly since your chances of even getting financed depend on your business credit score.

In fact, 27% of small companies surveyed by NSBA reported that they were turned down in their search for funding because of their poor credit score, which hindered their growth as a business.

That’s why you should steer clear of any activities that could negatively affect it.

If that happens to you, keep in mind that you’ll need anywhere from 12 to 18 months to improve your credit score, which is a long time.

Everything to do with financing heavy equipment is directly related to your credit score. Therefore, the higher it is, the better offers you will get.

Rates

Interest rates heavily depend on two things: the funder and your credit.

They are usually somewhere in the 5-30% range, which doesn’t say a lot.

That’s because it’s impossible to predict your interest rates without additional information, such as cash flow, business experience, and equipment type, among others. Most importantly, the funder gets to decide what they want to offer you.

These rates can be fixed or variable.

When they are fixed, you pay the same amount throughout your loan under the condition that you keep up with your payments.

Variable rates change with the current market or another fluctuating index rate.

However, some funders might not even offer interest rates. In general, loans that last less than a year don’t require interest rates payment. Nevertheless, a factor rate may apply in this case.

Much like interest rates, factor rates are costs added to your principal in case of a small loan. Unlike interest rates, they are counted only once and not monthly.

To explain, let’s say that your equipment costs $10,000, and you’ll get a loan at a factor rate of 1.5. In that case, the total amount you’d owe to the funder wouldn’t be $10,000 but $15,000.

Fees

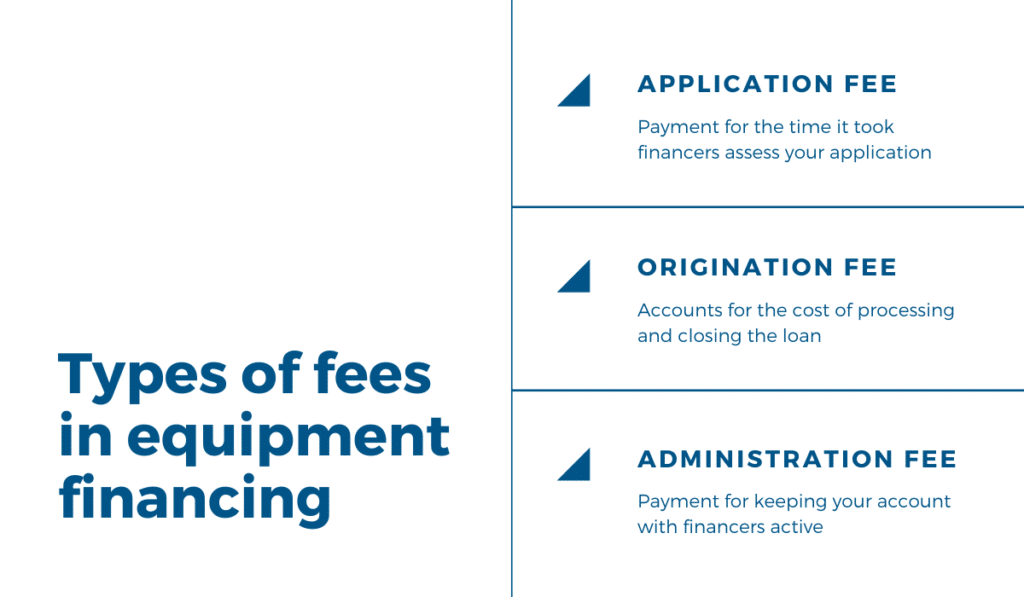

Keep in mind that many financers will also charge an application fee, which is a payment for the time it took them to even assess your application.

Of course, most funders will charge you this fee only if you choose to go through with the loan. But, be on the lookout for those who will send you a bill even if you don’t agree to their financing terms.

One of the usual costs of a loan is the origination fee, which accounts for the cost of processing and closing the loan. The origination fee is usually 1-9% of the total loan amount.

You will get a quote for this fee in percentages or as a fixed amount.

The origination fee is usually deducted from the total amount before it is paid out to you. If your total lease amount is $10,000 and the origination fee is $500, you—or the vendor directly, in many cases—will receive $9,500 from the funder.

Leases often come with an administration fee. What this fee entails is the financing entity keeping your account with them active. Of course, you have to keep paying this fee until the end of your lease.

Application Process and Requirements for Equipment Financing

Now let’s see what you need to know when applying for heavy equipment financing.

Before applying, you should understand the make and model of the machinery you want to obtain. Knowing this beforehand speeds the process up as you’re already bringing the necessary equipment information to the table.

The funder will likely want certain information about your business before you apply for financing.

For instance, they will ask about your time In business. They will need to know how long you’ve been active to assess your reliability.

Next, on top of your business credit score, they might also want to know about your personal credit score to determine how capable you are of paying off your debts.

They will also be interested in your debt-to-revenue ratio.

It’s the number you get by dividing your monthly debt payments with your monthly gross income; it also helps the funder determine whether you will be able to pay them back.

Prepare all of this information before applying and bring the relevant documentation to your meeting with the potential funders to speed up the process.

This is the documentation you will need to bring along:

- your driver’s license

- a void business check

- your company’s financial statements

- latest bank statements

- tax returns (both company and personal)

- vendor’s equipment quote or invoice

If your request gets approved, in most cases the financer will pay the vendor directly, but you can discuss these details before signing the contract.

After you sign, the equipment should be at your construction site on the date agreed with the funder.

However, don’t think that your work stops when you finally get your hands on the equipment. In fact, some would say that’s where it starts.

Why? Because you have to take care of the equipment as if it were yours.

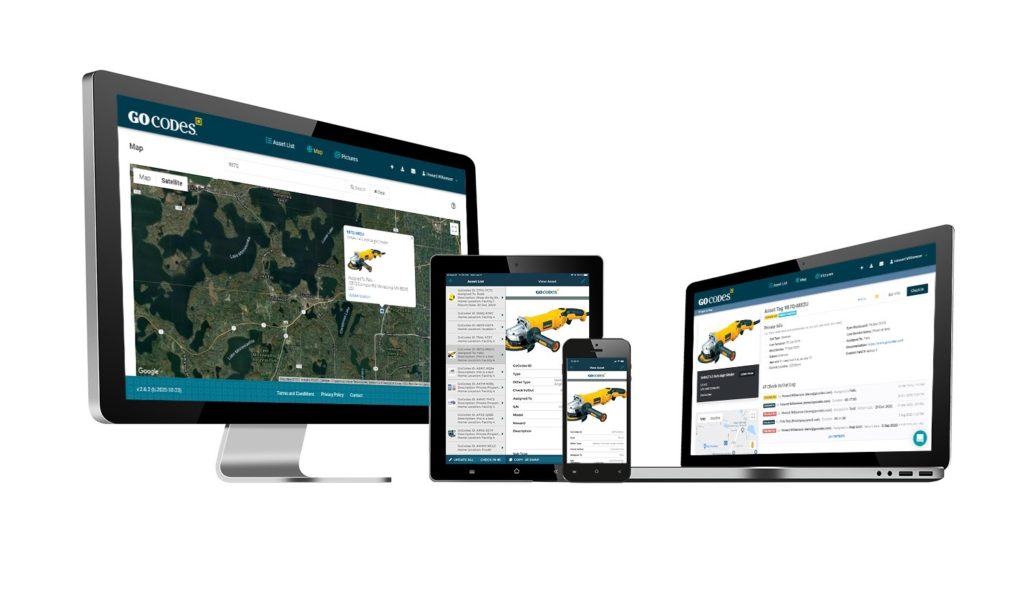

You can’t afford to lose, misplace, or damage the machinery, so investing in equipment tracking software would be the best course of action.

A software solution like that will let you track the equipment’s last known GPS location and keep a record of past maintenance sessions, as well as scheduling future ones, and thus ensuring that your machinery is always in optimal condition.

That way, your investment will pay off.

Conclusion

Being unable to pay for your machinery upfront is nothing to be ashamed about in this day and age.

There are many different ways of obtaining machinery through equipment financing that you can look at.

So, determine what sort of equipment you need on your construction site and decide whether you want to own it or just use it for a certain period.

If it’s the former, opt for a loan, but remember that you have to have enough money to deposit a down payment and that you can’t afford to stop making payments, as that can mean losing your equipment altogether.

If you don’t want to commit to a particular piece of equipment at this stage and you want to keep your options open, leases are the way to go.

Whichever option you choose, don’t forget to keep an eye out for all the terms, rates, and fees that may apply to your financing contract.